Law

US lawmakers introduce bills that could force crypto exchanges to cut ties with Russian wallets

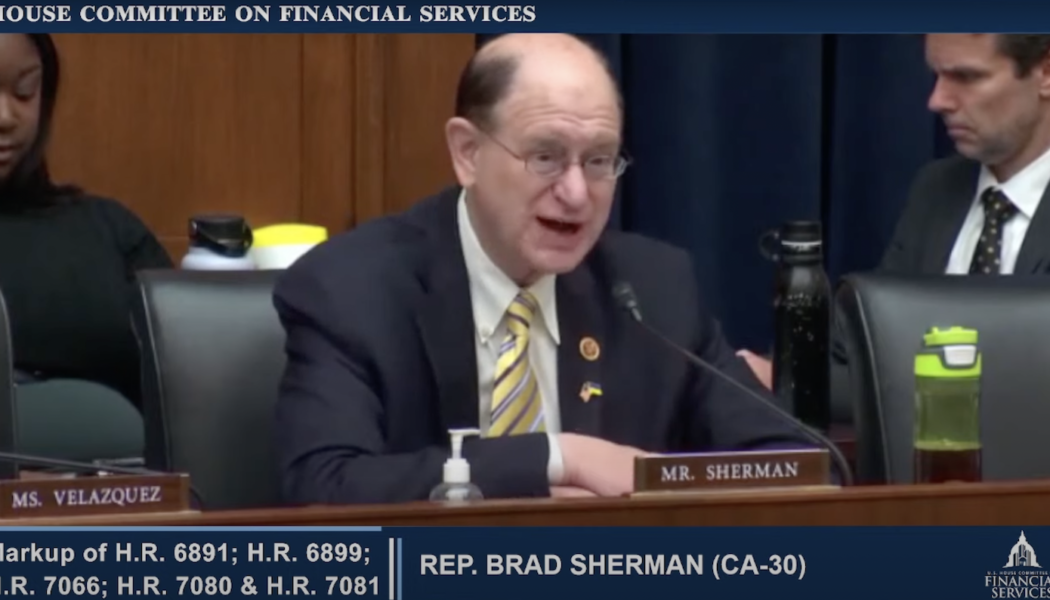

Representative Brad Sherman will be introducing a bill in the House aimed at cracking down on U.S. businesses handling crypto transactions for Russian banks and individuals. Speaking at a hybrid markup meeting with the House Financial Services Committee on Thursday, Sherman said he will be introducing a companion bill to Senator Elizabeth Warren’s legislation that would give the Biden administration “explicit authority to require that crypto exchanges that are subject to U.S. law stop facilitating transactions with Russian-based crypto wallets.” Warren first announced the legislation on March 8, later saying during a Senate Banking Committee hearing she will be introducing the bill on Thursday. Neither bill’s text is available through congressional records at the time of publication....

New Hampshire hopes its express approval of crypto-friendly law will attract new business

The New Hampshire House of Representatives passed a bill on Tuesday to adopt the new version of Chapter 12 of the Universal Commercial Code, or UCC, which will govern transfers of digital assets. The chapter is still in draft form, but if HB1503 is signed into law, New Hampshire will be the first U.S. state to adopt the chapter. Like the draft chapter of the UCC, the bill — titled “Exempting the developer, seller, or facilitator of the exchange of an open blockchain token from certain securities laws” — seeks to create a “workaround” to make it easier to buy and sell cryptocurrencies by stipulating conditions under which “a developer or seller of an open blockchain token shall not be deemed the issuer of a security.” It passed by a vote of 187 to 150. The UCC is a set of model l...

Ukraine’s president signs law establishing regulatory framework for crypto

Volodymyr Zelenskyy, the president of Ukraine currently based in Kyiv, has signed a law establishing a legal framework for the country to operate a regulated crypto market. In a Wednesday announcement, Ukraine’s Ministry of Digital Transformation said Zelenskyy signed a bill named “On Virtual Assets,” first adopted by the country’s legislature, the Verkhovna Rada, in February. Crypto exchanges and firms handling digital assets will be required to register with the government to operate legally in Ukraine, and banks will be allowed to open accounts for crypto firms. The law endows Ukraine’s National Securities and Stock Market Commission with the power to determine the country’s policies on digital assets, issue licenses to businesses dealing with crypto and act as a financial watchdo...

Commissioner Allison Lee announces her departure from the SEC

Securities and Exchange Commissioner Allison Herren Lee announced that she would be stepping down from her post at the end of her term in June. In a Tuesday announcement, Lee said that she will remain in the role until her successor has been confirmed. The SEC commissioner has spent less than three years at her current position, having been sworn in in 2019 to serve out the remainder of a five-year term expiring in June. With her departure, Lee, a Democrat who replaced former commissioner Kara Stein, will create a second vacancy at the SEC, with another left open by Republican Elad Roisman, who announced he would be leaving in January. Commissioner Hester Peirce, known to many in the space as the “Crypto Mom,” is currently the sole Republican on the five-member commission....

Bank of Israel issues draft guidelines on cryptocurrency AML/CFT

On Friday, the Bank of Israel published a draft regulation on Anti-Money-Laundering and Combatting the Financing of Terrorism (AML/CFT) risk management for the banks facilitating crypto-to-fiat transactions. The move hints at the Israeli government’s preparations to legalize and regulate the relationship between banks and virtual currency service providers (VASPs). The document cites the customers’ increased involvement with digital assets as the rationale for the new policy: “In view of the increase in customer activity in virtual currencies, and the resulting increase in customer requests to transfer money […] the Banking Supervision Department today published a draft circular dealing with managing AML/CFT risks derived from the provision to customers of payment services relat...

FBI director: Russia overestimates its ability to bypass US sanctions using crypto

Christopher Wray, the director of the Federal Bureau of Investigation, said that fiat was a more likely avenue for Russia to explore in circumventing sanctions, given the United States’ ability to block efforts using crypto. In a Thursday hearing of the Senate Select Committee on Intelligence, New Mexico Senator Martin Heinrich asked the FBI director if Russia might respond to the economic impact of the United States banning imports of the country’s oil and gas by using reserves of gold, China’s currency or cryptocurrency. Director Wray said the FBI and its partners had “built up significant expertise” on digital assets, citing the department’s recent work in seizing large amounts of tokens as evidence there were vulnerabilities in using crypto to get around sanctions. “The Rus...

Regulators and industry leaders react to Biden‘s executive order on crypto

Joe Biden has signed his 82nd executive order since being sworn into office in January 2021, directly addressing a regulatory framework for digital assets in a rare moment for the U.S. president. In a Wednesday announcement, the White House said President Biden’s executive order required government agencies to explore the potential rollout of a United States central bank digital currency as well as coordinate and consolidate policy on a national framework for crypto. Many media outlets previously reported the U.S. president had initially planned to sign the executive order in February, an event that was likely postponed following Russia’s military actions in Ukraine. The reaction from many industry leaders compared the executive order to a regulatory opportunity — Biden had rarely sp...

Biden to sign executive order on crypto, authorize all-government effort to consolidate regulation

Later today, U.S. President Joe Biden will sign a long-anticipated executive order on digital assets. Despite fears that the order may resound a regulatory clampdown on the industry, the language of the document is fairly favorable, the key focus being the coordination and consolidation of various agencies’ efforts within a unified national policy. The order designates six key areas of the federal government’s involvement with the digital asset ecosystem — consumer and investor protection, financial stability, financial inclusion, responsible innovation, the United States’ global financial leadership and combating illicit financial activity — and directs specific agencies to lead in designated policy and enforcement domains. The Department of the Treasury will take the lead in developing p...

Dubai establishes virtual asset regulator and announces new crypto law

Sheikh Mohammed bin Rashid Al Maktoum, the ruler of Dubai in the United Arab Emirates who holds several positions including prime minister, has announced a new law on virtual assets as well as the establishment of a crypto regulator. In a Wednesday announcement, Sheikh Al Maktoum said he had issued a law creating a legal framework for crypto in the Emirate of Dubai aimed at protecting investors and “designing much-warranted international standards” for industry governance. In addition, the ruler said a newly formed Dubai Virtual Asset Regulatory Authority, or VARA, would have enforcement powers in the Emirate’s special development zones and free zones with the exception of the Dubai International Financial Centre. “Approving the virtual asset law and establishing the Dubai Virtual As...

European Parliament will hold vote on crypto bill without PoW provision

The parliament of the European Union has scheduled a vote on a framework aimed at regulating cryptocurrencies after addressing concerns over proof-of-work mining. In a Monday Twitter thread, European Parliament Committee on Economics and Monetary Affairs member Stefan Berger said the committee will vote on the Markets in Crypto Assets, or MiCA, framework on March 14 following the submission of a final draft of the bill. As the rapporteur — the person appointed to report on proceedings related to the bill — Berger said the legislation will no longer include text that some had interpreted as a possible ban on proof-of-work crypto mining. “With MiCA, the EU can set global standards,” said Berger. “Therefore, all those involved are now asked to support the submitted draft & to vote for MiC...

Crypto industry seeks to educate, influence US lawmakers as it faces increasing regulation

Interaction between the cryptocurrency industry and Capitol Hill is becoming ever more intensive as efforts to regulate crypto grow in tandem with its popularity. The surge in crypto industry lobbying last year was given some concrete parameters in February by crypto analytics startup Crypto Head. It released a report showing that the crypto companies that spent the most money on lobbying in 2021 were Robinhood, Ripple Labs, Coinbase and the Blockchain Association. These organizations were the lobbying leaders during the past five years as well, although with different rankings. Here is what the United States crypto-lobbying landscape looks like today. Metrics of influence Robinhood spent $1.35 million on lobbying in 2021 and was the only crypto-related organization to spend more than $1 m...

Crypto firms may still face SEC penalties for self-reporting securities laws violations: Report

The U.S. Securities and Exchange Commission’s enforcement director has reportedly said cryptocurrency companies will not receive amnesty for reporting themselves for possible violations of securities laws. According to a Monday report from Reuters, the SEC director of the agency’s division of enforcement, Gurbir Grewal, said the agency may view crypto companies’ conduct “more favorably” if they reach out first for self-reporting securities law violations. However, he added that though firms may face smaller penalties, they will not be completely off the hook. “Our message to [crypto companies] is not, ‘Register your product and we’ll just ignore the billions you have under management in this crypto lending product and your violations of the securities laws,’” said G...