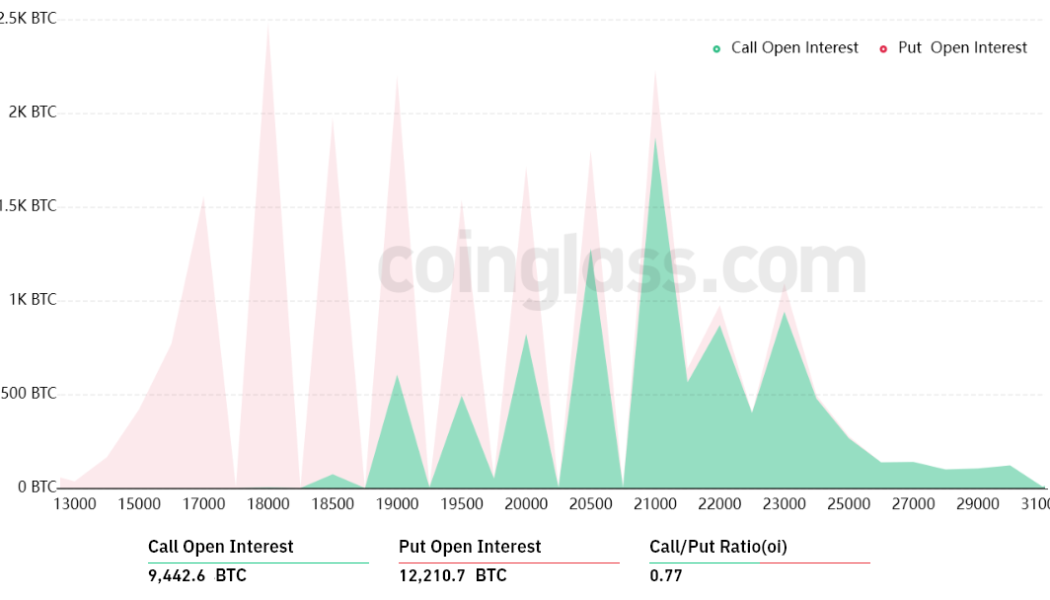

liquidations

Bitcoin margin long-to-short ratio at Bitfinex reach the highest level ever

Sept. 12 will leave a mark that will probably stick for quite a while. Traders at Bitfinex exchange vastly reduced their leveraged bearish Bitcoin (BTC) bets and the absence of demand for shorts could have been caused by the expectation of cool inflation data. Bears may have lacked confidence, but August’s U.S. Consumer Price Index (CPI) came in higher than market expectations and they appear to be on the right side. The inflation index, which tracks a broad basket of goods and services, increased 8.3% over the previous year. More importantly, the energy prices component fell 5% in the same period but it was more than offset by increases in food and shelter costs. Soon after the worse-than-expected macroeconomic data was released, U.S. equity indices took a downturn, with the tech-he...

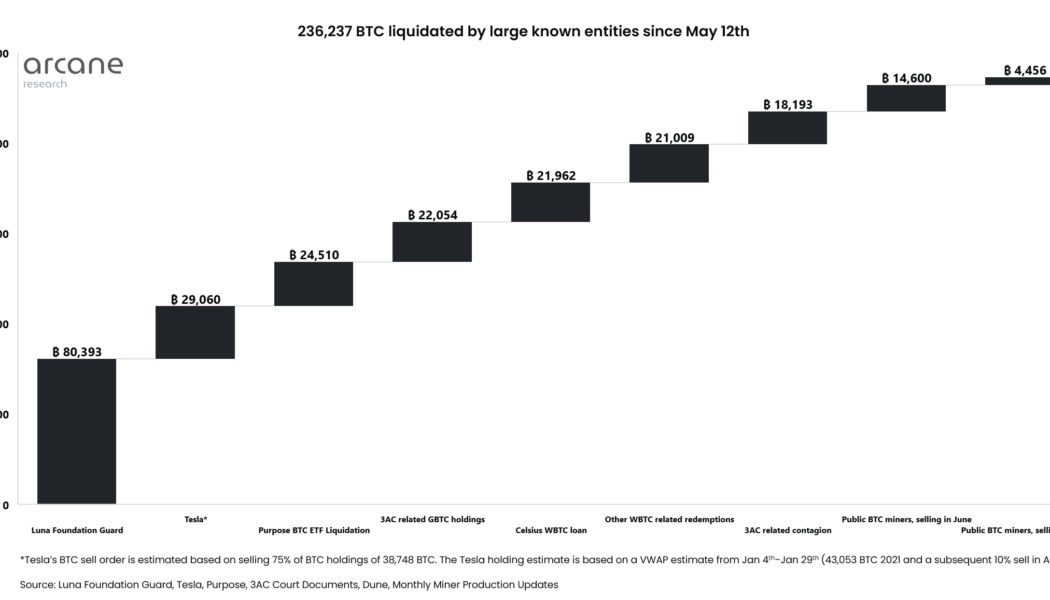

Large institutions sold $5.5B in BTC since May — and we’re still here

Since May 10, as much as 236,237 Bitcoin (worth $5.452 billion) has been sold by “large institutions” — mostly as a result of forced selling. A Twitter thread from Arcane Research analyst Vetle Lunde details how and when many institutional Bitcoin holders began selling their stacks. Lunde stated that “it all started with Do Kwon.” The Luna Foundation Guard (LFG), which controlled funds for the Terra project, dumped 80,081 BTC in a failed effort to protect the peg of its native Terra USD (UST) stablecoin in May. Terra’s collapse appears to have made some Bitcoin (BTC) miners face sell pressure. Lunde estimates that miners sold 19,056 coins between May and June. In some cases, miners were selling more than their monthly production, likely drawing from reserves. The Luna Foundation Guar...