Law

Alex Mashinsky sued by NY AG for allegedly hiding Celsius’ ‘dire financial condition’

New York Attorney General Letitia James has filed a lawsuit against Alex Mashinsky, alleging the Celsius founder and CEO made numerous “false and misleading statements” which led to investors losing billions. In a Jan. 5 announcement, the New York Attorney General’s office announced the lawsuit, which allegedly involved defrauding investors — including more than 26,000 residents of the U.S. state — out of billions of dollars worth of crypto. According to James, Mashinsky’s actions leading up to Celsius declaring bankruptcy contributed to investor losses by misrepresenting the platform’s financial condition and failing to abide by certain regulatory requirements. “As the former CEO of Celsius, Alex Mashinsky promised to lead investors to financial freedom but led them down a path of f...

Coinbase agrees to $100M settlement with NY regulator

The New York State Department of Financial Services, or NYDFS, has reached an agreement with Coinbase following an investigation into the cryptocurrency exchange’s compliance program. In a Jan. 4 announcement, the NYDFS said Coinbase will pay a $50-million fine in response to violations of New York’s financial services and banking laws, as well as invest $50 million to correct its compliance program. According to the financial regulator, the crypto exchange had many compliance “deficiencies” related to anti-money laundering (AML) requirements. The NYDFS reported issues with Coinbase’s process for onboarding users and monitoring transactions. “Coinbase has acknowledged its failures in this respect to the Department,” said the NYDFS. “Furthermore, certain of these issues have been known to C...

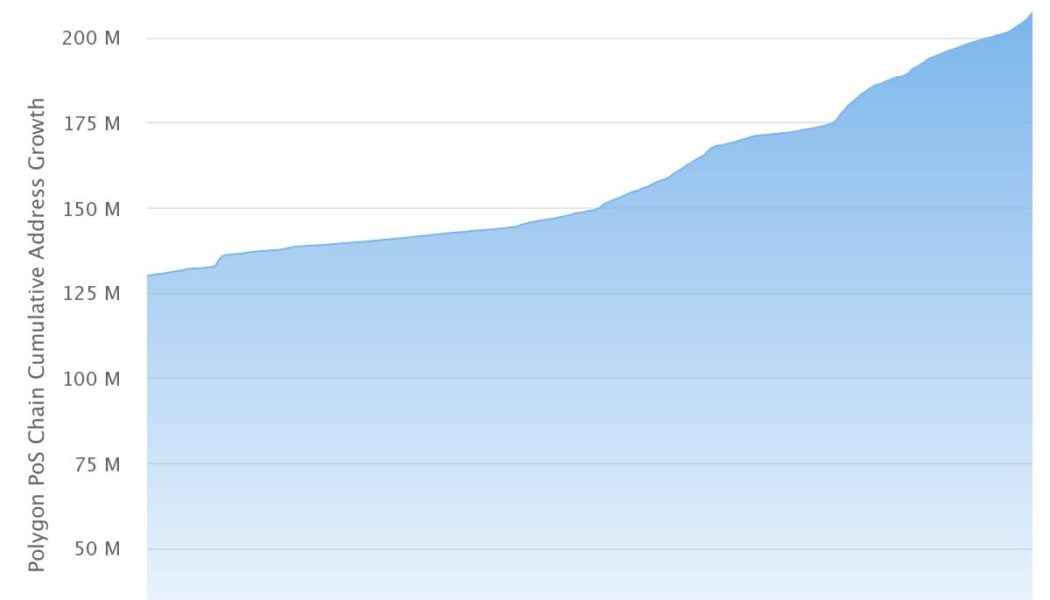

Crypto adoption in 2022: What events moved the industry forward?

It’s no secret that the crypto market was gripped by bearish pressure for the entirety of 2022. However, amid all the volatility and chaos, many positive news stories appeared as well — especially regarding the global adoption of digital assets and crypto-related technologies in general. Looking back at 2022, here are some key adoption-related events that helped drive the industry last year. Polygon accrues 200 million addresses despite challenging 2022 Even though an air of financial uncertainty has shrouded the crypto market since the end of 2021, Polygon — a layer-2 scaling solution running alongside the Ethereum blockchain, allowing for speedy transactions and low fees — continued to witness a lot of growth in 2022. To this point, the network’s unique address count recently surpassed t...

Sam Bankman-Fried’s legal team warns of ‘harassment and threats’ to parents in latest court filing

The legal team behind former FTX chief executive officer Sam Bankman-Fried has petitioned a court to redact certain information on individuals acting as sureties for his $250-million bond, citing threats made against his family. In a letter dated Jan. 3 filed to Judge Lewis Kaplan for the United States District Court in the Southern District of New York, Bankman-Fried’s legal team requested the court order “names and other identifying information” of two bail sureties not be disclosed to the public and redacted from bonds once they were signed on Jan. 5. Mark Cohen of the law firm Cohen & Gresser said that if the individuals’ personal information were to be available, they could be subject to similar harassment as the former FTX CEO’s parents, Barbara Fried and Joseph Bankman. “In...

Former Alameda CEO confirms firm borrowed billions from FTX customer deposits as part of plea deal

Caroline Ellison, the former CEO of Alameda Research, said as part of her plea deal that she was aware FTX funds had been made available for the venture capital firm’s investments. In a transcript of proceedings for her plea deal in the Southern District of New York released on Dec. 23, Ellison acknowledged the financial ties between FTX and Alameda at the center of prosecutors’ case against former FTX CEO Sam Bankman-Fried. According to the former Alameda CEO, Alameda had access to a “borrowing facility” through FTX from 2019 to 2022. “I understood that FTX executives had implemented special settings on Alameda’s FTX.com account that permitted Alameda to maintain negative balances in various fiat currencies and crypto currencies,” said Ellison. “In practical terms, this arrangement permit...

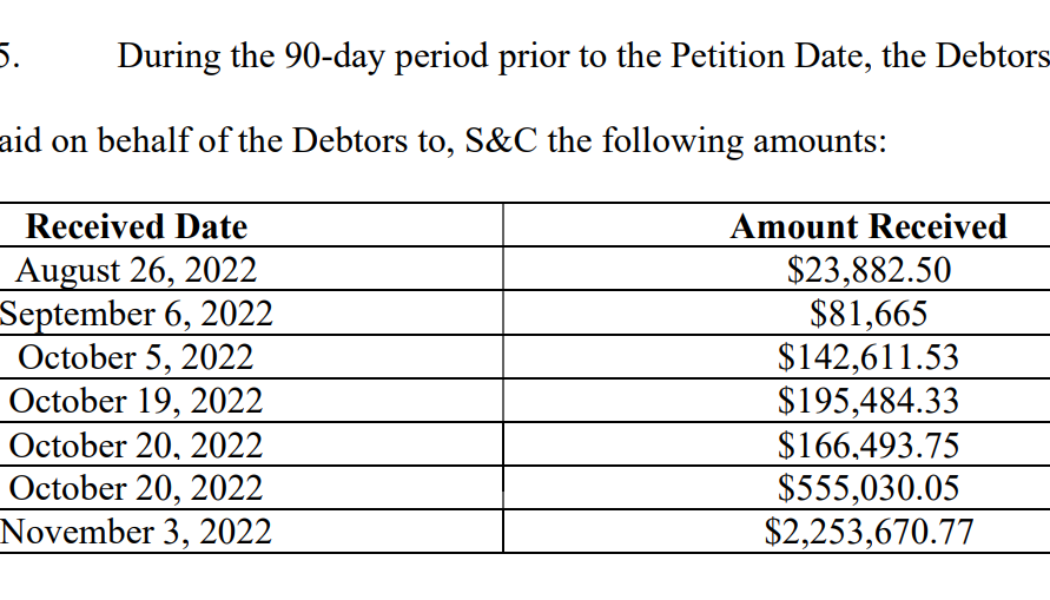

FTX paid $12M retainer to a New York law firm before bankruptcy filing

Defunct crypto exchange FTX paid a retainer of $12 million to bankruptcy lawyers as security for payment of its fees and expenses amid Chapter 11 bankruptcy proceedings, shows a court filing dated Dec. 21. Sullivan & Cromwell LLP (S&C), a law firm headquartered in New York City, received $12 million from West Realm Shires Services Inc. on behalf of FTX for legal services. In addition, the filing confirmed that over the past 90 days, i.e., since Aug. 26, 2022, FTX paid nearly $3.5 million to S&C. Snippet of the court filing revealing FTX’s historical payments to S&C law firm. Source: aboutblaw.com Based on the information provided, FTX paid at least $15.5 million to avail and retain the legal services of S&C. The filing further revealed that S&C currently ...

Blockware sued over alleged misrepresentation of miners’ performance

London-based Faes & Company filed a complaint against crypto mining firm Blockware Solutions LLC on Dec. 17, claiming it misrepresented the performance capability of its miners and lacked adequate power access to keep the machines running. Plaintiffs allege losses of $250,000 and are seeking compensatory and punitive damages. According to the complaint, the parties entered into contracts in October 2021 for Faes to buy $525,000 worth of Bitcoin miners and related hosting services. As part of the agreement, Blockware would host Faes’ miners at one of its server facilities, which it allegedly owns and operates for a monthly hosting fee and energy costs. Related: Public Bitcoin mining companies plagued with $4B of collective debt The plaintiff alleges that at the time of the a...

SEC general counsel announces departure from public service

Dan Berkovitz, general counsel for the United States Securities and Exchange Commission, said he will be leaving the agency after more than a year. In a Dec. 22 announcement, the SEC said Berkovitz will depart on Jan. 31. A former commissioner with the Commodity Futures Trading Commission, Berkovitz joined the agency in November 2021. At the time, he said he planned to work with SEC chair Gary Gensler on a “regulatory agenda that will enhance investor protection.” “After thirty-four years of public service, it is time for me to pursue new and different challenges and opportunities,” said Berkovitz. It’s unclear whether Berkovitz intends to join the private sector after leaving the SEC. Brian Quintenz, who served as a CFTC commissioner from 2017 to 2021, joined&n...

Third parties could return FTX funds directly to customers: Law firm

More than one million creditors of failed crypto exchange FTX have been waiting to be made whole since before the firm’s bankruptcy filing on Nov. 11, but according to one expert, recipients of donations and contributions may have a legal means of returning the funds directly to investors and customers. Louise Abbott, a partner at United Kingdom-based firm Keystone Law, told Cointelegraph it was “extremely unlikely” FTX would have a legal leg to stand on in its demands for the voluntary return of political campaign donations, grants, and other contributions the firm made prior to its bankruptcy. However, many individuals and organizations — likely the result of public scrutiny — have already returned or pledged to return an estimated $6.6 million to FTX, a fraction of the millions th...

Sam Bankman-Fried is one step closer to US extradition: Report

Former FTX CEO Sam Bankman-Fried, who has been in the custody of Bahamian authorities, faces extradition to the United States following a hearing. According to reports, Bankman-Fried appeared in a hearing of The Bahamas Magistrate Court on Dec. 21 — the third since his arrest — where he waived his right to a formal extradition process that could have taken weeks. Officials from the U.S. Embassy, Federal Bureau of Investigation, and U.S. Marshals Service were reportedly in attendance to facilitate Bankman-Fried’s handover, to which he had first signed papers on Dec. 20. Reuters reported that SBF’s legal team said the former CEO was “anxious to leave” The Bahamas. Jerome Roberts, on Bankman-Fried’s legal team, reportedly heard SBF say on Dec. 19 his decision...

Alaska adds ‘virtual currency’ to its regulatory regime

From Jan. 1, 2023, the term “virtual currency” will take its place in the money transmission regulations of Alaska. It will oblige the companies dealing with digital currencies to obtain a money transmission license in the state. As reported by the law firm Cooley on Dec. 19, the state of Alaska amended its money transmission regulations to include the definition of “virtual currency.” According to the amendment to the local Administrative Code, adopted by the Division of Banking and Securities (DBS), the virtual currency is: “[A] digital representation of value that is used as a medium of exchange, unit of account, or store of value; and is not money, whether or not denominated in money.” The most obvious impact of this change, which will come into force on Jan.1, is the requirement...

US Financial Stability Oversight Council urges congressional action on crypto

Officials with the United States Financial Stability Oversight Council, or FSOC, have recommended U.S. lawmakers pass legislation aimed at addressing regulatory gaps for crypto-related activities. In its annual report released on Dec. 16, the FSOC recommended members of Congress pass legislation granting “explicit rulemaking authority for federal financial regulators over the spot market for crypto-assets,” noting that tokens previously identified as securities would be exempt. The council also noted the lack of a comprehensive regulatory framework — specifically addressing stablecoins and visibility and supervision of crypto firms — in the United States. The FSOC cited the recent downfall of crypto exchange FTX as part of its background information in recommending actions on digital asset...