Market Analysis

Ethereum price moves toward $2,000, but analysts say it’s just another ‘relief rally’

On May 30, the cryptocurrency market experienced a much-needed bounce that saw Bitcoin (BTC) climb above $30,900 and Ether (ETH) rally 5.84% to $1,930, but analysts warn that it could be too early to expect a reversal. ETH/USDT 1-day chart. Source: TradingView Here’s a look at what several analysts are saying about the outlook for Ether moving forward and the major support and resistance levels to keep an eye on. A bounce off of major support The May 30 bounce in Ether came as “no surprise” to market analyst and pseudonymous Twitter user Rekt Capital, who posted the following chart, stating that “It’s more about how much #ETH will move from here.” ETH/USD 1-month chart. Source: Twitter Rekt Capital said: “Technically, #Ethereum could rally to as high as ~$2269 to flip it into new res...

On-chain data flashes Bitcoin buy signals, but the bottom could be under $20K

Every Bitcoin investor is searching for signals that the market is approaching a bottom, but the price action of this week suggests that we’re just not there yet. Evidence of this can be found by looking at the monthly return for Bitcoin (BTC), which was hit with a rapid decline that “translated to one of the biggest drawdowns in monthly returns for the asset class in its history,” according to the most recent Blockware Solutions Market Intelligence Newsletter. Bitcoin monthly returns. Source: Blockware Solutions Bitcoin continues to trade within an increasingly narrow trading range that is slowly being compressed to the downside as global economic strains mount. Whether the price continues to trend lower is a popular topic of debate among crypto analysts and the dominant opini...

3 metrics contrarian crypto investors use to know when to buy Bitcoin

Buying low and selling high is easier said than done, especially when emotion and volatile markets are thrown into the mix. Historically speaking, the best deals are to be found when there is “blood on the streets,” but the danger of catching a falling knife usually keeps most investors planted on the sidelines. The month of May has been especially challenging for crypto holders because Bitcoin (BTC) dropped to a low of $26,782, and some analysts are now predicting a sub-$20,000 BTC price in the near future. It’s times like these when fear is running rampant that the contrarian investor looks to establish positions in promising assets before the broader market comes to its senses. Here’s a look at several indicators that contrarian-minded investors can use to spot opportune moments for ope...

Low inflation or bust: Analysts say the Fed has no choice but to continue raising rates

As economic conditions continue to worsen, financial experts worldwide are increasingly placing the blame at the feet of the United States Federal Reserve after the central bank was slow to respond to rising inflation early on. Financial markets are currently experiencing their worst stretch of losses in recent history, and it doesn’t appear that there is any relief in sight. May 24 saw the tech-heavy Nasdaq fall another 2%, while Snap, a popular social media company, shed 43.1% of its market cap in trading on May 23. This past couple of months have been absolutely brutal for the markets… 8 consecutive weeks of red candles in the #SPX, #NASDAQ and #BTC… no significant bounces pic.twitter.com/hgU2VwIoxh — Crypto Phoenix (@CryptoPheonix1) May 24, 2022 Much of the recent turmoil again c...

Was Terra’s UST cataclysm the canary in the algorithmic stablecoin coal mine?

The past week has not been an easy one. After the collapse of the third-largest stablecoin (UST) and what used to be the second-largest blockchain after Ethereum (Terra), the depeg contagion seems to be spreading wider. While UST has completely depegged from the U.S. dollar, trading at sub $0.1 at the time of writing, other stablecoins also experienced a short period where they also lost their dollar peg due to the market-wide panic. Tether’s USDT stablecoin saw a brief devaluation from $1 to $0.95 at the lowest point in May. 12. USDT/USD last week from May. 8–14th. Source: CoinMarketCap FRAX and FEI had a similar drop to $0.97 in May. 12; while Abracadabra Money’s MIM and Liquity’s LUSD dropped to $0.98. FRAX, MIM, FEI and LUSD price from May. 9 – 15th. Source: CoinMarketCap A...

Buy the dip, or wait for max pain? Analysts debate whether Bitcoin price has bottomed

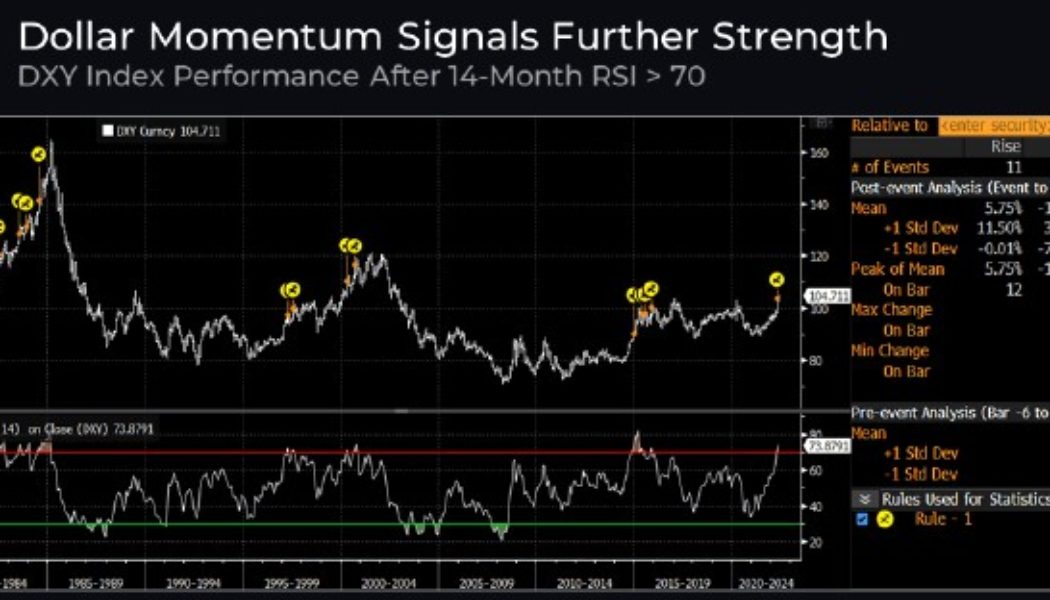

It has been a rough week for the cryptocurrency market, primarily because of the Terra ecosystem collapse and its knock-on effect on Bitcoin (BTC), Ethereum (ETH) and altcoin prices, plus the panic selling that took place after stablecoins lost their peg to the U.S. dollar. The bearish headwinds for the crypto market have been building since late 2021 as the U.S. dollar gained strength and the United States Federal Reserve hinted that it would raise interest rates throughout the year. According to a recent report from Delphi Digital, the 14-month RSI for the DXY has now “crossed above 70 for the first time since its late 2014 to 2016 run up.” DXY index performance. Source: Delphi Digital This is notable because 11 out of the 14 instances where this previously occurred “led to a strong...

Bitcoin fights to hold $29K as fear of regulation and Terra’s UST implosion hit crypto hard

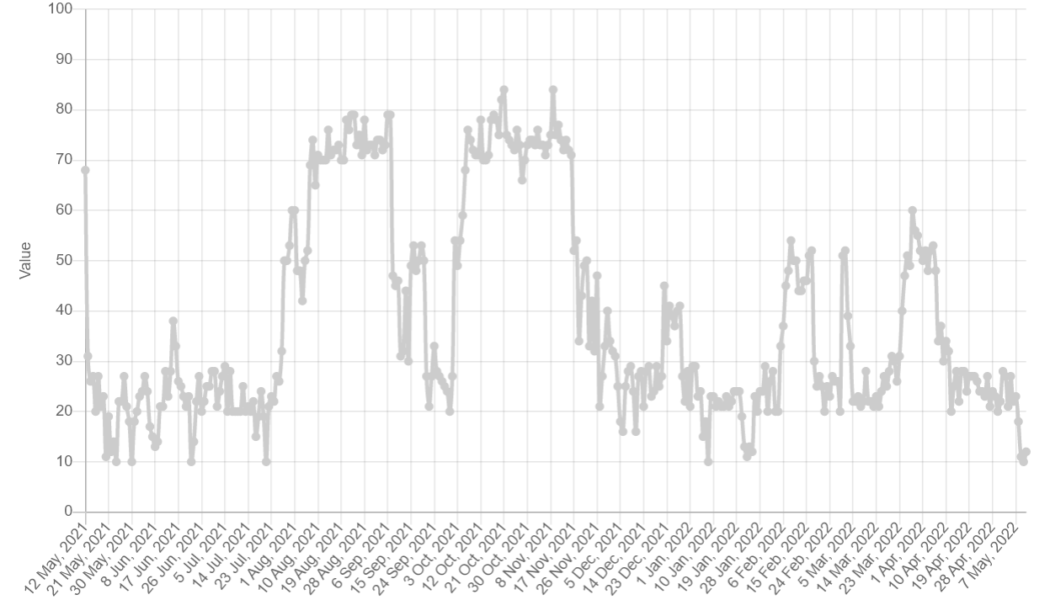

Bitcoin (BTC) price initially bounced from its recent low at $29,000 but the overall market sentiment after a 25% price drop in five days is still largely negative. Currently, the crypto “Fear and Greed Index,” which uses volatility, volume, social metrics, Bitcoin dominance and Google trends data, has plunged to its lowest level since March 2020 and at the moment, there appears to be little protecting the market against further downside. Crypto “Fear and Greed index”. Source: Alternative.me Regulation continues to weigh down the markets Regulation is still the main threat weighing on markets and it’s clear that investors are taking a risk-off approach to high volatility assets. Earlier this week, during a hearing of the Senate Banking Committee, United S...

What are the top social tokens waiting to take off? | Find out now on The Market Report

“The Market Report” with Cointelegraph is live right now. On this week’s show, Cointelegraph’s resident experts discuss the social tokens you should be keeping a close eye on. But first, market expert Marcel Pechman carefully examines the Bitcoin (BTC) and Ether (ETH) markets. Are the current market conditions bullish or bearish? What is the outlook for the next few months? Pechman is here to break it down. Next up: the main event. Join Cointelegraph analysts Benton Yaun, Jordan Finneseth and Sam Bourgi as each makes his case for the top social token. First up, we have Bourgi with his pick of STEEM, the native token of the Steem social blockchain network, which rewards users for content creation. Its aim is to give back value to content creators who contribute on the platform. Although is ...

WSJ says ‘the NFT market is collapsing’ but the data says otherwise

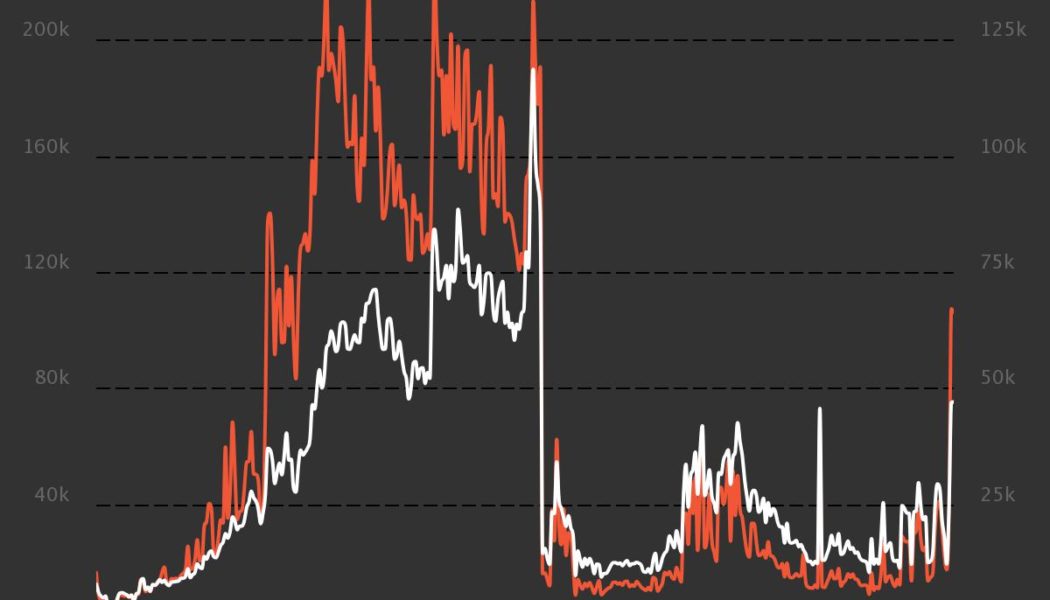

An article in the Wall Street Journal has claimed sales of non-fungible tokens (NFTs) are “flatlining” — in the same week that the top five collections alone accounted for more than $1 billion in primary and secondary sales. The article cited data from NFT market analysis platform Nonfungible suggesting the number of NFT sales has fallen by 92% since an all-time high in September 2021. Wallets active in the Ethereum (ETH) NFT market were also said to have declined by 88% since a high in November 2021. “The NFT market is collapsing,” the article concluded. Red line shows number of sales with volume on left y-axis, white shows active market wallets, volume on right y-axis. Source: Nonfungible However, onchain data from Dune Analytics’ dashboard suggest that the NFT market is still robust, wi...

Smart money is accumulating Ethereum even as traders warn of a drop to $2.4K

The upcoming Ethereum merge is one of the most widely discussed topics in the crypto sector and analysts have a wide range of perspectives on how the transition to proof of stake could impact Ether’s price. ETH/USDT 1-day chart. Source: TradingView Whales accumulate ahead of the merge A deeper dive into the ongoing accumulation of Ether by whale wallets was provided by cryptocurrency intelligence firm Jarvis Labs, which posted the following chart looking at the percentage change in whale wallet holdings versus ET price. Ether whale holding change. Source: Twitter The color of the dots relates to the price of Ether, with the chart showing that whale wallets began decreasing their holdings when the price was above $4,000 and they didn’t start to reaccumulate unti...

Is the surge in OpenSea volume and blue-chip NFT sales an early sign of an NFT bull market?

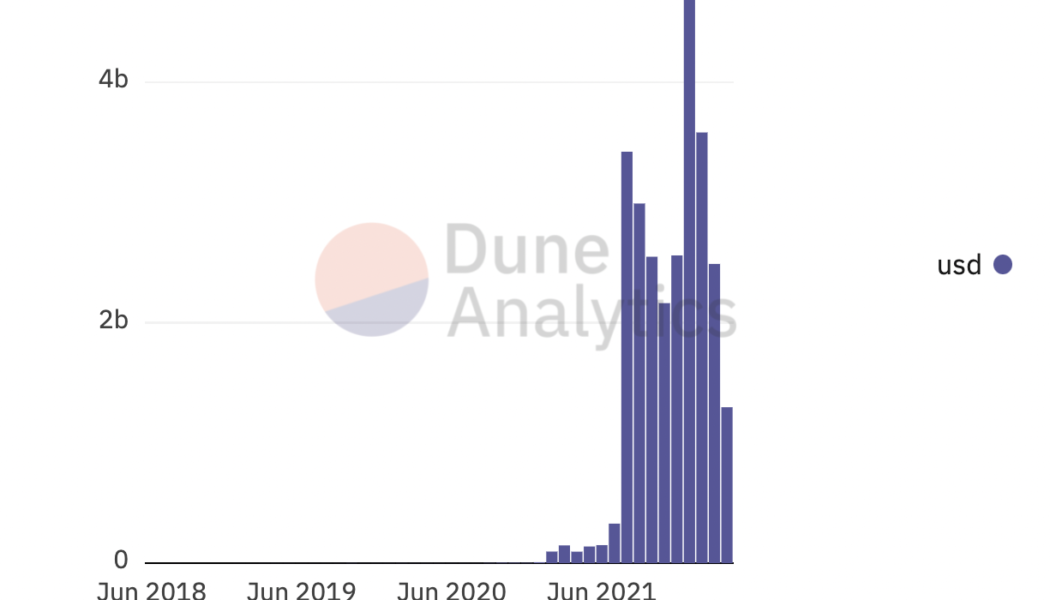

In the last two months, OpenSea began to cool down from its New Year’s bull run and many nonfungible token (NFT) pundits began to speculate about the beginning of a bear market once sales took a slight downward trend after closing out a record-breaking $5 billion in total volume sales in January. However, for the last seven days, the total sales volume has already exceeded the $1 billion mark and just a week into April, it seems the NFT markets are waking up to a resurgence of blue-chip caliber projects. Cue the “spring awakening.” OpenSea Monthly Volume. Source: DuneAnalytics @rchen8 Traders searching for the next Bored Ape Yacht Club (BAYC) project have patiently waited for another project to come in with the same force and brand equity. Some top contenders have been emerging...

What are the worst crypto mistakes to avoid in 2022? | Find out now on The Market Report

“The Market Report” with Cointelegraph is live right now. On this week’s show, Cointelegraph’s resident experts discuss the worst mistakes you should avoid making in crypto. But first, market expert Marcel Pechman carefully examines the Bitcoin (BTC) and Ether (ETH) markets. Are the current market conditions bullish or bearish? What is the outlook for the next few months? Pechman is here to break it down. Next up: the main event. Join Cointelegraph analysts Benton Yaun, Jordan Finneseth and Sam Bourgi as they talk about the worst crypto mistakes to avoid making in 2022. First up, we have Bourgi, who thinks investors should avoid “analysis paralysis.” In other words, don’t overanalyze. Make decisions based on firm conviction. Don’t just look at the price of a coin or token you’re interested...