Law

Vermont’s financial regulator alleges Celsius and its CEO made ‘false and misleading claims’

The Vermont Department of Financial Regulation, or DFR, alleged crypto lending platform Celsius Network and CEO Alex Mashinsky misled state regulators about the firm’s financial health and its compliance with securities laws. In a Wednesday filing with the U.S. Bankruptcy Court in the Southern District of New York, Vermont’s financial regulator said Celsius and Mashinsky “made false and misleading claims to investors” which allegedly downplayed concerns about volatility in the crypto market, encouraging retail investors to leave their funds on the platform or make new investments. According to the state regulator, Celsius and its CEO “lacked sufficient assets to repay its obligations” despite claiming the firm had enough funds in its reserves to mitigate the risk of insolvency. The DFR c...

Bank of Russia agrees to legalize crypto for cross-border payments: Report

The Bank of Russia, the country’s central bank, has reportedly admitted that cross-border payments in crypto are inevitable in the current geopolitical conditions. The Russian central bank has been rethinking the approach to regulating crypto and agreed with the finance ministry to legalize crypto for cross-border payments, the local news agency TASS reported on Monday. Deputy finance minister Alexei Moiseev reportedly said that the Bank of Russia and the finance ministry expect to legitimize cross-border payments in crypto soon. Moiseev outlined the importance of enabling local crypto services in Russia, noting that many Russians rely on foreign platforms to open a crypto wallet. “It is necessary to do this in Russia, involving entities supervised by the central bank, which are obliged to...

Tens of Celsius clients ask US court to recover $22.5M in crypto

The bankrupt cryptocurrency lender Celsius is facing more legal issues as disgruntled clients are taking action to recover their funds after the platform froze withdrawals in June. An ad hoc group of 64 custodial account holders at Celsius on Wednesday filed a complaint with the U.S. Bankruptcy Court for the Southern District of New York in order to recover their assets. According to court documents, the creditors are seeking to recover a total of more than $22.5 million worth of cryptocurrency assets collectively held in Celsius’ custody service. The ad hoc group is represented by bankruptcy-focused law firm Togut, Segal & Segal. The plaintiffs noted that Celsius has “not honored any withdrawals from any programs,” including custody services. According to the complaint, that contradic...

Crypto ‘cannot be partisan,’ says US lawmaker who scored negative on bipartisanship index: Report

United States House of Representatives member Tom Emmer has reportedly suggested that regulating and encouraging innovation in the crypto space should not be a political win for either Democrats or Republicans. According to an interview released Tuesday by Axios reporter Brady Dale, Emmer said many of his colleagues in Congress were treating cryptocurrencies as a risk that merited warnings, rather than an investment opportunity for the United States. The U.S. lawmaker added that encouraging figures like FTX CEO Sam Bankman-Fried to stay in the country will open more doors for residents rather than driving them away with regulatory uncertainty. Emmer, who has often pushed back against the “regulation by enforcement” approach some government agencies — including the Securities and Exchange C...

Lawyer Roche alleges statements he made about Ava Labs are false, the result of intoxication

Kyle Roche, the lawyer at the center of allegations made by website Cryptoleaks about a secret agreement between his firm and Ava Labs, responded Monday in a post on Medium. Like Ava Labs CEO Emin Gün Sirer, Roche denied the existence of any secret agreement between the parties. Roche claimed that the recordings that have been published on Cryptoleaks’ website were made at the behest of ICP Token creator Dominic Williams. Roche’s firm, Roche Freedman, brought a class action suit against Williams and his Dfinity Foundation last October. Roche said the recordings were heavily edited and he denied the truth of the statements he made in them. According to Roche: “Statements in the video […] are false, and were obtained through deceptive means, including a deliberate scheme to intoxicate, and t...

Binance froze $1M corporate account due to law enforcement request

Major crypto exchange Binance has confirmed it restricted account access to $1 million in crypto for a Tezos tool contributor after being called out on social media. In a Thursday Twitter thread, Binance said it had restricted the account of Tezos staking rewards auditor Baking Bad “as the result of a law enforcement request.” The Tezos contributor alleged that the crypto exchange had blocked access to its corporate account containing Bitcoin (BTC), Ether (ETH), Polgyon (MATIC), Tether (USDT) and other tokens since July 1 “without any explanations” — a claim Binance denied. “BakingBad is well aware of [Binance’s actions], as he was already advised of this multiple times and provided the LE contact form through our support chat system on 7/6, 7/12, and 7/22,” said Binance. “Attempting to mi...

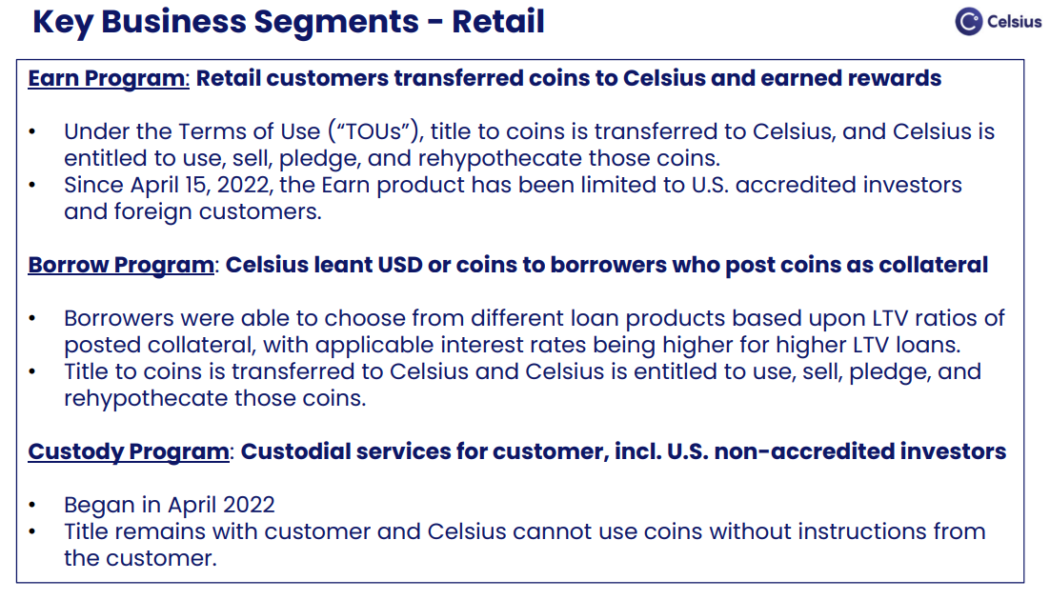

Celsius bankruptcy proceedings show complexities amid declining hope of recovery

The Celsius Network is one of many crypto lending firms that has been swept up in the wake of the so-called “crypto contagion.” Rumors of Celsius’ insolvency began circulating in June after the crypto lender was forced to halt withdrawals due to “extreme market conditions” on June 13 and eventually filed for chapter 11 bankruptcy a month later on July 13. The crypto lending firm showed a balance gap of $1.2 billion in its bankruptcy filing, with most liabilities owed to its users. User deposits made up the majority of liabilities at $4.72 billion, while Celsius’ assets include CEL tokens as assets valued at $600 million, mining assets worth $720 million and $1.75 billion in crypto assets. The value of the CEL tokens has drawn suspicion from some in the crypto community, however, as t...

Celsius calls out Prime Trust in court, alleging firm didn’t turn over $17M in crypto

Crypto lending platform Celsius Network has filed a lawsuit claiming that custodian Prime Trust failed to turn over roughly $17 million worth of cryptocurrency. In a Tuesday filing with the U.S. Bankruptcy Court in the Southern District of New York, Celsius’ legal team brought a complaint against Prime Trust, alleging the company did not return $17 million worth of crypto assets in June 2021 when it terminated its relationship with the lending firm. According to Celsius, Prime Trust acted as crypto custodian for New York- and Washington-based users from 2020 through mid-2021, returning $119 million in crypto following the end of the business arrangement but holding back some funds: 398 Bitcoin (BTC), 3,740 Ether (ETH), 2,261,448 USD Coin (USDC) and 196,268 Celsius (CEL). “Upon the commence...

European Central Bank addresses guidance on licensing of digital assets

The European Central Bank, or ECB, laid the foundation for the criteria it would be considering when harmonizing the licensing requirements for crypto in Europe. In a Wednesday statement, the ECB’s banking supervision division said it would be taking steps to regulate digital assets as “national frameworks governing crypto-assets diverge quite extensively” and given the seemingly differing approaches to harmonization following the passage of the Markets in Crypto-Assets (MiCA) regulation and the Basel Committee on Banking Supervision issuing guidelines for banks’ exposure to crypto. The ECB said it would apply criteria from the Capital Requirements Directive — in effect since 2013 — to assess licensing requests for crypto-related activities and services. Specifically, the central bank will...

BitGo to sue Galaxy Digital for $100M over dropped acquisition

Digital asset custodian BitGo said it planned to seek more than $100 million in damages from Galaxy Digital, alleging the investment firm owed the funds as part of a “reverse break fee” in its decision to terminate an acquisition agreement. In a Monday blog post, BitGo referred to Galaxy’s actions as “improper” in claiming a breach of contract to drop an agreement to acquire the digital asset custodian. BitGo has enlisted the services of law firm Quinn Emanuel to pursue legal action against Galaxy for not paying a “$100 million reverse break fee it had promised back in March 2022.” According to Galaxy, BitGo failed to provide audited financial statements for 2021 by July 31, 2022 as part of the acquisition agreement, a claim Quinn Emanuel partner R. Brian Timmons denied: “The attempt by Mi...

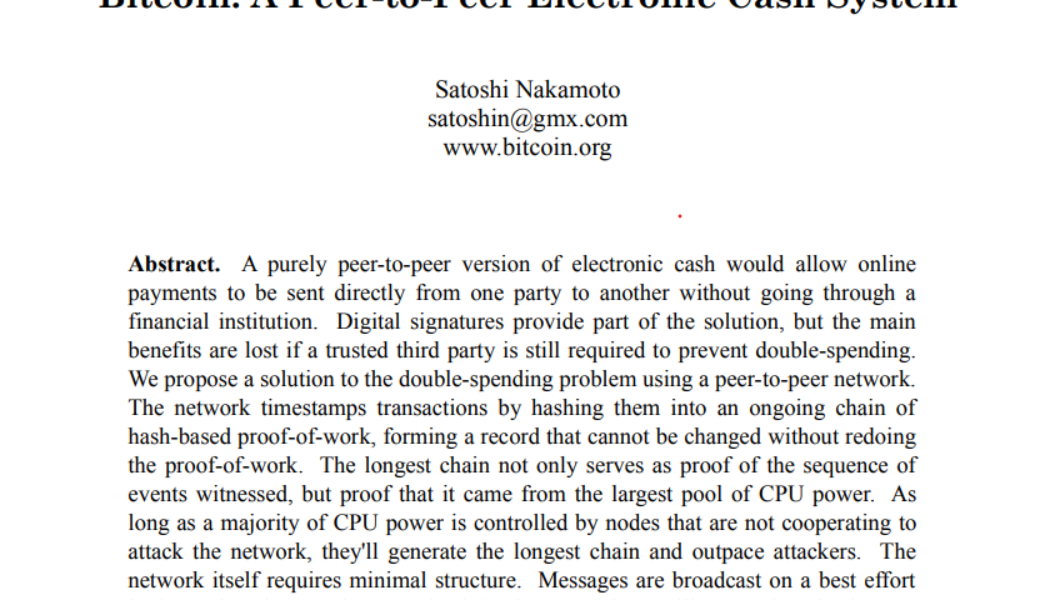

AML and KYC: A catalyst for mainstream crypto adoption

For Satoshi Nakamoto, the creator of Bitcoin (BTC), the motivation to create a new payment ecosystem from scratch in 2009 stemmed from the economic chaos caused by the banking sector’s over-exuberant and risky lending practices mixed accompanied by the bursting of the housing bubbles in many countries at the time. “And who do you think picked up the pieces after the fallout? The taxpayer, of course,” said Durgham Mushtaha, business development manager of blockchain analytics firm Coinfirm, in an exclusive interview with Cointelegraph. Satoshi recognized the need for a new monetary system based on equity and fairness — a system that gives back power into the hands of the people. A trustless system with anonymous participants, transacting peer-to-peer and without the need of a central ...