Market Analysis

DeFi flashes early revival signs as retail and institutional inflows trickle in

Decentralized finance (DeFi) has had a rough go so far in 2022, and data from Messari shows the top ten-ranked DeFi assets currently down between 10% to 50% since the start of the year. Top ten DeFi tokens by market capitalization. Source: Messari A positive is, the situation may change soon as funds have began to flow back into the DeFi ecosystem following a month of declines as data shows institutional and retail funds returning to crypto markets. Data from Defi Llama shows that the total value locked in all of DeFi platforms has climbed to $211.1 billion on Feb. 11, up from a low of $185.14 billion on Jan. 31 Total value locked in DeFi. Source: Defi Llama A closer look at the individual protocols that contribute to the total TVL shows that the biggest drawdowns in TVL over the past 30 d...

DeFi flashes early revival signs as retail and institutional inflows trickle in

Decentralized finance (DeFi) has had a rough go so far in 2022, and data from Messari shows the top ten-ranked DeFi assets currently down between 10% to 50% since the start of the year. Top ten DeFi tokens by market capitalization. Source: Messari A positive is, the situation may change soon as funds have began to flow back into the DeFi ecosystem following a month of declines as data shows institutional and retail funds returning to crypto markets. Data from Defi Llama shows that the total value locked in all of DeFi platforms has climbed to $211.1 billion on Feb. 11, up from a low of $185.14 billion on Jan. 31 Total value locked in DeFi. Source: Defi Llama A closer look at the individual protocols that contribute to the total TVL shows that the biggest drawdowns in TVL over the past 30 d...

3 things the crypto sector must offer to truly mainstream with TradFi

In the past year, we’ve seen the crypto economy undergo exponential expansion as heaps of money poured into various cryptocurrencies, decentralized finance (DeFi), nonfungible tokens (NFT), crypto indices, insurance products and decentralized options markets. The total value locked (TVL) in the DeFi sector across all chains has grown from $18 billion at the beginning of 2021 to $240 billion in January 2022. With so much liquidity in the ecosystem, the crypto lending space has also grown a significant amount, from $60 million at the beginning of 2021 to over $400 million by January 2022. Despite the exponential growth and the innovation in DeFi products, the crypto lending market is still only limited to token-collateralized loans, i.e. pledge one cryptocurrency as collateral to borro...

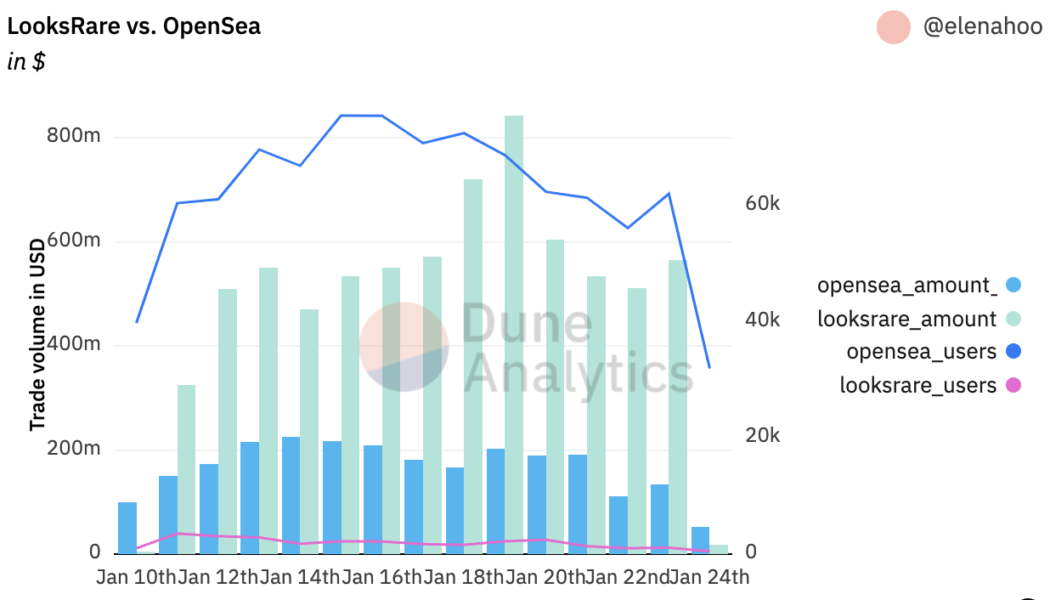

Clever NFT traders exploit crypto’s unregulated landscape by wash trading on LooksRare

LooksRare made its debut on Jan.10 and the recently launched NFT marketplace has drawn a lot of attention, not only because its daily trade volumes were more than double Opensea’s on the second day of trading, but also because it has become the new playground for wash traders. Wash trading is a series of trading activities involving the same trader buying and selling the same instrument simultaneously, creating artificially high trading volume and a manipulated market price for the asset in play. In the United States, wash trading in traditional financial markets has been illegal since 1936 and the most recent highly publicized scandal related to wash trading is the manipulation of LIBOR in 2012. While wash trading has been highly regulated and closely monitored by exchanges and regulators...

Altcoin Roundup: Cross-chain bridge tokens moon as crypto shifts toward interoperability

Interoperability is shaping up to be one of the main themes for the cryptocurrency market in 2022 as projects across the ecosystem unveil integrations that make their networks Ethereum (ETH) Virtual Machine (EVM) compatible. While this has been one of the long-term goals of the ecosystem as a step on the path to an interconnected network of protocols, it has also created a new decentralized finance (DeFi) market for multi-chain bridges and decentralized finance. Here are three of the top volume cross-chain bridges that the cryptocurrency community uses to transfer assets between blockchain networks. Multichain Multichain (MULTI), formerly known as Anyswap, is a cross-chain router protocol that aims to become the go-to router for the emerging Web3 ecosystem. According to data from Defi Llam...

Ethereum bulls aim to flip $2.8K to support before calling a trend reversal

The dire predictions calling for the onset of an extended bear market may have been premature as prices appear to be in recovery mode on Jan. 26 following a signal from the U.S. Federal Reserve that interest rates will remain near 0% for the time being. After the Fed announcement from, prices across the cryptocurrency market began to rise with Bitcoin (BTC) up 4.11% and making a strong push for $39,000. This sparked a wave of momentum that helped to lift a majority of tokens in the market, but at the time of writing BTC price has pulled back to the $37,000 zone. Data from Cointelegraph Markets Pro and TradingView shows that the top smart contract platform Ethereum (ETH) also responded positively to the rise in bullish sentiment as its price climbed 8.11% on the 24-hour chart to hit a...

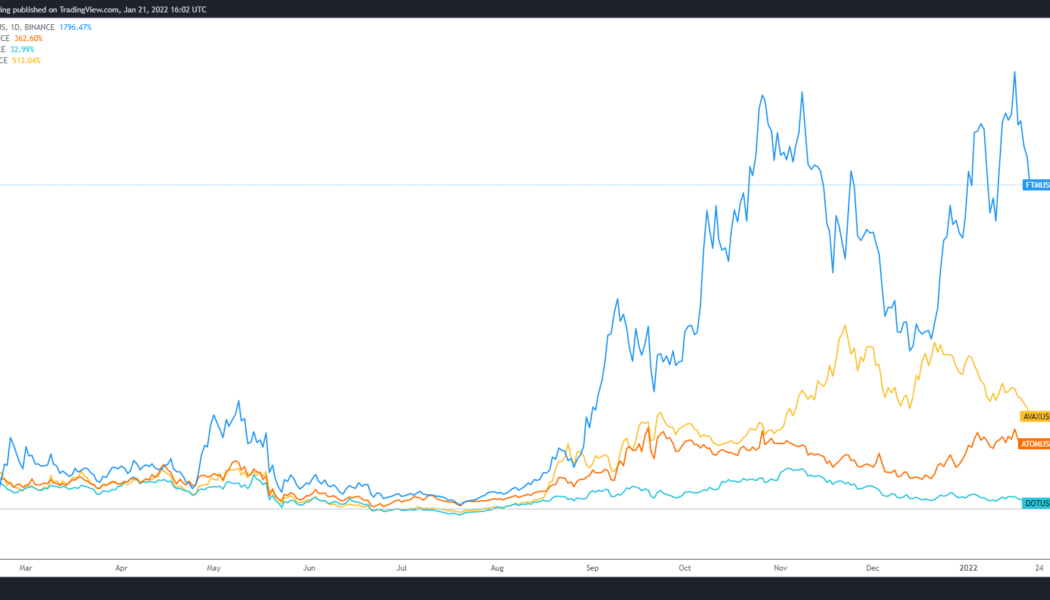

3 possible reasons why Polkadot is playing second fiddle in the L1 race

2021 was a sort of “coming-of-age” for many layer-one (L1) blockchain protocols because the growth of decentralized finance (DeFi) and nonfungible tokens (NFTs) forced users to look for solutions outside of the Ethereum (ETH) network where high fees and network congestion continued to be barriers for many. Protocols like Fantom (FTM), Avalanche (AVAX) and Cosmos (ATOM) saw their token values rise and ecosystems flourished as 2021 came to a close. Meanwhile, popular projects like Polkadot (DOT) underperformed, comparatively speaking, despite the high expectations many had for the sharded multi-chain protocol. FTM/USDT vs. AVAX/USDT vs. ATOM/USDT vs. DOT/USDT daily chart. Source: TradingView Setting aside the specific capability that each protocol offers in terms of transactions ...

Altcoin Roundup: 3 emerging P2E gaming trends to keep an eye on in 2022

Blockchain-based play-to-earn (P2E) gaming had a breakout year in 2021, and as the cryptocurrency ecosystem evolves in 2022, the P2E gaming sector and those that invest in it will need to consider what the next steps are. During bull markets, vaporware, speculation and euphoria can lead to unrealistic valuations and expectations, and this appears to also have impacted the P2E sector. Now that the hype is “over,” investors and developers will need to identify new value propositions that catalyze growth and steady investment into the blockchain gaming sector. Here’s a closer look at some of the trends that could emerge in the P2E ecosystem in 2022. Profit-sharing communities The first trend to keep an eye on in 2022 is projects that are looking to harness interest in nonfungible tokens to cr...

Altcoin Roundup: 3 ways blockchain technology could further mainstream in 2022

2021 was a breakout year for the cryptocurrency sector and this year is expected to see an extension of the “mass adoption” trend. Public awareness of blockchain technology is on the rise and a new cohort of projects designed to fill more niche roles in society are likely to emerge in the coming months. Three sectors that have the potential to see significant growth in 2022 are human resources (HR), employee payment solutions and platforms that serve the gig economy by offering corporate blockchain solutions. HR might pivot toward blockchain Human resource management is ripe for blockchain integration due to the security and data storage solutions offered. Blockchain would allow each employee to have a unique address where all pertinent information could be cryptographically stored. HR als...

Bitcoin cycle is far from over and miners are in it for the long haul: Fidelity report

Fidelity Digital Assets — the crypto wing of Fidelity Investments which has $4.2 trillion assets under management–shared their “two sats” on the future of the digital assets space. The key takeaways touched upon miners’ behavior and Bitcoin (BTC) network adoption. In the annual report released last week, the group shared some insights into the world of BTC mining: “As Bitcoin miners have the most financial incentive tho make the best guess as to the adoption and value of BTC (…) the current bitcoin cycle is far from over and these miners are making investments for the long haul.” The report stated that the recovery in the hash rate in 2021 “was truly astounding”, particularly when faced the world’s second-largest economy China banning Bitcoin in 2021. The rebound in hash rate s...

Was $39,650 the bottom? Bitcoin bulls and bears debate the future of BTC price

Bitcoin (BTC) price made a quick pop above $43,100 in the U.S. trading session but uncertainty is still the dominant sentiment among traders on Jan. 11 and bulls and bears are split on whether this week’s drop to $39,650 was BTC’s bottom. Data from Cointelegraph Markets Pro and TradingView shows that the price of Bitcoin has traded tightly around the $42,000 level as the global financial markets digested U.S. Federal Reserve Chair Jerome Powell’s statements on the upcoming fiscal policy changes. BTC/USDT 1-day chart. Source: TradingView Powell indicated that the central bank is prepared to “raise interest rates more over time” if inflation continues to persist at high levels, but analysts were quick to note further comments, suggesting that a low...

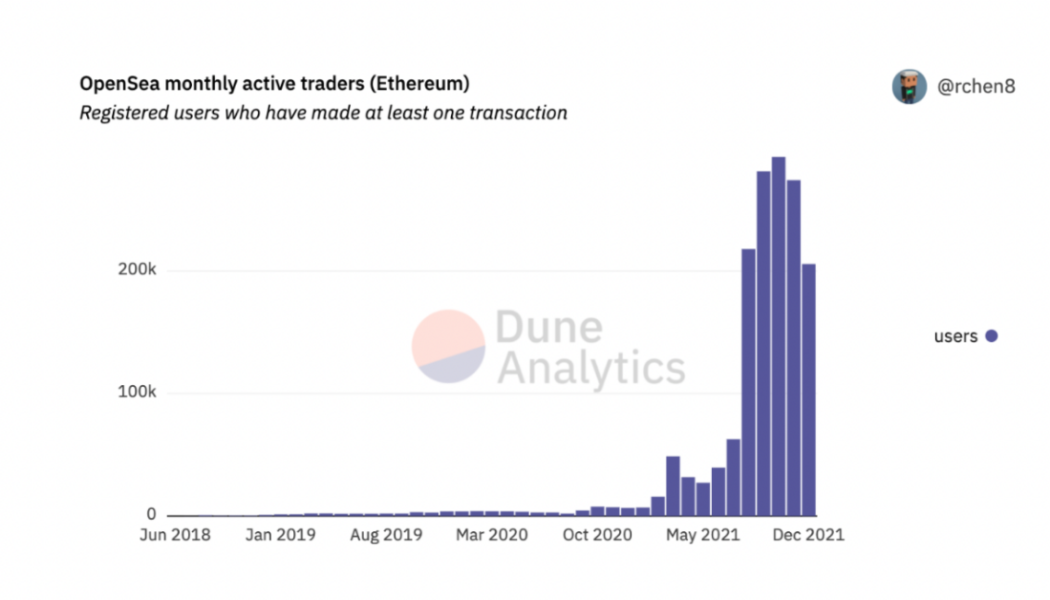

5 NFT marketplaces that could topple OpenSea in 2022

OpenSea has been the dominant decentralized platform for users looking to mint, buy, sell and trade nonfungible tokens (NFTs). Serving more as an NFT aggregator than a gallery, OpenSea locked in $3.25 billion in volume for December 2021 alone, according to data from Dune Analytics and from December 2020 to December 2021, the total volume increased by a whopping 90,968%. No stranger to contention and criticism, OpenSea has had its fair share of perils and pitfalls. Most notably, its former head of product, Nate Chastain, found using insider information to front-run and profit from selling the platform’s front page NFTs. Adding to the overall feeling of distrust, the community felt devalued after newly appointed chief financial officer (CFO) Brian Roberts hinted at going public. However, he ...