Liquidity Pool

‘Everything is fine’ — Gala Games calls for calm after fears of multi-billion dollar hack

Blockchain gaming company Gala Games urged its community for calm after misplaced fears of a multi-billion dollar rug pull or hack caused the GALA token to temporarily crash 25.6%. The initial panic, which Gala Games later implied was unfounded, came after a single wallet address appeared to mint over $2 billion GALA tokens out of thin air — which was flagged by blockchain security firm PeckShield on Nov. 3. Fears that the unusual activity was a sign of an exploit or rug pull caused the GALA token price to drop a dramatic 25.6% from $0.0394 to $0.0293 over a 130-minute stretch late on Nov. 3, according to data from CoinGecko. However, Gala Games took to Twitter on Nov. 4 to dispel the “FUD” surrounding its native token, explaining that “lots of people are tossing around words like ‘h...

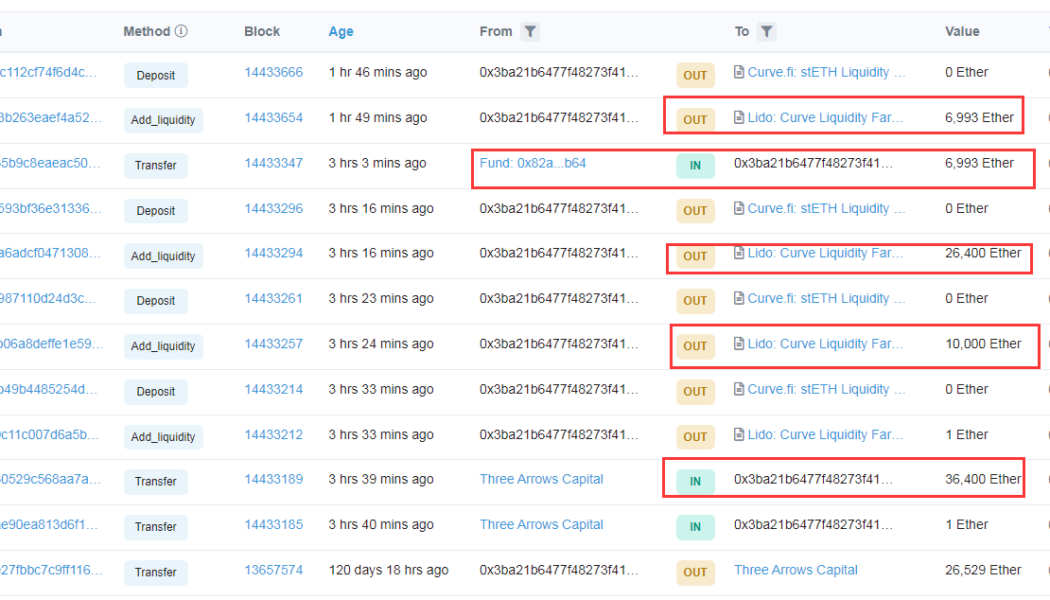

ETH price hits $3K as major crypto fund adds over $110M Ethereum to Lido’s staking pool

Ethereum’s native token Ether (ETH) rose above $3,000 on March 22 as fresh data suggests Three Arrows Capital staked at least $110 million worth of ETH into Lido’s liquidity pools. The Singapore-based hedge fund manager provided liquidity worth 36,401 ETH to Lido’s “Curve stETH pool” using a third-party Ether wallet, data from Etherscan shows. As a result, it became eligible to receive at least 36,401 stacked Ether (stETH) tokens from Lido: to ensure low slippage when un-staking those tokens for real ETH plus staking reward. Third-party Ethereum wallet that received ETH from Three Arrow Capital. Source: Etherscan.io Almost an hour later, another Ether address, marked with the word “fund,” sent 6,993 ETH (worth $21.12 million) to the ...