Litecoin

5 altcoins that could breakout if Bitcoin price stays bullish

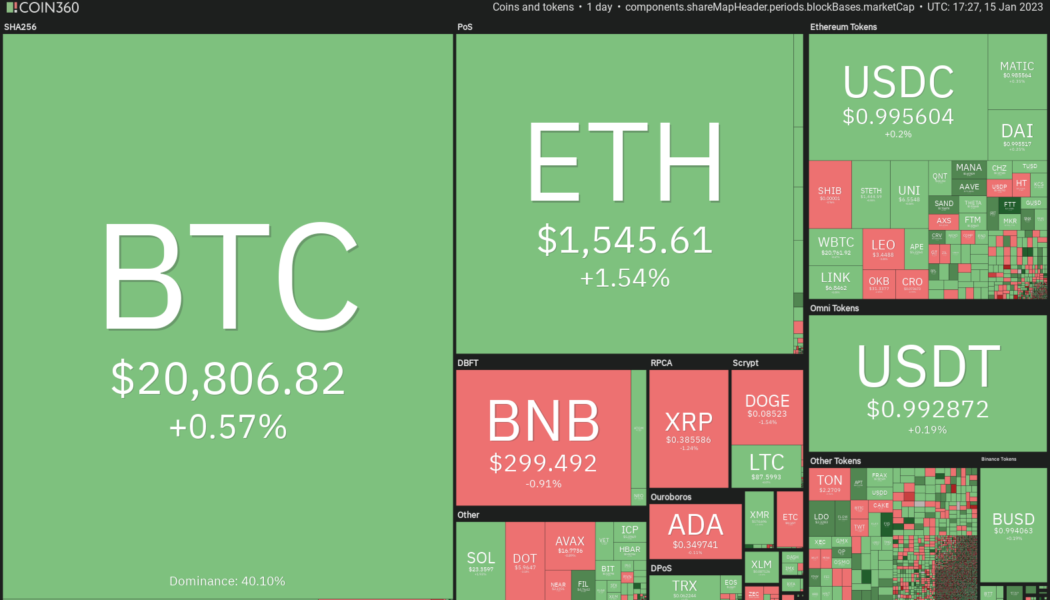

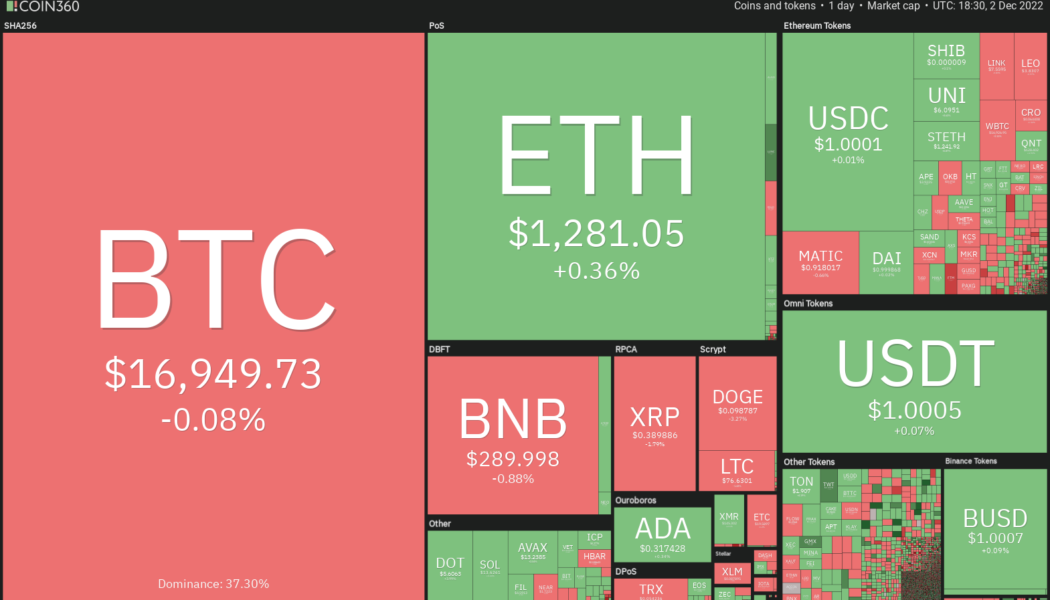

The cryptocurrency markets have made a strong comeback in the past few days. That drove the total crypto market capitalization to $995 billion on Jan. 14, according to CoinMarketCap data. Bitcoin (BTC) led the recovery from the front and skyrocketed above $21,000 on Jan. 14. After the sharp rally, the big question is whether the recovery is a dead cat bounce that is a selling opportunity, or is it the start of a new uptrend. It is difficult to predict with certainty if a macro bottom has been made but the charts suggest that a bottoming process has begun. Crypto market data daily view. Source: Coin360 Independent market analyst HornHairs highlighted that the 2017 to 2018 bear market lasted for 364 days and from 2021 to the current market low, the duration is again 364 days. Another interes...

Price analysis 1/6: BTC, ETH, BNB, XRP, DOGE, ADA, MATIC, DOT, LTC, UNI

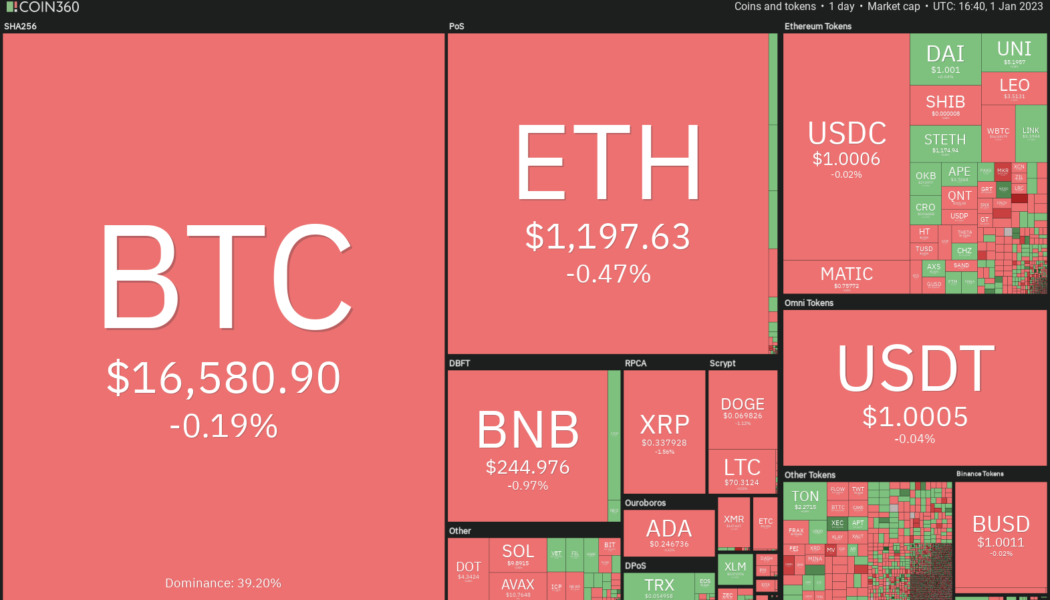

The United States December nonfarm payrolls report showed a growth of 223,000 jobs, above the market’s expectation of an increase of 200,000 jobs. While this shows that the economy remains strong, market observers shifted their focus to the slower wage growth of 0.3% for the month, below economists’ expectation of 0.4%. In addition, the euro zone’s headline inflation dropped from 10.1% in November to 9.2% in December. Both economic data boosted hopes that the central bank’s aggressive rate tightening may slow down. This triggered a rally in the U.S. and European stock markets. Daily cryptocurrency market performance. Source: Coin360 However, the reaction in the cryptocurrency space remains muted, with Bitcoin (BTC) continuing to trade inside a narrow range. The crypto investors...

These 4 altcoins may attract buyers with Bitcoin stagnating

Bitcoin’s (BTC) volatility remained subdued in the final few days of the last year, indicating that investors were in no hurry to enter the markets. Bitcoin ended 2022 near $16,500 and the first day of the new year also failed to ignite the markets. This suggests that traders remain cautious and on the lookout for a catalyst to start the next trending move. Several analysts remain bearish about Bitcoin’s near-term price action. David Marcus, CEO and founder of Bitcoin firm Lightspark, said in a blog post released on Dec. 30 that he does not see the crypto winter ending in 2023 and not even in 2024. He expects that it will take time to rebuild consumer trust but believes the current reset may be good for legitimate firms over the long term. Crypto market data daily view. Source: Coin360 The...

Price analysis 12/30: BTC, ETH, BNB, XRP, DOGE, ADA, MATIC, DOT, LTC, UNI

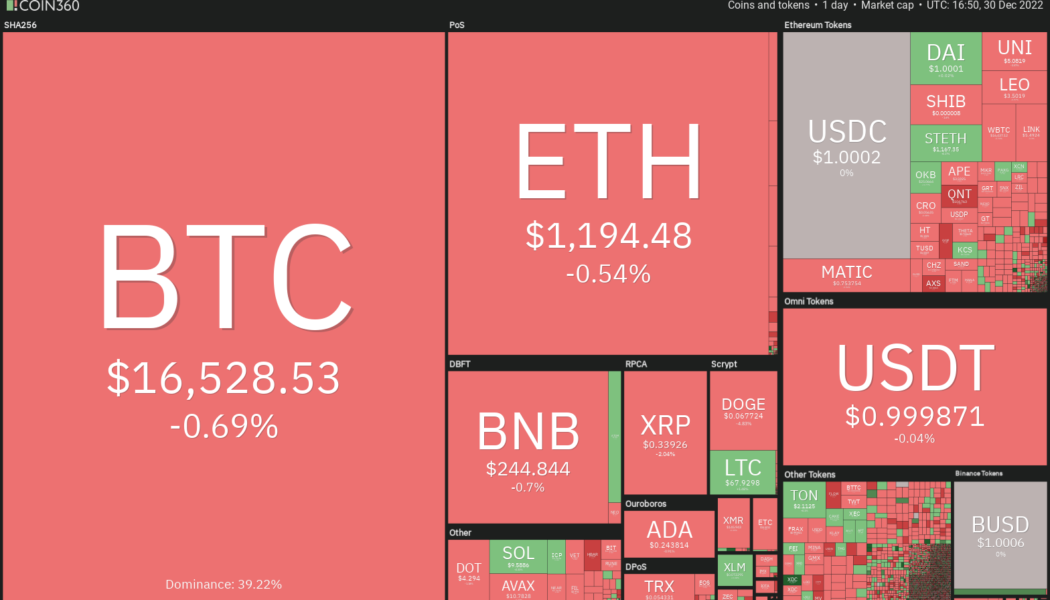

Investors have faced a tumultuous year in 2022 as stocks, bonds, and the cryptocurrency sector have all witnessed sharp declines. As of Nov. 30, the performance of a traditional portfolio comprising 60% stocks and 40% bonds has been the worst since 1932, according to a report by Financial Times. The next big question troubling crypto investors is whether the pain in Bitcoin (BTC) is over or will the downtrend continue in 2023. Analysts seem to be divided in their opinion for the first quarter of the new year. While some expect a drop to $10,000 others anticipate a rally to $22,000. Daily cryptocurrency market performance. Source: Coin360 While the near-term remains uncertain, research and trading firm Capriole Investments said in its latest edition of the Capriole Newsletter that Bitcoin c...

Price analysis 12/28: BTC, ETH, BNB, XRP, DOGE, ADA, MATIC, DOT, LTC, UNI

Gold has been an outperformer in 2022 compared to the United States equities markets and Bitcoin (BTC). The yellow metal is almost flat for the year while the S&P 500 is down more than 19% and Bitcoin has plunged roughly 64%. The sharp fall in Bitcoin’s price has hurt both short-term and long-term investors alike. According to Glassnode data, 1,889,585 Bitcoin held by short-term holders was at a loss as of Dec. 26 while the loss-making tally of long-term holders was 6,057,858 Bitcoin. Daily cryptocurrency market performance. Source: Coin360 In spite of gold’s good showing and Bitcoin’s dismal performance in 2022, billionaire investor Mark Cuban continues to favor Bitcoin over gold. While speaking on Bill Maher’s Club Random podcast, Cuban told Maher, “If you have gold, you’re dum...

Price analysis 12/23: BTC, ETH, BNB, XRP, DOGE, ADA, MATIC, DOT, LTC, UNI

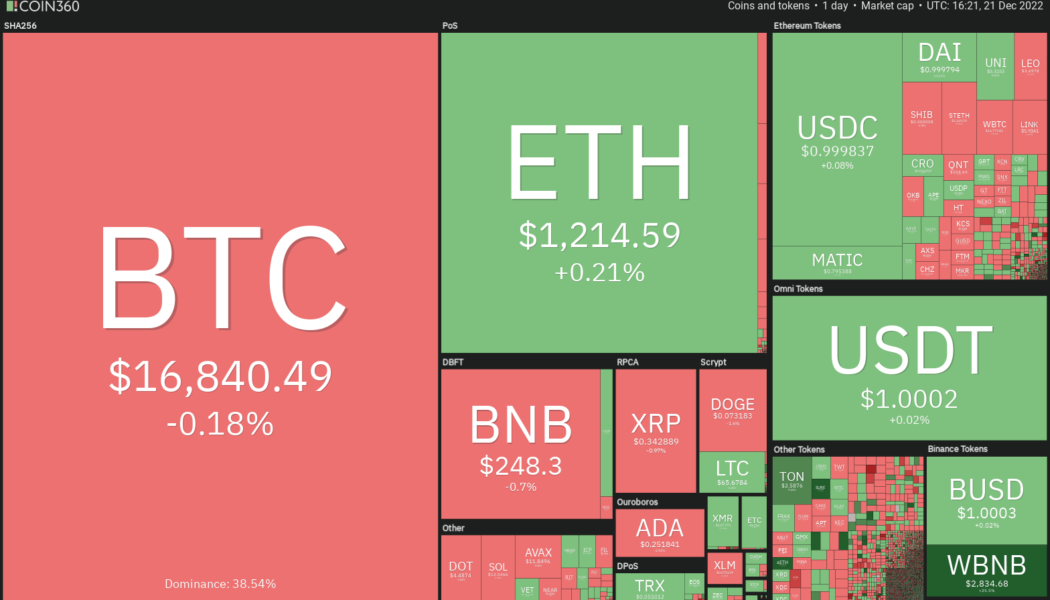

Bitcoin (BTC) is on track to end the year with a loss of about 65%. This would mark the third negative year for Bitcoin with the other two being 2014 and 2018. In comparison, the S&P 500 has fared much better but that is also down close to 20% in 2022. Although cryptocurrency prices have seen deep cuts this year, traders have continued to plow money into the space. An online survey conducted by Blockchain.com shows that 41% of the respondents bought crypto this year and 40% plan to purchase crypto in the next year. Daily cryptocurrency market performance. Source: Coin360 However, a sustained recovery in risk-assets may happen only after inflation shows signs of cooling. That would raise expectations of a pivot by the United States Federal Reserve from its aggressive monetary ...

Price analysis 12/21: BTC, ETH, BNB, XRP, DOGE, ADA, MATIC, DOT, LTC, UNI

As the year comes to an end, investors will be keenly watching for a Santa Claus rally on Wall Street as many believe that if the rally does not happen, the next year may either remain flat or turn negative. Jurrien Timmer, director of global macro at asset management giant Fidelity Investments, tweeted on Dec. 19 that the United States equities markets may remain “sideways” and choppy in 2023. He expects “one or more retests of the 2022 low, but not necessarily much worse than that.” Daily cryptocurrency market performance. Source: Coin360 The cryptocurrency market has been largely correlated with the S&P 500 in 2022. Unless both markets decouple, the sideways or negative action in the equities markets may not bode well for the cryptocurrency market. Analysts remain divided on t...

Price analysis 12/2: BTC, ETH, BNB, XRP, ADA, DOGE, MATIC, DOT, LTC, UNI

Non-farm payrolls in the United States rose by 263,000 in November, exceeding economists’ expectations of an increase of 200,000. Analysts believe that the numbers remain hot and do not allow much scope for the Federal Reserve to slow down its aggressive rate hikes. This is contrary to Fed Chair Jerome Powell’s remarks delivered at the Brookings Institution where he said that the central bank could reduce the pace of rate hikes “as soon as December.” That triggered a sharp rally in risk assets. After the latest jobs report, the market participants will closely watch the Fed’s comments and decision in its Dec. 13 and Dec.14 meeting. Daily cryptocurrency market performance. Source: Coin360 The Fed’s decision may also affect Bitcoin (BTC), which remains in a firm bear grip. Co...

Price analysis 11/25: BTC, ETH, BNB, XRP, ADA, DOGE, MATIC, DOT, LTC, UNI

FTX’s collapse dealt a major blow to the already fragile sentiment among cryptocurrency investors. Although a quick recovery is unlikely, Blockchain analysis firm Chainalysis said that the crypto universe could emerge stronger from this crisis. Chainalysis’ research lead Eric Jardine arrived at the conclusion after comparing FTX’s fall to that of Mt. Gox. Another calming statement came from Bloomberg Intelligence exchange-traded fund analyst James Seyffart, who said that there was a “99.9% chance” that the Grayscale Bitcoin Trust (GBTC) held the Bitcoin (BTC) it claimed. He added that GBTC was “unlikely” to be liquidated. Daily cryptocurrency market performance. Source: Coin360 The negative events of the past few days do not seem to have scared away the small investors who remain on an acc...

Price analysis 11/16: BTC, ETH, BNB, XRP, ADA, DOGE, MATIC, DOT, UNI, LTC

The collapse of FTX cryptocurrency exchange has created a liquidity crisis in the crypto space, which could extend the crypto winter through the end of 2023, according to a research report by Coinbase. According to analysts, the FTX implosion could keep the institutional investors at bay because they are even more likely to tread cautiously for some time. The crisis has negatively impacted several crypto-focused companies who have assets stuck on FTX following the company’s bankruptcy filing on Nov. 11. Investors also fear the contagion could spread, causing further damage to the cryptocurrency ecosystem. Daily cryptocurrency market performance. Source: Coin360 Although several investors were rattled by the collapse of FTX, billionaire venture capitalist and serial blockchain in...

Litecoin pre-halving fractal hints at 200% LTC price rally by July 2023

The price of Litecoin (LTC) could skyrocket by up to 200% by July 2023, coinciding with its halving event, reducing miner block rewards by 50%. Litecoin has bottomed out? Litecoin has undergone two halvings since its launch in October 2011. The first one occurred in August 2015, which reduced its block reward from 50 LTC to 25 LTC. The second happened in August 2019, which slashed the 25 LTC reward to 12.5 LTC. Interestingly, each Litecoin halving event occurred after a volatile LTC price cycle, namely an enormous price pump, followed by a similarly massive correction, a price bottom, and recovery to a local top. After the Litecoin halvings, LTCs’ price corrected from its local top, established another bottom, and followed it with another massive price rally to a new record...

Litecoin Foundation’s managing director shares his thoughts on decentralized money

Litecoin (LTC), known as “the silver to Bitcoin’s gold,” has been around for almost 11 years — which is quite a feat considering a fair amount of cryptocurrencies go bust within 12 months of launching. Cointelegraph spoke with the Litecoin Foundation’s managing director, Alan Austin, about why he thinks Litecoin’s core utility is serving as a reliable means of payment. As told by Austin, much of his vision for Litecoin is drawn from personal experience: “When I finished grad school, I worked with startup technology companies and real estate. And one of the things I did was managing accounts for firms like Bank of America and Fannie Mae, and it was surprising to see how old their technology was and how difficult it was to get stuff done.” After the 2008 financial crisis, Austin began losing...

- 1

- 2