Market Update

Analysts say Bitcoin’s bounce at $36K means ‘it’s time to start thinking about a bottom’

Bears remain in full control of the cryptocurrency market on Jan. 24 and to the shock of many, they managed to pound the price of Bitcoin (BTC) to a multi-month low at $32,967 during early trading hours. This downside move filled a CME futures gap that was left over from July 2021. Data from Cointelegraph Markets Pro and TradingView shows that the $36,000 level was overwhelmed in the early trading hours on Monday, leading to a sell-off that dipped below $33,000 before dip buyers arrived to bid the price back above $35,500. BTC/USDT 1-day chart. Source: TradingView Here’s a look at what several analysts are saying about the macro factors at play in the global financial markets and what to be on the lookout for in the months ahead. “Rate hikes don’t kill risk assets” F...

Bitcoin falls to $36K, traders say bulls need a ‘Hail Mary’ to avoid a bear market

Bitcoin (BTC) price continues to sell-off and the knock-on effect is an even sharper correction in altcoins and DeFi tokens. At the time of writing, BTC price has sank to its lowest level in 6 months and most analysts are not optimistic about an immediate turn around. Data from Cointelegraph Markets Pro and TradingView shows that a wave of selling that began late in the day on Jan. 20 continued into midday on Friday when BTC hit a low of $36,600. BTC/USDT 1-day chart. Source: TradingView Here’s a check-in with what analysts have to say about the current downturn and what may be in store for the coming weeks. Traders expect consolidation between $38,000 and $43,000 The sudden price drop in BTC has many crypto traders predicting various dire outcomes along the lines of an ext...

Analysts warn that Bitcoin could dip to $38K ‘before an eventual breakout’

The cryptocurrency market faced another day of weakness on Jan. 18 as the price of Bitcoin (BTC) dropped lower and additional pressure was also put on the altcoin market. Currently, the crypto Fear and Greed Index registered “Extreme Fear” among investors and some traders caution that BTC price could soon fall below its recent $39,000 swing low. Crypto Fear & Greed index. Source: Alternative Data from Cointelegraph Markets Pro and TradingView shows that bulls lost control of the $42,000 support level during the early trading hours on Jan. 18 as bears hammered the BTC price to a daily low of $41,250. BTC/USDT 1-day chart. Source: TradingView January is historically weak for Bitcoin Many crypto holders who were disappointed by the lack of a blow-off top to close out 2021 are ...

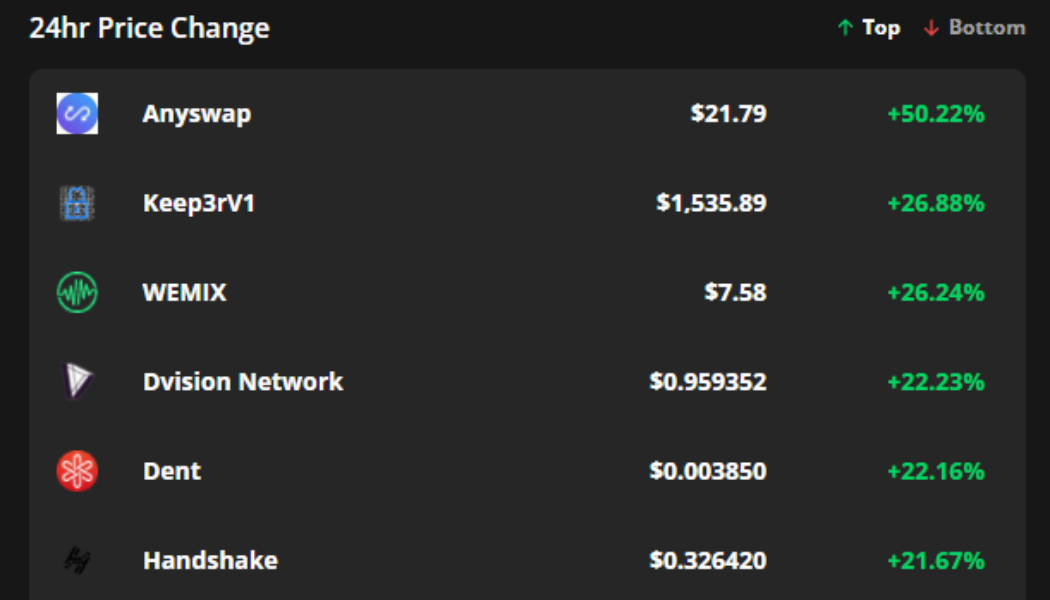

Anyswap, Keep3rV1, WEMIX follow Bitcoin’s move to $44K with double-digit rallies

The cryptocurrency community is back in high spirits on Jan. 12 after a majority of tokens in the top 200 flashed green following Bitcoin’s (BTC) spike to $44,000. The return of bullish momentum has come as a boon to several altcoin projects, with multiple tokens seeing gains in excess of 20%. Top 7 coins with the highest 24-hour price change. Source: Cointelegraph Markets Pro Data from Cointelegraph Markets Pro and TradingView shows that the biggest gainers over the past 24-hours were Anyswap (ANY), Keep3rV1 (KP3R) and WEMIX (WEMIX). Anyswap expands its list of supported networks Gains in the altcoin market were led by Anyswap, a decentralized exchange that specializes in allowing users to transfer and swap tokens between 25 distinct networks. Data from Cointelegraph Markets Pr...

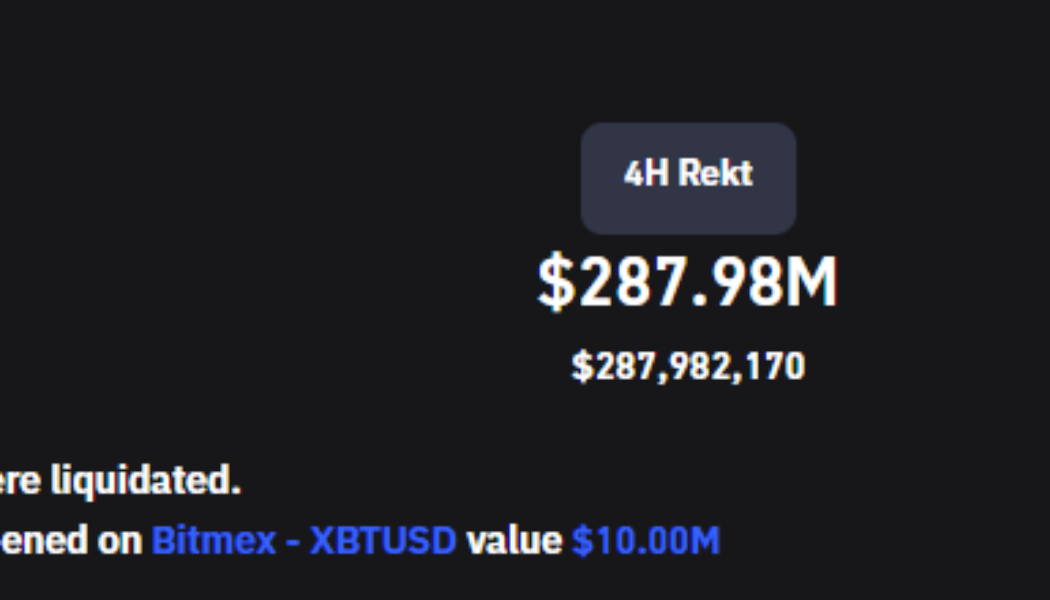

Bitcoin price drops to $43.7K after Fed minutes re-confirm plans to hike rates

Bitcoin (BTC) and the wider cryptocurrency market fell under as equities markets pulled back at the closing bell after minutes from the Federal Reserve’s December FOMC meeting showed that the regulator is committed to decreasing its balance sheet and increasing interest rates in 2022. As stock markets corrected, BTC price followed suit by dropping below $44,000, setting off a cascade of liquidations that reached $222 million in less than an hour. Total liquidations. Source: Coinglass Data from Cointelegraph Markets Pro and TradingView shows that after oscillating around support at $46,000 for the past couple of days, Bitcoin was hit with a wave of selling that pulled the price to an intraday low of $43,717. BTC/USDT 4-hour chart. Source: TradingView Based on the current situati...

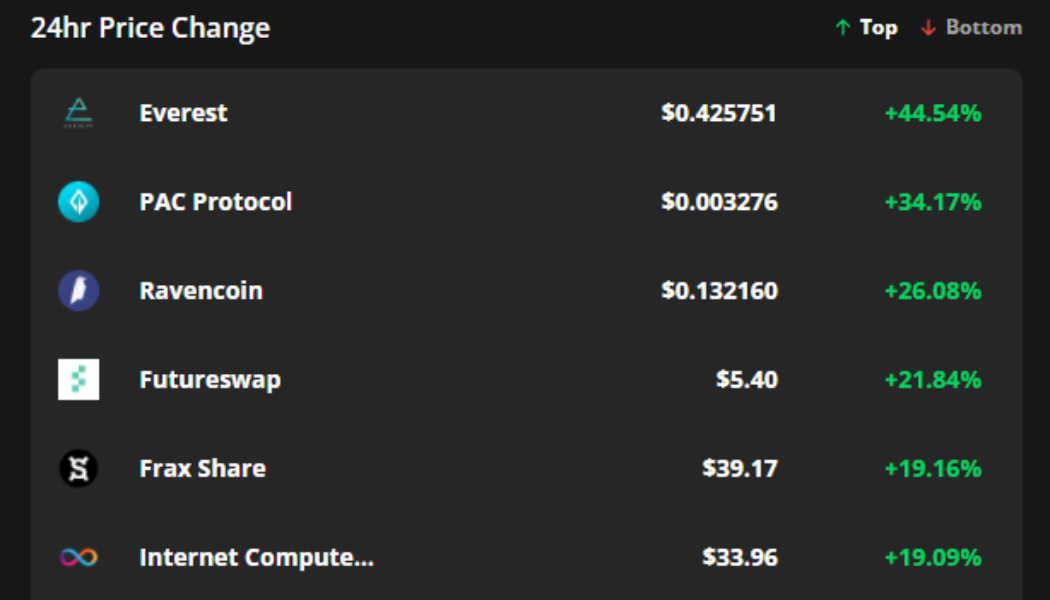

Altcoins turn bullish even as Bitcoin price slips below $46K again

The mood across the cryptocurrency is one of growing anticipation as the price of Bitcoin (BTC) continues to trade just below $47,000. The sideways price action has analysts warning that an “explosive volatility period” is rapidly approaching but few have been willing to predict the direction of the breakout. While Bitcoin price compresses, the altcoin market has come alive and multiple tokens are posting notable gains, especially in the DeFi cohort. Top 7 coins with the highest 24-hour price change. Source: Cointelegraph Markets Pro Data from Cointelegraph Markets Pro and TradingView shows that the biggest gainers over the past 24-hours were Everest (ID), PAC Protocol (PAC) and Ravencoin. Everest expands its interoperability Everest is a blockchain company with a focus on removing b...

Terra (LUNA) hits record $20B TVL, surpassing Binance Smart Chain

Terra (LUNA), an open-source stablecoin network, hit an all-time high of $20.05 billion in total value locked, or TVL, across its 13 product offerings, according to industry data. On Dec. 1, Terra’s TVL was at $11.9 billion, signifying a 68% increase in less than a month. This means that the platform’s users are investing in large quantities into the protocol to receive staking rewards. The price of LUNA, Terra’s native token, is also steadily trending upwards, trading above $94 with a 31% increase in one week, according to Cointelegraph Markets Pro. The coin now has a total market capitalization of $34.8 billion, placing it in the top 10 crypto projects. LUNA continues to be one of crypto’s hottest performers. Source: Cointelegraph Markets Pro In terms of TVL...

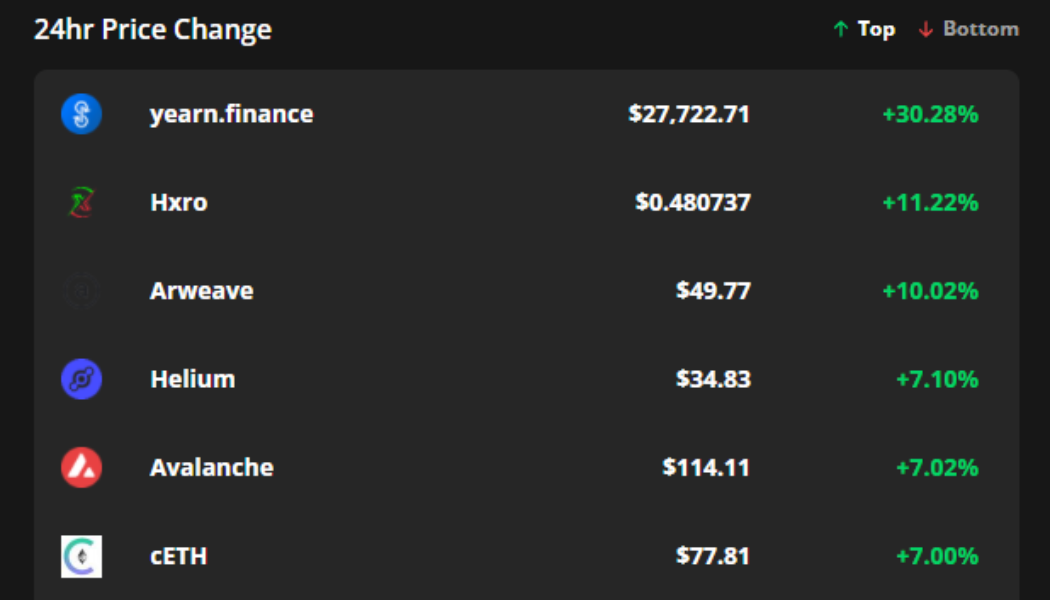

YFI, HXRO and AR post gains even as Bitcoin price dips to $45.5K

Bitcoin (BTC) bulls took another beating on Dec. 17 as a midday onslaught dropped the price to $45,500. The price did manage a quick bounce back to $47,000 but sweeping a new daily low could be a sign that additional downside is in store. Amid the wider market downturn, several altcoins provided weary traders with a source of refuge as token buybacks and increased network activity helped bolster their prices and provide shelter from the storm. Top 7 coins with the highest 24-hour price change. Source: Cointelegraph Markets Pro Data from Cointelegraph Markets Pro and TradingView shows that the biggest gainers over the past 24-hours were Yearn.finance (YFI), Hxro (HXRO) and Arweave (AR). YFI benefits from token buybacks Yearn.finance is a decentralized finance (DeFi) aggregator service that ...

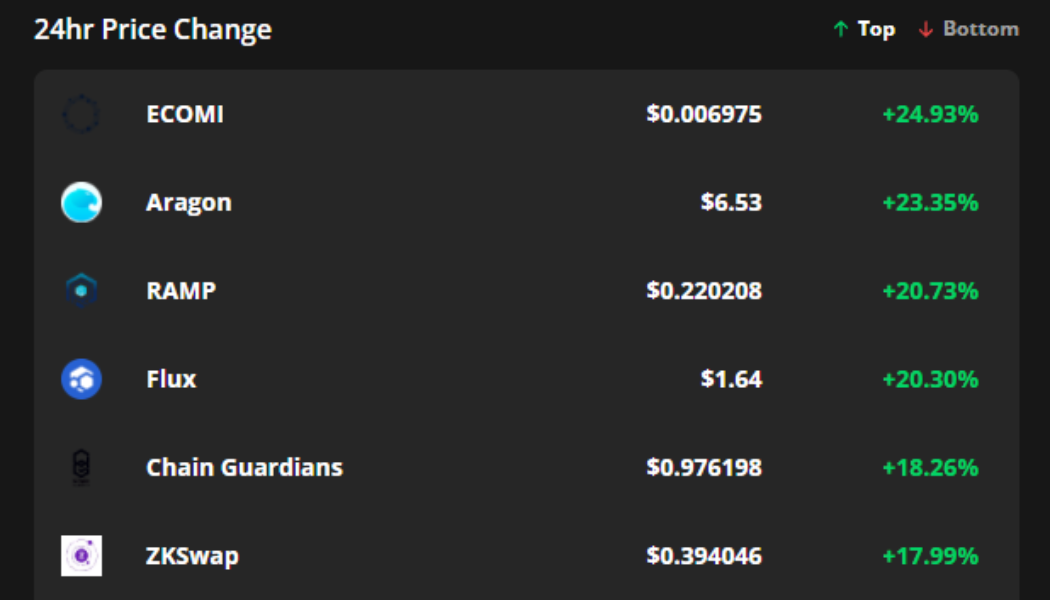

ECOMI, Aragon and Ramp breakout after Bitcoin price pushes above $49K

Cryptocurrency prices and investor sentiment reversed course on Dec. 15 after Federal Reserve chairman Jerome Powell confirmed the bank’s plan to hike interest rates in 2022 and slow down the bond purchasing program that had been in play since the emergence of the coronavirus in March 2020. Following the announcement, Bitcoin (BTC) price tacked on a 1.65% gain, bringing the price above $49,000 and Ether trekked back above the $4,000 mark. Altcoins followed suit with their usual double-digit gains and for the moment, it appears as if bulls have taken back control of the market. Top 7 coins with the highest 24-hour price change. Source: Cointelegraph Markets Pro Data from Cointelegraph Markets Pro and TradingView shows that the biggest gainers over the past 24-hours were ECOMI (OM...

Look out below! Analysts eye $40K Bitcoin price after today’s dip to $45.7K

On Monday, Bitcoin’s short-term outlook worsened after the price fell to an intra-day low at $45,672, a far cry from the weekend’s promising rally above the $50,000 level. With the year nearly complete, and all-time highs nearly 33% away, traders are most likely readjusting their expectations and pushing the $100,000 BTC target a bit further into 2022. Daily cryptocurrency market performance. Source: Coin360 Day traders, 4-hour chart watchers and over-leveraged longs are likely freaking out (unless they went short from $50,000 over the weekend or at this morning’s weakness), but let’s zoom out a little bit to see where Bitcoin price stands. BTC/USDT daily chart. Source: TradingView On the daily timeframe, we can see the price struggling to breakout away from the trend of daily lower ...

Bitcoin price slips below $47K as stocks, crypto prepare for this week’s FOMC meeting

Bitcoin (BTC) bulls are once again on the defensive foot after the breakout momentum that put the price above $50,000 on the weekend evaporated and pulled the price under $47,000. Analysts say the slight pullback in equities markets and the upcoming Federal Open Market Committee (FOMC) meeting are the primary reasons for Dec. 13’s pullback and a few suggest that a revisit to the swing low at $42,000 could be on the cards. BTC/USDT 4-hour chart. Source: TradingView Here’s a look at what analysts are saying about the current Bitcoin price action and what they expect in the short term. Fed tapering talks put pressure on the market The current headwinds facing BTC are in large part being influenced by regulatory matters in the United States, as highlighted in a recent report from D...

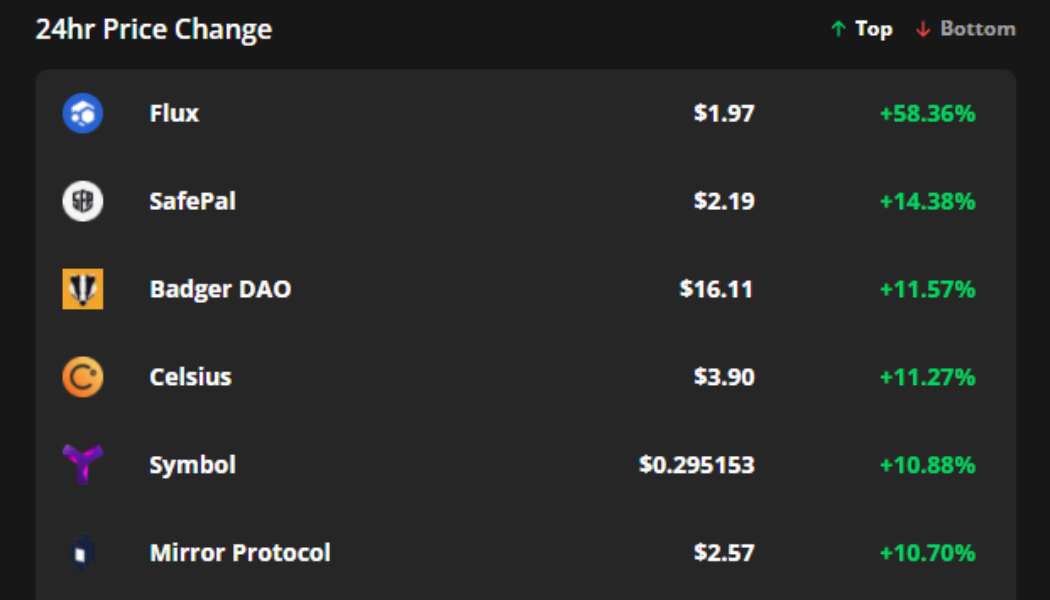

FLUX, SFP and Badger DAO surge even as Bitcoin price falls to $47K

The year-long mantra that the crypto market would see a blow-off top in December has proven to be a dud thus far and for the last week, most cryptocurrencies have been under sell pressure and Bitcoin (BTC) is encountering difficulty in trading above $47,000. That said, it’s not all bad news for cryptocurrency holders on Dec. 10 because several altcoins have managed to post double-digit gains due to new exchange listings and protocol upgrades. Top 7 coins with the highest 24-hour price change. Source: Cointelegraph Markets Pro Data from Cointelegraph Markets Pro and TradingView shows that the biggest gainers over the past 24-hours were Flux (FLUX), SafePal (SFP) and Badger DAO (BADGER). FLUX benefits from the “Binance bump” Flux is a GPU mineable proof-of-work p...