Markets

What factors cause the cryptocurrency value to fluctuate?

Cryptocurrency price fluctuation can benefit or hurt traders. The 9 factors that may affect… The post What factors cause the cryptocurrency value to fluctuate? appeared first on The Home of Altcoins: All About Crypto, Bitcoin & Altcoins | Cointext.com.

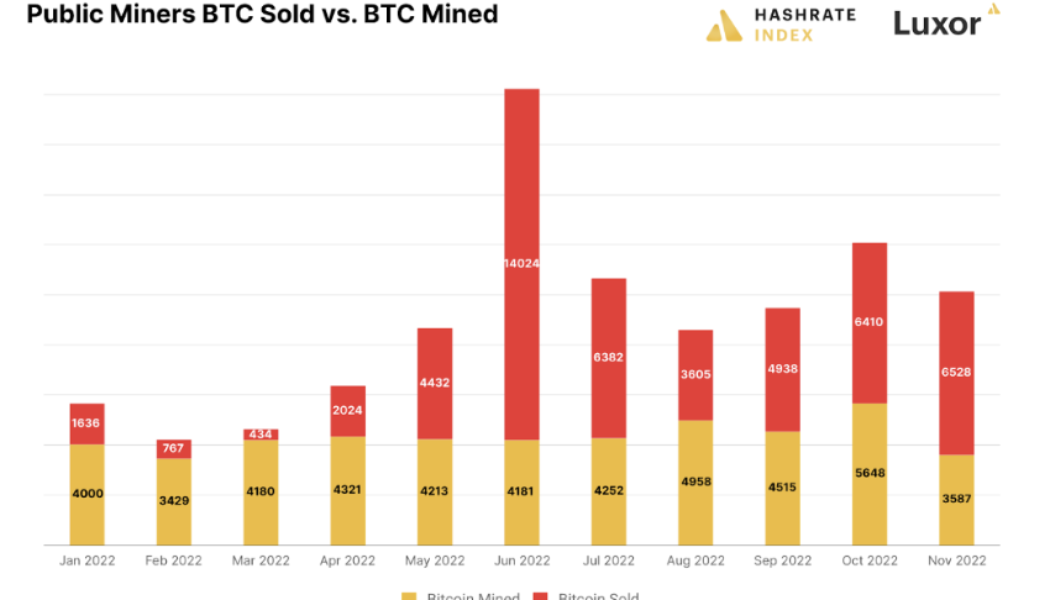

Bitcoin price rally provides much needed relief for BTC miners

Bitcoin mining powers network transactions and BTC price. During the 2021 bull run, some mining operations raised funds against their Bitcoin ASICs and BTC reserves. Miners also preordered ASICs at a hefty premium and some raised funds by conducting IPOs. As the crypto market turned bearish and liquidity seized within the sector, miners found themselves in a bad situation and those who were unable to meet their debt obligations were forced to sell the BTC reserves near the market bottom or declare bankruptcy Notable Bitcoin mining bankruptcies in 2022 came from Core Scientific, filing for bankruptcy, but BTC’s early 2023 performance is beginning to suggest that the largest portion of capitulation has passed. Despite the strength of the current bear market, a few miners were able to i...

Opinion: Bots are a critical tool for retail investors

The thing about the future, where robotic super traders battle over micromovements in stock price, is that it’s already here. With access to algorithmic trading bots a click away, we could be seeing the fall of human investors and the triumph of artificial intelligence. Algorithmic trading bots are programmed to buy and sell when they detect preprogrammed conditions and can execute pretty much any trading strategy. They have been used by professional traders for two decades, and these firms have taken them into the crypto markets too. Now, a new crop of accessible crypto trading tools has hit the market, made with retail clients in mind. I know — I have built several of them. Currently, I’m working on a system that helps neophyte investors find their own risk preferences based on the...

Price analysis 1/17: SPX, DXY, BTC, ETH, BNB, XRP, DOGE, ADA, MATIC, DOT

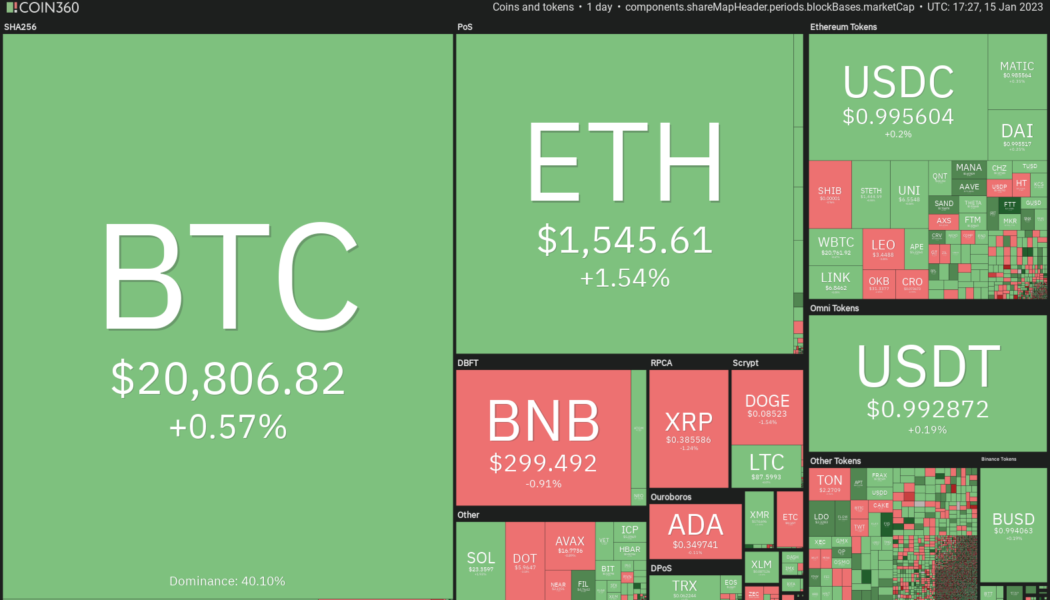

Risk assets have started the new year on a strong note. The S&P 500 (SPX) and the Nasdaq closed in the positive for the second successive week and also notched their best weekly performance since November. Bitcoin (BTC) led the recovery in the crypto markets with a sharp 21% rally last week. That sent the Bitcoin Fear and Greed Index into the neutral territory of 52 on Jan. 15, its highest since April 5, 2022. However, the index has given back its gains and is again back into the Fear zone on Jan. 17. Daily cryptocurrency market performance. Source: Coin360 The strong rally in Bitcoin has divided analysts’ opinions. While some expect the rally to be a bull trap, others believe that the up-move could be the start of a new bull market. The confirmation of the same will happen...

5 altcoins that could breakout if Bitcoin price stays bullish

The cryptocurrency markets have made a strong comeback in the past few days. That drove the total crypto market capitalization to $995 billion on Jan. 14, according to CoinMarketCap data. Bitcoin (BTC) led the recovery from the front and skyrocketed above $21,000 on Jan. 14. After the sharp rally, the big question is whether the recovery is a dead cat bounce that is a selling opportunity, or is it the start of a new uptrend. It is difficult to predict with certainty if a macro bottom has been made but the charts suggest that a bottoming process has begun. Crypto market data daily view. Source: Coin360 Independent market analyst HornHairs highlighted that the 2017 to 2018 bear market lasted for 364 days and from 2021 to the current market low, the duration is again 364 days. Another interes...

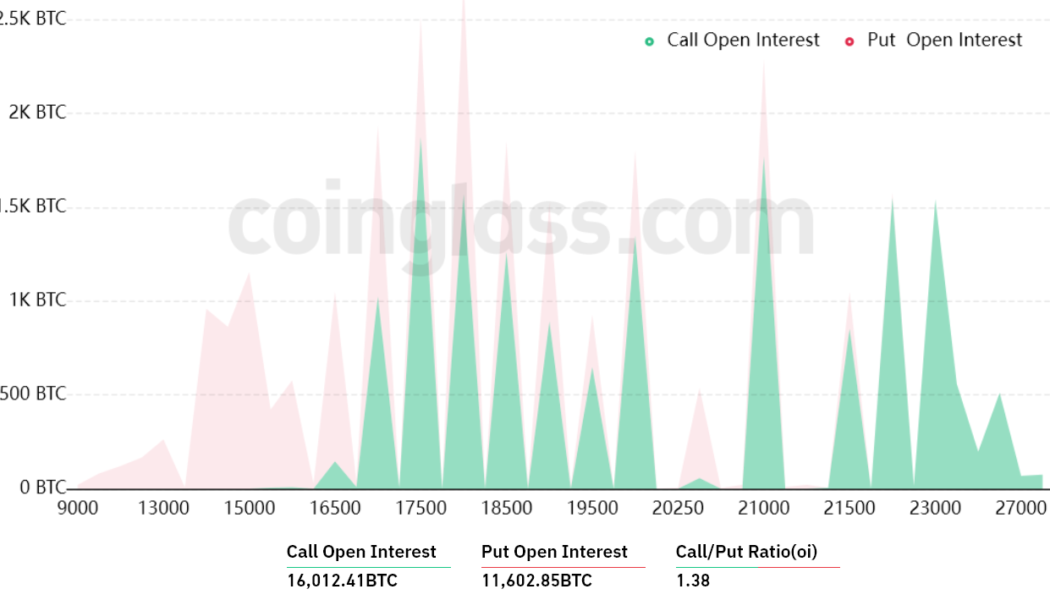

Bitcoin price rally over $21K prompts analysts to explore where BTC price might go next

After Bitcoin (BTC) hit a yearly high of $21,095 on Jan. 13, where is it headed next? Bitcoin is currently witnessing an uptick in bullish momentum after the positively perceived Consumer Price Index (CPI) report was followed by a strong rally across the crypto market. The recent rally in Bitcoin is creating increased volume levels and higher social engagement on whether the price is in a breakout of fakeout mode. Is the Bitcoin bear market over? While the market is still technically in a bear market compared to last week, investor sentiment is improving. According to the Fear and Greed Index, a crypto-specific metric that measures sentiment using five weighted sources, investors’ feelings about the market hit a monthly high. Bitcoin Fear and Greed index. Source: alternative.me Bitco...

Total crypto market cap closes in on $1T right as Bitcoin price moves toward $20K

The total cryptocurrency market capitalization reached its highest level in over two months on Jan. 13 after breaking above the $900 billion mark on Jan. 12. While the 15.5% year-to-date gain sounds promising, the level is still 50% below the $1.88 trillion crypto market cap seen before the Terra-Luna ecosystem collapsed in April 2022. Crypto markets total capitalization, USD. Source: TradingView “Hopeful skepticism” is probably the best description of most investors’ sentiment at the moment, especially after the recent struggles of recapturing a $1 trillion market capitalization in early November. That rally to $1 trillion was followed by a 27.6% correction in three days and it invalidated any bullish momentum that traders might have expected. Bitcoin (BTC) has gained 15.7% year-to-...

Cryptocurrency is headed toward surviving its first age

The past year was a challenge across the globe. Financial markets plunged deep into the red, affecting millions, if not billions, of people worldwide. Inflation rose. For crypto, it has arguably been the worst year since Bitcoin’s (BTC) inception. It has been more of an ice age than a crypto winter, and bad actors and weak projects have dominated headlines — including FTX, Voyager, Celsius, Terra, Hodlnaut, and this week, Nexo. In 2023, the purge could continue with projects that — like Tezos, Lisk and EOS — do not develop any new technology, nor do they innovate. It’s been said frequently that 90% of crypto projects will ultimately fade away or disappear because, among other failures, they solve nothing. The dubious actors failed to comply with transparency and decentralization an...

Huobi net outflows crossed over 60M within the past 24 hours: Report

Cryptocurrency exchange Huobi has seen over $94.2 million dollars in net outflows within the past week. Within the past 24 hours alone, approximately $60 million has flowed out of the exchange, according to crypto analytics company Nansen. In the past 24 hours, Huobi has seen a significant increase in net outflows $60.9M* of the $94.2M* net outflow in the past week occurred in the past day alone *Contains Ethereum, Avalanche, BNB Chain, Fantom, & Polygon flows pic.twitter.com/JV1Tg13QMY — Nansen (@nansen_ai) January 6, 2023 Nansen also reported that a significant portion of withdrawals were in Tether (USDT), USD Coin (USDC), and Ether (ETH), from wallets with high balances. The significant increase in outflows from the exchange was allegedly triggered by rumors circulating on Twi...