Liquidation

Alameda wallet under liquidator control incurred $11.5M in losses: Arkham

The liquidators of Alameda Research have reportedly incurred at least $11.5 million in losses since taking control of Alameda’s trading accounts. On Jan. 16, a Twitter thread from Arkham Intelligence reported that one wallet under the control of liquidators has seen a string of “significant losses” due to liquidations, some of which were “preventable losses.” Over the past two weeks being under Liquidator control, the account incurred significant losses: Largest single liquidation: $4.85MTotal liquidated amount: $11.5MPreventable losses: $4M+ — Arkham (@ArkhamIntel) January 16, 2023 As one example, Arkham noted that the account ending 0x997 initially had a short position of 9,000 Ether (ETH) ($10.8 million) against the collateral of $20 million in USD Coin (US...

Binance to liquidate its entire FTX Token holdings after ‘recent revelations’

The CEO of cryptocurrency exchange Binance, Changpeng “CZ” Zhao, said his company will liquidate the entirety of its position in FTX Token (FTT), the native token of competing exchange FTX. In a Nov. 6 tweet, Zhao said the decision was made after “recent revelations that have came to light.” In a later tweet, CZ explained the FTT liquidation was “just post-exit risk management” referring to lessons learned from the fall of Terra Luna Classic (LUNC) and how it impacted market players. He also added “we won’t support people who lobby against other industry players behind their backs.” Liquidating our FTT is just post-exit risk management, learning from LUNA. We gave support before, but we won’t pretend to make love after divorce. We are not against anyone. But we won’t supp...

Three Arrows Capital fund moves over 300 NFTs to a new address

Starry Night Capital, a nonfungible-token (NFT)-focused fund launched by the co-founders of the now-bankrupt hedge fund Three Arrows Capital (3AC), has moved over 300 NFTs out of its address, according to reports. The Starry Night Capital was founded last year by Su Zhu and Kyle Davies, and pseudonymous NFT collector Vincent Van Dough. At the time, the fund planned to exclusively invest in “the most desired” NFTs on the market. Blockchain data provider Nansen on Oct. 4 on Twitter noted that the NFTs were reportedly shifted from a wallet associated with the fund, including “Pepe the Frog NFT Genesis,” which sold for 1,000 Ether (ETH) in October last year, worth $3.5 million at the time. Nansen said the NFTs previously collected by Starry Night Capital are...

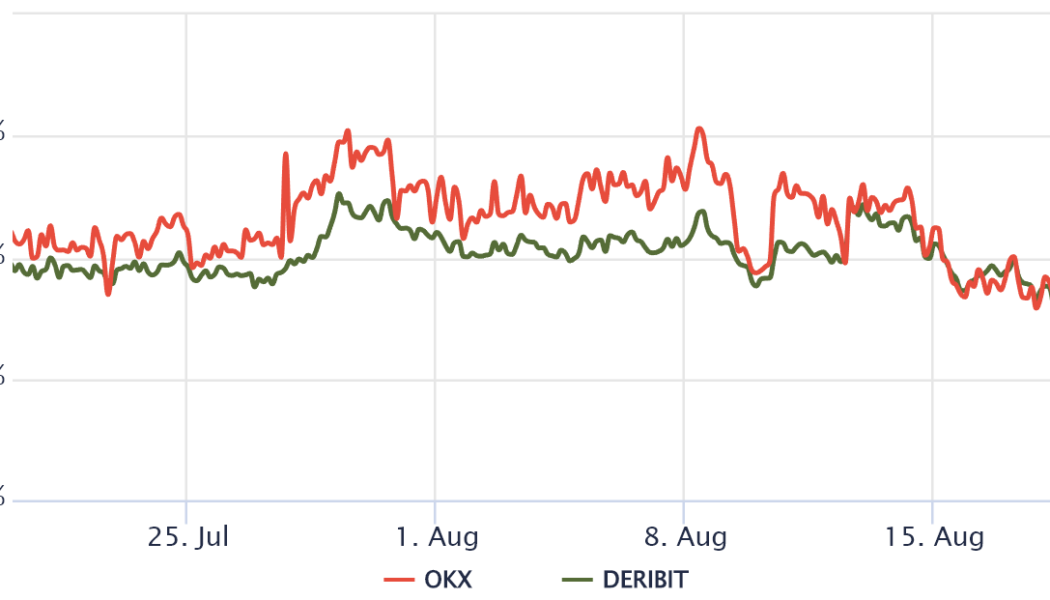

3 reasons why Bitcoin’s drop to $21K and the market-wide sell-off could be worse than you think

On Friday, August 19, the total crypto market capitalization dropped by 9.1%, but more importantly, the all-important $1 trillion psychological support was tapped. The market’s latest venture below this just three weeks ago, meaning investors were pretty confident that the $780 billion total market-cap low on June 18 was a mere distant memory. Regulatory uncertainty increased on Aug. 17 after the United States House Committee on Energy and Commerce announced that they were “deeply concerned” that proof-of-work mining could increase demand for fossil fuels. As a result, U.S. lawmakers requested the crypto mining companies to provide information on energy consumption and average costs. Typically, sell-offs have a greater impact on cryptocurrencies outside of the top 5 asset...

BTC price crashes to $20.8K as ‘deadly’ candles liquidate $1.2 billion

Bitcoin (BTC) came within $1,000 of its previous cycle all-time highs on June 14 as liquidations mounted across crypto markets. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Bitcoin price hits 18-month lows Data from Cointelegraph Markets Pro and TradingView showed BTC/USD hitting $20,816, on Bitstamp, its lowest since the week of December 14, 2020. A sell-off that began before the weekend intensified after the June 13 Wall Street opening bell, with Bitcoin and altcoins falling in step with United States equities. The S&P 500 finished the day down 3.9%, while the Nasdaq Composite Index shed 4.7% ahead of key comments from the U.S. Federal Reserve on its anti-inflation policy. The worst of the rout was reserved for crypto, however, and with that, BTC/USD lost 22...

BTC price crashes to $20.8K as ‘deadly’ candles liquidate $1.2 billion

Bitcoin (BTC) came within $1,000 of its previous cycle all-time highs on June 14 as liquidations mounted across crypto markets. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Bitcoin price hits 18-month lows Data from Cointelegraph Markets Pro and TradingView showed BTC/USD hitting $20,816, on Bitstamp, its lowest since the week of December 14, 2020. A sell-off that began before the weekend intensified after the June 13 Wall Street opening bell, with Bitcoin and altcoins falling in step with United States equities. The S&P 500 finished the day down 3.9%, while the Nasdaq Composite Index shed 4.7% ahead of key comments from the U.S. Federal Reserve on its anti-inflation policy. The worst of the rout was reserved for crypto, however, and with that, BTC/USD lost 22...

- 1

- 2