Market Analysis

How bad is the current state of crypto? On-chain analyst explains

Despite the market downturn and the widespread negative sentiment in the industry in the wake of the FTX collapse, on-chain data still show reasons to be bullish on Bitcoin (BTC). As pointed out by on-chain analyst Will Clemente, it’s enough to look at the positions of long-term holders, which reached an all-time high despite their profitability being at an all-time low. “Long-term holders buy heavily into the bear market. They set the floor, […] and then those long-term holders distribute their holdings to new market participants in the bull market,” he told Cointelegraph in an exclusive interview. Another positive trend worth noticing after the FTX collapse, in Clemente’s opinion, is that the average crypto user is increasingly turning away from exchanges and taking self-cust...

Could a Grayscale Bitcoin Trust collapse be the next black swan event? Watch The Market Report

On this week’s The Market Report show, Cointelegraph’s resident experts discuss what the ramifications would be if Grayscale Bitcoin Trust were to collapse. We start off this week’s show with the latest news in the markets: GBTC next BTC price black swan? — 5 things to know in Bitcoin this week Bitcoin (BTC), the largest cryptocurrency, just like the rest of the crypto industry, remains highly susceptible to downside risk as it continues to deal with the fallout from the implosion of exchange FTX. Contagion is the word on everyone’s lips as November grinds on — just like the Terra collapse earlier this year — and fears are that new victims of FTX’s giant liquidity vortex will continue to surface. Grayscale Bitcoin Trust (GBTC) seems to be on everyone’s radar this week for all the wrong rea...

When will the crypto bear market end? Watch The Market Report

On this week’s The Market Report show, Cointelegraph’s resident experts discuss how much longer this crypto bear market could possibly last and when we could see some volatility back in the markets. To kick things off, we break down the latest news in the markets this week: Bitcoin price edges closer to $20K as ‘way worse’ US data boosts stocks A relief bounce on risk assets looks in store after Empire State Manufacturing Index numbers for October fall far short of expectations. The numbers fell to -9.1 for October, heavily below the forecast -4.3 and September’s -1.5 reading. Some industry analysts consider this to be way worse than expected, but could this actually cause Bitcoin (BTC) to rally in the near future? Bitcoin clings to $19K as trader promises capitulation ‘will happen’ B...

Autumn bulls vs. winter bears — Will October be bullish or bearish for Bitcoin? Watch Market Talks

In this week’s episode of Market Talks, we welcome Rekt Capital, a cryptocurrency analyst who shares macro research, commentary and technical analysis related to crypto markets. He publishes a popular newsletter and provides courses that help educate traders on how to make informed decisions when buying and selling cryptocurrencies. He has more than 328,000 followers across his various social media platforms, many of whom are prominent individuals, including big names like Binance CEO Changpeng Zhao. First things first, we have officially entered Q4 2022 and, more importantly, October, which has historically been a bullish month for cryptocurrencies. We ask Rekt Capital if he thinks this trend is likely to continue or if we are headed toward more downside for Bitcoin (BTC). ...

Ether exchange netflow highlights behavioral pattern of ETH whales

The exchange netflow of Ether (ETH) over the past couple of years highlights a behavioral pattern among Ether whales that market analysts believe is done to pump the price of the second-largest cryptocurrency. The “exchange netflow” is an indicator that measures the net amount of crypto entering or exiting wallets of all centralized exchanges. The metric’s value is simply calculated by taking the difference between the exchange inflows and the exchange outflows. Data shared by one of the pseudonymous traders of crypto analytic firm Cryptoquant indicates that ETH whales have consistently sent their holdings onto exchanges to raise the price of ETH and sell it at a higher market price. The Ethereum exchange netflow data confirmed the behavioral pattern among ETH whales and in...

Next few weeks are ‘critical’ for stock market and Bitcoin, analyst says

The stock market’s movements in the next few weeks will be critical for determining whether we are heading towards a short-term recession or a long term-one, according to forex trader and crypto analyst Alessio Rastani. During the October-December 2022 period, the analyst expects to see the S&P rallying. “If that bounces or rally fails and drops back down again, then very likely, we’re entering a long-term recession and something very close to similar to 2008”, said Rastani in the latest Cointelegraph interview. [embedded content] According to the analyst, such a recession could last until 2024 and would inevitably negatively impact the price of Bitcoin (BTC). Talking about the latest Pound sterling crisis, Rastani opined that its principal cause is the rally of...

The Ethereum Merge to proof-of-stake is complete — What’s next? | Interview with Dr. Julian Hosp

In this week’s episode of Market Talks, we welcome Julian Hosp, CEO and co-founder of Cake DeFi. Julian Hosp is the CEO and co-founder of Cake DeFi, a highly intuitive online platform dedicated to providing access to decentralized financial services. He is widely regarded as a leading influencer in the crypto and blockchain space with over one million followers across all of his channels globally. He is also a best-selling author and his vision is to bring blockchain awareness and understanding to a billion more people by 2025. The Merge has been all over the place recently, with different news outlets, influencers and YouTube channels covering the event as much as possible, but why does the Ethereum Merge actually matter, and why is it such a significant event in crypto? We ask...

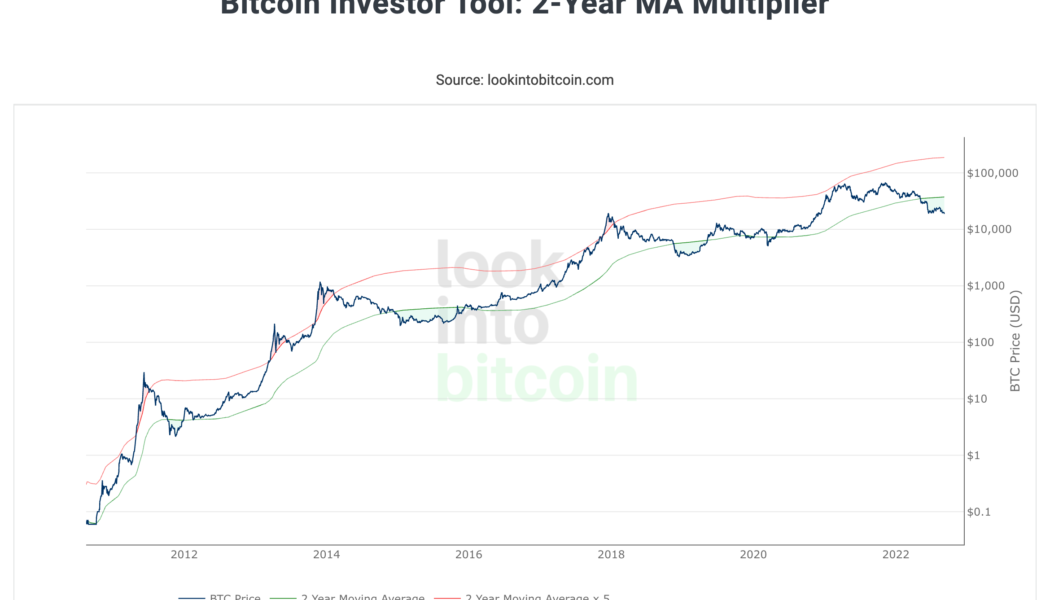

3 reasons why Bitcoin traders should be bullish on BTC

Bitcoin (BTC) has been in a rut, and BTC’s price is likely to stay in its current downtrend. But like I mentioned last week, when nobody is talking about Bitcoin, that’s usually the best time to be buying Bitcoin. In the last week, the price took another tumble, dropping below $19,000 on Sept. 6 and currently, BTC bulls are struggling to flip $19,000–$20,000 back to support. Just this week, Federal Reserve Chairman Jerome Powell reiterated the Fed’s dedication to doing literally whatever it takes to combat inflation “until the job is done,” and market analysts have increased their interest rate hike predictions from 0.50 basis points to 0.75. Basically, interest rate hikes and quantitative tightening are meant to crush consumer demand, which in turn, eventually leads to a decrease in...

Will the Ethereum Merge crash or revive the crypto market? | Find out now on The Market Report

On this week’s “The Market Report” show, Cointelegraph’s resident experts discuss the Ethereum Merge and how it might impact the crypto market To kick things off, we broke down the latest news in the markets this week. Surge or purge? Why the Merge may not save Ether (ETH) price from “Septembear.” Options data, macroeconomic catalysts and technical signals suggest a decline in Ether price is on the table despite the Merge. Ethereum’s native token, Ether, is not immune to downside risk in September after rallying approximately 90% from its bottom of around $880 in June. Can Ethereum prove analysts wrong and break out in price following the Merge or has the price already been factored in and we’ve already seen the price spike for the end of this year? ETH Merge: CoinGecko c...

ATOM price is reaching for the Cosmos, but why?

As a market crash takes place, assets become oversold and typically there’s an “oversold bounce,” “return to mean,” “mean reversion,” or some price snapback to the bottom of the pre-crash range. Afterward, the asset under study either consolidates, continues the downtrend, or returns to the bullish uptrend if the downside catalyst was not significant enough to break the market structure. That’s all basic trading 101. This week Cosmos (ATOM) price appears to be following this path, and the altcoin is showing a bit of strength with a 35% gain since Aug. 22. But why? Depending on how you look at it, and technical analysis is by all means a subjective process, ATOM price is either in an ascending channel, or one could say a rounding bottom pattern is present with price close to breaking ...

Why $20.8K is a critical level for Bitcoin | Find out now on Market Talks with Charlie Burton

In this week’s episode of Market Talks, we welcome professional trader Charlie Burton. Charlie is a professional trader with 24 years of experience and has been trading full-time since 2001. He is the founder of EzeeTrader and Charlie Burton Trading. He is also undefeated in the annual London Forex show live trade-off for the five years it was running. He has also been featured in the hugely popular BBC documentary “Trader, Millions by the Minute.” Charlie is one of the very few trading educators who is also a professional money manager trading FCA-regulated capital. The main topic of discussion with Charlie will be the current support level for Bitcoin (BTC) and why it is so critical. If Bitcoin goes below its current support, what are other major price levels you should...

3 reasons why the Bitcoin price bottom is not in

Bitcoin (BTC) recovered modestly on Aug. 20 but remained on course to log its worst weekly performance in the last two months. Bitcoin hash ribbons flash bottom signal On the daily chart, BTC’s price climbed 2.58% to $21,372 per token but was still down by nearly 14.5% week-to-date, its worst weekly returns since mid August. Nonetheless, some on-chain indicators suggest that Bitcoin’s correction phase could be coming to an end. That includes Hash Ribbons, a metric that tracks Bitcoin’s hash rate to determine whether miners are in accumulation or capitulation mode. As of Aug. 20, the metric is showing that the miners’ capitulation is over for the first time since August 2021, which could result in the price momentum switching from negative to positive. Bitcoin Hash R...