Market Analysis

‘People should invest in all of the major layer-1s,’ says a veteran trader

Scott Melker, veteran trader and pocaster, is convinced that major layer-1 protocols should be part of everyone’s investment portfolio. Instead of picking individual crypto projects, such as NFTs or blockchain games, Melker thinks it makes more sense to bet on the blockchain infrastructure on which these projects are built. “Any of these small projects could absolutely go nuts. But you’re going to have trouble choosing what they are. You should just own the layer-1 and the infrastructure that they’re all built on,” he said in an exclusive interview with Cointelegraph. “You may not own a Bored Ape, but Ethereum holders have certainly benefited from the success of Bored Apes!” he pointed out. Talking about his portfolio construction, Melker revealed that about 6...

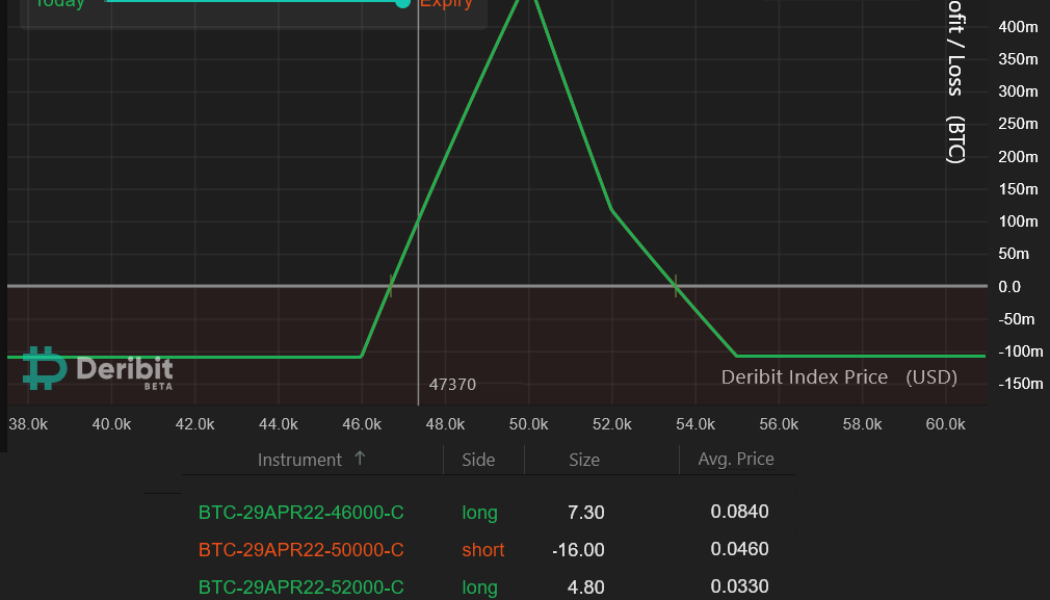

Here’s how pro traders use Bitcoin options to profit even during a sideways market

Bitcoin (BTC) price swings might be impossible to predict, but there is a strategy frequently used by pro traders that yields high returns with minimal cost. Typically, retail traders rely on leveraged futures positions which are highly susceptible to forced liquidations. However, trading Bitcoin options provide excellent opportunities for investors aiming to maximize gains while limiting their losses. Using multiple call (buy) options can create a strategy capable of returns six times higher than the potential loss. Moreover, these can be used in bullish and bearish circumstances, depending on the investors’ expectations. The regulatory uncertainty surrounding cryptocurrencies has long been a significant setback for investors and this is another reasons why neutral market strategies...

Wonky Mars Protocol launch shows ecosystem expansion may not add to network value

New protocols are launching every day on different networks in the crypto space and the trend is likely to continue through this year. When looking at the top five networks by total value locked (TVL) — Ethereum (ETH), Terra (LUNA), Binance Smart Chain (BSC), Avalanche (AVAX) and Solana (SOL) — according to data from DeFiLlama, Ethereum have 579 protocols (including L1 and L2); Terra has 25, BSC has 348, Avalanche and Solana have 187 and 64 protocols, respectively. The low number of protocols and high TVL from Terra surely stand out as the outlier here. Terra’s TVL reached an all-time high at $20 billion in December 2021 before dropping to $13 billion during the January 2022 crash. To date, the ecosystem has managed to boost its liquidity back to $26 billion. With only 25 protoco...

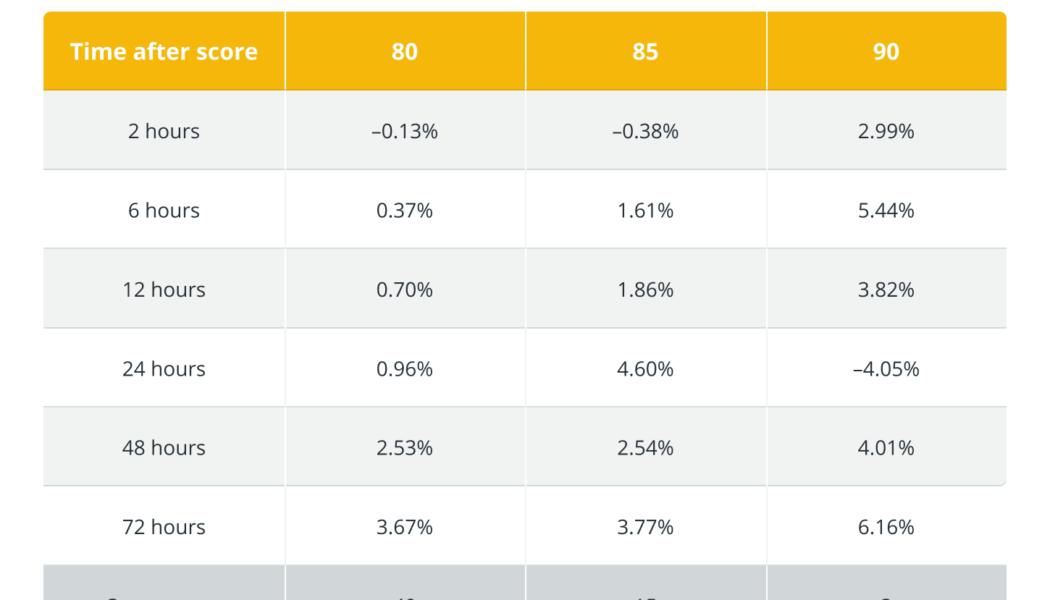

Here is how studying tokens’ price history helps patient traders enjoy consistent average gains.

Whether you consider cryptocurrency trading as art, science or a game of skill, one thing is beyond dispute: Those who excel at it are not the traders who maintain the longest series of lucky one-offs but those who establish sustainable trading processes yielding consistent returns. Ask a sample of seasoned pros if they would prefer to catch one obscure token’s 300%-in-a-day brush with fame or learn a strategy that systematically generates a 3% return on investment. You will be surprised how many of them (likely close to 100% of the sample) prefer modest yet systematic profits. How does one make their trading processes more systematic? One way is to rely on automated data analytics tools with a proven track record of consistent performance. One such tool is the VORTECS™ Score, an ar...

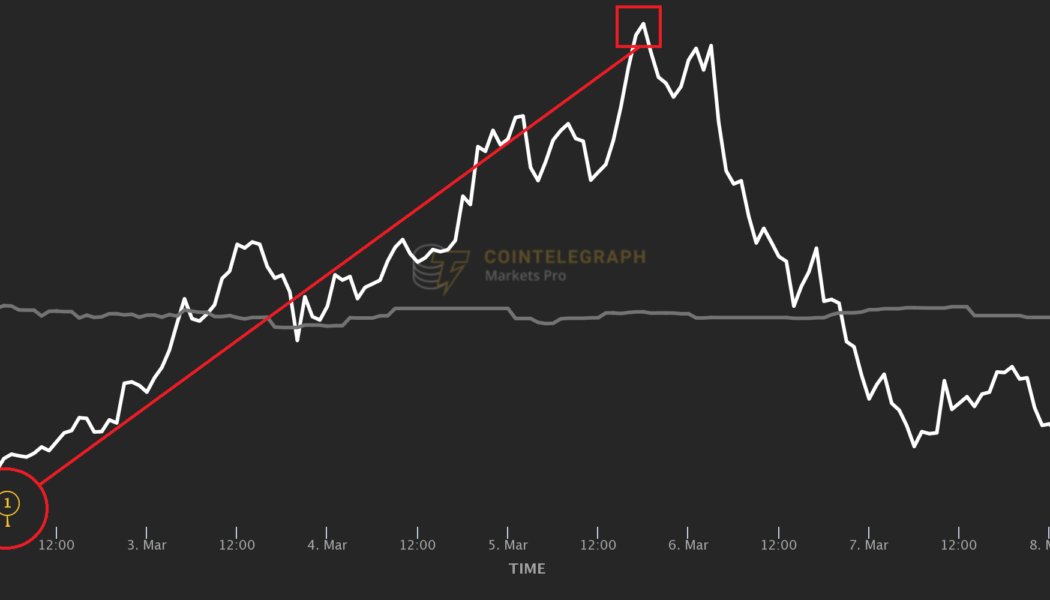

3 times in March that savvy crypto traders bought breaking news for the price of a rumor

As an old saying goes: Buy the rumor, sell the news. As a digital-native asset class, the prices of cryptocurrencies are clearly susceptible to market-moving news developments that instantly spread on the internet. Staying on top of bullish announcements can help crypto traders reap huge gains, but navigating the crypto news landscape can be daunting. Two major roadblocks get in the way: the abundance of potentially relevant information and the difficulty of making sure one is always among the first to learn the news that really matters. Extensive research shows that three types of crypto-related developments move digital asset prices most consistently: listings, staking announcements and big partnerships. This insight somewhat narrows down the scope of the developments that will most inte...

Fact or fiction? Did ApeCoin (APE) really drop by 80% since launch?

ApeCoin (APE), the governance token of the well-known Bored Ape Yacht Club (BAYC) NFT project was airdropped to BAYC and Mutant Ape Yacht Club (MAYC) owners at 8.30 am EST on March 17 and only eight hours after APE became tradable in the open market, it has already jumped to the 110th most traded token ranked by CoinGecko, totaling $900 million in trading volume across all tracked platforms. As one would expect, there were some volatile price movements minutes after the airdrop and headlines show the price of APE dropping 80% since its launch. This raises the question of whether the ordinary BAYC and MAYC owner could have sold APE at $40 instead of $14, which it is trading for at the time of publishing. Let’s take a look at APE’s price minutes after the airdrop was claimed and the token li...

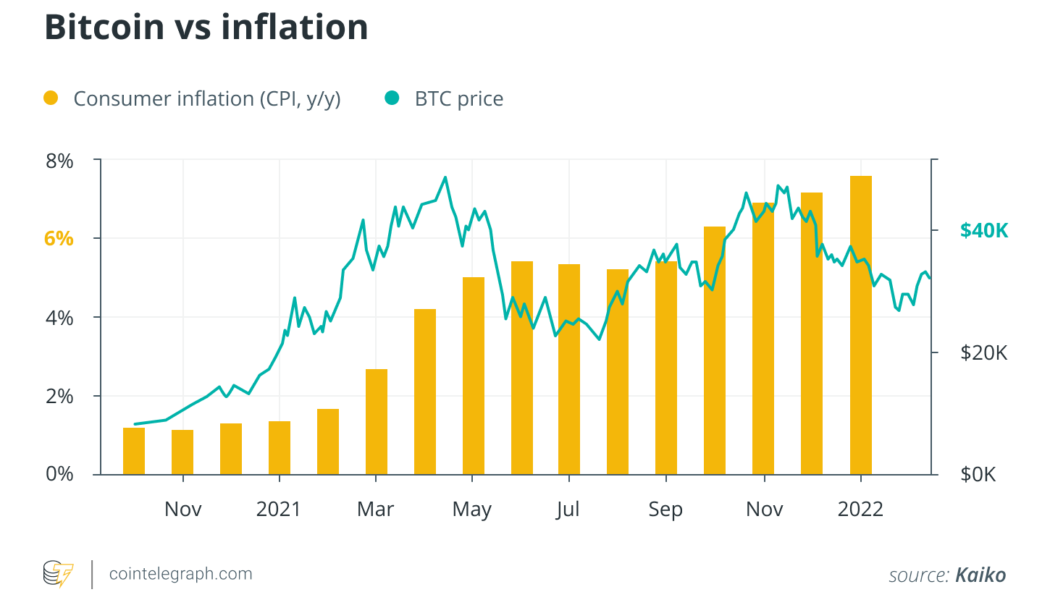

Inflation spikes in Europe: What do Bitcoiners, politicians and financial experts think?

Rising prices are grabbing headlines all over the world. Across the pond in the United States, inflation recently broke a 40-year record. The situation is severe in Europe, with prices rising over 5% across the Eurozone and 4.9% in the United Kingdom. While prices rise, Bitcoin (BTC) is flatlining at around $39,000. It poses many questions: Is Bitcoin an effective hedge against rising prices, what role can Bitcoin play in a high inflation environment and did Bitcoiners know that inflation was coming? Experts from the world of Bitcoin, finance and even European politics responded to these questions, sharing their views with Cointelegraph about the alarming price rises in Europe. From data analysts Kaiko’s monthly report, the Bitcoin price marched ahead of inflation, implying...

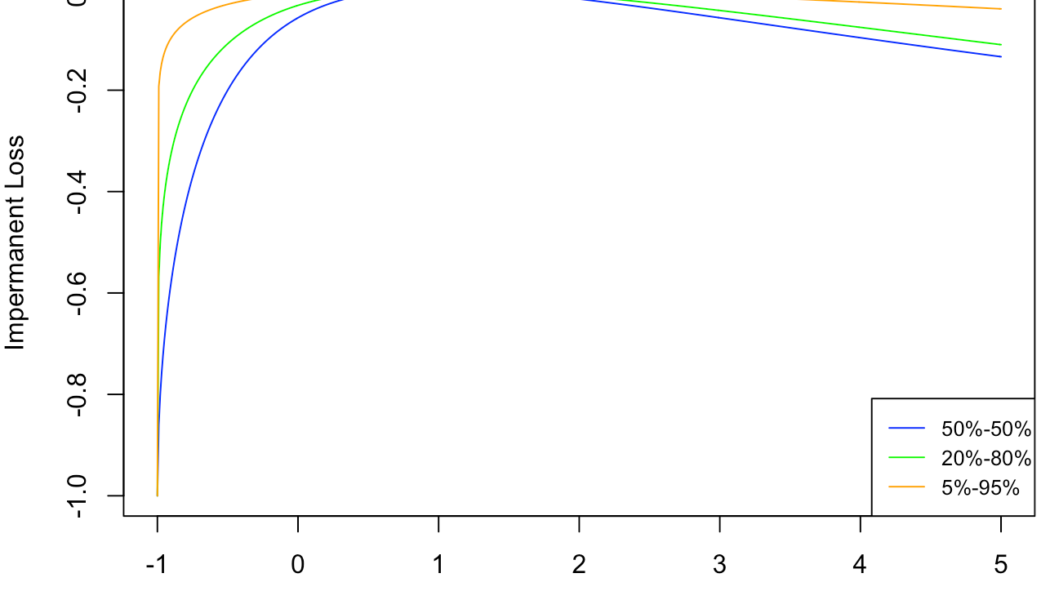

Impermanent loss challenges the claim that DeFi is the ‘future of France’

Impermanent loss is one of the most recognized risks that investors have to contend with when providing liquidity to an automated market maker (AMM) in the decentralized finance (DeFi) sector. Although it is not an actual loss incurred from the liquidity provider’s (LP) position — rather an opportunity cost that occurs when compared with simply buying and holding the same assets — the possibility of getting less value back at withdrawal is enough to keep many investors away from DeFi. Impermanent loss is driven by the volatility between the two assets in the equal-ratio pool — the more one asset moves up or down relative to the other asset, the more impermanent loss is incurred. Providing liquidity to stablecoins, or simply avoiding volatile asset pairs, is an easy way to reduce impermanen...

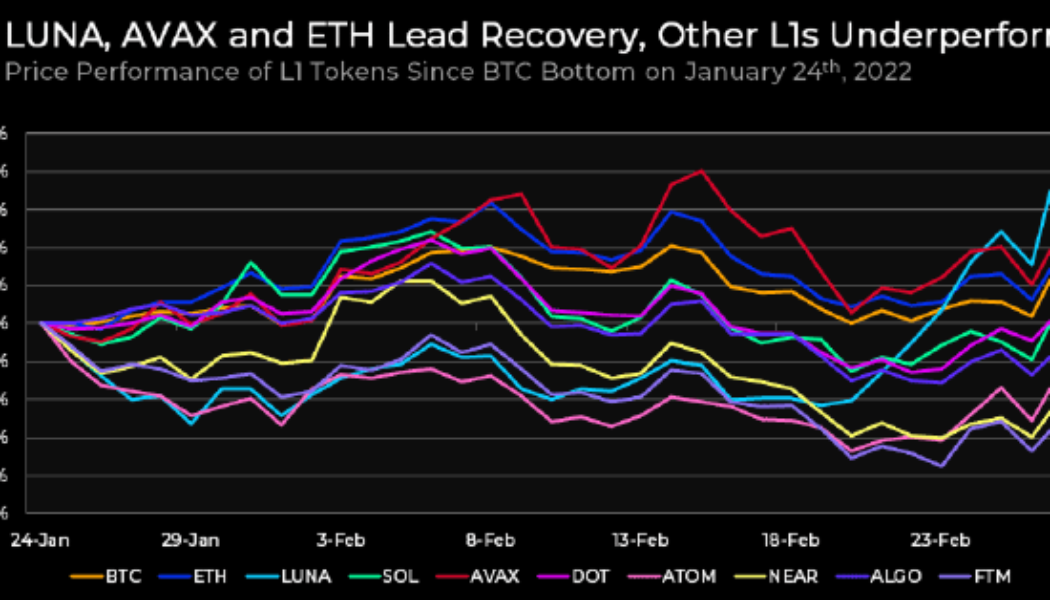

Terra, Avalanche and Osmosis lead the L1 recovery while Bitcoin searches for support

The layer-one (L1) ecosystem has received increased attention in recent months as users search for new investment opportunities in the Cosmos (ATOM), Fantom (FTM) and NEAR. Following January’s market sell-off, where Bitcoin (BTC) price dropped to bottom below $34,000, much of the L1 field has struggled to regain its momentum. Price performance of L1 tokens since Jan. 24. Source: Delphi Digital According to data from Delphi Digital, since the BTC bottom on Jan. 24, the only L1 to experience a notable gain in price include Terra (LUNA), Avalanche (AVAX) and Ethereum (ETH). Terra ecosystem growth The price growth seen in LUNA was in large part due to the announcement from the Luna Foundation Guard that it had raised $1 billion to form a Bitcoin reserve for the ecosystem’s Terra US...

Here’s why AI-equipped NFTs could be the real gateway to the Metaverse

Nonfungible tokens (NFTs) have been largely acquired as proof-of-profile pictures (PFPs) that represent a brand, embody culture or ultimately, reflect as a static status symbol. Blue-chip NFTs like the Bored Ape Yacht Club or Cool Cats were not originally backed by any tangible utility other than speculative value and hype, along with the promise of an illustrative roadmap, but in 2022, investors are looking for a little bit “more.” However, nonfungible tokens are finding their use beyond branding and status symbols by attempting to build out an existence in the Metaverse and some are ambitious enough to start within it. The Altered State Machine (ASM) Artificial Intelligence Football Association (AIFA) has introduced a novel concept to NFTs called nonfungible intelligence or NFI. By...

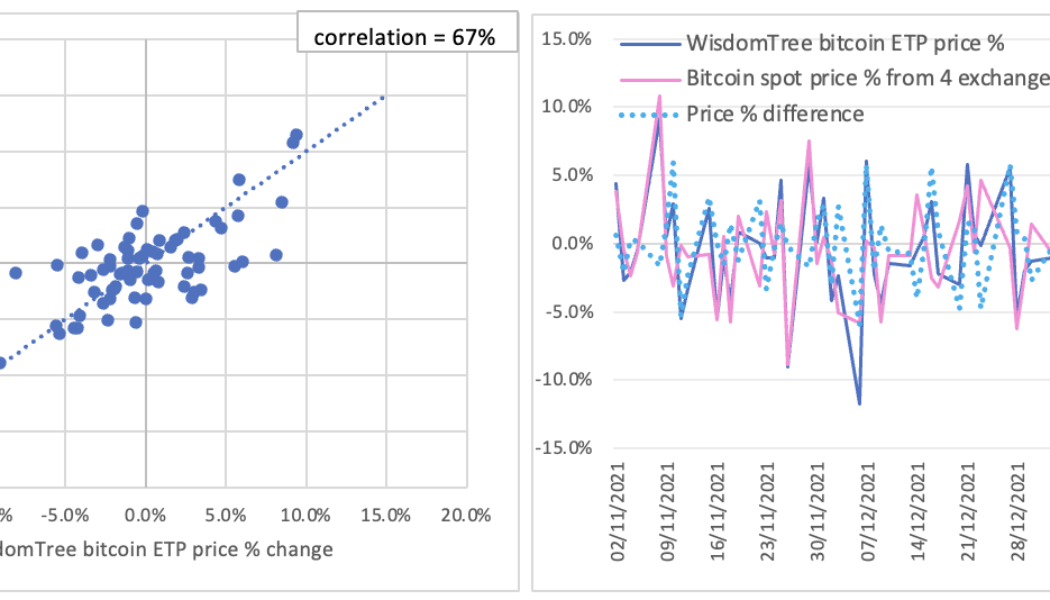

Here’s why the SEC keeps rejecting spot Bitcoin ETF applications

It is not the first time the U.S. Securities and Exchange Commission (SEC) rejected proposals for a Bitcoin spot exchange traded product (ETP), but efforts continue to be made by different financial institutions. The recent attempt made by Cboe BZX Exchange on Jan. 25 to list the Fidelity Wise Origin Bitcoin Trust as a Bitcoin ETP has also failed. The SEC letter published on Feb. 8 pointed out that the exchange has not met its burden to demonstrate the fund is “designed to prevent fraudulent and manipulative acts” and “to protect investors and the public interest”. Although proposals of Bitcoin spot ETPs have never been approved by the SEC and such products are not available in the U.S. market, they do exist in the European market. By investigating the prices of these ETPs traded in ...

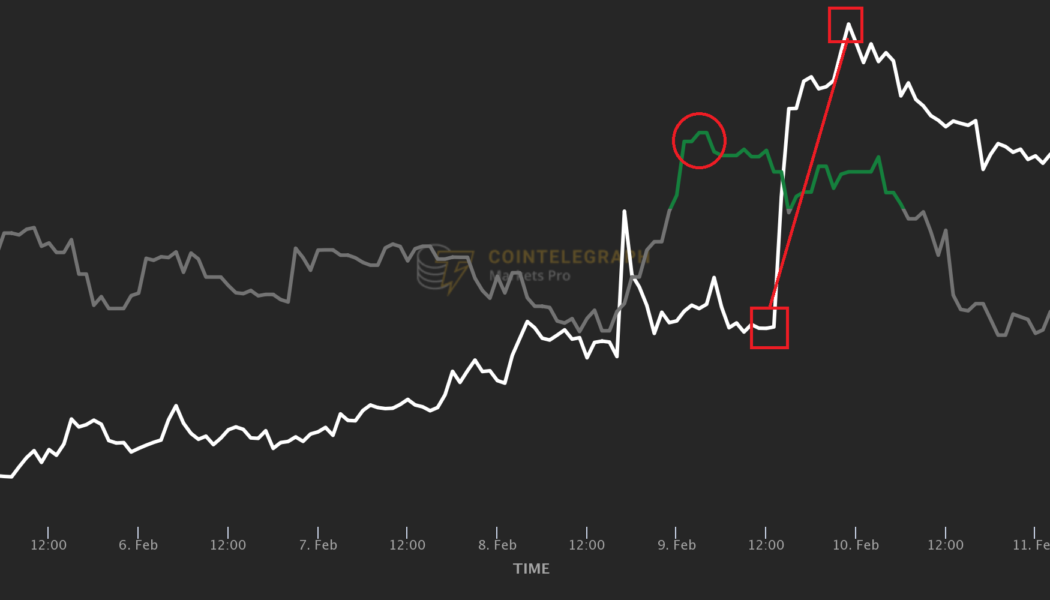

Here’s how traders got alerted to some of the biggest rallies of this week’s resurging market

This crypto winter wasn’t a very long one. Having briefly touched $34,000 in the second half of January, Bitcoin (BTC) is on its way up again, touching the $45,000 mark on Feb. 10. Many altcoins have been catching up as well and posting double-digit weekly returns. However, not all relief rallies were equally impressive. Is there a way for traders to pick the assets that are about to pull off the strongest rebounds? Luckily, bullish marketwide reversals tend to look similar in terms of both price movement and other variables that shape market activity: rising trading volumes, spikes of online attention to individual tokens, and the elevated sentiment of social media chatter around them. Furthermore, the conditions that underlie individual assets’ rallies in a resurging crypto market often ...