luna

Crypto users react to Terraform Labs legal team purportedly leaving company

The ongoing saga with Terraform Labs, the blockchain developer behind Terra (LUNA), took a turn following a supposed change in employment status for many on the firm’s legal team. According to their LinkedIn profiles, Terraform Labs general counsel Marc Goldich, chief litigation and regulatory counsel Noah Axler and chief corporate counsel Lawrence Florio have all stopped working for the blockchain firm as of May 2022. Goldich started at Terraform Labs in August 2021 while Axler and Florio joined in January 2022. The change in employment status for three members of Terraform Labs’ legal team followed major volatility in the crypto market after the price of LUNA collapsed to $0.00 within two weeks. Stablecoins including Tether (USDT) depegged from the U.S. dollar, while the price of TerraUS...

Bitcoin and Ethereum had a rough week, but derivatives data reveals a silver lining

This week the crypto market endured a sharp drop in valuation after Coinbase, the leading U.S. exchange, reported a $430 million quarterly net loss and South Korea announced plans to introduce a 20% tax on crypto gains. During its worst moment, the total market crypto market cap faced a 39% drop from $1.81 trillion to $1.10 trillion in seven days, which is an impressive correction even for a volatile asset class. A similar size decrease in valuation was last seen in February 2021, creating bargains for the risk-takers. Total crypto market capitalization, USD billion. Source: TradingView Even with this week’s volatility, there were a few relief bounces as Bitcoin (BTC) bounced 18% from a $25,400 low to the current $30,000 level and Ether (ETH) price also made a brief rally to $2,100 af...

Terra ‘rescue plan’ still at large as LUNA falls below $5, Bitcoin spikes to ‘$138K’ in UST

Panic appeared to set in on crypto markets overnight on May 11 as Blockchain protocol Terra failed to steady its bleeding cryptoassets. Data from Cointelegraph Markets Pro and TradingView showed both the firm’s in-house token, LUNA and stablecoin, TerraUSD (UST) seeing fresh heavy losses on the day. A dubious new “all-time high” for Bitcoin After a mass sell-off which some argued was “coordinated” to destroy the Terra ecosystem, UST lost its peg to the U.S. dollar. Attempts to shore up the peg with both LUNA and Bitcoin (BTC) reserves failed, and as uncertainty gripped the market, both UST and LUNA dived to levels unimaginable just days previously. Getting close … stay strong, lunatics — Do Kwon (@stablekwon) May 10, 2022 Co-founder Do Kwon said that a “recove...

‘Kwontitative easing’ — BTC price hits $43K in UST as Terra empties $2.2B BTC bag

Bitcoin (BTC) fell below $30,000 for the first time in ten months on May 10 as turmoil at Blockchain protocol Terra continued. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Bitcoin price bounces at $29,700 Data from Cointelegraph Markets Pro and TradingView showed BTC/USD plumbing lows of $29,731 on Bitstamp. The first trip under the $30,000 mark since July 2021, overnight BTC price performance came amid both declining stock markets and fresh trouble for Terra’s United States dollar stablecoin, TerraUSD (UST). As Cointelegraph continues to report, UST saw an attack involving mass-selling this week, which culminated in Terra using its giant 750 million BTC reserves to prop up its USD peg. Initial liquidity steps to mitigate the impact of the threat proved insufficient, ho...

Bitcoin price target now $29K, trader warns after Terra weathers $285M ‘FUD’ attack

Bitcoin (BTC) prepared for a rare bear feature to return on May 8 after an overnight sell-off took the market ever closer to January lows. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView BTC circles $34,400 lows Data from Cointelegraph Markets Pro and TradingView showed BTC/USD dipping to $34,200 on Bitstamp, recovering to trade around $500 higher at the time of writing. The pair had seen brief support around the $36,000 mark, but this gave way as thin weekend liquidity added to the volatility. Bitcoin liquidations themselves were limited, however, as market sentiment had long expected a deeper pullback after a tumultuous week on stock markets. Data from on-chain monitoring resource Coinglass countered 24-hour liquidations for both Bitcoin and Ether (ETH), running at aroun...

LUNA drops 20% in a day as whale dumps Terra’s UST stablecoin — selloff risks ahead?

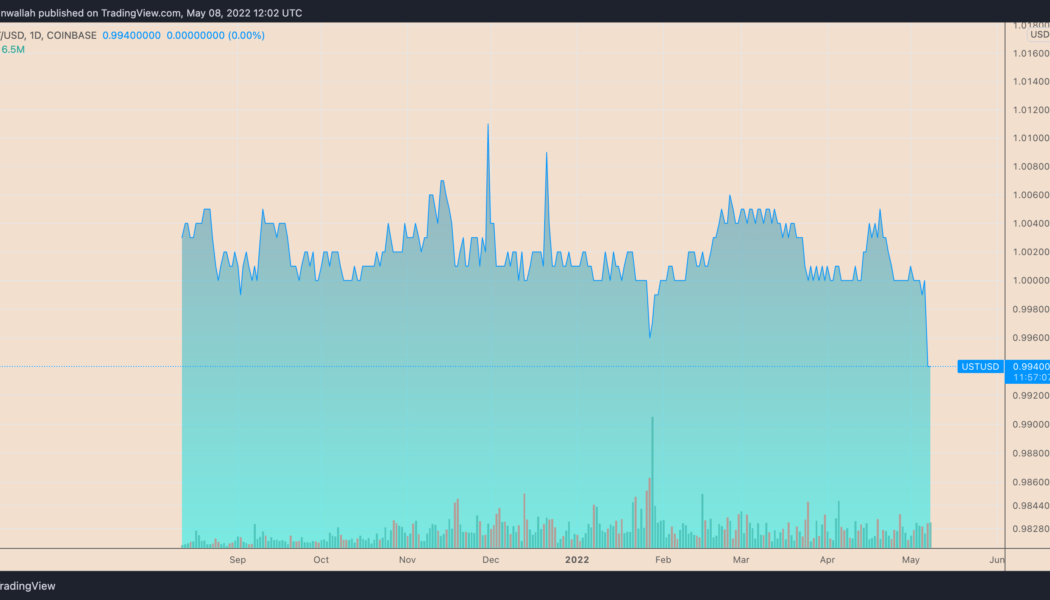

Terra (LUNA) has plunged significantly after witnessing a FUD attack on its native stablecoin TerraUSD (UST). The LUNA/USD pair dropped 20% between May 7 and May 8, hitting $61, its worst level in three months, after a whale mass-dumped $285 million worth of UST. As a result of this selloff, UST briefly lost its U.S. dollar peg, falling to as low as $0.98. UST daily price chart. Source: TradingView Excessive LUNA supply LUNA serves as a collateral asset to maintain UST’s dollar peg, according to Terra’s elastic monetary policy. Therefore, when the value of UST is above $1, the Terra protocol incentivizes users to burn LUNA and mint UST. Conversely, when UST’s price drops below $1, the protocol rewards users for burning UST and minting LUNA. Therefore, during UST supp...

Anchor Protocol rebounds sharply after falling 70% in just two months — what’s next for ANC?

Anchor Protocol (ANC) returned to its bullish form this May after plunging by over 70% in the previous two months. Pullback risks ahead ANC’s price rebounded by a little over 42.50% between May 1 and May 6, reaching $2.26, its highest level in three weeks. Nonetheless, the token experienced a selloff on May 6 and May 7 after ramming into what appears to be a resistance confluence. That consists of a 50-day exponential moving average (50-day EMA; the red wave) and 0.786 Fib line of the Fibonacci retracement graph, drawn from the $1.32-swing low to the $5.82-swing high, as shown in the chart below. ANC/USD daily price chart. Source: TradingView A continued pullback move could see ANC’s price plunging towards its rising trendline support, coinciding with the floor near&...

Ethereum risks 35% drop by June with ETH price confirming ‘ascending triangle’ fakeout

Ethereum’s native token Ether (ETH) faces the possibility of a 35% price correction in Q2 as it comes closer to breaking below its “ascending triangle” pattern. ETH price breakdown ahead? Ether’s price swung between profits and losses on May 2 while trading around $2,825, showing indecisiveness among traders about their next bias. Interestingly, the Ethereum token wobbled in the proximity of a rising trendline that constitutes an ascending triangle pattern in conjugation with a horizontal line resistance. To recap, ascending triangles are typically continuation patterns. That being said, Ether’s price was trending lower before forming its ascending triangle, raising its chances of a breakdown in the next few weeks. Another bearish sign comes from Ether&#...

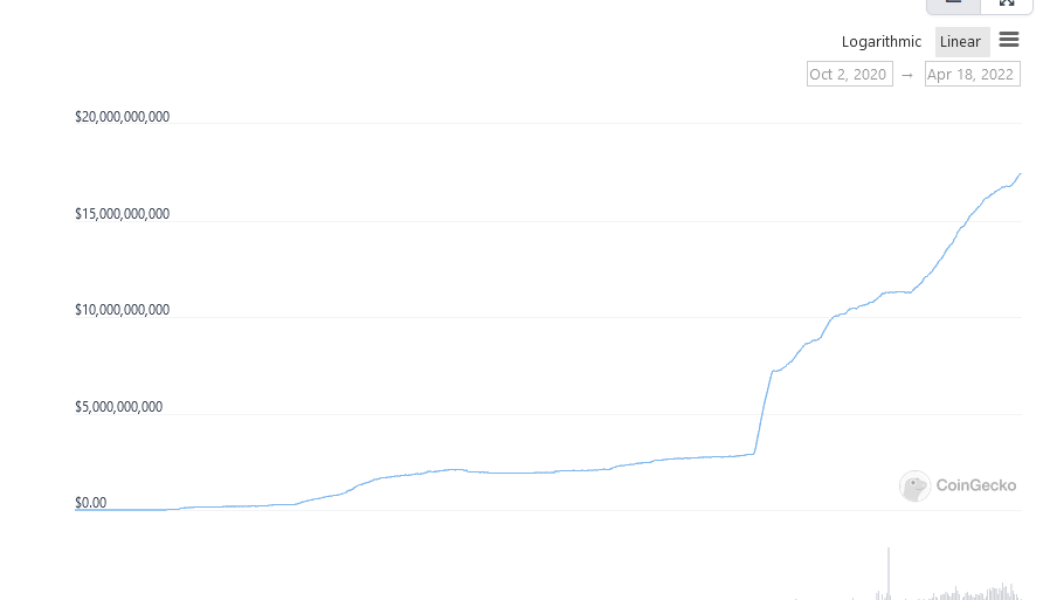

Terra’s UST flips BUSD to become third-largest stablecoin

The Terra (LUNA) blockchain’s algorithmic stablecoin Terra USD (UST) has flipped Binance USD (BUSD) to become the third-largest stablecoin on the market. UST is a USD-pegged stablecoin that was launched in September 2020. Its minting mechanism requires a user to burn a reserve asset such as LUNA to mint an equivalent amount of UST. According to Coingecko, UST’s total market capitalization has surged 15% over the past 30 days to sit at roughly $17.5 billion at the time of writing. The figure currently places UST as the third-largest stablecoin after it flipped BUSD with a slightly lower market cap of $17.46 billion. The asset now trailing only behind industry giants Tether (USDT) at $82.8 billion, and USD Coin (USDC) at $50 billion, however, the gap is quite substantial at this stage. The d...

Terraform Labs gifts another $880M to Luna Foundation Guard

Terra (LUNA) blockchain developer Terraform Labs (TFL) has gifted the Luna Foundation Guard 10 million LUNA worth around $820 million at current prices. The Luna Foundation Guard (LFG) is a nonprofit organization attached to Terra that is tasked with collateralizing the network’s algorithmic stablecoin Terra USD (UST) to keep it pegged with the U.S. dollar. Terraform Labs’ latest announcement came via Twitter on April 14, but did not outline what the funds will go towards specifically. However, transaction data from Terra Finder shows that 7.8 million LUNA (roughly $630 million) was promptly transferred out of the LFG’s reserve wallet yesterday. TFL has gifted an additional 10 million $LUNA to the @LFG_org. https://t.co/tNirkgGGm0 — Terra (UST) Powered by LUNA (@terra_money) April 14, 2022...

Terra price key support level breaks after 30% weekly drop — more pain for LUNA ahead?

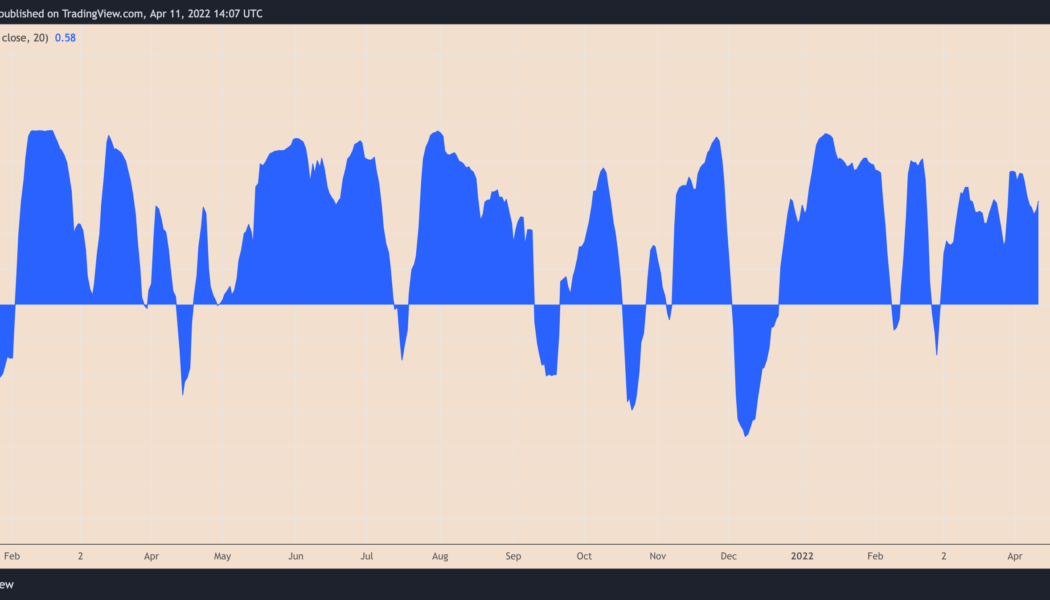

Terra (LUNA) price slid on April 11 as a broader correction across crypto assets added to the uncertainties concerning its token burning mechanism. Bitcoin (BTC) and Ether (ETH) led to a decline in the rest of the cryptocurrency market, with LUNA’s price dropping by over 8% to nearly $91.50, and about 30% from its record high of $120, set on April 6. The overall drop tailed similar moves in the U.S. stock market last week after the Federal Reserve signaled its intentions to raise interest rates and shrink balance sheets sharply to curb rising inflation. Arthur Hayes, the co-founder of BitMEX exchange, said Monday that Bitcoin’s correlation with tech stocks could have it run for $30,000 next. In other words, LUNA’s high correlation with BTC so far this year puts it at risk...

THORChain quietly outperforms crypto market in Q1 — Can RUNE price break $10 next?

THORChain (RUNE) could continue its upward momentum in the coming weeks even as it treads inside a classic bearish reversal structure. RUNE’s price has rebounded strongly by over 165% four weeks after testing its multi-month horizontal level support near $3.15. What’s more, its upside retracement has opened up possibilities about an extended bull run toward $11.50, about 45% above the current price level near $7.89, as shown in the chart below. RUNE/USD weekly price chart featuring descending triangle setup. Source: TradingView The $11.50-level coincides with RUNE’s multi-month falling trendline resistance, forming a descending triangle, a bearish setup, in conjunction with the lower horizontal support. That could have RUNE’s price correct again to $3.15 after reach...