Lido DAO

Ethereum risks another 10% drop versus Bitcoin as $15.4M exits ETH investment funds

Ethereum’s Merge on Sep. 15 turned out to be a sell-the-news event, which looks set to continue. Notably, Ether (ETH) dropped considerably against the U.S. dollar and Bitcoin (BTC) after the Merge. As of Sep. 22, ETH/USD and ETH/BTC trading pairs were down by more than 20% and 17%, respectively, since Ethereum’s switch to Proof-of-Stake (PoS. ETH/USD and ETH/BTC daily price chart. Source: TradingView What’s eating Ether bulls? Multiple catalysts contributed to Ether’s declines in the said period. First, ETH’s price fall against the dollar appeared in sync with similar declines elsewhere in the crypto market, driven by Federal Reserve’s 75 basis points (bps) rate hike. Second, Ethereum faced a lot of flak for becoming too centralized ...

Selling the rumor? Biggest Ethereum Merge staker Lido DAO loses 40% in 30 days

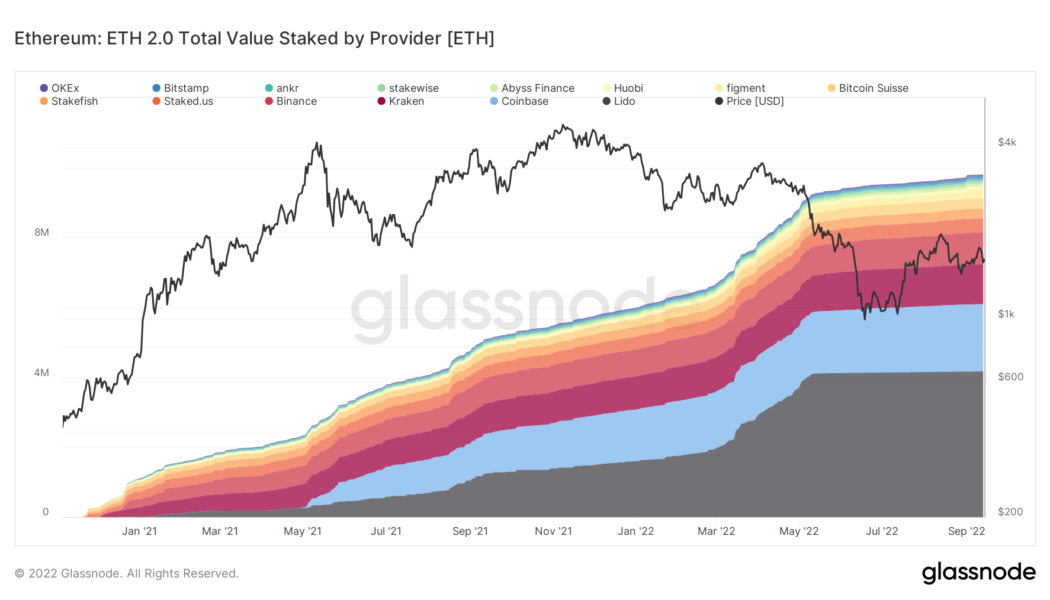

Lido DAO (LDO) has declined by more than 40% in the last 30 days with more room to fall in the coming days amid a potential sell-the-news event, such as the Merge. Lido DAO Ether deposits surge 160% in 2022 Lido DAO is Ethereum’s biggest staking service, having deposited over 4.14 million of the blockchain’s native asset, Ether (ETH), into the Ethereum 2.0 smart contract on behalf of its users, according to the latest data. ETH 2.0 total value staked by provider. Source: Glassnode In comparison, Lido DAO’s total staked amount was around 1.6 million ETH at the beginning of this year. The boom reflects a growing demand for Lido DAO services ahead of Ethereum’s scheduled transition from proof-of-work (PoW) to proof-of-stake (PoS) via the Merge on Sep. 15. LDO, a governance...

Uniswap’s 80% gains in July are in danger with UNI price painting a classic bearish pattern

Uniswap (UNI) looks ready to post its best monthly performance in more than a year as it rallied approximately 80% in July, but signs of an extended pullback in the near term are emerging. Uniswap price nearly doubles in July UNI’s price is having one of its best months ever, reaching nearly $9 on July 30 versus nearly $5 at the beginning of the month, best returns since January 2021’s 250% price rally. UNI/USD monthly price chart. Source: TradingView Merge FOMO an UNI “fee switch” proposal Uniswap’s gains primarily surfaced due to similar upside moves in a broader crypto market. But they turned out to be relatively massive due to an ongoing euphoria surrounding “the Merge.” Notably, the Ethereum blockchain’s potential transition ...

Lido DAO most ‘overbought’ since April as LDO price rallies 150% in two weeks — what’s next?

The price of Lido DAO (LDO) dropped heavily a day after its key momentum oscillator crossed into “overbought” territory. LDO undergoes overbought correction LDO’s price plunged to as low as $1.04 on July 16 from $1.32 on July 15, amounting to a 20%-plus decline. The token’s sharp downside move took its cues from multiple bearish technical indicators, including its daily relative strength index (RSI) and its 100-day exponential moving average (EMA). LDO’s latest plunge came after it rallied over 150% in just two weeks, a move that simultaneously pushed its daily RSI above 70 on July 15, thus turning it overbought. An overbought RSI signals that the rally may be nearing an end while readying for a short-term pullback. Meanwhile, more downside cues for the ...

DAO treasuries surged 40X in 2021: DeepDAO

The total combined value of treasuries, or assets under management (AUM) for the use of decentralized autonomous organizations, increased by around 40 times between January and September of 2021. According to data from DAO stats platform DeepDAO, the total AUM for DAO treasuries listed on the platform increased from around $380 million in January to a peak of roughly $16 billion in mid-September. Looking ahead at 2022: ✍️How far and how deep will DAOs go into the mainstream, and into which use cases? ✍️(When) will DAO treasuries exceed $100B? Lots of interesting questions, but together we can BUIDL this! pic.twitter.com/JDEC9JBuHC — DeepDAO.io (@DeepDAO_io) December 30, 2021 As of mid-December, the total AUM has decreased by 28.1% since the high water mark to si...