Margin

Ethereum price weakens near key support, but traders are afraid to open short positions

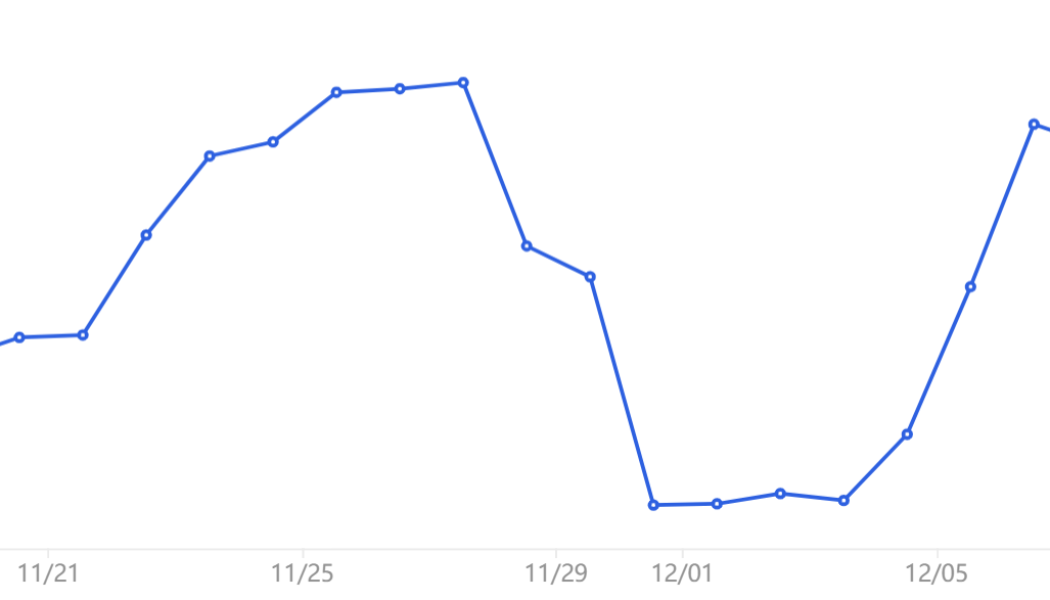

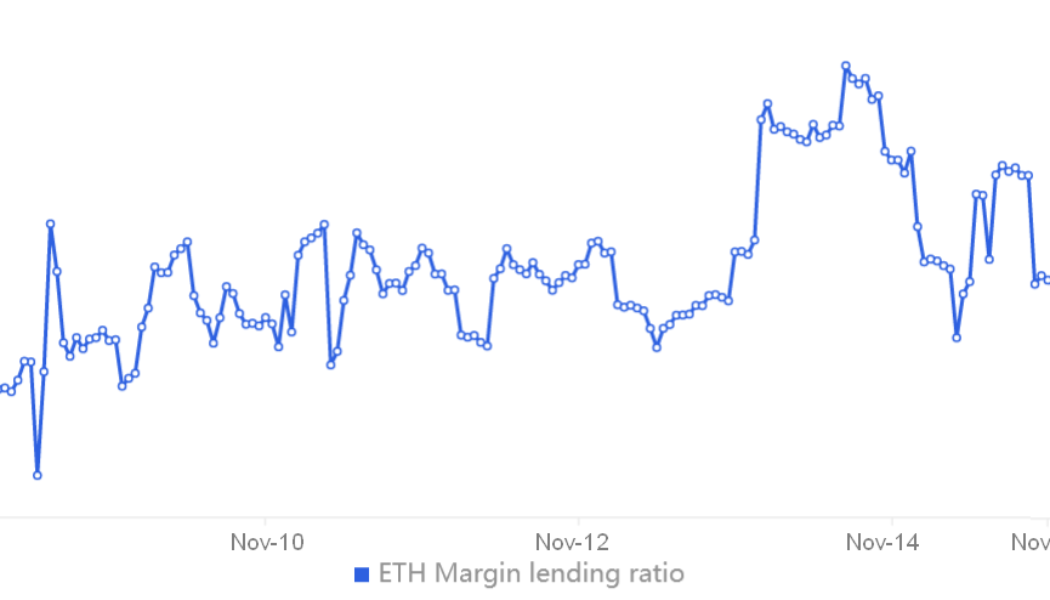

Ether (ETH) has been stuck between $1,170 to $1,350 from Nov. 10 to Nov. 15, which represents a relatively tight 15% range. During this time, investors are continuing to digest the negative impact of the Nov. 11 Chapter 11 bankruptcy filing of FTX exchange. Meanwhile, Ether’s total market volume was 57% higher than the previous week, at $4.04 billion per day. This data is even more relevant considering the collapse of Alameda Research, the arbitrage and market-making firm controlled by FTX’s founder Sam Bankman-Fried. On a monthly basis, Ether’s current $1,250 level presents a modest 4.4% decline, so traders can hardly blame FTX and Alameda Research for the 74% fall from the $4,811 all-time high reached in November 2021. While contagion risks have caused investors to drai...

Bitcoin fails to break the $21K support, but bears remain shy

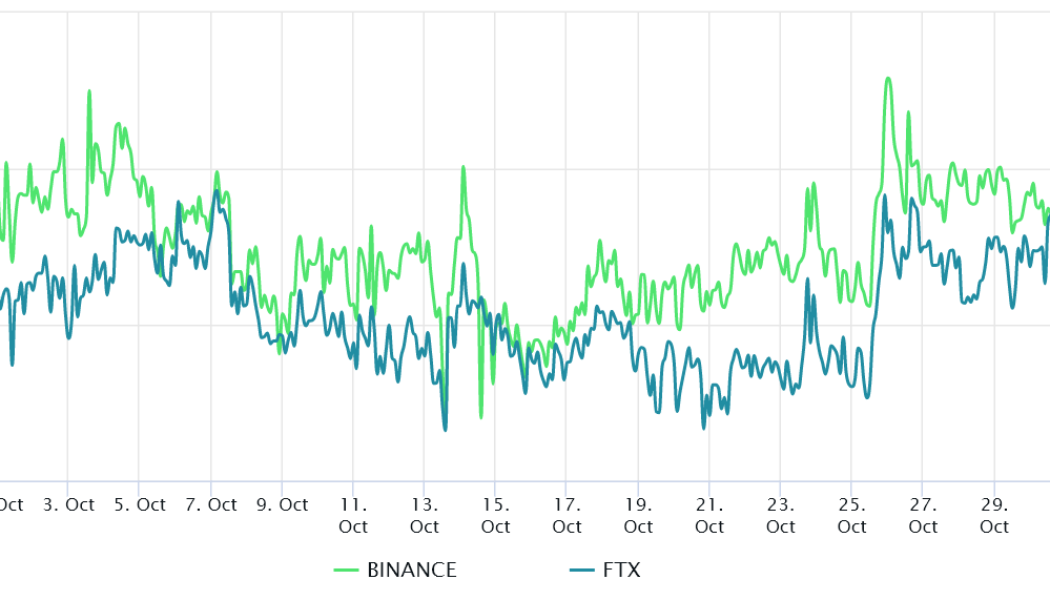

Bitcoin (BTC) rallied on the back of the United States stock market’s 3.4% gains on Oct. 28, with the S&P 500 index rising to its highest level in 44 days. In addition, recently released data showed that inflation might be slowing down, which gave investors hope that the Federal Reserve might break its pattern of 75 basis-point rate hikes after its November meeting. In September, the U.S. core personal consumption expenditures price index rose 0.5% from the previous month. Although still an increase, it was in line with expectations. This data is the Federal Reserve’s primary inflation measure for interest rate modeling. Additional positive news came from tech giant Apple, which reported weak iPhone revenues on Oct. 27 but beat Wall Street estimates for quarterly earnings and margin. M...

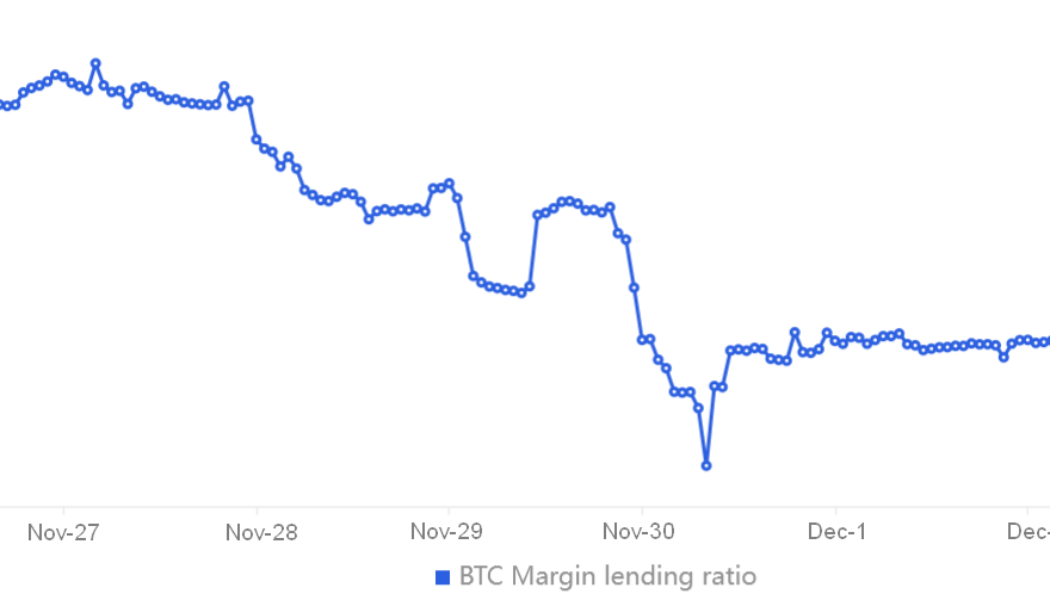

Bitcoin margin long-to-short ratio at Bitfinex reach the highest level ever

Sept. 12 will leave a mark that will probably stick for quite a while. Traders at Bitfinex exchange vastly reduced their leveraged bearish Bitcoin (BTC) bets and the absence of demand for shorts could have been caused by the expectation of cool inflation data. Bears may have lacked confidence, but August’s U.S. Consumer Price Index (CPI) came in higher than market expectations and they appear to be on the right side. The inflation index, which tracks a broad basket of goods and services, increased 8.3% over the previous year. More importantly, the energy prices component fell 5% in the same period but it was more than offset by increases in food and shelter costs. Soon after the worse-than-expected macroeconomic data was released, U.S. equity indices took a downturn, with the tech-he...

Bitcoin struggles to flip $24K to support, but data shows pro traders stacking sats

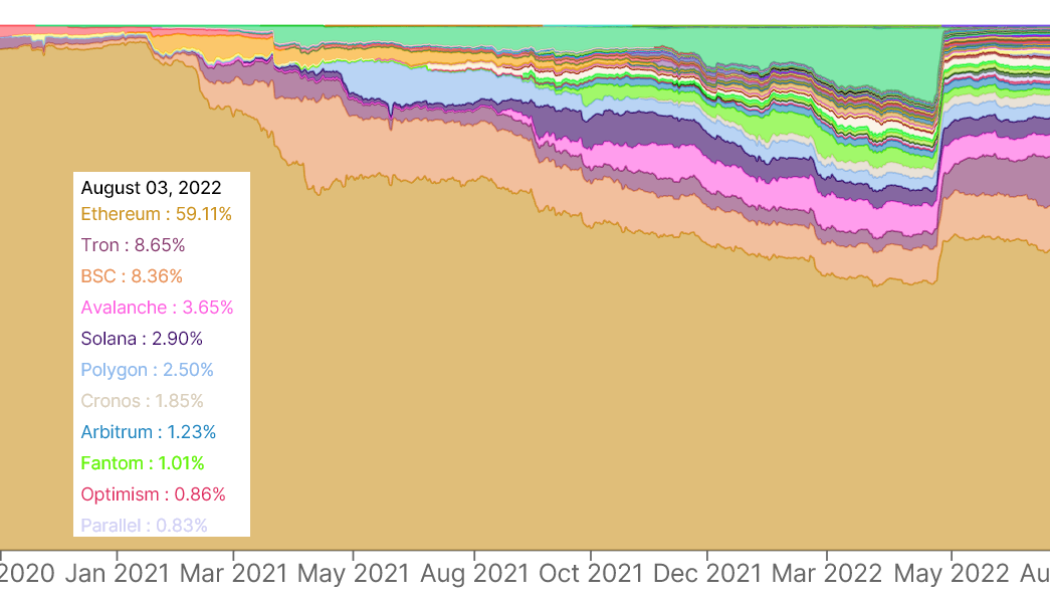

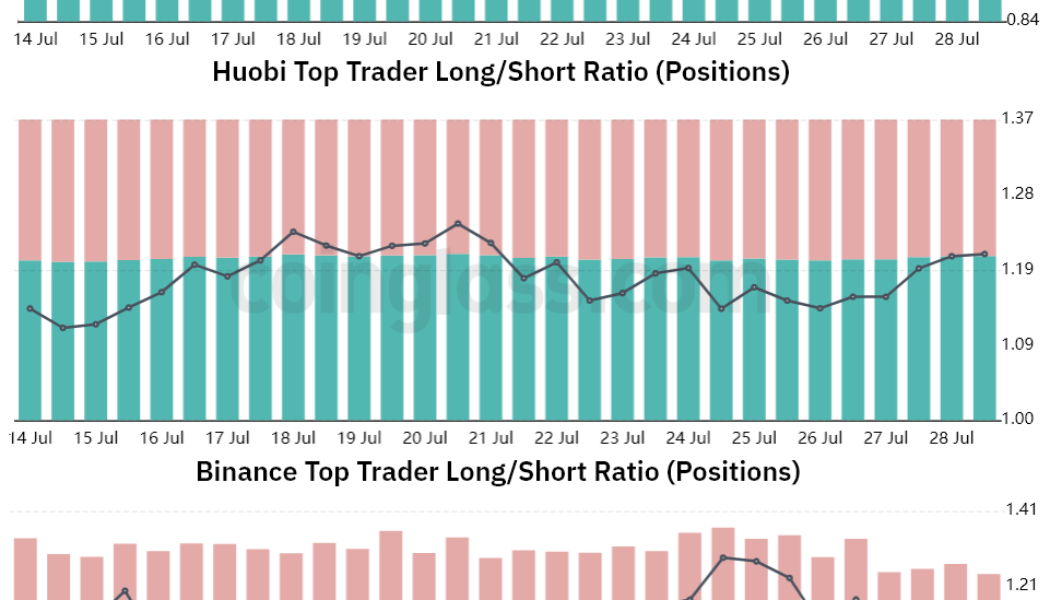

Bitcoin (BTC) rallied on the back of the United States Federal Reserve’s decision to hike interest rates on July 27. Investors interpreted Federal Reserve chairman Jeremy Powell’s statement as more dovish than the previous FOMC committee meeting, suggesting that the worst moment of tight economic policies is behind us. Another positive news for risk assets came from the U.S. personal consumption expenditures price (PCE) index, which rose 6.8% in June. The move was the biggest since January 1982, reducing incentives for fixed income investments. The Federal Reserve focuses on the PCE due to its broader measure of inflation pressures, measuring the price changes of goods and services consumed by the general public. Additional positive news came from Amazon after the e-commerce giant re...

Majority of Brazilians support impeaching President Bolsonaro, poll shows

For the first time, a majority of Brazilians support impeaching President Jair Bolsonaro, according to a poll released on Saturday, as serious graft allegations related to vaccine procurement hit the right-wing leader’s already battered image. According to the survey by Datafolha, 54% of Brazilians support a proposed move by the country’s lower house to open impeachment proceedings against Bolsonaro, while 42% oppose it. In the last Datafolha survey on the issue, released in May, supporters and opponents of impeachment were essentially tied. In a separate Datafolha poll, released on Thursday, 51% of Brazilians said they disapproved of Bolsonaro, the highest figure since he took office in January 2019. In recent weeks, Brasilia has been rocked by allegations that federal officials solicited...

Naira slides again at official market

Naira for the second day in a row fell against the U.S. dollar at the official market Wednesday, but managed a rebound at the parallel market, a day after hitting its lowest black-market rate in at least four years. Data on the FMDQ Security Exchange where forex is officially traded showed that the naira closed at N412.00 per $1 at the Nafex window. The local currency performance on Wednesday represents a N0.25 or 0.06 per cent decrease from N411.75 the rate it traded in the previous session on Tuesday. The trading session on Wednesday witnessed a forex turnover of $131.86 million, this translates to a 23.44 per cent depreciation from $172.24 million posted in the previous session on Tuesday. The domestic currency experienced an intraday low of N420.97 and a high of N400.00 before closing ...

- 1

- 2