luna

Algorithmic stabilization is the key to effective crypto-finance

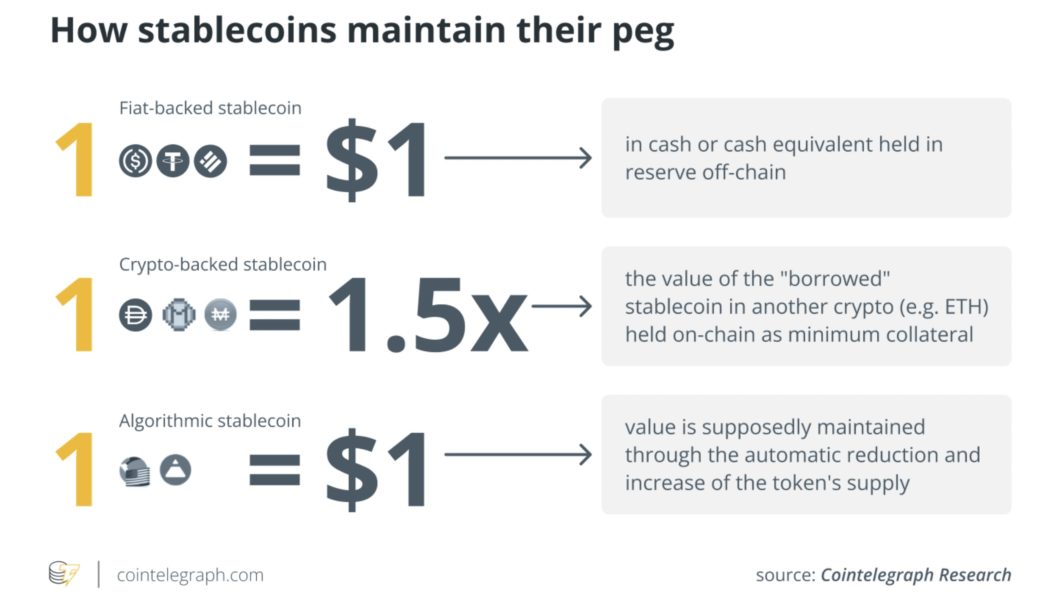

After the collapse of Terraform Labs’ cryptocurrency, Terra (LUNA), and its stablecoin, Terra (UST), the notion of “algorithmic stabilization” has fallen to a low point in popularity, both in the cryptocurrency world and among mainstream observers. This emotional response, however, is strongly at odds with reality. In fact, algorithmic stabilization of digital assets is a highly valuable and important class of mechanism whose appropriate deployment will be critical if the crypto sphere is to meet its long-term goal of improving the mainstream financial system. Blockchains, and other similar data structures for secure decentralized computing networks, are not only about money. Due to the historical roots of blockchain tech in Bitcoin (BTC), however, the theme of blockchain-based digita...

WSJ: Terraform Labs claims case against Do Kwon is ‘highly politicized’

Terraform Labs, the company behind the development of the Terra (LUNA) blockchain said South Korea’s case against its co-founder Do Kwon has become political, alleging prosecutors expanded the definition of a security in response to public pressure. “We believe that this case has become highly politicized, and that the actions of the Korean prosecutors demonstrate unfairness and a failure to uphold basic rights guaranteed under Korean law,” a Terraform Labs spokesman said to The Wall Street Journal on Sept. 28. South Korean prosecutors issued an arrest warrant for Kwon on Sept. 14 for violations of the countries capital markets laws, but Terraform Labs laid out a defense arguing Terra (now known as Terra Luna Classic (LUNC)) isn’t legally a security, meaning it isn’t covered by capital mar...

Breaking: Interpol ‘Red Notice’ issued for Do Kwon — South Korea prosecutors

Interpol has reportedly issued a “Red Notice” to law enforcement worldwide for the arrest of Terraform Labs co-founder Do Kwon. South Korean prosecutors in Seoul on Monday told Bloomberg the international policing organization issued the notice in response to charges Kwon faces in South Korea related to the collapse of the Terra ecosystem. The news comes only a week after South Korean prosecutors reportedly asked Interpol to issue a “Red Notice” for Kwon on Sept. 19. A Red notice is a “request to law enforcement worldwide to locate and provisionally arrest a person pending extradition, surrender, or similar legal action” according to the Interpol website. It also comes less than two weeks after South Korean authorities issued an arrest warrant for Kwon and five other associates for alleged...

Terra co-founder Do Kwon says he’s not ‘on the run’

Do Kwon, the co-founder of the Terra ecosystem, took to Twitter on Saturday asserting he’s “not ‘on the run’ or anything similar” after the Singapore Police Force (SPF) said Kwon wasn’t in the city-state. On Sept. 14, South Korean authorities issued an arrest warrant for Kwon and five other associates for alleged violations of the country’s capital markets laws. All were known to be in Singapore at the time, with prosecutors also attempting to revoke their passports a day later on Sept. 15. “For any government agency that has shown interest to communicate, we are in full cooperation and we don’t have anything to hide,” Kwon tweeted. I am not “on the run” or anything similar – for any government agency that has shown interest to communicate, we are in full cooperation and we don’t hav...

Crypto insurance a ‘sleeping giant’ with only 1% of investments covered

While on-chain insurance has been around since 2017, only a measly 1% of all crypto investments are actually covered by insurance, meaning the industry remains a “sleeping giant,” according to a crypto insurance executive. Speaking to Cointelegraph, Dan Thomson, the CMO of decentralized cover protocol InsurAce said there is a massive disparity between the total value locked (TVL) in crypto and decentralized finance (DeFi) protocols and the percentage of that TVL with insurance coverage: “DeFi insurance is a sleeping giant. With less than 1% of all crypto covered and less than 3% of DeFi, there’s a huge market opportunity still to be realized.” Though plenty of investment has poured into smart contract security audits, on-chain insurance serves as a viable solution for digital asset protect...

Terra back from the dead? LUNA price rises 300% in September

Terra has become a controversial blockchain project after the collapse of its native token LUNA and stablecoin TerraUSD (UST) in May. But its recent gains are hard to ignore for cryptocurrency traders. LUNA rising from the dead? After crashing to nearly zero in May, LUNA is now trading for around $6, a whopping 17,559,000% price rally in less than four months when measured from its lowest level. Meanwhile, LUNA’s performance in September is particularly interesting, given it has rallied by more than 300% month-to-date after a long period of sideways consolidation. LUNA/USDT daily price chart. Source: TradingView Terra ecosystem in September It is vital to note that LUNA also trades with the ticker LUNA2 across multiple exchanges. In detail, Terraform Labs, the firm behind...

‘Far too easy’ — Crypto researcher’s fake Ponzi raises $100K in hours

Crypto influencer FatManTerra claims to have gathered over $100,000 worth of Bitcoin (BTC) from crypto investors in an investment scheme that was later revealed as fake. The crypto researcher said he created the fake investment scheme as an experiment and to teach people a lesson about blindly following the investment advice of influencers. The account on Twitter has around 101,100 followers and is mostly known for being a former Terra proponent that now actively speaks out against the project and founder Do Kwon following its $40 billion collapse in May. In a Sept. 5 tweet, FatManTerra told his followers he had “received access to a high-yield BTC farm” by an unnamed fund, and said that people could message him if they wanted-in on the yield farming opportunity. “I’ve maxed ou...

Contagion only hit firms with ‘poor balance sheet management’ — Kraken Aus boss

The crypto contagion sparked by Terra’s infamous implosion this year only spread to companies and protocols with “poor balance sheet management” and not the underlying blockchain technology, says Kraken Australia’s managing director Jonathon Miller. Speaking with Cointelegraph, the Australian crypto exchange head argued that sectors such as Ethereum-based decentralized finance (DeFi) revealed its fundamental strength this year by weathering severe market conditions: “Some of the contagion that we saw across some of the lending models in the space, [was in] this traditional finance kind of lending model sitting on top of crypto. But what we didn’t see is a kind of catastrophic failure of the underlying protocols. And I think that’s been recognized by a lot of people.” “Platforms...

Anonymous vows to bring Do Kwon’s ‘crimes’ to light

Hacktivist group Anonymous has pledged to “make sure” Terra co-founder Do Kwon is “brought to justice as soon as possible” in regards to the collapse of the Terra (LUNA) and TerraUSD (UST) ecosystems in May. On Sunday, a video purportedly coming from the Anonymous hacker group rehashed a laundry list of Kwon’s alleged wrongdoings, including cashing out $80 million each month from Luna and TerraUSD prior to its collapse as well as his role in the fall of stable coin Basis Cash, for which Do Kwon allegedly co-created under the pseudonym “Rick Sanchez” in late 2020. “Do Kwon, if you are listening, sadly, there is nothing that can be done to reverse the damage that you have done. At this point, the only thing that we can do is hold you accountable and make sure that you are brought to ju...

Investors dumping on Terra as LUNA 2 tanks 70% in two days

The price of Terra (LUNA) has tanked around 70% since the re-launch of the Terra ecosystem via Terra 2.0 on May 28. Under the revival plan of Terraform Labs founder Do Kwon, new LUNA tokens, also referred to as LUNA 2, are being airdropped to investors that previously held Luna Classic (LUNC), TerraUSD Classic (USTC) and Anchor Protocol UST (aUST). The only reason to buy $LUNA 2.0 is to qualify for the next airdrop of $LUNA 3.0 after it goes to zero like $LUNA 1.0 — Luke Martin (@VentureCoinist) May 29, 2022 According to data from CoinGecko, LUNA has dropped roughly 69% since its opening of $18.87 on Saturday to sit at around $5.71 at the time of writing. LUNA/USD chart: CoinGecko At this stage, the sharp plummet seems to suggest a relative lack of faith in Do Kwon’s revamp moving for...

Bitcoin price stuck below $29K as Terra LUNA comes back from the dead

Bitcoin (BTC) analysts faced another day of frustration on May 28 as BTC/USD refused to offer volatility up or down. BTC/USD 1-day candle chart (Bitstamp). Source: TradingView “Not the decoupling we wanted” Data from Cointelegraph Markets Pro and TradingView showed the largest cryptocurrency sticking in a narrow short-term range into the weekend. Previously forecast support levels to avoid a deeper correction managed to hold in the May 27 Wall Street trading session, but a bounce higher was similarly absent as commentators looked for fresh cues. “Short resistance and long support until one of them breaks. Keep it simple in ranges as they are there to engineer liquidity for trend continuation or reversals,” popular trading account Crypto Tony summarized in part ...

South Korean police request exchanges freeze LFG related funds

Crypto exchanges in South Korea have been issued notices from police requesting the sequestering of funds related to the Luna Foundation Guard. On May 23rd, 2022, Korean authorities sent a request to the top crypto exchanges in the country to prevent funds from being withdrawn. Specifically, the Seoul Metropolitan Police Agency asked to prohibit the Luna Foundation Guard from taking any action. The police claim that clues have been found that may link the organization to embezzlement. The Luna/Terra algorithmic stablecoin crash, which reduced the value of the coin by over 99%, crushed investor portfolios overnight earlier this month. However, this request is not a demand and is not enforceable by law. Each exchange can choose how they would like to respond, but it is not yet known ho...