Maple Finance

Maple Finance 2.0 overhaul aimed at speeding up the defaulting process

Maple Finance is a decentralized credit market powered by blockchain technology. Instead of requiring overcollaterlization of loans, it instead allows managers, called “Pool Delegates” to issue loans from its lending pools based on a set of risk-management criteria, according to the protocol’s documents. Introducing Maple 2.0. Maple 2.0 is a fundamental overhaul of the smart contract architecture. The new contracts are modular and robust and will facilitate Maple bringing capital markets on-chain. pic.twitter.com/5GGsMXaXhv — Maple (@maplefinance) December 14, 2022 However, in the wake of FTX’s collap, the platform experienced two major defaults from borrowers on the platform. On Dec. 1, algo trading and market maker Auros Global missed its payment of 2,400 Wrapped Ether (wETH) follo...

Crypto trading firm Auros Global misses DeFi payment due to FTX contagion

Crypto trading firm Auros Global appears to be suffering from FTX contagion after missing a principal repayment on a 2,400 Wrapped Ether (wETH) decentralized finance (DeFi) loan. Institutional credit underwriter M11 Credit, which manages liquidity pools on Maple Finance, told its followers in a Nov. 30 Twitter thread that the Auros had missed a principal payment on the 2,400 wETH loan, which is worth in total around $3 million. M11 Credit suggests that it is always in close communication with its borrowers, particularly after events in the last month, and said Auros is experiencing a “short-term liquidity issue as a result of the FTX insolvency.” We remain committed to providing transparent updates whenever possible, and are working with Auros to provide a joint statement that provides fur...

Finance Redefined: 1Password partners with Phantom, and Stark deploys nine DApps, Feb. 18–25

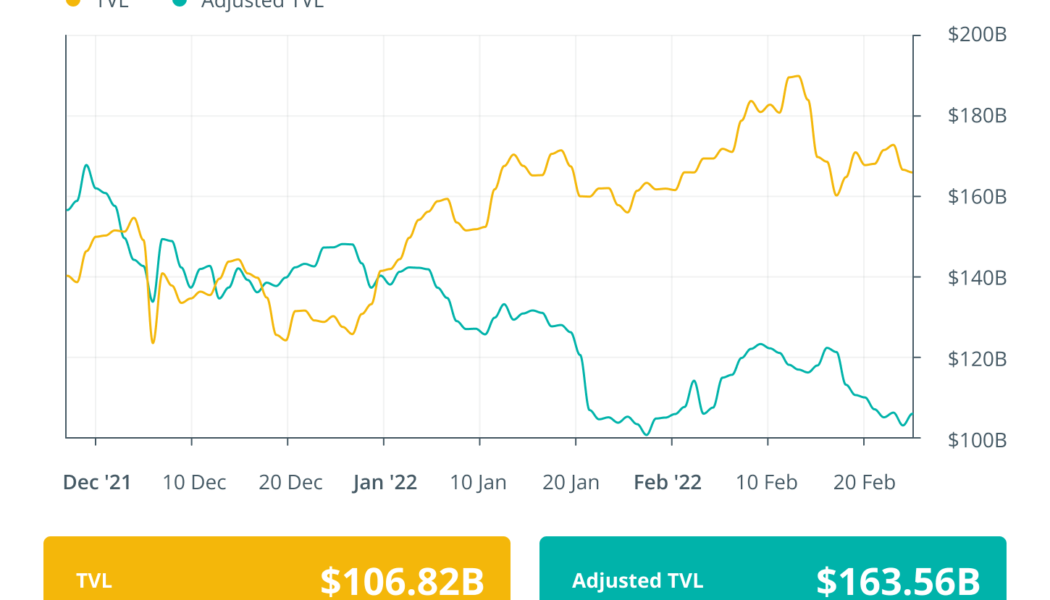

Welcome to the latest edition of Cointelegraph’s decentralized finance newsletter. In the aftermath of concerning political situations this week, the markets reacted strongly to the downside, but some assets attempted a recovery to end the week positively. 1Password collaborates with Phantom Wallet on API service Digital security platform 1Password announced a joint partnership with Phantom Wallet this week to grant asset holders the ability to consolidate their lists of public key addresses, seed phrases and other corresponding security details into a single “Save in 1Password” system. Operating primarily in the traditional financial sector at this time, 1Password has over 100,000 corporate clients from a panoply of industries, including well-recognized brands such as IBM, Slack, Shopify ...