Market Update

Kyber Network (KNC) soars after integrating with Uniswap v3 and Avalanche Rush Phase 2

The outlook for projects in the decentralized finance (DeFi) sector has begun to improve in recent months as a combination of global events have highlighted the benefits of holding funds outside of the traditional financial systems. One project that has rallied over the past few months is Kyber Network (KNC), a multi-chain cryptocurrency trading and liquidity hub that aims to offer users the best trading rates. Data from Cointelegraph Markets Pro and TradingView shows that after bouncing off a low of $2.83 on April 6, the price of KNC jumped 55.4% to hit an all-time high of $4.04 on April 8 amid a 253% spike in its 24-hour trading volume. KNC/USDT 1-day chart. Source: TradingView Three reasons for the building momentum of KNC include the integration of support for ten separate blockchain n...

xASTRO staking and upcoming ‘Terra wars’ send Astroport price to new highs

Projects that launch on up-and-coming blockchain networks can often benefit from a low competition environment that allows them to attract new users and liquidity at a faster rate than crowded networks like Ethereum. A recent example of this is Astroport (ASTRO), an automated market maker (AMM) on the Terra (LUNA) network that has seen an influx of activity alongside the increased attention that is being focused on the Terra ecosystem and its Terra USD (UST) stablecoin. . Data from CoinGecko shows that since hitting a low of $1.28 on March 7, the price of ASTRO has exploded 194% to hit a new all-time high of $4.80 on April 5. ASTRO/USDT 4-hour chart. Source: TradingView Three reasons for the price appreciation seen in ASTRO include the increased attention the Terra ecosystem ha...

Ecosystem expansion and $45M funding round boost Boba Network (BOBA) price by 30%

The institutional adoption of cryptocurrencies has been gaining momentum over the past couple of years due to venture capitalists and money managers looking to the crypto market as the next investment class that will offer the greatest return. The Boba Network (BOBA) is the most recent protocol to benefit from institutional interest and the long search for an Ethereum (ETH) layer-two scaling solution capable of low-cost transactions and fast processing times. Data from Cointelegraph Markets Pro and TradingView shows that BOBA has gained 50.71% over the past week and a half after climbing from a low of $1.24 on March 27 to a daily high at $1.873 on April 5. BOBA/USDT 4-hour chart. Source: TradingView Three reasons for the climbing price of BOBA include the completion of a $45 million ...

Bitcoin recovers the $46K level, but several factors could prevent a stronger breakout

After dropping below $45,000 on March 31, Bitcoin (BTC) surprised investors with a quicker-than-expected recovery to the $46,500 level. Data from Cointelegraph Markets Pro and TradingView shows that bears managed to drop BTC to an overnight low of $44,210 before bulls showed up in force to lift the price back above $46,500 by midday. BTC/USDT 1-day chart. Source: TradingView Here’s what several analysts are saying about the short-term outlook for Bitcoin moving forward and what developments could present headwinds for the top cryptocurrency as a new month gets underway. The macro environment continues to impact BTC price Events in the global financial market continue to have a large impact on cryptocurrency markets and are likely to continue to do so for the foreseeable future. Accord...

A retest is expected, but most analysts expect Bitcoin price to extend much higher

The mood across the cryptocurrency market has seen a notable improvement in the last week as prices are on the rise with Bitcoin (BTC) now trading near $48,000 while Ether (ETH) attempting to hold above $3,400. Data from Cointelegraph Markets Pro and TradingView shows that the price of Bitcoin has been oscillating around $48,000 since it broke out above $45,000 early on March 28 and bulls are now debating whether a bull run to $80,000 is on the cards. BTC/USDT 1-day chart. Source: TradingView Here’s a look at what several analysts in the market are saying about the outlook for BTC moving forward and what levels to keep an eye on in case of a price pullback or another breakout to the upside. Bitcoin breaks above its 1-year moving average “Keeping it simple is often best” accordi...

Loopring (LRC) price surges by 50% after GameStop NFT marketplace integration

Filling multiple needs within the cryptocurrency community is one way a project can set itself apart from the competition and new attract users and liquidity to its ecosystem. Loopring aims to do exactly this by aiming to offer a EVM-based solution with low fees where DeFi and NFT developers and investors can transact. The layer-two (L2) scaling solution utilizes zk-Rollups to provide fast, low-cost transactions and the project has been gaining traction throughout the month of March. Data from Cointelegraph Markets Pro and TradingView shows that the price of LRC gained 57% between March 21 and March 23 as its price increased from $0.78 to $1.23 amidst a spike in its 24-hour trading volume to $2.75 billion. LRC/USDT 4-hour chart. Source: TradingView Three developments that have helped...

Ethereum price hits $3.2K as anticipation builds ahead of the ‘Merge’

The week-long uptrend in the cryptocurrency market has begun to awaken bullish crypto investors and the successful March 15 launch of the Ethereum “merge” on the Kiln testnet has the community excited about the upcoming switch to proof-of-stake (POS). Data from Cointelegraph Markets Pro and TradingView shows that since the successful launch on Kiln, the price of Ether has climbed 25% from $2,500 to a daily high at $3,193 on March 25 as traders look to lock in their positions ahead of the merge. ETH/USDT 1-day chart. Source: TradingView Here’s a look at what analysts in the market are saying could happen with the price of Ether as the merge approaches and how the switch to POS could affect its price long term. A clear breakout from the downtrend The turnaround in Ether pri...

Bitcoin hits $44K, but traders want to see a few daily closes here before a move higher

Morale across the cryptocurrency ecosystem is rising on March 24 as several days of positive moves have helped lift Bitcoin (BTC) back above $44,000 and Ether bulls took control at $3,100. The climbing price of BTC comes amid a backdrop of surging inflation and rising interest rates, which could see up to seven hikes over the course of 2022, according to Minneapolis Federal Reserve President Neel Kashkari. BTC/USDT 1-day chart. Source: TradingView Data from Cointelegraph Markets Pro and TradingView shows that after trading near $43,000 throughout the morning session on March , a midday spike lifted the price of BTC to an intraday high at $44,186 where it bumped up against a major resistance zone. Bitcoin needs to flip $44,000 into support A look at the weekly chart shows that “Bitcoi...

Ethereum price breaks through $3K, but analysts warn that a retest is needed

The cryptocurrency market continues to forge ahead on March 23 despite facing headwinds on multiple fronts. At the moment, global conflict, rising inflation and widespread economic uncertainty are taking a toll on financial markets and helping to highlight the need for a diversified investmen portfolio. Altcoins have managed to gain some ground in recent days, led by Ethereum, the top smart contract platform, which managed to climb back to the major support and resistance zone at $3,000 where bulls are now battling for control. ETH/USDT 1-day chart. Source: TradingView Here’s a look at what several analysts in the market are saying about the path forward for Ether and whether or not further upside is expected in the short-term. Upcoming test of $3,125 A general overview of the recent...

Bitcoin bulls take aim at $45K while some analysts warn of possible correction

The bullish narrative is beginning to build across the cryptocurrency ecosystem on March 22 as the price of Bitcoin (BTC) briefly spiked above $43,000 while Ether (ETH) has reclaimed support at $3,000 following a deposit of $110 million worth of ETH into Lido’s liquidity pools. Data from Cointelegraph Markets Pro and TradingView shows that the price of Bitcoin rallied 6.15% from a low of $40,884 in the early hours of Tuesday to an intraday high at $43,380 before consolidating around support at $42,300. BTC/USDT 1-day chart. Source: TradingView Here’s what several analysts are saying about Bitcoin’s recent price action and which support and resistance levels to keep an eye on moving forward. BTC price could correct lower A foreshadowing of Bitcoin’s move on March 22 was pro...

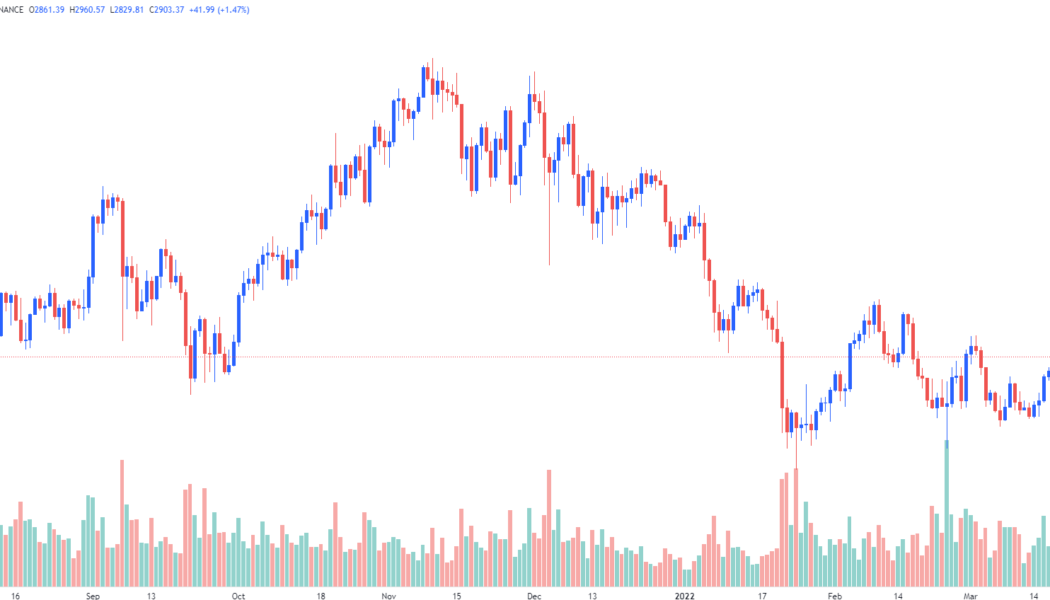

Ether bulls eye resistance at $3K as the network prepares to undergo ‘The Merge’

A new week in the cryptocurrency market has brought more of the same sideways price action that the wider ecosystem has experienced in recent months, as Bitcoin (BTC) continues to hold support near $41,000 while some analysts warn that high inflation and rising interest rates could see the top cryptocurrency fall to $30,000. On the altcoin front, Ether (ETH) appears to be showing some signs of life as noted by cryptocurrency analyst Willy Woo, who recently tweeted that “Ether [is] setting up to break upwards out of a very long term, 3.5-month bearish trend line.” Data from Cointelegraph Markets Pro and TradingView shows that the ETH price is now trading above support at $2,900, with bulls looking to make another run at breaking the $3,000 resistance after being firmly rejected a...

Bitcoin rallied, but analysts say it’s ‘more of the same’ until $46K becomes support

“Volatility” is the word of the month and that is exactly what cryptocurrency investors saw today as Bitcoin rallied after concerns over the Biden administration’s executive order on crypto turned out to be a ‘nothingburger’. Data from Cointelegraph Markets Pro and TradingView shows that after trading near the $39,000 mark for the past few days, the price of Bitcoin (BTC) spiked 10.42% to an intraday high at $42,606 on as cautious traders flooded back into the market. BTC/USDT 1-day chart. Source: TradingView Here’s a look at what traders and analysts in the market are saying about this latest move and the areas of support and resistance to keep an eye on. “Different pump, same story” Wednesday’s move for Bitcoin was just a repeat of recent be...