layer2

Polygon Studios’ Ryan Watt talks Web3’s core principles and fairer internet

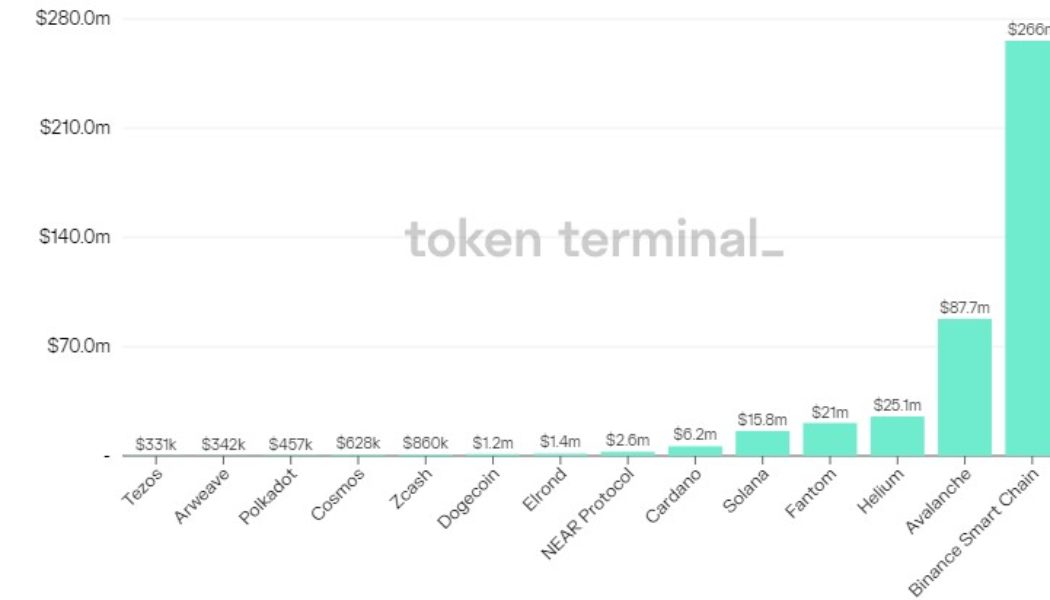

The year 2022 in crypto was eventful in many ways. However, the negative impacts of a bear market dampened the excitement around the blockchain upgrades that significantly brought crypto ecosystems closer to the future of finance. For Bitcoin, it was the Taproot soft fork upgrade, which was aimed at improving the scripting capabilities and privacy of the Bitcoin network. Ethereum underwent the Merge upgrade to transition from a proof-of-work to a proof-of-stake (PoS) consensus mechanism. Leading decentralized Ethereum scaling platform Polygon kicked off the year with mainnet upgrades based on Ethereum Improvement Proposal (EIP)-1559, otherwise known as the London hard fork. The upgrade was accompanied by Polygon (MATIC) token burning and better fee visibility. On Jan. 25, Ryan Wyatt joined...

Ethereum launches testnet for Shanghai upgrade: Here’s what is next

Staked ETH withdrawal and lower gas fees are some of the developments expected with the next critical improvements for the Ethereum network, the Shanghai upgrade. The testnet version, dubbed Shandong, is now live. Developers can now begin working on the implementations; a process expected to continue until September 2023. This is the first major update since Ethereum’s consensus switched to Proof-of-Stake (PoS) in September after the Mainnet and Beacon Chains merged. Moreover, the coming upgrade introduces an elemental change to Ethereum Virtual Machine (EVM), the technology that powers the network smart contracts. EIP-3540, or EVM object format, is one of the community’s most-anticipated updates since it separates coding from data, which could be beneficial for on-...

The Bitcoin bottom — Are we there yet? Analysts discuss the factors impacting BTC price

When Bitcoin was trading above $60,000, the smartest analysts and financial-minded folk told investors that BTC price would never fall below its previous all time high. These same individuals also said $50,000 was a buy the dip opportunity, and then they said $35,000 was a generational buy opportunity. Later on, they also suggested that BTC would never fall under $20,000. Of course, “now” is a great time to buy the dip, and one would think that buying BTC at or under $10,000 would also be the purchase of a lifetime. But by now, all the so-called “experts” have fallen quiet and are nowhere to be seen or heard. So, investors are left to their own devices and thoughts to contemplate whether or not the bottom is in. Should one be patient and wait for the forecast “drop to $10,000” ...

Ethereum will outpace Visa with zkEVM Rollups, says Polygon co-founder

zkEVM Rollups, a new scaling solution for Ethereum, will allow the smart contract protocol to outpace Visa in terms of transaction throughput, said Polygon co-founder Mihailo Bjelic in a recent interview with Cointelegraph. Polygon recently claimed to be the first to implement a zkEVM scaling solution, which aims at reducing Ethereum’s transaction costs and improving its throughput. This layer-2 protocol can bundle together several transactions and then relay them to the Ethereum network as a single transaction. The solution, according to Bjelic, represents the Holy Grail of Web3 as it offers security, scalability and full compatibility with Ethereum, which means developers won’t have to learn a new programing language to work with it. “When you launch a scaling solution,...

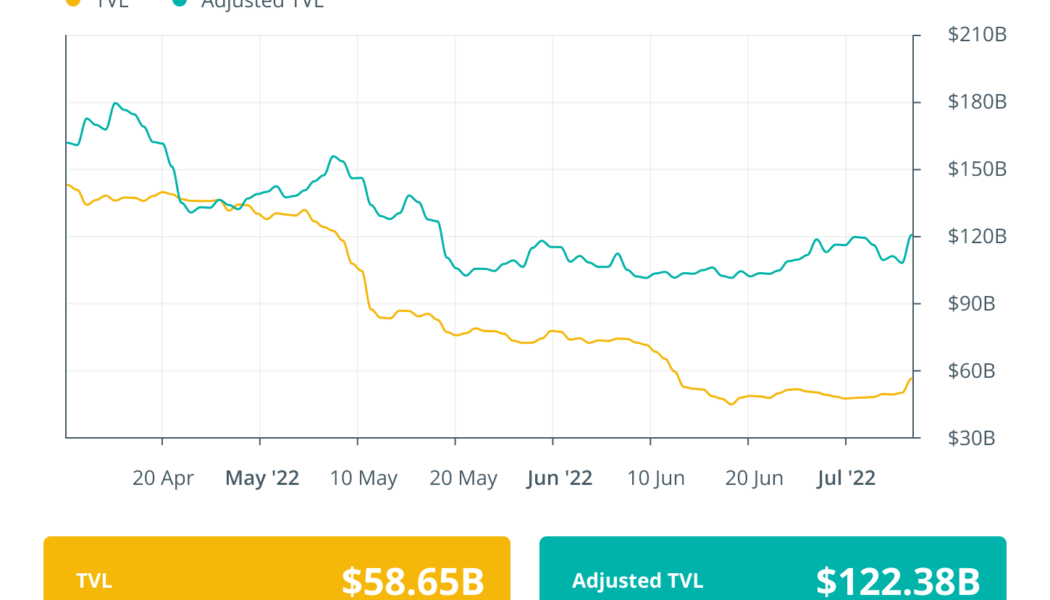

Finance Redefined: DeFi’s downturn deepens, but protocols with revenue could thrive

Welcome to Finance Redefined, your weekly dose of key decentralized finance (DeFi) insights — a newsletter crafted to bring you some of the major developments over the last week. This past week, the DeFi ecosystem saw several new developments related to the DeFi lending crisis as Celsius filed for bankruptcy. At a time when bears are more dominant in the current market, DeFi protocols with a revenue system can thrive. Lido Finance has announced plans to offer its Ether (ETH) staking services across the entire L2 system. Aave plans to leverage Pocket’s distributed network of 44,000 nodes to access on-chain data from various blockchains, and gamers are plugging in DeFi through the Razer reward partnership. The majority of the top 100 DeFi tokens traded in green, with many registering double-...

UNI, MATIC and AAVE surge after Bitcoin price bounces back above $20K

Crypto investors found cause for celebration on July 14 as the market experienced a positive trading session just one day after the Consumer Price Index (CPI) posted a June print of 9.1%, its highest level since 1981. Daily cryptocurrency market performance. Source: Coin360 The move higher in the market wasn’t entirely unexpected for seasoned traders who have become familiar with a one to two-day bounce in asset prices following the most recent CPI prints. These traders also know there’s nothing to get too excited about as the bounces have typically been followed by more downside once people realize that the high inflation print is a negative development. Nevertheless, the green in the market is a welcome sight after the rough start to 2022. Top 5 coins with the highest 24-hour price...

TrueFi launches on Optimism, expanding access to on-chain credit

Unsecured lending protocol TrueFi has become the latest project to launch on Optimism, Ethereum’s popular layer-2 scaling solution, in a move that’s expected to boost demand from non-institutional lenders. By launching on Optimism, TrueFi’s lender community will have access to a faster and cheaper user experience, as well as gain exposure to a wider pool of retail lenders. “TrueFi users can now lend, borrow and launch portfolios on Optimism to enjoy dramatically reduced transaction costs and network speeds,” Rafael Cosman, co-founder of TrustToken, told Cointelegraph in a written statement. He further explained: “Since Optimism transactions are on average 77x cheaper than Ethereum, we expect greater adoption from non-institutional lenders, hopefully increasing global access to TrueFi...

Balancer launches on Ethereum L2 network Optimism

Automated market maker and decentralized finance (DeFi) protocol Balancer has officially deployed on Optimism, the highly touted Ethereum layer-2 scaling solution, in a move designed to enhance user functionality by increasing scalability and reducing fees. Balancer’s Optimism deployment was carried out in conjunction with Beethoven X, a decentralized investment platform on the Fantom Network that forked from Balancer v2. Together, both teams are said to have developed a decentralized exchange that is set to compete in the Optimism ecosystem. Balancer Labs CEO Fernando Martinelli said his project’s Optimism deployment reflects the belief that layer-2 scaling solutions will be effective in reducing transaction fees and network congestion. Optimism is a layer-2 scaling solu...

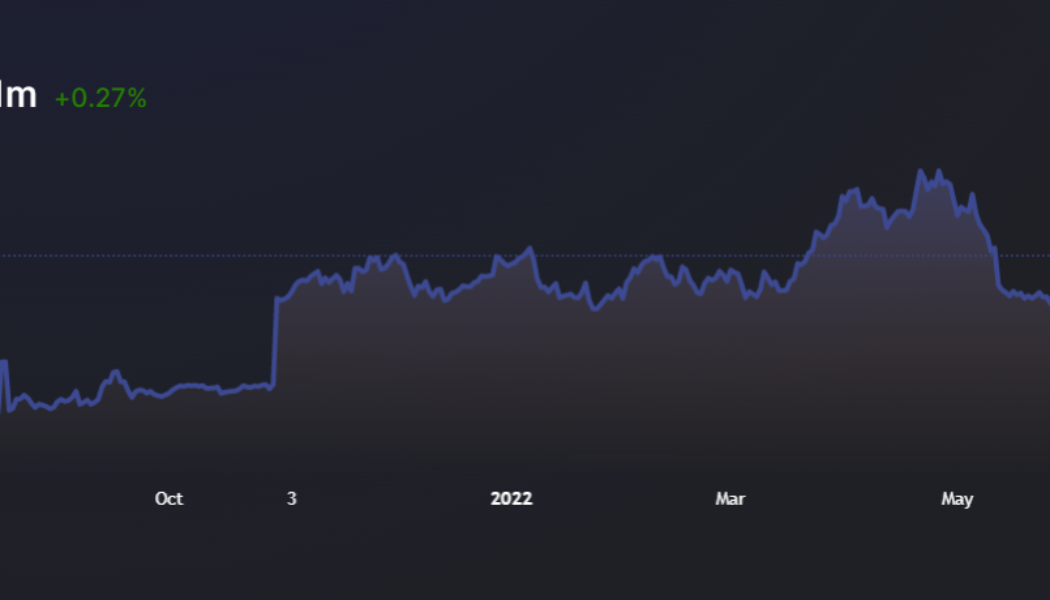

StarkWare nets $100M as investors bank on layer-2 success

Ethereum (ETH) layer-2 developer StarkWare has raised a further $100 million in its latest fundraising round despite the prevailing downturn in cryptocurrency markets. StarkWare’s series D fundraising round sees the firm’s valuation up to $8 billion, marking a four-fold increase in value just six months after its Series C round in November 2021. Tech investment firm Greenoaks Capital led the latest fundraising round in addition to private equity firm Coatue, Tiger Global and other investors. StarkWare has established itself as a major player in the Ethereum layer-2 scaling space, boasting more transaction throughput than the Bitcoin network and collectively more than all other layer-2 platforms in 2022. The firm makes use of rollup technology for its Ethereum layer-2 scaling platforms. By ...

Hop Protocol reveals details of Hop DAO and Optimism-style airdrop

Hop Protocol, a cross-chain bridge designed to facilitate the quick transfer of tokens between different Ethereum Layer-2 scaling solutions, has unveiled a new governance model alongside an airdrop that will see early users receive 8% of the total supply of soon-to-be-released HOP tokens. Similar to Optimism, which recently unveiled a new governance structure that will see early users airdropped 5% of the total supply of the OP token — Hop Protocol is aiming to create a community-oriented governance model, called Hop DAO, that seeks to aid Layer-2 scalability. An official date for the airdrop is yet to be announced. repost: There will be an initial supply of 1b $HOP tokens: • 8% airdropped to early users• 60.5% to the Hop treasury• 22.45% to the initial development team (3 yr vesting, 1 ye...

Tezos co-founder Arthur Breitman discusses the untapped potential of DeFi

Arthur Breitman, the co-founder of layer-1 protocol Tezos (XTZ), spoke with Cointelegraph’s Jackson DuMont at the Paris Blockchain Week Summit (PBWS) last week about what it would take to unlock the true potential of decentralized finance, or DeFi. Breitman delivered a keynote speech following this interview about the company’s strategy. Related: Paris Blockchain Week, April 14: Latest updates from the Cointelegraph team on the ground According to Breitman, “people haven’t really tapped into DeFi for real-world assets being tokenized.” When he says real-world assets, he means stocks, real estate, digital art or “anything you can think of.” While calling for a merge of traditional financial securitization and DeFi applications, Breitman also be...

- 1

- 2