Lending

Tens of Celsius clients ask US court to recover $22.5M in crypto

The bankrupt cryptocurrency lender Celsius is facing more legal issues as disgruntled clients are taking action to recover their funds after the platform froze withdrawals in June. An ad hoc group of 64 custodial account holders at Celsius on Wednesday filed a complaint with the U.S. Bankruptcy Court for the Southern District of New York in order to recover their assets. According to court documents, the creditors are seeking to recover a total of more than $22.5 million worth of cryptocurrency assets collectively held in Celsius’ custody service. The ad hoc group is represented by bankruptcy-focused law firm Togut, Segal & Segal. The plaintiffs noted that Celsius has “not honored any withdrawals from any programs,” including custody services. According to the complaint, that contradic...

Amid crypto winter, Nexo commits additional $50M to buyback program

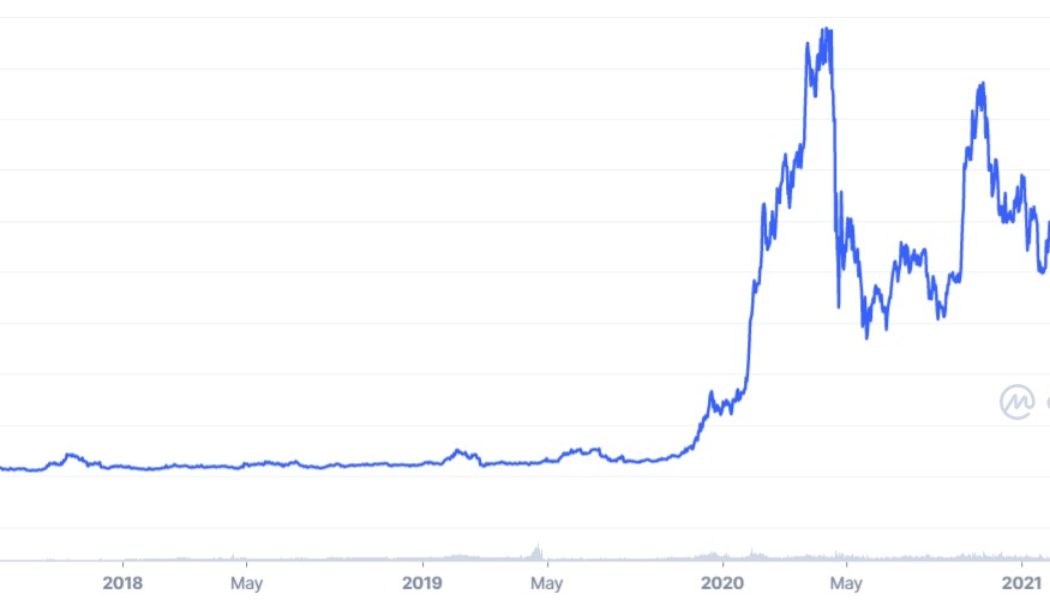

Crypto lending platform Nexo has increased the size of its buyback program, giving the company more discretionary ability to repurchase its native token to boost interest payments or make strategic investments in the future. On Tuesday, Nexo disclosed that its board of directors had committed an additional $50 million to buybacks, building off the company’s initial $100 million repurchase program launched in November 2021. The approval green lights the discretionary repurchase of up to $50 million worth of NEXO tokens on the open market. NEXO is the platform’s native cryptocurrency, giving users the ability to earn interest and lock in lower rates for borrowing. The token currently has a market capitalization of $563.6 million and 24-hour trading volumes of $46.7 million, according to Nexo...

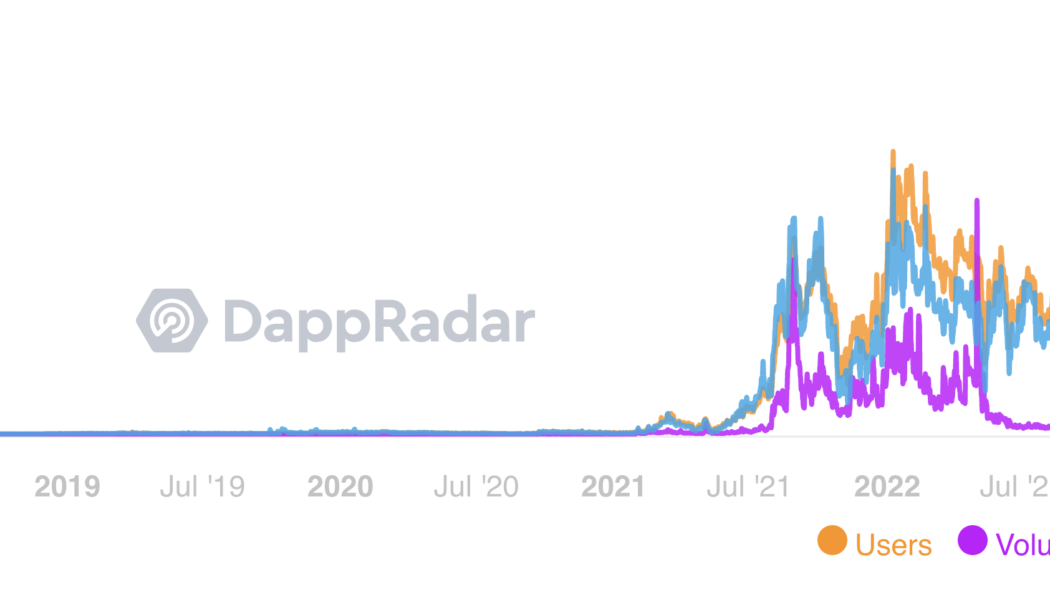

Looks bare: OpenSea turns into NFT ghost-town after volume plunges 99% in 90 days

OpenSea, the world’s largest nonfungible token (NFT) marketplace, has witnessed a substantial drop in daily volumes as fears about a potential market bubble grow. OpenSea volume plummets to yearly lows Notably, the marketplace processed nearly $5 million worth of NFT transactions on Aug. 28 — approximately 99% lower than its record high of $405.75 million on May 1, according to DappRadar. OpenSea users, volume, and transactions statistics. Source: DappRadar The massive declines in daily volumes coincided with equally drastic drops in OpenSea users and their transactions, suggesting that the value and interest in the blockchain-based collectibles have diminished in the recent months. That is further visible in the falling floor prices — the minimum amount one is ready to pay for an NF...

Hacker tries to exploit bridge protocol, fails miserably: Finance Redefined

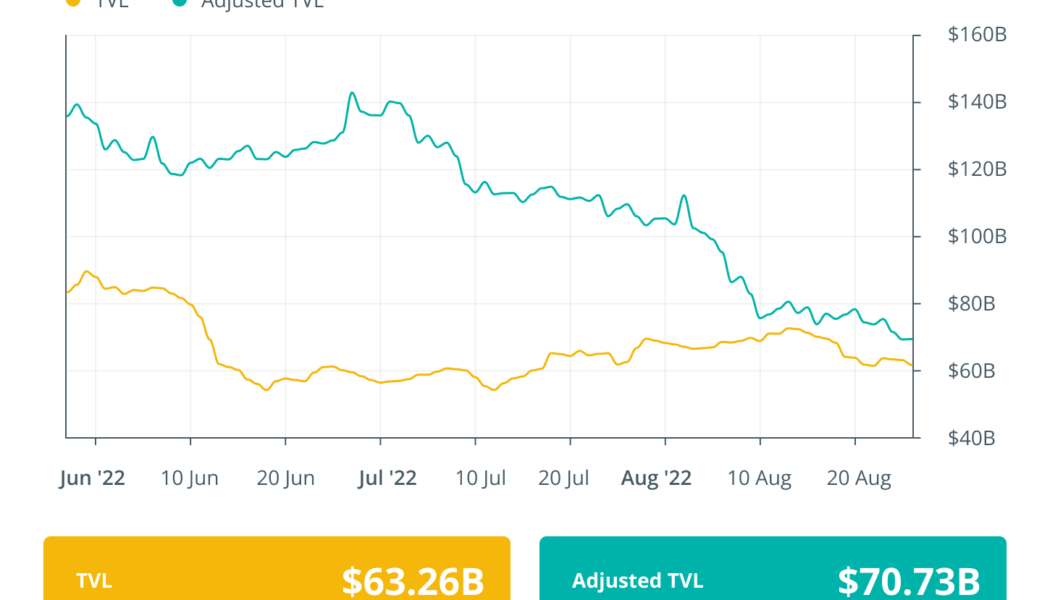

Welcome to Finance Redefined, your weekly dose of essential decentralized finance (DeFi) insights — a newsletter crafted to bring you significant developments over the last week. This past week, there were some major developments in the run-up to the upcoming Ethereum Merge slated for Sept. 15. Bitfinex became the latest crypto exchange to throw its support behind the chain split token. While DeFi bridge hacks have become a norm this year, developers behind Rainbow Bridge managed to foil an exploit attempt within seconds, leading to the hacker losing their safety deposit. The Tornado Cash developer who was arrested last week was sent to 90-day judicial custody awaiting charges. It didn’t go down well with the crypto community, who have actively rallied behind the developer and have accused...

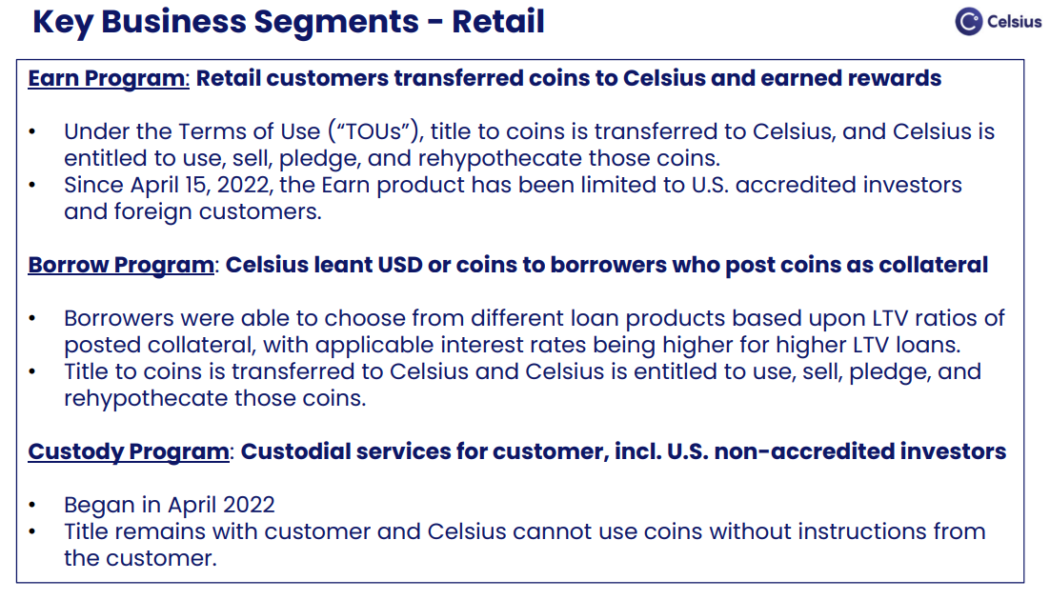

Celsius bankruptcy proceedings show complexities amid declining hope of recovery

The Celsius Network is one of many crypto lending firms that has been swept up in the wake of the so-called “crypto contagion.” Rumors of Celsius’ insolvency began circulating in June after the crypto lender was forced to halt withdrawals due to “extreme market conditions” on June 13 and eventually filed for chapter 11 bankruptcy a month later on July 13. The crypto lending firm showed a balance gap of $1.2 billion in its bankruptcy filing, with most liabilities owed to its users. User deposits made up the majority of liabilities at $4.72 billion, while Celsius’ assets include CEL tokens as assets valued at $600 million, mining assets worth $720 million and $1.75 billion in crypto assets. The value of the CEL tokens has drawn suspicion from some in the crypto community, however, as t...

Celsius calls out Prime Trust in court, alleging firm didn’t turn over $17M in crypto

Crypto lending platform Celsius Network has filed a lawsuit claiming that custodian Prime Trust failed to turn over roughly $17 million worth of cryptocurrency. In a Tuesday filing with the U.S. Bankruptcy Court in the Southern District of New York, Celsius’ legal team brought a complaint against Prime Trust, alleging the company did not return $17 million worth of crypto assets in June 2021 when it terminated its relationship with the lending firm. According to Celsius, Prime Trust acted as crypto custodian for New York- and Washington-based users from 2020 through mid-2021, returning $119 million in crypto following the end of the business arrangement but holding back some funds: 398 Bitcoin (BTC), 3,740 Ether (ETH), 2,261,448 USD Coin (USDC) and 196,268 Celsius (CEL). “Upon the commence...

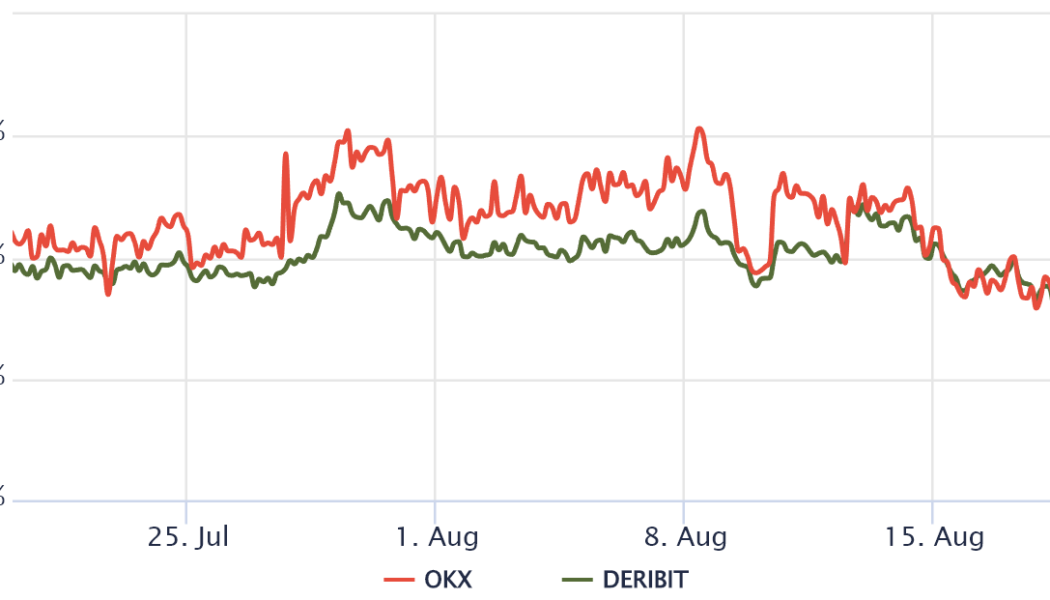

3 reasons why Bitcoin’s drop to $21K and the market-wide sell-off could be worse than you think

On Friday, August 19, the total crypto market capitalization dropped by 9.1%, but more importantly, the all-important $1 trillion psychological support was tapped. The market’s latest venture below this just three weeks ago, meaning investors were pretty confident that the $780 billion total market-cap low on June 18 was a mere distant memory. Regulatory uncertainty increased on Aug. 17 after the United States House Committee on Energy and Commerce announced that they were “deeply concerned” that proof-of-work mining could increase demand for fossil fuels. As a result, U.S. lawmakers requested the crypto mining companies to provide information on energy consumption and average costs. Typically, sell-offs have a greater impact on cryptocurrencies outside of the top 5 asset...

Celsius Network coin report shows a balance gap of $2.85 billion: Finance Redefined

Welcome to Finance Redefined, your weekly dose of essential decentralized finance (DeFi) insights — a newsletter crafted to bring you significant developments over the last week. This past week, Celsius’s financial troubles mounted further as a new coin report showed the company had a balance gap of $2.85 billion, more than double what it had shown in the bankruptcy filing. Aave (AAVE) called upon community members to commit to the Ethereum proof-of-stake (PoS) Merge. Coinbase CEO said the exchange would rather wind down its staking services than implement on-chain censorship in the form of regulatory compliance. The crypto market saw another depeg this week, with the Acala ecosystem seeing its native stablecoin lose the peg. With a sudden price drop toward the end of the week, the majorit...

Crypto lender Hodlnaut seeks judicial management to avoid forced liquidation

Singapore-based crypto lending platform Hodlnaut is seeking judicial management to manage its ongoing liquidity crisis and avoid the forced liquidation of assets in the current bear market. The crypto lender informed its users in a Tuesday announcement that they have applied to the Singapore High Court to be placed under judicial management. The firm said: “We are aiming to avoid a forced liquidation of our assets as it is a suboptimal solution that will require us to sell our users’ cryptocurrencies such as BTC, ETH and WBTC at these current depressed asset prices. Instead, we believe that undergoing judicial management would provide the best chance of recovery.” Judicial management is a law in Singapore that allows financially troubled firms to rehabilitate themselves. Und...

Mark Cuban faces class action lawsuit for promoting Voyager crypto products

Mark Cuban, the billionaire entrepreneur who has been quite active in the crypto ecosystem for the past year, is facing a class-action lawsuit over his promotions of the bankrupt crypto brokerage firm Voyager Digital. The Moskowitz Law Firm filed a civil suit in the United States District Court in Southern Florida against Cuban for promoting Voyager’s unregulated crypto products. The lawsuit demanded a jury hearing for the case. The lawsuit alleged Cuban also misrepresented the firm on numerous occasions, making dubious claims of it being cheaper than competitors and offering “commission-free” trading services. Cuban, along with Voyager Digital CEO Stephen Ehrlich, leveraged their years of experience to lure inexperienced customers into investing their life savings in what they called...

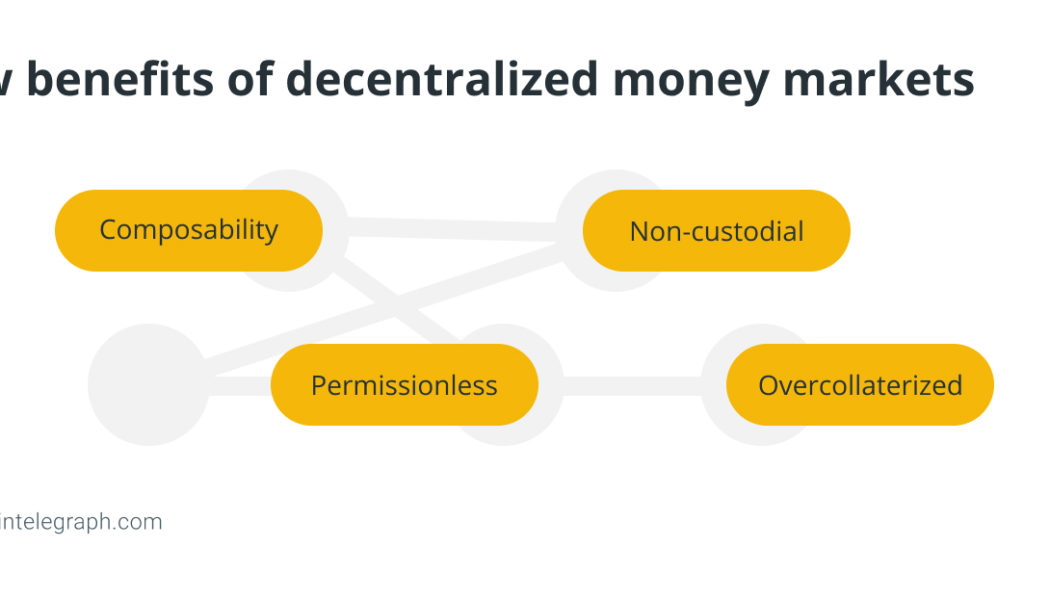

What is a decentralized money market and how does it work?

The seamless flow of capital between borrowers and lenders is a key aspect of a vibrant economy. Anyone with an extra asset can lend it to put their idle capital to work, while people needing it to grow business or meet operational costs can easily access it. Money markets are the platforms where borrowers and lenders can meet. Throughout history, money markets have been generators of economic activities. Though the structure of money markets has altered with time, their role has remained unchanged. How does the money market work? Conventionally, money markets were centralized structures facilitating the deals between lenders and borrowers. Borrowers would approach money markets to get a short-term loan (under a year) that might be collateralized. If the borrowers can’t pay back their loan...

Voyager plans to resume cash withdrawals on Aug. 11

Crypto lender Voyager Digital Holdings has reported users may be able to make cash withdrawals from the app more than a month after suspending trading, deposits, withdrawals and loyalty rewards. In a Friday blog post, Voyager said clients with U.S. dollars in their accounts could withdraw up to $100,000 in a 24-hour period starting as early as Aug. 11, with the funds received in 5–10 business days. The announcement followed a judge ruling on Thursday the crypto lending firm was cleared to return $270 million in customer funds held at the Metropolitan Commercial Bank in New York. “Requests will be processed as quickly as possible but will require some manual review, including fraud reviews and account reconciliation, and timing will depend, in part, upon the individual banks to which custom...