Markets

Price analysis 7/29: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, MATIC, AVAX

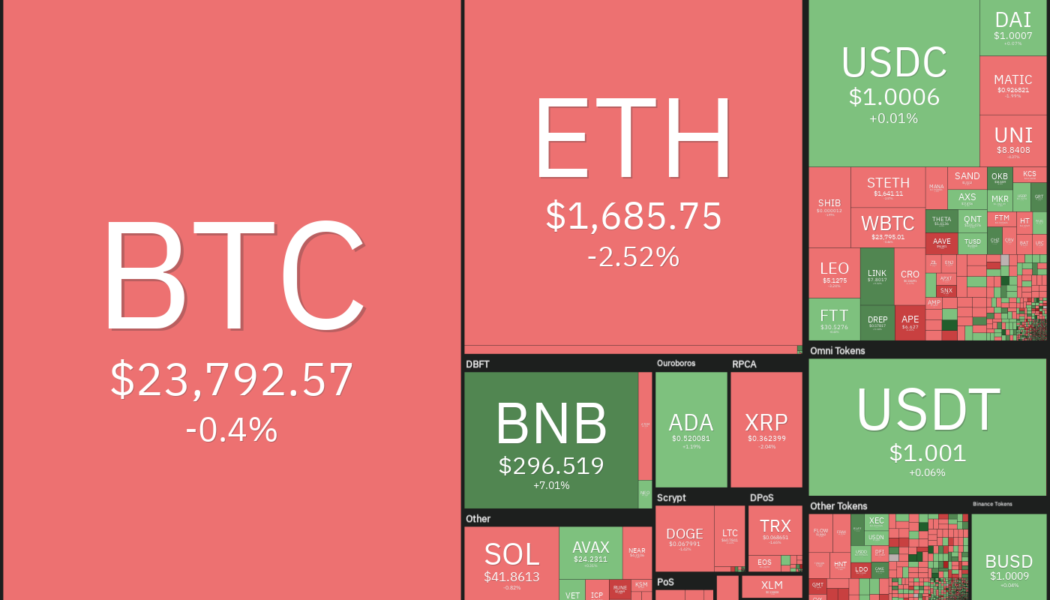

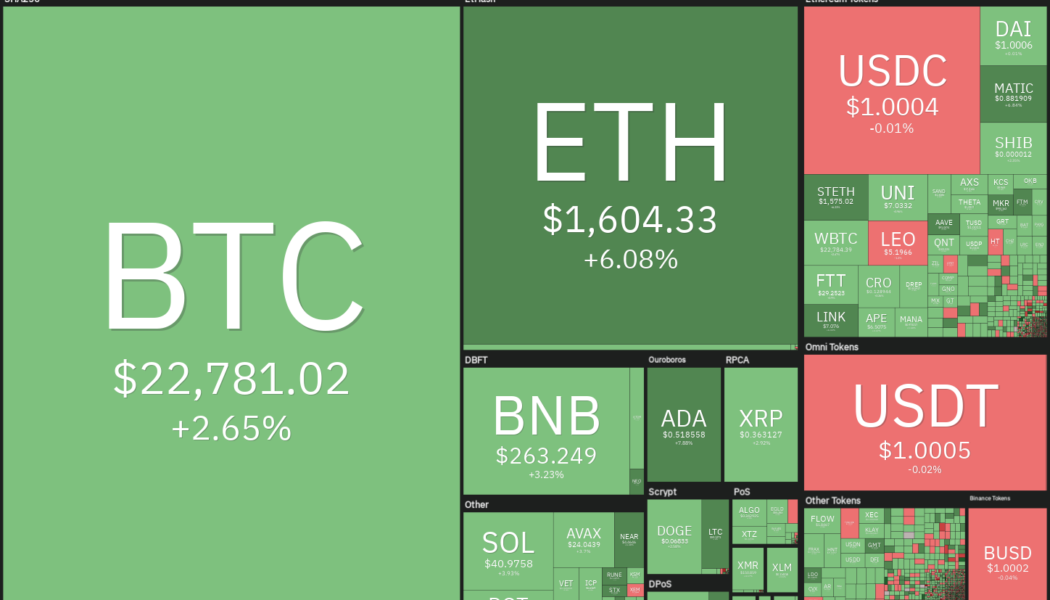

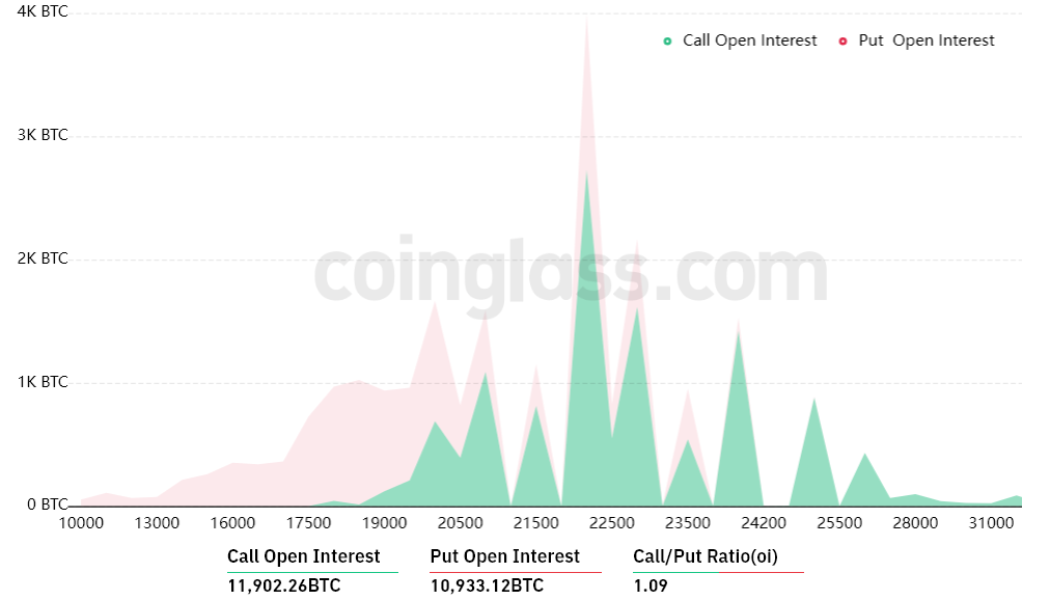

Bitcoin (BTC) hit a six-week high above $24,000 on July 29, extending its rally that picked up momentum after the United States Federal Reserve hiked rates by 75 basis points on July 27. If the rally sustains for the next two days, Bitcoin could be on target to close the month of July with gains of more than 20%, according to data from Coinglass. It is not only the crypto markets that have seen a post-Federal Open Market Committee (FOMC) rally. The U.S. equities markets are on track for big monthly gains in July. The S&P 500 and the Nasdaq Composite are up about 8.8% and 12% in July, on track to their best monthly gains since November 2020. Daily cryptocurrency market performance. Source: Coin360 The crypto and equities markets have risen in the expectation that the pace of rate hikes ...

Bitcoin price falls under $21K, bringing more capitulation or just consolidation?

On July 26, Bitcoin (BTC) price dropped below $21,000, giving back the majority of the gains accrued in the previous week and returning to the $23,300 to $18,500 range that Glassnode analysts describe as “the Week 30 high and Week 30 low.” A handful of analysts and traders attribute the July 26 to July 27 Federal Open Market Committee (FOMC) meeting and the expected Federal Reserve rate hike as the primary reasons for the current sell-off. Barring the announcement that the United States economy has entered a recession, a few traders believe that the expected 75 to 100 basis point (BPS) hike will be followed by a relief rally that could see BTC, Ether and other large-cap altcoins snack back to the top of their current range. Of course, this sentiment reflects more speculation than sou...

Price analysis 7/25: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, MATIC, AVAX

Bitcoin (BTC) and most major altcoins are witnessing profit-booking on July 25 as the bulls scale back their positions before the Federal Open Market Committee meeting on July 26 through July 27. This indicates that the sentiment remains fragile and that bulls are not confident about carrying long positions into the event. Several analysts have retained their bearish view after Bitcoin failed to sustain above the 200-week moving average at $22,780. CryptoQuant contributor Venturefounder expects the selling to resume and Bitcoin to fall as low as $14,000 before a macro bottom is confirmed. Daily cryptocurrency market performance. Source: Coin360 The institutional investors seem to be absent from the markets and the recovery is being driven by the retail investors. Data from on-chain analyti...

Fed policy and crumbling market sentiment could send the total crypto market cap back under $1T

The total crypto market capitalization broke above $1 trillion on July 18 after an agonizing thirty-five-day stint below the key psychological level. Over the next seven days, Bitcoin (BTC) traded flat near $22,400 and Ether (ETH) faced a 0.5% correction to $1,560. Total crypto market cap, USD billion. Source: TradingView The total crypto capitalization closed July 24 at $1.03 trillion, a modest 0.5% negative seven-day movement. The apparent stability is biased toward the flat performance of BTC and Ether and the $150 billion value of stablecoins. The broader data hides the fact that seven out of the top-80 coins dropped 9% or more in the period. Even though the chart shows support at the $1 trillion level, it will take some time until investors regain confidence to invest in cryptocurrenc...

Top 5 cryptocurrencies to watch this week: BTC, ETH, BCH, AXS, EOS

The bulls are attempting to achieve a strong weekly close for Bitcoin (BTC), while the bears are attempting to regain their advantage. Analysts are closely watching the 200-week moving average which is at $22,705 and BTC’s current setup suggests that a decisive move is imminent. Many analysts expect a weekly close above the 200-week MA to attract further buying but a break below it could signal that bears are back in the game. Although the short-term picture looks uncertain, analyst Caleb Franzen said that Bitcoin has been in an accumulation zone since May. Crypto market data daily view. Source: Coin360 Meanwhile, on-chain analytics firm CryptoQuant highlighted increasing outflows of Ether (ETH) from major exchanges, totaling $1.87 million coins on July 22. Usually, outflows fr...

A short-term BTC rally or trend reversal? Find out now on ‘Market Talks’ with Crypto Jebb

The latest episode of Market Talks welcomes Nicholas Merten, the founder of DataDash, one of the largest cryptocurrency YouTube channels. Merten is an international speaker, thought leader and crypto analyst. He has utilized his 10-plus years of experience in traditional markets to understand the potential of cryptocurrencies and help his 515,000 YouTube subscribers make better investment decisions. One of the topics up for discussion with Merten isthe recent Bitcoin (BTC) price rally. Are the markets finally out of the sideways trend it’s been stuck in for months, or is this just another bull trap forming, with BTC to head back down below $20,000? With all seasoned traders and experts eyeing the BTC 200-week moving average, Merten is asked the significance of this indicator and why many c...

Price analysis 7/22: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, MATIC, AVAX

In a downtrend, when markets do not respond negatively to bearish news, it is a sign that the selling may have reached exhaustion. Reports of electric vehicle maker Tesla dumping 75% of its Bitcoin (BTC) holdings in the second quarter only caused a minor blip as lower levels attracted strong buying from the bulls. Tesla was not the only institution that sold its Bitcoin. Arcane Research analyst Vetle Lunde highlighted in a Twitter thread that large institutions have sold 236,237 BTC since May 10. It is encouraging to note that even after huge selling by institutions and the unfavorable macro environment, Bitcoin has held up quite well. Daily cryptocurrency market performance. Source: Coin360 The current bear market allows an opportunity for new traders to enter at lower levels. A repo...

Ether price stalls at $1,630 after gaining 50% in under a week

Price action across the cryptocurrency market was largely subdued on July 21, as traders took a day to digest gains over the past week and book profits following the biggest relief rally since early June. Amid speculation about what drove the recent rally, the Ethereum Merge has consistently ranked at the top of the list. The market rally shifted into high gear after a tentative date of Sept. 19 was set for the mainnet Merge. Data from Cointelegraph Markets Pro and TradingView shows that after hitting a high of $1,620 on July 20, Ether’s (ETH) price retraced to a low of $1,463 in the early trading hours on July 21 and has since climbed back above support at $1,500. ETH/USDT 1-day chart. Source: TradingView Now that the initial price surge brought on by the Merge announcemen...

Price analysis 7/20: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, MATIC, AVAX

Bitcoin (BTC) briefly extended its recovery above $24,000 and the altcoins continued to make smart gains on July 20, but the bullish momentum of the week experienced a brief setback after Tesla’s earnings report showed the company had sold 75% of its BTC position. Although the sharp breakout of this week is a positive sign, analysts were quick to point out that a sustained recovery depends on a strong performance from Wall Street. Analyst Venturefounder pointed out that the rally was largely macro-driven and Bitcoin’s correlation with NASDAQ remained at a historical high of 91%. Bitcoin’s sharp rally in the past few days has awakened hibernating bulls who are dishing out lofty targets. Analyst TechDev projected a target of $120,000 in 2023, while Galaxy Digital CEO Mike Novogratz tol...