Litecoin

Dogecoin becomes second largest PoW cryptocurrency

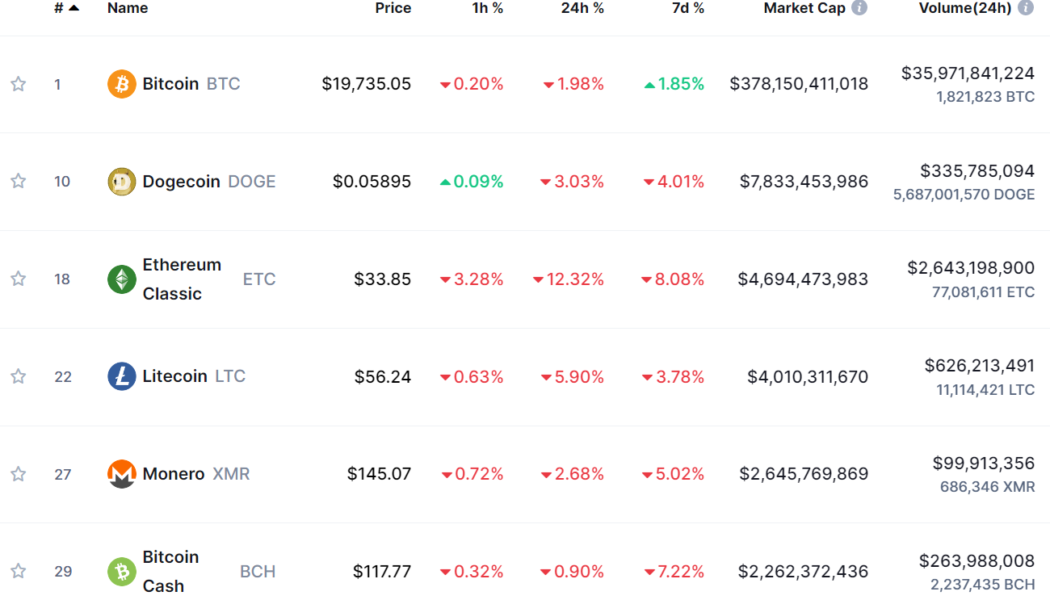

Meme-inspired cryptocurrency Dogecoin (DOGE) is now officially the second largest proof-of-work (PoW) crypto in terms of market cap, following the Ethereum network’s proof-of-stake upgrade on Sept. 15. Bitcoin (BTC) of course remains miles ahead of Dogecoin’s market cap of $7.83 billion, though the well-followed memecoin is still comfortably ahead of the third place PoW cryptocurrency Ethereum Classic (ETC) (with a market cap of $4.69 billion), Litecoin (LTC) ($4.01 billion) and Monero (XMR) ($2.65 billion). Ranking of PoW-Based Cryptocurrencies by Market Cap. Source: Coinmarketcap.com. One Dogecoin fan appeared to be in disbelief of Dogecoin’s rise to become the second largest PoW cryptocurrency, stating “who would have thought that this would happen. Congrats #Doge...

Top 5 cryptocurrencies to watch this week: BTC, SOL, LTC, LINK, BSV

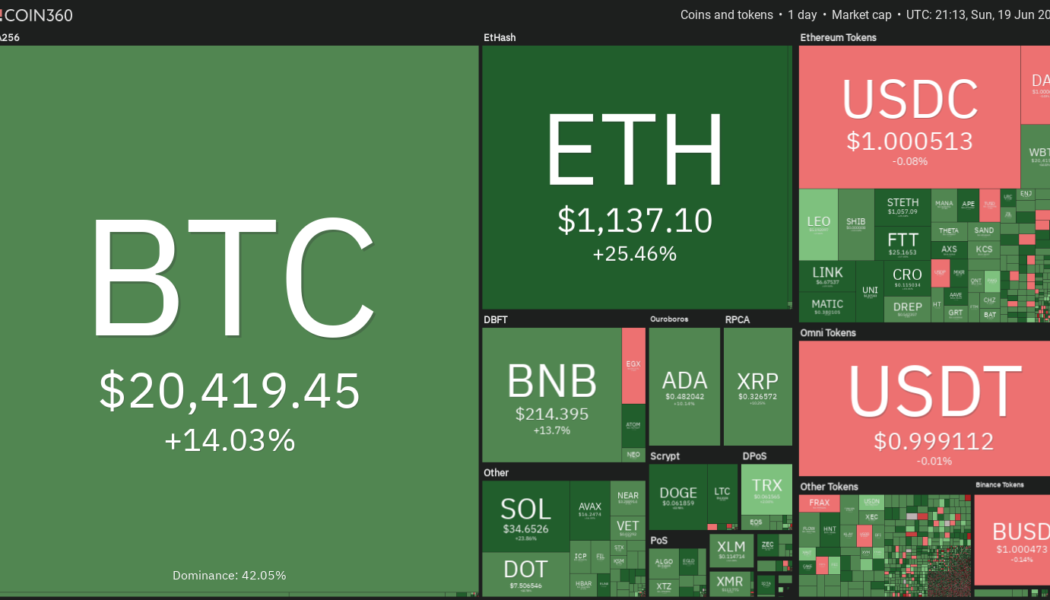

Bitcoin (BTC) plummeted to $17,622 on June 18. This marked the first time in Bitcoin’s history that it has fallen below its previous cycle high. The United States Federal Reserve’s aggressive monetary tightening, a crisis at crypto lending platform Celsius and liquidity issues at investment fund Three Arrows Capital are creating a sense of panic among traders. Markets commentator Holger Zschaepitz said that Bitcoin has crashed more than 80% four times in history. That puts the current fall of about 74% within historical standards. Previous bear markets have bottomed out just below the 200-week moving average, according to market analyst Rekt Capital. If history repeats itself, Bitcoin is unlikely to stay at the current depressed levels for a long time. Crypto market data daily view. Source...

Rune’s upcoming mainnet launch and Terra (LUNA) integration set off a 74% rally

2021 was a roller coaster of a year for THORChain (RUNE), which saw its price top out at $20.31 only to come crashing down below $4 as a series of hacks and declining interest in decentralized finance had the token limping into 2022. Data suggests that investors could be taking a closer look at Rune and a few potentially bullish factors could include the protocol’s recent integration with the Terra and Cosmos ecosystem, an upcoming mainnet launch and the attractive yields offered to liquidity providers. RUNE/USDT 4-hour chart. Source: TradingView Data from Cointelegraph Markets Pro and TradingView shows that after hitting a low of $3.00 on Feb. 24, the price of RUNE has rallied 74.2% to a daily high at $5.23 on March 1 amid a 388% surge in its 24-hour trading volume. Rune integrates ...

SBI Group launches crypto-asset fund for Japanese investors

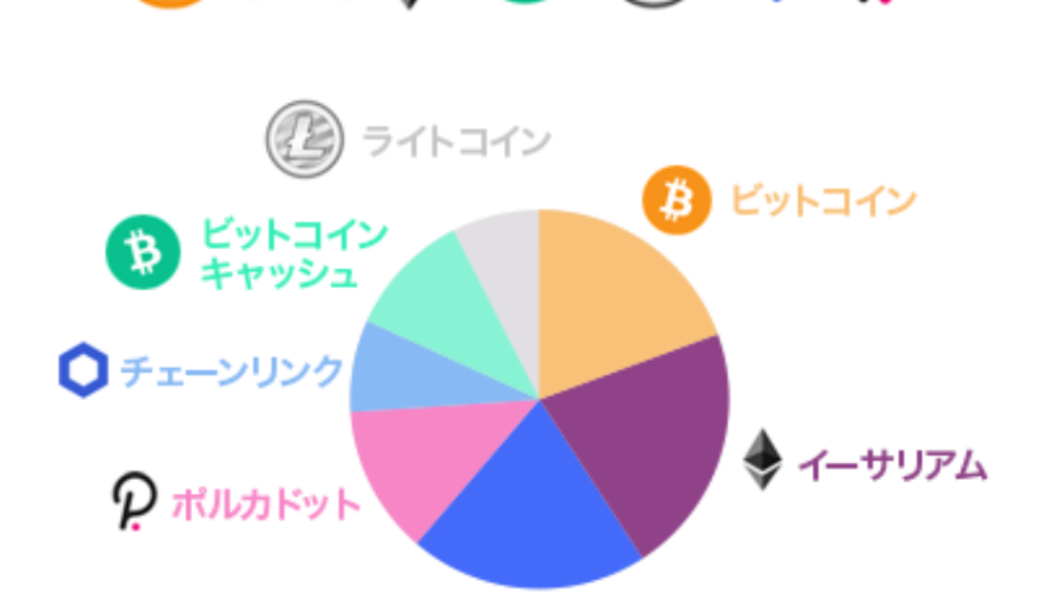

Tokyo’s biggest finserv firm, SBI Group, will now allow general Japanese investors to purchase cryptocurrencies via its newly launched ‘crypto asset fund’. The fund is composed of seven cryptocurrencies including Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), XRP, Bitcoin Cash (BCH), Chainlink (LINK) and Polkadot (DOT). The crypto-asset fund, to be traded and operated by the SBI Alternative Fund, was established on Dec. 02 with a dedicated capital of 5 million yen, worth approximately $45,000 at the time of writing. However, the company may choose to release the capital in smaller break-ups of 1 million yen each. Source: SBI According to the official statement, investors will be required to go through an application process that includes an anonymous partnership agreement with SBI Al...

- 1

- 2