Markets

Fed reverse repo reaches $2.3T, but what does it mean for crypto investors?

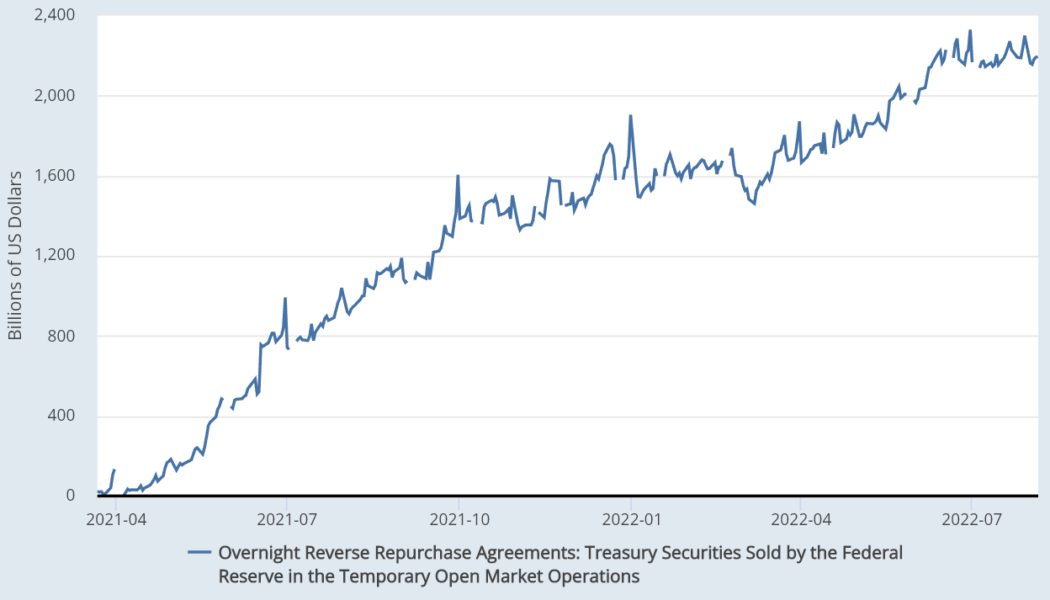

The U.S. Federal Reserve (FED) recently initiated an attempt to reduce its $8.9 trillion balance sheet by halting billions of dollars worth of treasuries and bond purchases. The measures were implemented in June 2022 and coincided with the total crypto market capitalization falling below $1.2 trillion, the lowest level seen since January 2021. A similar movement happened to the Russell 2000, which reached 1,650 points on June 16, levels unseen since November 2020. Since this drop, the index has gained 16.5%, while the total crypto market capitalization has not been able to reclaim the $1.2 trillion level. This apparent disconnection between crypto and stock markets has caused investors to question whether the Federal Reserve’s growing balance sheet could lead to a longer than expecte...

Bitcoin likely to transition to a risk-off asset in H2 2022, says Bloomberg analyst

Bitcoin is likely to transition from a risk-on to a risk-off asset in the second half of 2022, as the macroeconomic environment is rapidly shifting towards a recession, said Mike McGlone, senior commodity strategist at Bloomberg, in a recent interview with Cointelegraph. McGlone predicted: “ I see it transitioning to be more of a risk-off asset like bonds and gold, then less of a risk-on asset like the stock market.” According to the analyst, the crypto market has flushed out most of the speculative excesses that marked 2021 and it is now ripe for a fresh rally. McGlone also pointed out that the Fed’s aggressive hiking of interest rates will lead the global economy to a deflationary recession, which will ultimately favor Bitcoin: “I fully expect we’re going to have a prett...

Top 5 cryptocurrencies to watch this week: BTC, FLOW, THETA, QNT, MKR

The United States jobs data on Aug. 5 was above market expectations, indicating that inflation has not cooled down. The strong numbers reduce the possibility that the U.S. Federal Reserve will slow down its aggressive pace of rate hikes. After the release, the likelihood of a 75 basis points hike in September has risen to 68%, according to CME Group data. However, analysts at Fundstrat Global Advisors have a different view. They highlighted that three out of six times, the S&P 500 bottomed out six months before the Fed’s last rate hike. Therefore, the firm anticipates the S&P 500 to witness a strong rally to 4,800 in the second half of the year. Crypto market data daily view. Source: Coin360 If the tight correlation between the equities markets and the cryptocurrency markets mainta...

Price analysis 8/5: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, MATIC, AVAX

The United States Labor market added 528,000 jobs in July, much better than the 258,000 estimate. Wages saw growth of 5.2% year-over-year and 0.5% over the month. This suggests that inflation remains high and the U.S. Federal Reserve may continue with its rate hikes in the near future. After staying in close correlation with the U.S. equities markets for the past several months, the crypto space could be ready to chalk out a new course. Bloomberg Intelligence senior commodity strategist Mike McGlone and senior market structure analyst Jamie Coutts said in a recent report that Bitcoin (BTC) has started base building similar to the one seen near $5,000 in 2018–2019. They expect the recovery to decouple from stocks and behave more like U.S. “Treasury bonds or gold.” Daily cryptocu...

2 metrics signal the $1.1T crypto market cap resistance will hold

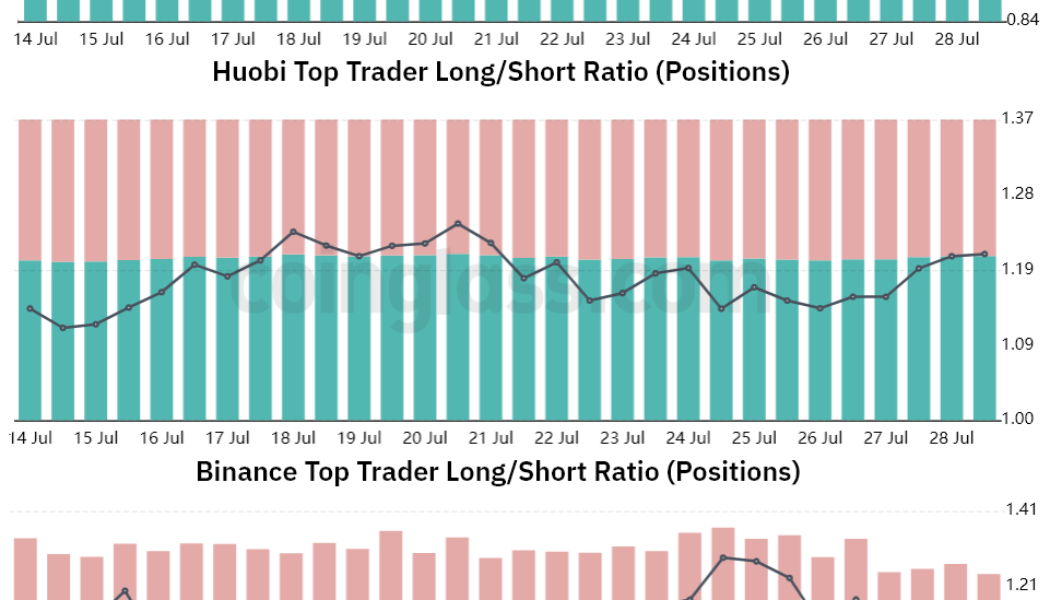

Cryptocurrencies have failed to break the $1.1 trillion market capitalization resistance, which has been holding strong for the past 54 days. The two leading coins held back the market as Bitcoin (BTC) lost 2.5% and Ether (ETH) retraced 1% over the past seven days, but a handful of altcoins presented a robust rally. Crypto markets’ aggregate capitalization declined 1% to $1.07 trillion between July 29 and Aug. 5. The market was negatively impacted by reports on Aug. 4 that the U.S. Securities and Exchange Commission (SEC) is investigating every U.S. crypto exchange after the regulator charged a former Coinbase employee with insider trading. Total crypto market cap, USD billions. Source: TradingView While the two leading cryptoassets were unable to print weekly gains, traders’ appetite...

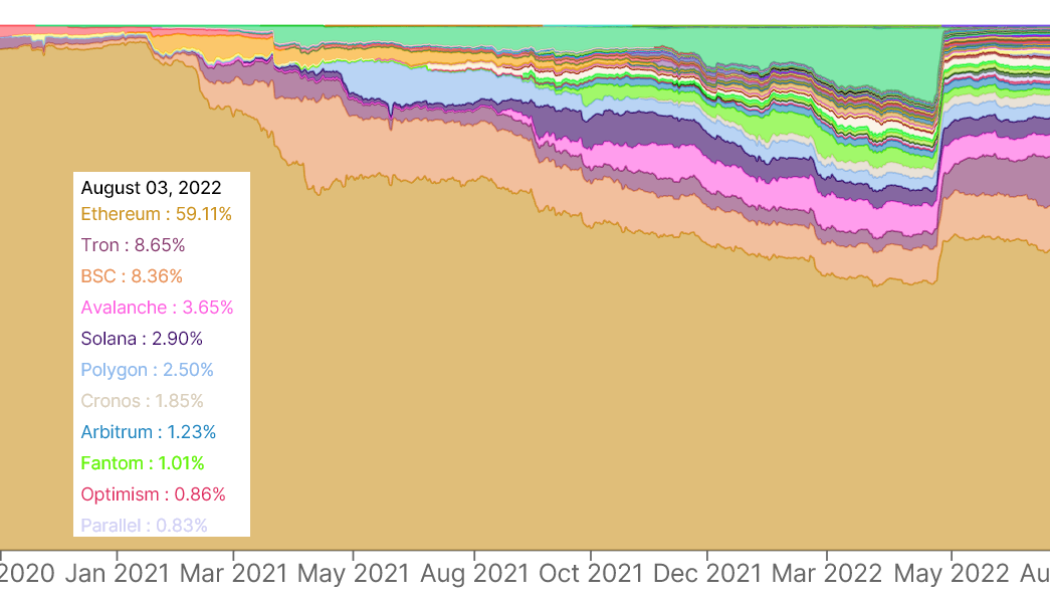

BNB rallies 39% despite smart contract deposits dropping 28% — Should investors be worried?

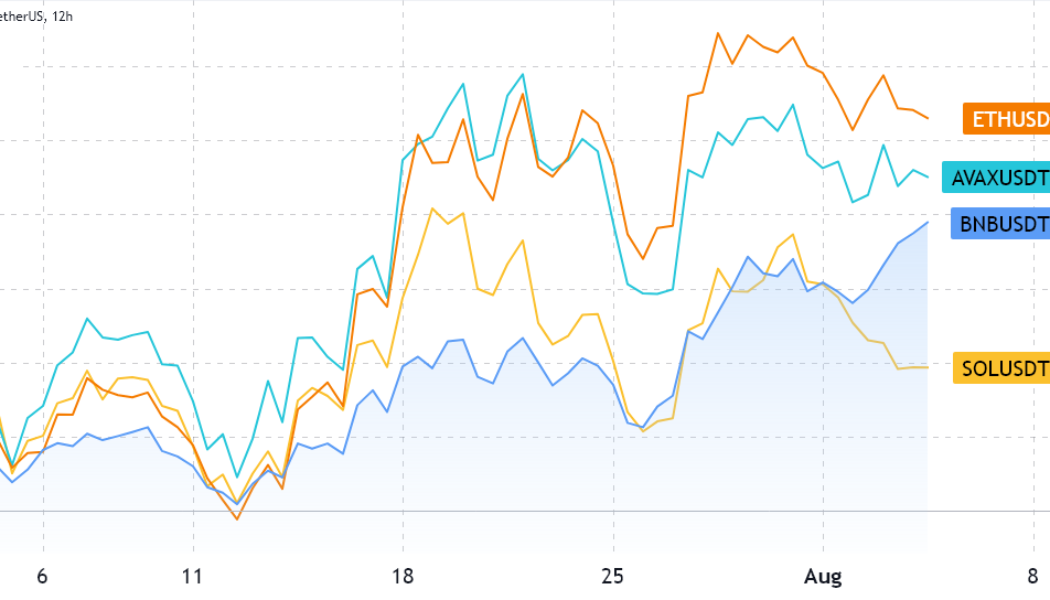

Cryptocurrencies’ total market capitalization bounced from $860 billion on June 30 to the current $1.03 trillion, a 20.6% relief in five weeks. Ether (ETH) might have been the absolute leader among the largest smart contract chains, but BNB managed to gain 39% over that period. BNB (blue) vs. Ether (orange), AVAX (cyan), SOL (yellow). Source: TradingView BNB token’s year-to-date performance remains negative by 43%, but the current $49.5 billion market capitalization ranks it the third largest, excluding stablecoins. Furthermore, the leading decentralized application (DApp) is PancakeSwap — 843,630 active addresses in the past seven days — which runs on BNB Chain. The token serves primarily as a utility asset within the Binance exchange ecosystem, enabling traders to earn discounts or ...

Polygon gains 83% in a month, but data show project has been losing traction

Polygon (MATIC) had a promising July, gaining an impressive 83% in 30 days. The smart contract platform uses layer-2 scaling and aims to become an essential Web3 infrastructure solution. However, investors question whether the recovery is sustainable, considering lackluster deposits and active addresses data. MATIC/USD on FTX. Source: TradingView According to Cointelegraph, Polygon rallied after being selected for the Walt Disney Company’s accelerator program to build augmented reality, nonfungible token (NFT) and artificial intelligence solutions. Polygon announced on July 20 plans to implement a zero-knowledge Ethereum Virtual Machine (zkEVM), which bundles multiple transactions before relaying them to the Ethereum (ETH) blockchain. In a recent interview with Cointelegraph, Polygon...

Top 5 cryptocurrencies to watch this week: BTC, BNB, UNI, FIL, THETA

Bitcoin (BTC) has made a strong comeback in the month of July and is on track for its best monthly gains since October 2021. The sharp recovery in Bitcoin and several altcoins pushed the Crypto Fear and Greed Index to 42/100 on July 30, its highest level since April 6. Investors seem to be making the most of the depressed levels in Bitcoin. Data from on-chain analytics firm Glassnode shows that Bitcoin in exchange wallets has dropped to 2.4 million Bitcoin in July, down from the March 2020 levels of 3.15 million Bitcoin. This has sent the metric to its lowest level since July 2018. Crypto market data daily view. Source: Coin360 Bloomberg Intelligence senior commodity strategist Mike McGlone highlighted that the United States Federal Reserve’s indication to consider rate hikes on a “meeting...

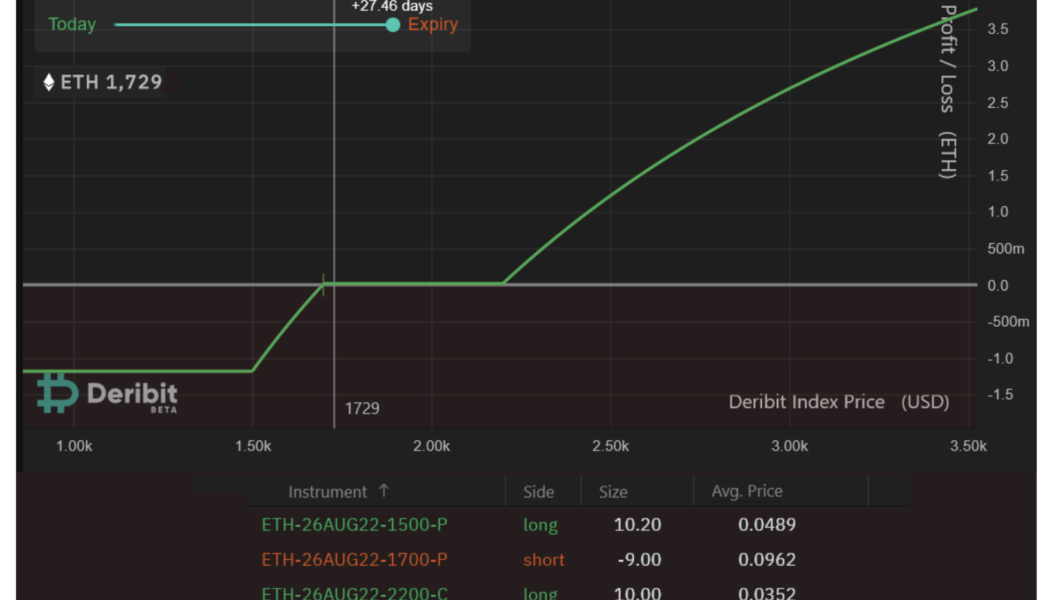

Pro traders may use this ‘risk averse’ Ethereum options strategy to play the Merge

Ether (ETH) is reaching a make-it or break-it point as the network moves away from proof-of-work (PoW) mining. Unfortunately, many novice traders tend to miss the mark when creating strategies to maximize gains on potential positive developments. For example, buying ETH derivatives contracts is a cheap and easy mechanism to maximize gains. The perpetual futures are often used to leverage positions, and one can easily increase profits five-fold. So why not use inverse swaps? The main reason is the threat of forced liquidation. If the price of ETH drops 19% from the entry point, the leveraged buyer loses the entire investment. The main problem is Ether’s volatility and its strong price fluctuations. For example, since July 2021, ETH price crashed 19% from its starting point within 20 d...

Bitcoin struggles to flip $24K to support, but data shows pro traders stacking sats

Bitcoin (BTC) rallied on the back of the United States Federal Reserve’s decision to hike interest rates on July 27. Investors interpreted Federal Reserve chairman Jeremy Powell’s statement as more dovish than the previous FOMC committee meeting, suggesting that the worst moment of tight economic policies is behind us. Another positive news for risk assets came from the U.S. personal consumption expenditures price (PCE) index, which rose 6.8% in June. The move was the biggest since January 1982, reducing incentives for fixed income investments. The Federal Reserve focuses on the PCE due to its broader measure of inflation pressures, measuring the price changes of goods and services consumed by the general public. Additional positive news came from Amazon after the e-commerce giant re...

Will the Bitcoin mining industry collapse? Analysts explain why crisis is really opportunity

Bitcoin mining involves a delicate balance between multiple moving parts. Miners already have to face capital and operational costs, unexpected repairs, product shipping delays and unexpected regulation that can vary from country to country — and in the case of the United States, from state to state. On top of that, they also had to contend with Bitcoin’s precipitous drop from $69,000 to $17,600. Despite BTC price being 65% down from its all-time high, the general consensus among miners is to keep calm and carry on by just stacking sats, but that doesn’t mean the market has reached a bottom just yet. In an exclusive Bitcoin miners panel hosted by Cointelegraph, Luxor CEO Nick Hansen said, “There’s going to definitely be a capital crunch in publicly listed companies or at least ...