Loans

Public Bitcoin mining companies plagued with $4B of collective debt

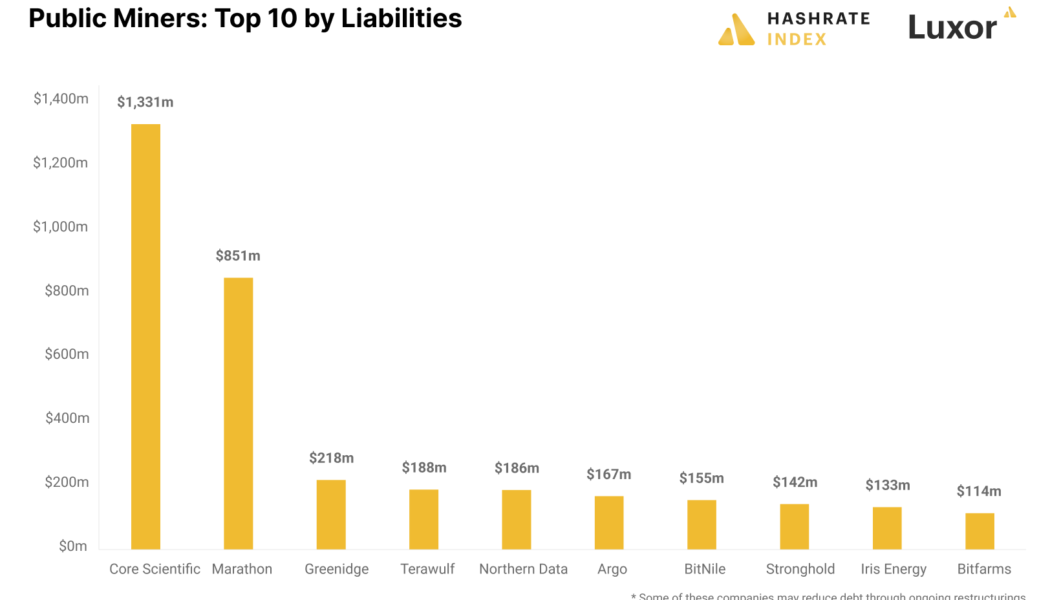

The recent bankruptcy filing of Bitcoin (BTC) miner Core Scientific despite a $72M relief offer from creditors raised questions about the overall health of the bitcoin mining community amid a prolonged bear market. Turns out, the public bitcoin miners owe more than $4 billion in liabilities and require an immediate restructuring to get out of the unsustainably high debt levels. The Bitcoin mining community took up massive loans during the 2021 bull market, negatively impacting their bottom lines during a subsequent bear market. Bitcoin mining data analytics by Hashrate Index show that just the top 10 Bitcoin mining debtors cumulatively owe over $2.6 billion. Public Bitcoin mining companies with highest debt. Source: Hashrate Index Core Scientific, the biggest debtor among the lot — with $1...

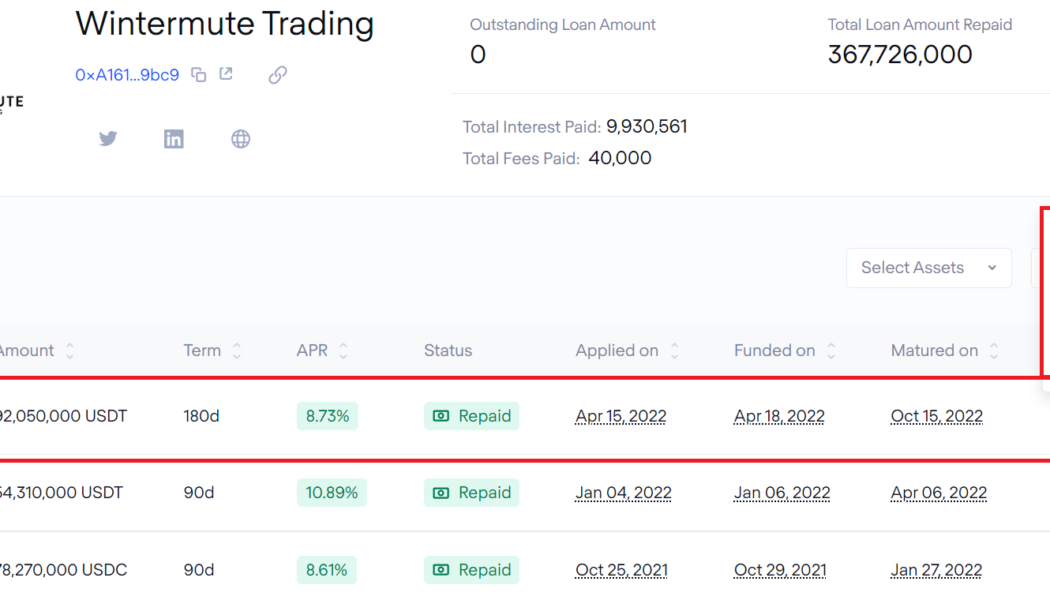

Wintermute repays $92M TrueFi loan on time despite suffering $160M hack

When Wintermute, a cryptocurrency market maker, lost $160 million due to a hack, concerns related to the repayment of debt worth $189.4 million surfaced. However, in an exciting turn of events, Wintermute paid back its largest debt due Oct. 15, involving a $92 million Tether (USDT) loan issued by TrueFi. After repayment of TrueFi’s $92 million loan, Wintermute still owes $75 million to Maple Finance in USD Coin (USDC) and wrapped ether (WETH) and $22.4 million to Clearpool, a total of $97.4 million in debt. Loan details show that Wintermute Trading had borrowed $92.5 million for a term period of 180 days. James Edwards from Libre Blockchain suspects that “some of the funds from their recent “hack” contributed to the payback.” He further claimed that BlockSec’s attempt to debunk...

Mango Market’s DAO forum set to approve $47M settlement with hacker

Following a $117 million exploit on Oct. 11, the Mango Markets community is set to make a deal with its hacker, allowing the hacker to keep $47 million as a bug bounty, according to the decentralized finance (DeFI) protocol governance forum. The proposed terms reveal that $67 million of the stolen tokens will be returned, while $47 million will be kept by the hacker. 98% of the voters, or 291 million tokens, have voted in favor of the deal, which also stipulates that Mango Markets will not pursue criminal charges on the case. With the quorum reached, the voting is likely to happen on Oct. 15. The proposal stated: “The funds sent by you and the mango DAO treasury will be used to cover any remaining bad debt in the protocol. All mango depositors will be made whole. By voting...

Celsius pays down 143M in DAI loans since July 1

Celsius (CEL) has repaid a substantial amount of its outstanding debt to Maker (MKR) protocol since the beginning of the month, signaling that the troubled crypto lending platform was trying to stave off a complete collapse amid credible rumors of insolvency. Since July 1, Celsius has repaid $142.8 million worth of Dai (DAI) stablecoins across four separate transactions, according to data from DeFi Explorer. The crypto lender still has $82 million in outstanding debt owed to Maker. Out of $1.8 billion in lifetime investments, the firm’s losses currently stand at $667.2 million. With the loan repayments, Celsius’ liquidation price on its Wrapped Bitcoin (wBTC) loan has dropped to $4,966.99 Bitcoin (BTC). The liquidation price reportedly fell by nearly half since Celsius posted a...

Voyager Digital freezes trading, deposits, withdrawals and rewards, blames 3AC default

Cryptocurrency exchange Voyager Digital announced Friday that it was temporarily suspending trading, deposits, withdrawals and loyalty rewards. “The failure of a borrower, Three Arrows Capital, to repay a substantial loan from us makes this the right path forward,” Voyager Digital CEO Stephen Ehrlich said on Twitter soon after the service suspension went into effect. “This decision, while far from optimal, will give us time to work to strengthen our balance sheet, a necessary condition to protect assets and preserve the future of the Voyager platform we have built together,” Ehrlich continued. A statement issued by the company said it has engaged Moelis & Co. and the Consello Group as financial advisers, and Kirkland & Ellis as legal advisers. Voyagers, today we made the diff...

How a DAO for a bank or financial institution will look like

DAOs can provide several services for banks, including asset management, compliance and lending. Banks today are already using blockchain technology for things like payment, clearing and settlement, trade finance, identity and syndicated loans, according to The Financial Times. However, there are still many unexplored areas in banking where a DAO-based model might be useful: Fundraising In the crypto world, initial coin offerings (ICOs) are breaking down the barrier between access to capital and traditional services like capital-raising firms. Likewise, banks can use DAOs to raise capital from a wider pool of investors via ICOs. Loans and Credit Using decentralized technology in banking can eliminate the need for gatekeepers in the lending industry. DAOs provide more secure ways for people...

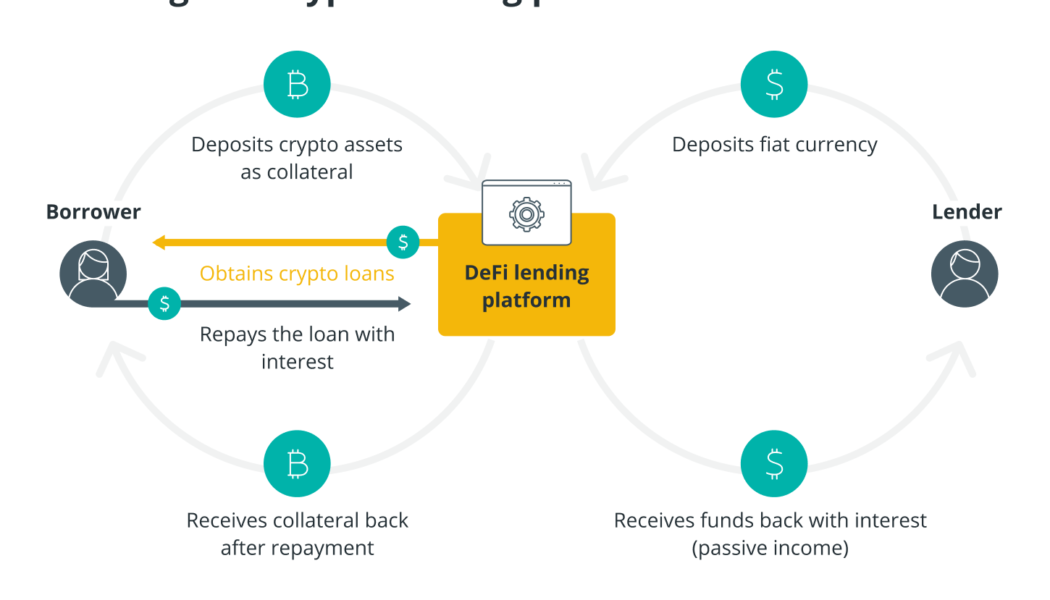

DeFi transforming lending routes on the blockchain

The world of decentralized finance (DeFi) is gradually expanding to encompass a significant share of the global financial lending space by virtue of the inherently trustless manner of operation and the ease of accessing capital. As the crypto ecosystem has grown to a $2-trillion industry by market capitalization, new products and offerings have emerged thanks to burgeoning innovation in blockchain technology. Lending and borrowing have become an integral part of the crypto ecosystem, especially with the emergence of DeFi. Lending and borrowing are one of the core offerings of the traditional financial system, and most people are familiar with the terms in the form of mortgages, student loans, etc. In traditional borrowing and lending, a lender provides a loan to a borrower and earns intere...

MicroStrategy may explore ‘future yield generation opportunities’ on 95,643 BTC holdings

Business intelligence firm MicroStrategy said it will consider opportunities for yield generation on 95,643 “unencumbered” Bitcoin (BTC) held by its subsidiary MacroStrategy. In MicroStrategy’s report for the first quarter of 2022 released on Tuesday, the firm said it “may conservatively explore future yield generation opportunities on unencumbered MacroStrategy bitcoins” as a consideration following a $205 million BTC-collateralized loan issued by Silvergate Bank in March. As of March 31, MicroStrategy held a total of 129,218 BTC, which the firm reported had a carrying value of roughly $2.9 billion, reflecting cumulative impairment losses of more than $1 billion and an aggregate cost of $4 billion. “The original cost basis and market value of MicroStrategy’s bitcoin were $3.967 billion an...

MicroStrategy may explore ‘future yield generation opportunities’ on 95,643 BTC holdings

Business intelligence firm MicroStrategy said it will consider opportunities for yield generation on 95,643 “unencumbered” Bitcoin (BTC) held by its subsidiary MacroStrategy. In MicroStrategy’s report for the first quarter of 2022 released on Tuesday, the firm said it “may conservatively explore future yield generation opportunities on unencumbered MacroStrategy bitcoins” as a consideration following a $205 million BTC-collateralized loan issued by Silvergate Bank in March. As of March 31, MicroStrategy held a total of 129,218 BTC, which the firm reported had a carrying value of roughly $2.9 billion, reflecting cumulative impairment losses of more than $1 billion and an aggregate cost of $4 billion. “The original cost basis and market value of MicroStrategy’s bitcoin were $3.967 billion an...

Home sweet hodl: How a Bitcoiner used BTC to buy his mom a house

There’s a special bond between mothers and their sons. For pseudonymous Alan, a 28-year-old engineer, a Bitcoin (BTC) loan helped his mom to buy a house. Alan told Cointelegraph that he took out a Bitcoin-backed loan in 2021 — serendipitously on his sister’s birthday — to gift his mom the tax-free money. She then used the funds to buy a house in North Yorkshire, England, while Alan kept his Bitcoin. Yorkshire, England, known as “God’s own country.” Source: North Yorkshire City Council Alan first used Bitcoin in 2012, learning it was a useful currency to buy things on the internet. He used the peer-to-peer (P2P) service localbitcoins.com, whose team are regular Cointelegraph contributors, to buy Bitcoin. Alan described the process of buying Bitcoin from real people as a “bizarre experience....

Looking to take out a crypto loan? Here’s what you need to know

Loans based on cryptocurrencies have become a mainstay of the decentralized finance (DeFi) universe ever since the smart contract-based lending/borrowing platforms began offering the service to crypto users. The Ethereum network, the first blockchain that scaled the smart contract functionality, sees most of the total value locked (TVL) on DeFi protocols dominated by cryptocurrency lending platforms. According to data from DeFi Pulse, the top 4 of 10 DeFi protocols are lending protocols that account for $37.04 billion in TVL, just 49% of TVL of the entire DeFi market on the Ethereum blockchain. Ethereum leads in terms of being the most utilized blockchain for the DeFi market and the TVL on the network. Maker and Aave are the biggest players here, with a TVL of $14.52 billion and $11.19 bil...

Nexo launches crypto card…and you don’t have to sell your coins

Nexo, the digital asset lending institution, today launched the Nexo Card. In a partnership with MasterCard, the crypto-powered card boasts the ability to be used to transact with over 90 million merchants. And the thing that makes it one-of-a-kind? You don’t have to sell your crypto. Which for crypto people, is a very good thing. Keep Your Assets That’s because the Nexo Card is linked to a crypto-backed credit line with Nexo, which starts at 0% APR and is capped at 13.9%. So rather than spending your digital assets, you instead use them as collateral – a pretty neat piece of innovation. Furthermore, the collateral mechanism is dynamic, and you can put up multiple assets against your credit – such as a mix of Bitcoin, Ethereum stablecoins and much more. It’s a product which crypto enthusia...