Market Analysis

A sharp drop in TVL and DApp use preceded Avalanche’s (AVAX) 16% correction

After an impressive 73% rally between July 13 and Aug. 13, Avalanche (AVAX) has faced a 16% rejection from the $30.30 resistance level. Some analysts will try to pin the correction as a “technical adjustment,” but the network’s deposits and decentralized applications reflect worsening conditions. Avalanche (AVAX) index, USD. Source: TradingView To date, Avalanche remains 83% below its November 2021 all-time high at $148. More data than technical analysis can be analyzed to explain the 16% price drop, so let’s take a look at the network’s use in terms of deposits and users. The decentralized application (DApp) platform is still a top-15 contender with a $7.2 billion market capitalization. Meanwhile, Solana (SOL), another proof-of-work (PoW) layer-1 platform, holds a $14.2 billio...

Bitcoin likely to transition to a risk-off asset in H2 2022, says Bloomberg analyst

Bitcoin is likely to transition from a risk-on to a risk-off asset in the second half of 2022, as the macroeconomic environment is rapidly shifting towards a recession, said Mike McGlone, senior commodity strategist at Bloomberg, in a recent interview with Cointelegraph. McGlone predicted: “ I see it transitioning to be more of a risk-off asset like bonds and gold, then less of a risk-on asset like the stock market.” According to the analyst, the crypto market has flushed out most of the speculative excesses that marked 2021 and it is now ripe for a fresh rally. McGlone also pointed out that the Fed’s aggressive hiking of interest rates will lead the global economy to a deflationary recession, which will ultimately favor Bitcoin: “I fully expect we’re going to have a prett...

Interview with Kevin O’Leary: $28K Bitcoin next or lower? | Market Talks with Crypto Jebb

With the price of Bitcoin (BTC) holding above $22,000, more and more market players are turning bullish again. Does this mean that we could see BTC go to $28,000 in the short term or will it fall below its current levels? Join us as we discuss this and other topics with Crypto Jebb and Mr. Wonderful, himself, Kevin O’Leary. In this week’s episode of Market Talks, we welcome businessman, entrepreneur, author, winemaker and television presenter, Mr. Kevin O’Leary. O’Leary, best known as the shark on the hit reality TV show Shark Tank, is the chairman of O’Shares Investments and a strategic investor in WonderFi. Mr. O’Leary’s success story starts where most entrepreneurs begin — with a big idea and zero cash. The main topic of discussion on the show is whether BTC will go as high as $28...

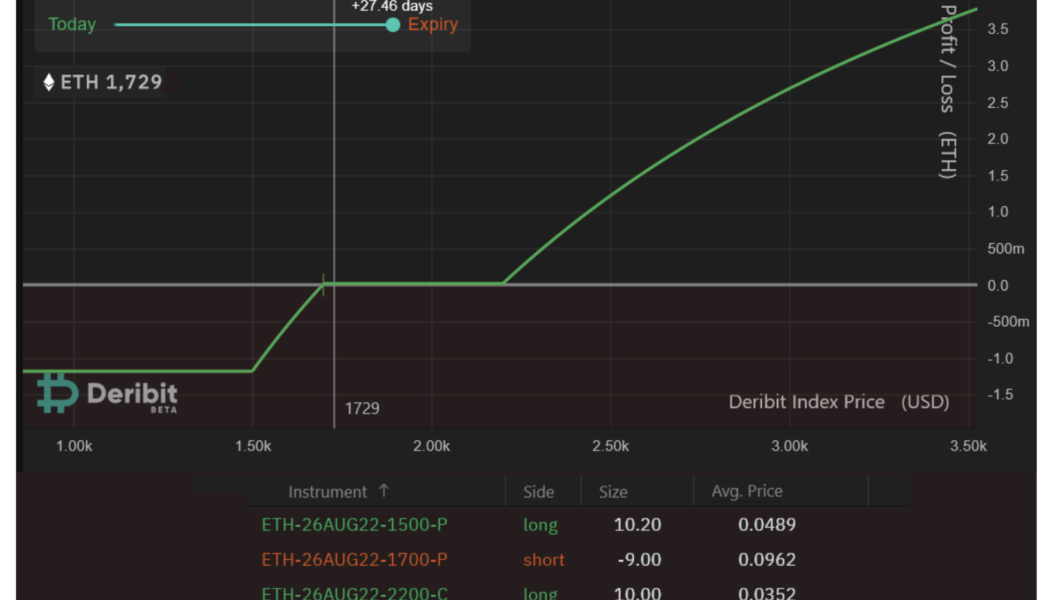

Pro traders may use this ‘risk averse’ Ethereum options strategy to play the Merge

Ether (ETH) is reaching a make-it or break-it point as the network moves away from proof-of-work (PoW) mining. Unfortunately, many novice traders tend to miss the mark when creating strategies to maximize gains on potential positive developments. For example, buying ETH derivatives contracts is a cheap and easy mechanism to maximize gains. The perpetual futures are often used to leverage positions, and one can easily increase profits five-fold. So why not use inverse swaps? The main reason is the threat of forced liquidation. If the price of ETH drops 19% from the entry point, the leveraged buyer loses the entire investment. The main problem is Ether’s volatility and its strong price fluctuations. For example, since July 2021, ETH price crashed 19% from its starting point within 20 d...

Bitcoin price falls under $21K, bringing more capitulation or just consolidation?

On July 26, Bitcoin (BTC) price dropped below $21,000, giving back the majority of the gains accrued in the previous week and returning to the $23,300 to $18,500 range that Glassnode analysts describe as “the Week 30 high and Week 30 low.” A handful of analysts and traders attribute the July 26 to July 27 Federal Open Market Committee (FOMC) meeting and the expected Federal Reserve rate hike as the primary reasons for the current sell-off. Barring the announcement that the United States economy has entered a recession, a few traders believe that the expected 75 to 100 basis point (BPS) hike will be followed by a relief rally that could see BTC, Ether and other large-cap altcoins snack back to the top of their current range. Of course, this sentiment reflects more speculation than sou...

A short-term BTC rally or trend reversal? Find out now on ‘Market Talks’ with Crypto Jebb

The latest episode of Market Talks welcomes Nicholas Merten, the founder of DataDash, one of the largest cryptocurrency YouTube channels. Merten is an international speaker, thought leader and crypto analyst. He has utilized his 10-plus years of experience in traditional markets to understand the potential of cryptocurrencies and help his 515,000 YouTube subscribers make better investment decisions. One of the topics up for discussion with Merten isthe recent Bitcoin (BTC) price rally. Are the markets finally out of the sideways trend it’s been stuck in for months, or is this just another bull trap forming, with BTC to head back down below $20,000? With all seasoned traders and experts eyeing the BTC 200-week moving average, Merten is asked the significance of this indicator and why many c...

Why is there so much uncertainty in the crypto market right now? | Market Talks with Crypto Jebb and Crypto Wendy O

In the fourth episode of Market Talks, we welcome YouTube media creator and crypto educator Crypto Wendy O. Crypto Wendy O is a YouTube media creator and crypto educator. Wendy became interested in cryptocurrency and blockchain technology in November of 2017. She has been into crypto full-time since the summer of 2018 and focuses on providing transparent marketing & media solutions for blockchain companies globally. Wendy also provides free education via YouTube and Twitter to her growing audience of over 170 thousand, giving her the largest following of any female crypto influencer in the world. Some of the topics up for discussion with Wendy are the new consumer price index (CPI) numbers and how they might impact the crypto market going forward, and why there is so much uncertai...

Three Arrows Capital has failed to meet margin calls: Report

Venture firm Three Arrows Capital (3AC) has reportedly failed to meet margin calls from its lenders, raising the spectre of insolvency after this week’s crypto market collapse triggered unforeseen liquidations for the Singapore-based company. Crypto lender BlockFi was among the firms to liquidate at least some of 3AC’s positions, according to the Financial Times. Citing people familiar with the matter, FT reported that 3AC had borrowed Bitcoin (BTC) from the lender but was unable to meet a margin call after the market turned sour earlier this week. The issues surrounding 3AC appear to have impacted Finblox, a Hong Kong-based platform that allows investors to earn yield on their digital assets. Finblox said it was forced to reduce its withdrawal limits on Thursday due to concerns surroundin...

Ethereum 2.0 vs. the top Ethereum killers|The Market Report

“The Market Report” with Cointelegraph is live right now. On this week’s show, Cointelegraph’s resident experts give you the details about Ethereum 2.0, its main competitors, and how they differ from each other. To kick things off, we break down the latest news in the markets this week. Here’s what to expect in this week’s markets news breakdown: Bitcoin ‘Bart Simpson’ returns as BTC price dives 7% in hours: Bitcoin (BTC) price action failed to crack $32,000 and headed back to square one, sparking $60 million of long liquidations in the process. How much longer will we stay in the current price range? What is it going to take for Bitcoin to break out from here? Bad day for Binance with SEC investigation and Reuters exposé: The United States Securities and Exchange Commission...

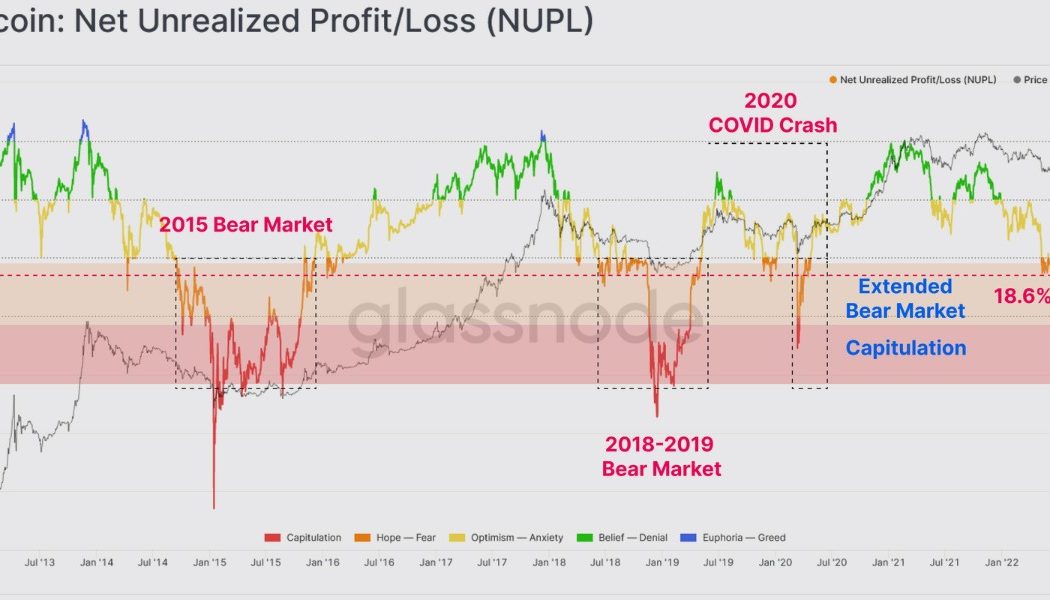

Traders think Bitcoin bottomed, but on-chain metrics point to one more capitulation event

The bull market euphoria that carried prices to new highs throughout 2021 has given way to bear market doldrums for any Bitcoin (BTC) buyer who made a purchase since Jan. 1, 2021. Data from Glassnode shows these buyers “are now underwater” and the market is gearing up for a final capitulation event. Bitcoin net unrealized profit/loss. Source: Glassnode As seen in the graphic above, the NUPL, a metric tha is a measure of the overall unrealized profit and loss of the network as a proportion of the market cap, indicates that “less than 25% of the market cap is held in profit,” which “resembles a market structure equivalent to pre-capitulation phases in previous bear markets.” Based on previous capitulation events, if a similar move were to occur at the current levels, t...

Ethereum’s Merge FOMO isn’t priced in, making a spike to $2.6K a possibility

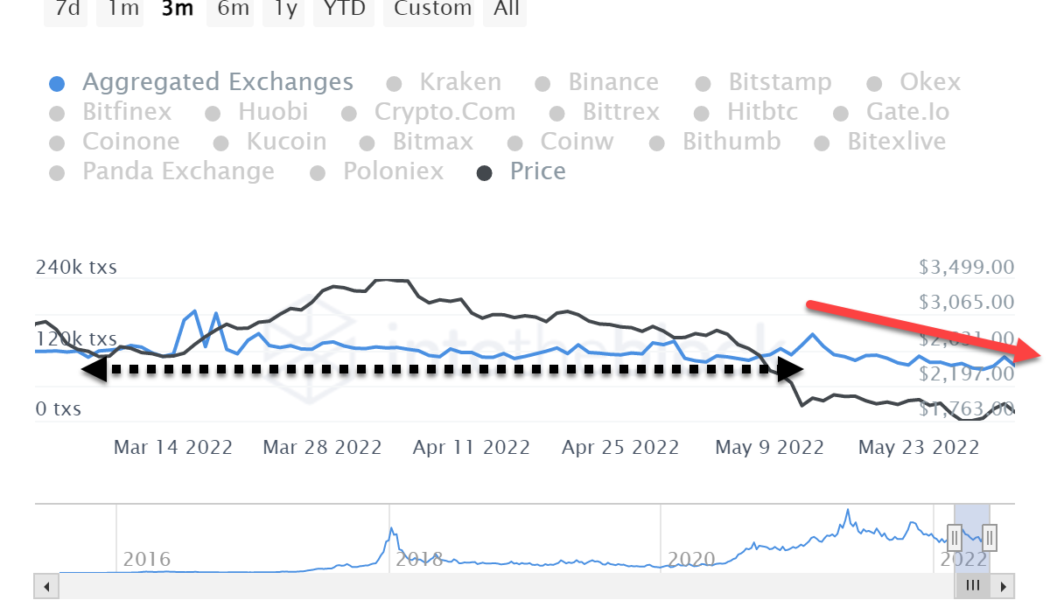

In a May 30 tweet, Ethereum (ETH) core developer Tim Beiko confirmed that the much-anticipated Ropsten testnet trial of the Merge from proof-of-work to proof-of-stake can be expected “around June 8 or so.” Interestingly, Ether’s price action is relatively unchanged despite the unexpected bullish announcement. There was a +10% spike on May 30, but those gains were given back between May 31 and June 2. It is very likely that the Merge — currently anticipated in August — has yet to be priced in, giving traders and investors a possible early entrant advantage. It’s essential to monitor on-chain data From an investing and trading viewpoint, cryptocurrency markets have a distinct disadvantage in comparison with regulated markets and transparency. The stock market is chock full of legally r...

Here are 3 altcoins that could surge once Bitcoin flips $35K to support

Bitcoin (BTC) and the wider cryptocurrency market are taking a breather after the rally on May 31. Meanwhile, most altcoins remain severely oversold, with most between 70% and 90% below their all-time highs. Total altcoin index capitalization What is clear is that fear is everywhere and blood is in the water. Risk-on markets are suffering worldwide, but it is exactly these kinds of conditions that create opportunities where professional money accumulates and adds to positions. Let’s take a look at three altcoins that could be positioned for a rebound if the broader market enters a new uptrend. ADA could be setting up for an 80% surge Cardano (ADA) has a significantly bullish update coming very soon. The much anticipated Vasil hard fork, which increases performance and adds more Plutu...