m-pesa

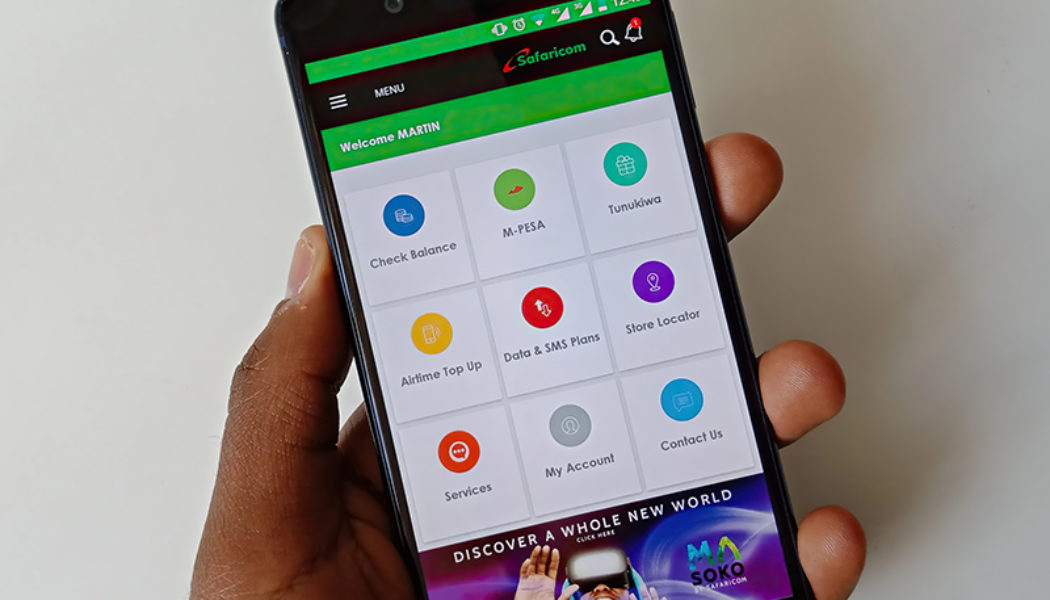

Telkom Kenya Faces Delays on its New Mobile Money Subsidiaries

Image sourced from News24 Telkom Kenya says that it is facing delays in getting approval from the Communications Authority of Kenya (CA) for its two mobile money subsidiaries that it announced last year. According to Business Daily, the telecommunications company announced Telkom Digital and T-Kash in May 2021 as a bid to reorganise its company structure. T-Kash, the telco’s mobile money services will reportedly house T-Kash Loan, a loan service that hasn’t been activated on the app as yet. The digital subsidiary is expected to involve infrastructure including a fibre network, international submarines cables, and a smart landing hub to act as a gateway to the East African region amid increased demand for data service, as per Business Daily. “We have done most of it we are waiting for the r...

The Role of Mobile Money in Kenya’s Tech Surge

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept All”, you consent to the use of ALL the cookies. However, you may visit “Cookie Settings” to provide a controlled consent.

Minors Won’t Get Access to Loan Services in M-Pesa Junior Accounts

Image sourced from Kansas Discovery. Safaricom, a telecommunications provider in Kenya, confirmed that minors will not get access to loan services like M-Shwari and Fuliza. The Kenyan telco announced on Friday that it is introducing M-PESA Junior Accounts for individuals between the age of 10 and 18 years old. The company said that the minors will have access to the network via SIM cards registered under their guardians or parents. “We plan to soon launch an M-PESA Junior Product for our children who may have access to mobile phones,” Safaricom CEO Peter Ndegwa said. According to Techweez, M-Pesa makes the most money for the company, hence it wants to expand the scope of its M-Pesa services. It recorded a 30.3% YoY growth to KES 107.69 billion ($926.2-million). The total M-PESA transaction...