Law

Buenos Aires to accept crypto for tax payments, launch DLT-backed citizen profiles

The capital of Argentina and an agglomeration with more than 12 million citizens, Buenos Aires will make blockchain a vital part of its digitalization drive. Specifically, the city will accept public financial transactions in crypto. As city Mayor Horacio Rodríguez Larreta revealed in his Steve Jobs-styled presentation on April 25, the 12-step development plan titled “Buenos Aires +” envisions a significant increase in crypto and blockchain adoption. Con Buenos Aires + vamos a dar un paso más en el camino hacia un Estado facilitador que desburocratice y agilice los procesos. Un camino en el que el Estado sea el que se acerca a la gente, y no al revés. pic.twitter.com/yi6fUMmAUI — Horacio Rodríguez Larreta (@horaciorlarreta) April 26, 2022 The city authorities intend to launch a platf...

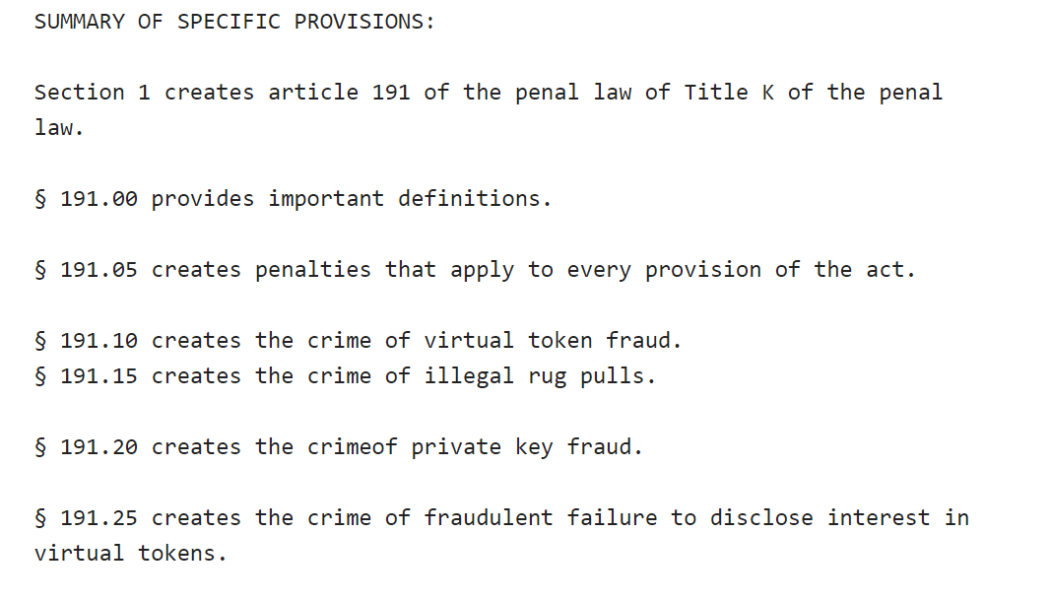

NY Sen. Thomas proposes to criminalize rug pulls and other crypto frauds

New York State Senator Kevin Thomas introduced a new bill amendment request to establish certain offenses related to rug pulls and other frauds related to virtual token distribution, misuse of private keys and hidden interests in crypto projects. The bill drafted by Sen. Thomas, Senate Bill S8839, calls for defining, penalizing and criminalizing frauds specifically targeted at developers and projects that intend to dupe crypto investors. A snippet of Senate Bill S8839. Source: nysenate.gov Through the bill, Thomas seeks to provide prosecutors with a clear legal framework against crypto crimes that align with the spirit of the blockchain while combatting fraud. It calls for a law amendment that will imply rug pull charges on developers that sell “more than 10% of such tokens within fiv...

As labor struggle takes center stage, can DAOs democratize work?

Web3 has given rise to a number of innovative business models. In particular, decentralized autonomous organizations (DAOs) have started gaining traction as Web3 as the creator economy comes to fruition. Natalie Salemink, CEO and founder of Prismatic — a tooling and treasury management platform for DAOs — told Cointelegraph that DAOs are internet-native organizations that utilize smart contracts to facilitate coordination and governance in pursuit of a common goal. When it comes to traditional businesses, though, one of the most interesting aspects a DAO structure can provide is leadership based on computer-generated code rather than individual authority. The idea of operating a business without any central governance has become especially intriguing to brick and mortar compani...

Law Decoded: Paris is always a good idea, even for talking crypto policy — April 11–18

Last week was the Paris Blockchain Week, and the epicenter of crypto policy and regulatory conversation moved to the French capital accordingly. Cointelegraph reported extensively from the ground and ran a series of interviews with some of the crypto industry’s captains who shared their thoughts on the state of regulatory affairs. For one, Binance’s Changpeng Zhao said that he was excited to see regulators embracing financial innovation and introducing crypto-friendly policies, calling it a major trend of 2022. Bertrand Perez, chief operating officer of the Web3 Foundation, opined that many policymakers, including some in the European Union, still tend to act too fast on crypto regulation without getting properly educated on the subject first. Ripple’s Brad Garlinghouse even filled in the ...

DAO regulation in Australia: Issues and solutions, Part 3

Lawmakers in Australia want to regulate decentralized autonomous organizations (DAOs). In this three-part series, Oleksii Konashevych discusses the risks of stifling the emerging phenomenon of DAOs and possible solutions. Crypto anarchy is unlikely to be the future that the majority of people support. Company regulation, in its essence, has a lot of positive aspects or at least, a good intention, albeit one often embodied in a red tape that stifles business. Nevertheless, nowadays, corporation rules and regulations are formalized to the extent that they could be put in the machine code. So, the role of the government is to establish mandatory standards for those DAOs that would like to operate in the Australian market. [embedded content] Non-digital There are cases when a written legal tex...

President Biden announces former Ripple adviser as pick for Fed vice chair for supervision

Following the withdrawal of former Federal Reserve Board governor Sarah Bloom Raskin, United States President Joe Biden has announced his intention to nominate former Obama administration official and law professor Michael Barr as the central bank’s vice chair for supervision. In a Friday announcement, the White House said Barr was Biden’s pick to supervise the Federal Reserve and set the regulatory agenda for its leadership. Barr was on the advisory board of Ripple Labs from 2015 to 2017, served as the Treasury Department’s assistant secretary for financial institutions under former President Barack Obama, and taught courses on financial regulation at the University of Michigan. According to the White House, he was “a key architect” of the Dodd-Frank Act — legislation that continues to in...

Texas regulators order virtual casino to stop selling NFTs

A virtual, Cyprus-registered casino Sand Vegas Casino Club faced an emergency cease and desist order from Texas and Alabama state securities regulators. The company is ordered to “stop a fraudulent investment scheme tied to metaverses”. On April 13, the Texas State Securities Board reported issuing the order, accusing Sand Vegas Casino Club, Martin Schwarzberger and Finn Ruben Warnke of illegally offering nonfungible tokens (NFTs) to fund the development of virtual casinos in metaverses. Allegedly, Sand Vegas offered 11,111 NFTs to raise funds for its metaverse casinos. The firm offered those who purchased Gambler NFTs and Golden Gambler NFTs a share of the future casino’s profits. By Sand Vegas’ projections, owners of Gambler NFTs could expect profits between $1,224 and $24,48...

China-based regulatory and trade associations target NFTs in latest risk notice

The China Banking Association, the China Internet Finance Association and the Securities Association of China issued a joint statement warning the public about the “hidden risks” of investing in nonfungible tokens, or NFTs. In a Wednesday notice, the three associations launched initiatives aimed at encouraging innovation in the crypto and blockchain space focused on NFTs as well as “resolutely curb[ing] the tendency of NFT financialization and securitization” to reduce the risks around illicit activities. The China Banking Association said member institutions should not consider NFTs assets like securities, precious metals, and other financial products. In addition, cryptocurrencies including Bitcoin (BTC), Ether (ETH) and Tether (USDT) should not be used for the pricing and settlement of ...

EU bans providing ‘high-value crypto-asset services’ to Russia

The Council of the European Union has cut Russians off from certain cryptocurrency services as part of a package of restrictive measures against Russian President Vladimir Putin’s “brutal aggression against Ukraine and its people.” In a Friday announcement, the EU council said it would be closing potential loopholes in using digital assets for Russian entities and individuals to evade sanctions with a “prohibition on providing high-value crypto-asset services” to the country. The action was one of three financial measures the European Commission proposed alongside banning transactions and freezing assets connected to four Russian banks as well as a “prohibition on providing advice on trusts to wealthy Russians.” Russian Prime Minister Mikhail Mishustin claimed on Thursday that Russians hol...

Number of UK crypto firms operating under FCA temporary registration status drops

The number of firms permitted to offer crypto services to U.K. residents under temporary registration status from the Financial Conduct Authority has dropped from 12 to five. According to a Thursday update to its list of “Cryptoasset firms with Temporary Registration,” the United Kingdom’s financial regulator named CEX.IO, Revolut, Copper, Globalblock and Moneybrain as companies in the crypto space allowed to operate in the country in addition to the 34 registered crypto asset firms the FCA has approved since August 2020. The FCA said on March 30 that it would be extending the temporary registration status for “a small number of firms where it is strictly necessary,” which included 12 companies at the time. In the United Kingdom, firms permitted to “carry out crypto ...

Treasury Secretary hints at regulatory framework to address potential risks in digital asset markets

United States Treasury Secretary Janet Yellen listed stablecoins as one of the major policy concerns in the digital asset space for regulators, currently subject to “inconsistent and fragmented oversight.” Speaking to attendees at American University in Washington, D.C. on Thursday, Yellen said the Treasury Department was working with Congress to advance legislation to help ensure that “stablecoins are resilient to risks” for consumers and the U.S. financial system. According to the Treasury Secretary, while stablecoins raised “policy concerns” and issues around the coins’ reserve assets, many parts of the digital asset space present potential risks that could exacerbate inequality. “Our regulatory frameworks should be designed to support responsible innovation while managing risks and esp...

Toomey drafts bill to exempt stablecoins from securities regulations

Republican Senator Pat Toomey, the ranking member for the Senate Banking Committee, has drafted a bill proposing a regulatory framework for stablecoins in the United States. According to a draft released Wednesday, the Stablecoin Transparency of Reserves and Uniform Safe Transactions Act, abbreviated as the Stablecoin TRUST Act, proposed that the digital assets be identified as “payment stablecoins” — a convertible virtual currency used as a medium of exchange that can be redeemed for fiat by the issuer. Critically, the bill proposed that such offerings should be exempt from securities regulations by amending existing laws to ensure the definition of “security” does not include a payment stablecoin. The legislation also proposed that stablecoin issuers — which would include national t...