Liquidity

Crypto lender Hodlnaut seeks judicial management to avoid forced liquidation

Singapore-based crypto lending platform Hodlnaut is seeking judicial management to manage its ongoing liquidity crisis and avoid the forced liquidation of assets in the current bear market. The crypto lender informed its users in a Tuesday announcement that they have applied to the Singapore High Court to be placed under judicial management. The firm said: “We are aiming to avoid a forced liquidation of our assets as it is a suboptimal solution that will require us to sell our users’ cryptocurrencies such as BTC, ETH and WBTC at these current depressed asset prices. Instead, we believe that undergoing judicial management would provide the best chance of recovery.” Judicial management is a law in Singapore that allows financially troubled firms to rehabilitate themselves. Und...

Stablecoin projects need collaboration, not competition: Frax founder

Stablecoin projects need to take a more collaborative approach to grow each other’s liquidity and the ecosystem as a whole, says Sam Kazemian, the founder of Frax Finance. Speaking to Cointelegraph, Kazemian explained that as long as stablecoin “liquidity is growing proportionally with each other” through shared liquidity pools and collateral schemes, there won’t ever be true competition between stablecoins. Kazemian’s FRAX stablecoin is a fractional-algorithmic stablecoin with parts of its supply backed by collateral and other parts backed algorithmically. Kazemian explained that growth in the stablecoin ecosystem is not a “zero-sum game” as each token is increasingly intertwined and reliant on each other’s performance. FRAX uses Circle’s USD Coin (USDC) as a porti...

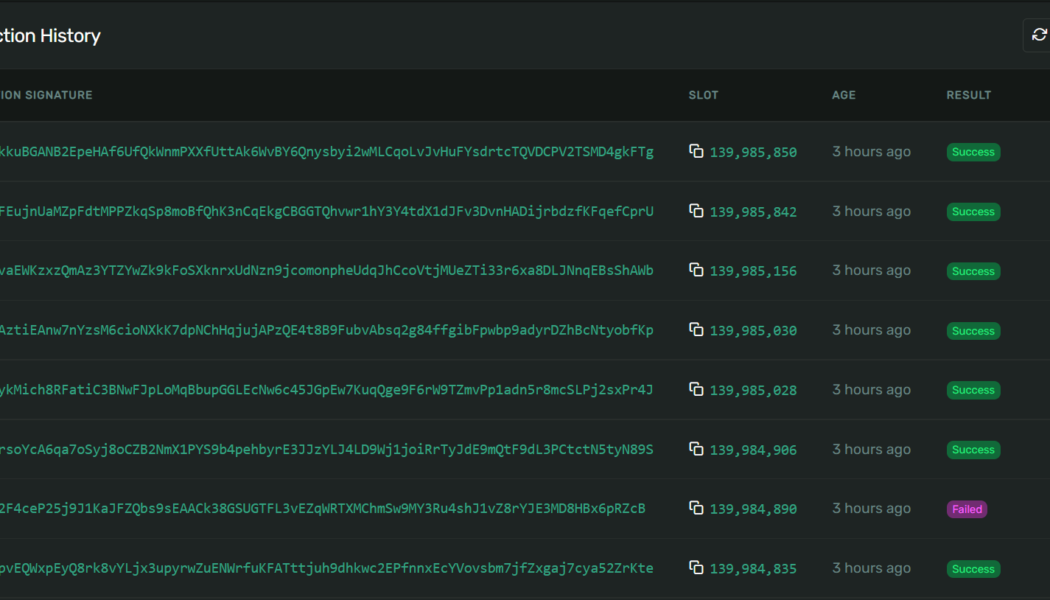

Crema Finance shuts liquidity protocol on Solana amid hack investigation

Crema Finance, a concentrated liquidity protocol over the Solana blockchain, announced the temporary suspension of its services owing to a successful exploit that has drained a substantial but undisclosed amount of funds. Soon after realizing the hack on its protocol, Crema Finance suspended the liquidity services to refrain the hacker from draining out its liquidity reserves — which include the funds of the service provider and investors. Attention! Our protocol seems to have just experienced a hacking. We temporarily suspended the program and are investigating it. Updates will be shared here ASAP. — CremaFinance (@Crema_Finance) July 3, 2022 Speaking to Cointelegraph about the matter, Henry Du, the co-founder of Crema Finance confirmed the commencement of the investigation. He state...

Crypto conspiracy theories abound, but prop traders are just doing their job

Alameda Research is a cryptocurrency trading firm and liquidity provider founded by crypto billionaire Sam Bankman-Fried (SBF). Before founding his firm in 2017, SBF spent three years as a trader at the quantitative proprietary trading giant Jane Street Capital, which specializes in equity and bonds. In 2019, SBF founded the crypto derivatives and exchange FTX, which has quickly grown to become the fifth-largest by open interest. The Bahamas-based exchange raised $400 million in January 2022 and was valued at $32 billion. FTX’s global derivatives exchange business is separate from FTX US, another entity controlled by SBF, which raised another $400 million from investors including the Ontario Teachers Pension and SoftBank. The self-made billionaire has big dreams, like purchasing ...

Voyager Digital cuts withdrawal amount as 3AC contagion ripples through DeFi and CeFi

The Singapore-based crypto venture firm Three Arrows Capital (3AC) failed to meet its financial obligations on June 15 and this caused severe impairments among centralized lending providers like Babel Finance and staking providers like Celsius. On June 22, Voyager Digital, a New York-based digital assets lending and yield company listed on the Toronto Stock exchange, saw its shares drop nearly 60% after revealing a $655 million exposure to Three Arrows Capital. Voyager offers crypto trading and staking and had about $5.8 billion of assets on its platform in March, according to Bloomberg. Voyager’s website mentions that the firm offers a Mastercard debit card with cashback and allegedly pays up to 12% annualized rewards on crypto deposits with no lockups. More recently, on June 2...

Do Kwon dismisses allegation of cashing out $2.7B from Terra (LUNA), UST

Do Kwon, the CEO and co-founder of the infamous Terra (LUNA) and TerraUSD (UST) ecosystems, refuted the claims of cashing out $80 million every month for nearly three years. Numerous unconfirmed reports surfaced on June 11, claiming Kwon’s participation in draining liquidity out of LUNA and UST before the crash to purchase US dollar-pegged stablecoin such as Tether (USDT). Rumors about Kwon cashing out LUNA and UST reserves surfaced after a Twitter thread by @FatManTerra shared the alleged details on how Kwon, along with Terra influencers, managed to drain funds while artificially maintaining the liquidity. Some of you thought $80m per month was bad. That’s nothing. Here’s how Do Kwon cashed out $2.7 billion (33 x $80m!) over the span of mere months thanks to Degenbox: th...

Anchor Protocol rebounds sharply after falling 70% in just two months — what’s next for ANC?

Anchor Protocol (ANC) returned to its bullish form this May after plunging by over 70% in the previous two months. Pullback risks ahead ANC’s price rebounded by a little over 42.50% between May 1 and May 6, reaching $2.26, its highest level in three weeks. Nonetheless, the token experienced a selloff on May 6 and May 7 after ramming into what appears to be a resistance confluence. That consists of a 50-day exponential moving average (50-day EMA; the red wave) and 0.786 Fib line of the Fibonacci retracement graph, drawn from the $1.32-swing low to the $5.82-swing high, as shown in the chart below. ANC/USD daily price chart. Source: TradingView A continued pullback move could see ANC’s price plunging towards its rising trendline support, coinciding with the floor near&...

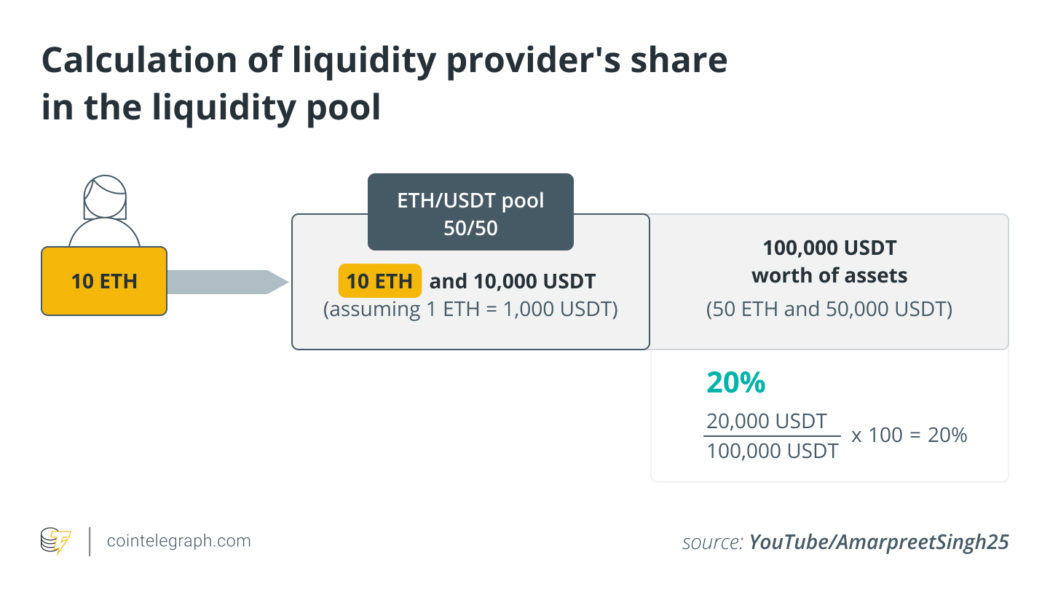

What is impermanent loss and how to avoid it?

The difference between the LP tokens’ value and the underlying tokens’ theoretical value if they hadn’t been paired leads to IL. Let’s look at a hypothetical situation to see how impermanent/temporary loss occurs. Suppose a liquidity provider with 10 ETH wants to offer liquidity to a 50/50 ETH/USDT pool. They’ll need to deposit 10 ETH and 10,000 USDT in this scenario (assuming 1ETH = 1,000 USDT). If the pool they commit to has a total asset value of 100,000 USDT (50 ETH and 50,000 USDT), their share will be equivalent to 20% using this simple equation = (20,000 USDT/ 100,000 USDT)*100 = 20% The percentage of a liquidity provider’s participation in a pool is also substantial because when a liquidity provider commits or deposits their assets to a pool via ...

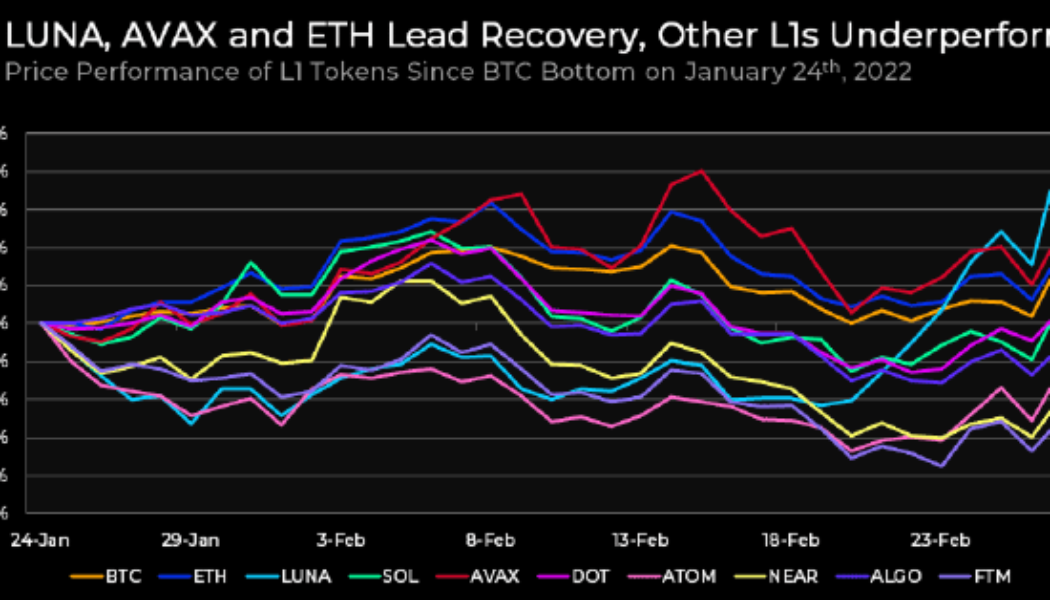

Terra, Avalanche and Osmosis lead the L1 recovery while Bitcoin searches for support

The layer-one (L1) ecosystem has received increased attention in recent months as users search for new investment opportunities in the Cosmos (ATOM), Fantom (FTM) and NEAR. Following January’s market sell-off, where Bitcoin (BTC) price dropped to bottom below $34,000, much of the L1 field has struggled to regain its momentum. Price performance of L1 tokens since Jan. 24. Source: Delphi Digital According to data from Delphi Digital, since the BTC bottom on Jan. 24, the only L1 to experience a notable gain in price include Terra (LUNA), Avalanche (AVAX) and Ethereum (ETH). Terra ecosystem growth The price growth seen in LUNA was in large part due to the announcement from the Luna Foundation Guard that it had raised $1 billion to form a Bitcoin reserve for the ecosystem’s Terra US...

Altcoin Roundup: JunoSwap, Solidly and VVS Finance give DeFi a much-needed refresh

Decentralized finance (DeFi) was the talk of the town in early 2021, but it has since taken a back seat to more appealing sectors like nonfungible tokens (NFTs), memecoins and blockchain gaming. Now that cross-chain bridges and interoperability have allowed for the easier migration of assets to competing chains, a new class of DeFi protocols is arising to challenge those left from 2021. Here’s a look at three DeFi projects that have launched on some of the up-and-coming layer-1 blockchain networks, catching the eye of the crypto community. VVS Finance VVS Finance is the largest DeFi protocol on the Cronos network, a project that emerged out of the Crypto.com ecosystem which has since been fully rebranded to Cronos (CRO). The goal of VVS Finance is to offer instant swaps with low fees...

3 reasons why Lido DAO Token could be on the verge of breaking its downtrend

Ethereum (ETH) and decentralized finance (DeFi) are undergoing a seismic shift as the transition to Eth2 and a proof-of-stake consensus mechanism is helping to increase the value proposition for the network which has historically has been plagued with scaling issues and high transaction costs. Alongside this transition has been the introduction of liquid staking, which is helping to add utility to DeFi and giving investors the option to do more with their assets than just lock them up indefinitely. Liquid staking could also help investors build more capital efficient portfolios. One protocol that has benefited from the shift toward liquid staking is Lido (LDO), a platform that allows investors to earn staking rewards on their tokens while also enabling them to put the resulting...