Market Analysis

Even after the pullback, this crypto trading algo’s $100 bag is now worth $20,673

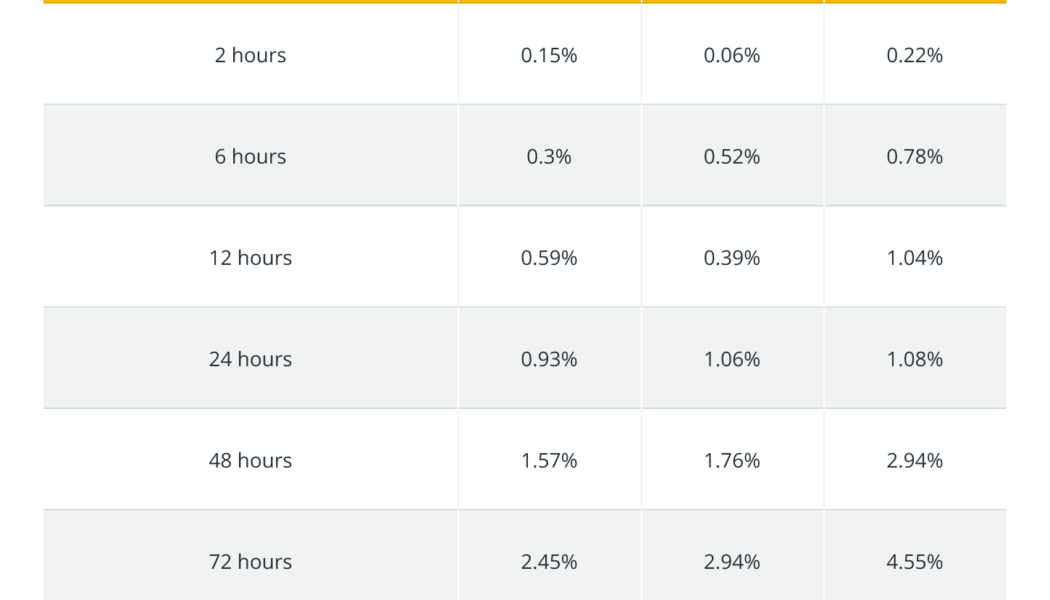

Exactly one year ago, on Jan. 9, 2021, Cointelegraph launched its subscription-based data intelligence service, Markets Pro. On that day, Bitcoin (BTC) was trading at around $40,200, and today’s price of $41,800 marks a year-to-year increase of 4%. An automated testing strategy based on Markets Pro’s key indicator, the VORTECS™ Score, yielded a 20,573% return on investment over the same period. Here is what it means for retail traders like you and me. How can I get my 20,000% a year? The short answer is – you can’t. Nor can any other human. But it doesn’t mean that crypto investors cannot massively enhance their altcoin trading game by using the same principles that underlie this eye-popping ROI. The figure in the headline comes from live testing of various VORTECS™-based tra...

5 NFT-based blockchain games that could soar in 2022

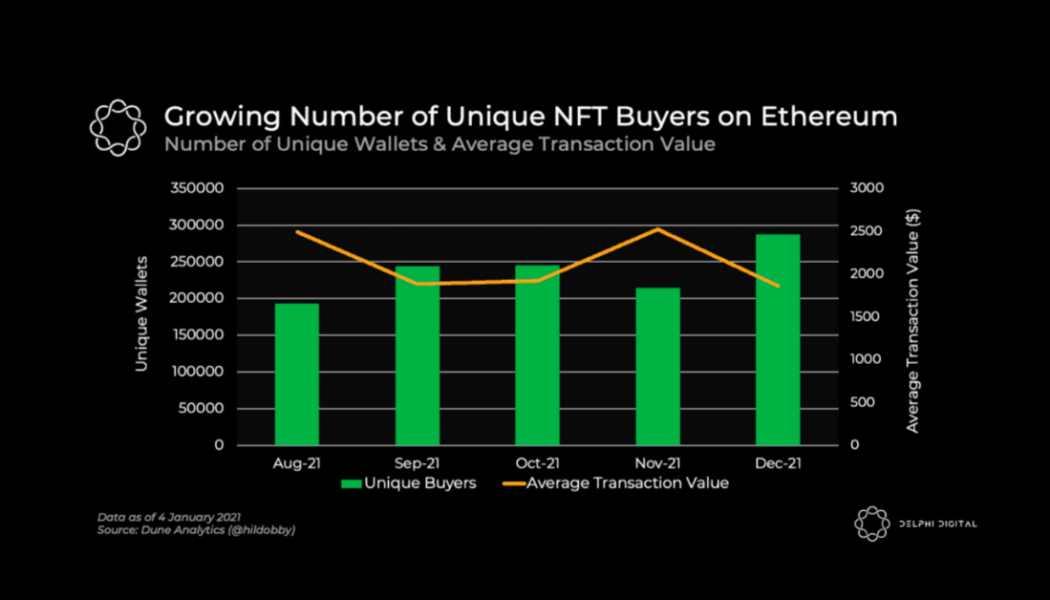

After the popularity of DeFi, came the rise of nonfungible tokens (NFTs) and to the surprise of many, NFTs took the spotlight and remain front and center with the highest volume in sales, occuring at the start of January 2022. Growing number of unique NFT buyers on Ethereum Source: Delphi Digital While 2021 became the year of NFTs, GameFi applications did surpass DeFi in terms of user popularity. According to data from DappRadar, Bloomberg gathered: “Nearly 50% of active cryptocurrency wallets connected to decentralized applications in November were for playing games. The percentage of wallets linked to decentralized finance, or DeFi, dapps fell to 45% during the same period, after months of being the leading dapp use case.” Blockchain, play-to-earn game Axie infinity, skyrocketed an...

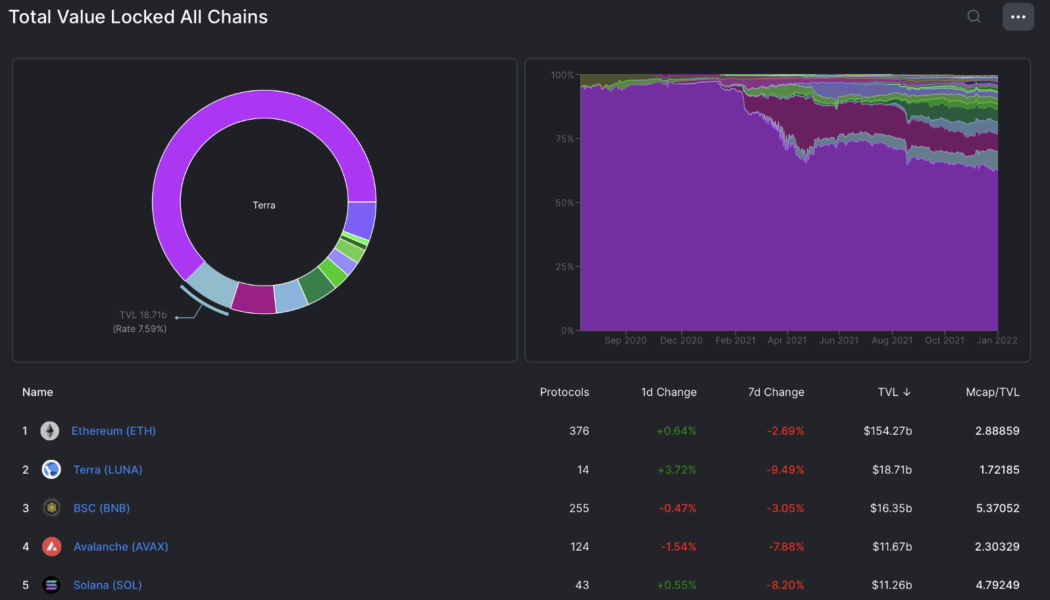

Here’s how Terra traders use arbitrage to profit from LUNA and bLUNA

The end of the year is normally a time to wind down and prepare for the holiday season, but the last few weeks of 2021 saw a crypto market that showed no signs of resting. One of the headline-grabbing stories related to Terra reaching an all-time high in terms of the total value locked (TVL), and the project surpassed Binance Smart Chain (BSC) as the second-largest decentralized finance blockchain after Ethereum. After reaching the $20-billion TVL mark on Dec. 24, Terra’s TVL has come down to around $19.3 billion at the time of writing according to data from Defi Llama, but this is in no way, shape or form a bearish signal. Top 5 total value locked on the top 5 blockchains. Source: Defi Llama Currently, Terra has only 14 protocols built on the chain, compared to the 257 protocols on ...

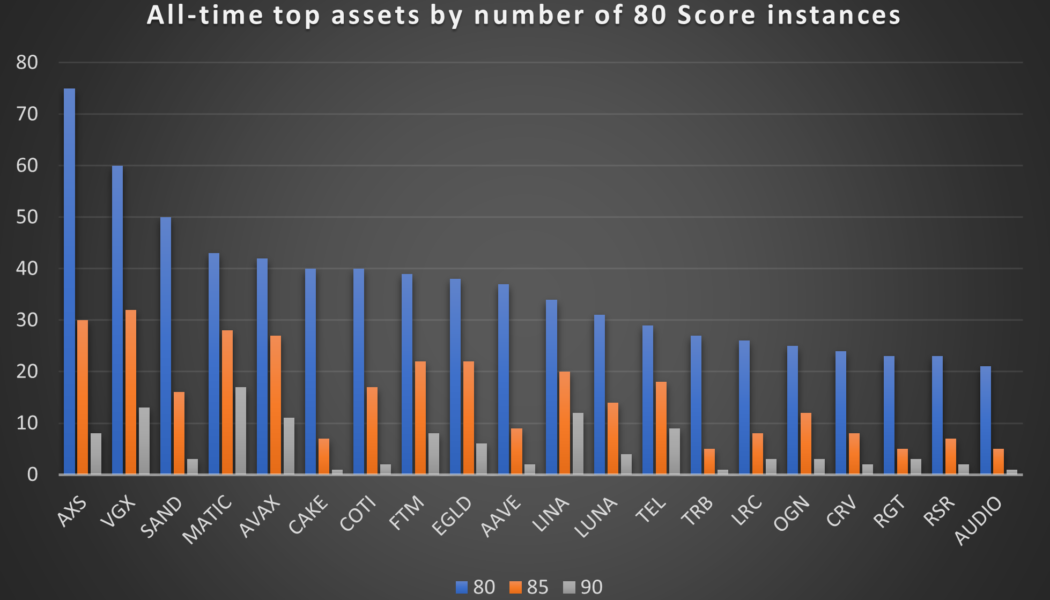

Here are the most predictable tokens of 2021 – for those who knew where to look

Digital assets’ past performance is never a guarantee of future price movement. There are never two identical situations in the crypto marketplace, so even historically similar patterns of a token’s behavior can be followed by starkly different price action charts. Still, crypto assets’ individual history of price action often rhymes, giving those who can ready this history right a massive edge over other traders. And, importantly, some tokens are much more likely than others to exhibit recurring behavior, which makes their bullish setups more recognizable ahead of time. Cointelegraph Markets Pro, a subscription-based data intelligence platform whose job is to search for regularities in crypto assets’ past trading behavior and alert traders to historically bullish conditions around individ...

Traders delay $100K Bitcoin prediction, but still expect a blow-off top in 2022

Bullish traders that drank the “Bitcoin to $100,000 by year-end” Kool-Aid are now coming to terms with the fact that there may be no Santa Claus rally to wrap up 2021. At the moment, the pipe dream has morphed into simple hopes that the top cryptocurrency can at least finish the year above $50,000. Data from Cointelegraph Markets Pro and TradingView shows that the bounce in price seen in BTC following remarks from Federal Reserve Chair Jerome Powell has pretty much evaporated and over the past 48-hours the price has swept fresh lows at $45,500 and from the look of things, the price could drop even further. BTC/USDT 4-hour chart. Source: TradingView Here’s a look at what traders think about Bitcoin’s current price action and what could be in store for the remainder o...

A tale of two NFTs: Could Bored Ape Yacht Club flip CryptoPunks?

Rising from its modest minting price of 0.08 Ether (ETH), Bored Ape Yacht Club (BAYC) has climbed to nonfungible-token (NFT) stardom, competing with one of the earliest examples of Larva Labs CryptoPunk NFT. Given its steady but amplified growth, BAYC has many crypto natives speculating that its collection will eventually “flip” CryptoPunks, and there are several reasons to back it. Tip-toeing around which collection is the top NFT contender, the competition between these two collections is driven by several factors. With an existing divide between mainstream media adoption and the IP rights granted to its owners, the BAYC and CryptoPunks collection also have a disparate amount of unique holders. This is important because the amount of unique holders is often indicative of a wider sp...

Altcoin Roundup: Three smart contract platforms that could see deeper adoption in 2022

Decentralized finance (DeFi) dominated media headlines throughout 2021 and the sector, along with nonfungible tokens (NFTs), helped to initiate the mass adoption of cryptocurrencies. While high yields on staking and instant profits from flipping jpegs have proven to be very lucrative for investors, it’s important to remember that none of it would have been possible without the underlying capabilities of smart contract technology. The Ethereum network remains, hands-down, the most widely used layer-one smart contract platform in the crypto ecosystem, but everyone knows about the high fee and clogged network issues of the past few years. In 2021, competing networks like Avalanche and Binance Smart Chain enabled compatibility with the Ethereum Virtual Machine (EVM) and this produced pos...

Here’s why Bitcoin traders expect choppy markets for the remainder of 2021

Inflation concerns and a general sense of trepidation about the future of the global economy continue to put a damper on Bitcoin and altcoin prices and currently the Crypto Fear and Greed index is solidly in the ‘fear’ zone where it has been parked since the beginning of December. Crypto Fear & Greed Index. Source: Alternative Despite the brief bump in prices seen across the markets following the recent Federal Open Market Committee (FOMC) meeting where Fed Chair Jerome Powell indicated that interest rates would remain low for the time being, the overall sentiment in the crypto market continues to wane, signaling that 2021 could end on a bearish note. BTC price could dampen due to macro concerns In a recent report from Delphi Digital, analysts noted that the price of Bitcoin (BTC...

ZK-rollups step into the limelight after the quest to scale Ethereum evolves

Scalability on the Ethereum (ETH) network has been a point of contention within the cryptocurrency ecosystem for years, primarily due to high fees and network congestion during periods of peak demand. The latest solution to emerge as the final fix to Ethereum’s scalability woes are Zero-knowledge rollups (ZK rollups), a form of scaling that runs computations off-chain and submits them on-chain via a validity proof. Zk rollup season — cryptowarlord.eth ( ͡° ͜ʖ ͡°) (@CryptoWarlordd) December 7, 2021 Earlier in the year, protocols that opted to use optimistic rollups such as Optimism and Arbitrum dominated the headlines and were touted as the best solution to scaling on Ethereum, but aside from Arbitrum, the hype for those protocols has quieted down and traders have pointed out that even opti...