Liquidity

Battle of the bots: WTF token launch drains 58 ETH

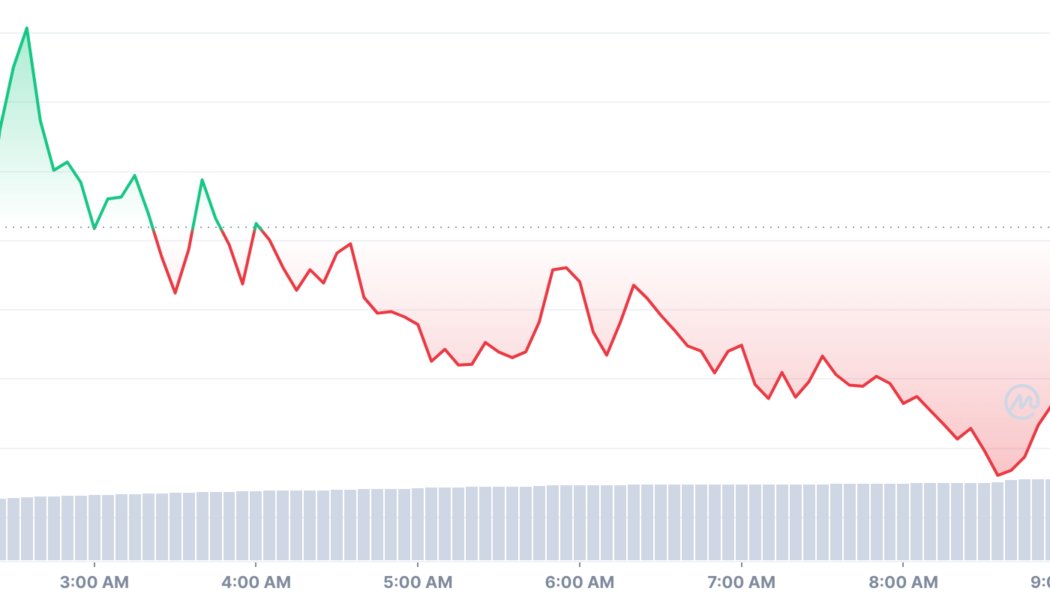

Fees.wtf is a simple service that shows Ether (ETH) users their lifetime spending amount on Ethereum blockchain transactions by measuring gas. You plug in your wallet address on its website, and it tells you how much gas you spent. The project released its WTF token in an airdrop Friday. Essentially, users were able to claim WTF tokens as well as a “Rekt” nonfungible token (NFT) for 0.01 ETH. The Rekt NFT grants lifetime access to the pro version of Fees.wtf. According to its Discord announcement, the initial launch planned to offer 100 million WTF, and the “circulating supply will be the main attraction in the tokenomics.” However, it didn’t quite go as planned. Following frantic trading behavior between bots in the opening hours of the airdrop, one bot ran off with a repo...

NNPC commits to ensuring energy sufficiency, wealth creation for Nigerians

The Nigerian National Petroleum Corporation (NNPC) has reiterated its commitment to ensuring effective stewardship of the nation’s hydrocarbon resources to guarantee energy security and drive wealth creation in Nigeria. The Group Managing Director of NNPC, Mallam Mele Kyari, made this assertion while delivering the keynote address at the 2021 Nigeria Oil and Gas Conference and Exhibition (NOG 2021) on Tuesday in Abuja. Speaking on the topic: “Vision and Priorities for Nigeria’s Energy Transformation,” Mallam Kyari stated that for a nation with a teeming youth and a developing economy, Nigeria needed the right policies to unlock its huge economic potential, stressing that NNPC was working towards bridging the energy gap to multiply wealth for its varied stakeholders. “We see a nation that m...

Nigerian government borrows over N2 trillion from bond investors in 2020

Leveraging on excess liquidity that persisted in the banking system and the near zero yields on treasury bills (TBs), the Federal Government, through the Debt Management Office (DMO), raised N2.1 trillion from investors in its monthly bond issuance programme in 2020. This represents 33 percent, year-on-year, (y/y) increase when compared with the N1.58 trillion raised by the DMO in 2019. The N2.1 trillion raised in 2020 also represents 31 percent more than the N1.6 trillion funding target for the DMO under the Revised 2020 Budget. Meanwhile, the monthly bond auctions conducted by the DMO in 2020 recorded 275 percent oversubscription, reflecting scramble for the high yielding FGN bonds by investors. Newsmen report on monthly bond auction results show that the DMO offered N1.825 trillion wort...