Latin America

Coldplay Announce Latin American Tour Dates with Camila Cabello

Coldplay have expanded their “Music of the Spheres World Tour” with new dates in Peru, Chile, and Brasil. Notably, Coldplay’s September shows in Lima, Peru and Santiago, Chile will feature support from Camila Cabello. In October, Coldplay will play gigs in Rio de Janeiro and São Paulo, Brasil with H.E.R. But before all that, Coldplay will kick off the North American leg of their “Music of the Spheres World Tour” starting in early May with stadium shows in Texas, Arizona, and California. Further dates are scheduled in Chicago, D.C., New York, Philadelphia, Atlanta, and Tampa. Coldplay will then spend the summer touring Europe. Advertisement Related Video Check out Coldplay’s updated tour schedule below, and grab tickets via Ticketmaster. Coldplay are touring behind their latest album, Music...

Coinbase to reportedly buy the $2.2B Brazilian unicorn behind Mercado Bitcoin

Coinbase is set to continue its global acquisition strategy, reportedly buying the Brazilian company 2TM, the parent company of Mercado Bitcoin. According to information from Estadão, the third-largest newspaper read by Brazil’s 212 million populace, the Coinbase acquisition could be complete by next month. Negotiations for the purchase have been taking place over the course of 2022. Mercado Bitcoin is Latin America’s largest crypto brokerage, whose parent company, 2TM cemented its unicorn status as a billion-dollar company in 2021. Valued at $2.2 billion, 2TM has also pursued an acquisition strategy, particularly in lusophone countries. 2TM’s Mercado Bitcoin snapped up Portuguese CriptoLoja, a Lisbon-based crypto exchange in January. The 2TM holding company umbrella now covers ...

Bitcoin is ‘not regulated’ — Honduras’ central bank pushes back against legal tender rumors

The Central Bank of Honduras, or BCH, addressed rumors regarding the country potentially adopting Bitcoin as legal tender like its neighbor El Salvador — and the answer seems to be negative. In a Wednesday statement, Honduras’ central bank said “for the time being” Bitcoin (BTC) was not regulated in the country and not recognized as legal tender in many others. The BCH reiterated its authority under Honduras’ constitution that it was the only authorized “issuer of banknotes and coins” considered to be legal tender in the country. “BCH does not supervise or guarantee operations carried out with cryptocurrencies as means of payment,” said the central bank, according to a translated statement. “Any transaction carried out with these types of virtual assets is the responsibility an...

14% of Salvadoran businesses have transacted in BTC: Chamber of Commerce

Businesses in El Salvador have been slow to adopt Bitcoin (BTC) ever since the country famously recognized the digital asset as legal tender in September 2021, according to a recent survey by the Salvadoran Chamber of Commerce. Of the 337 companies polled between Jan. 15 and Feb. 9, only 14% said they had transacted in BTC since the Bitcoin Law came into effect. Over 90% of the companies indicated that Bitcoin adoption in the country had little impact on their sales. Seventy-one percent of the companies polled were micro or small businesses, 13% classified as medium-sized enterprises and 16% were large companies. While the low adoption rate may appear underwhelming at the surface, El Salvador has been on the U.S. dollar standard since 2001. Unlike the currencies of other emerging eco...

Crypto education can bring financial empowerment to Latin Americans

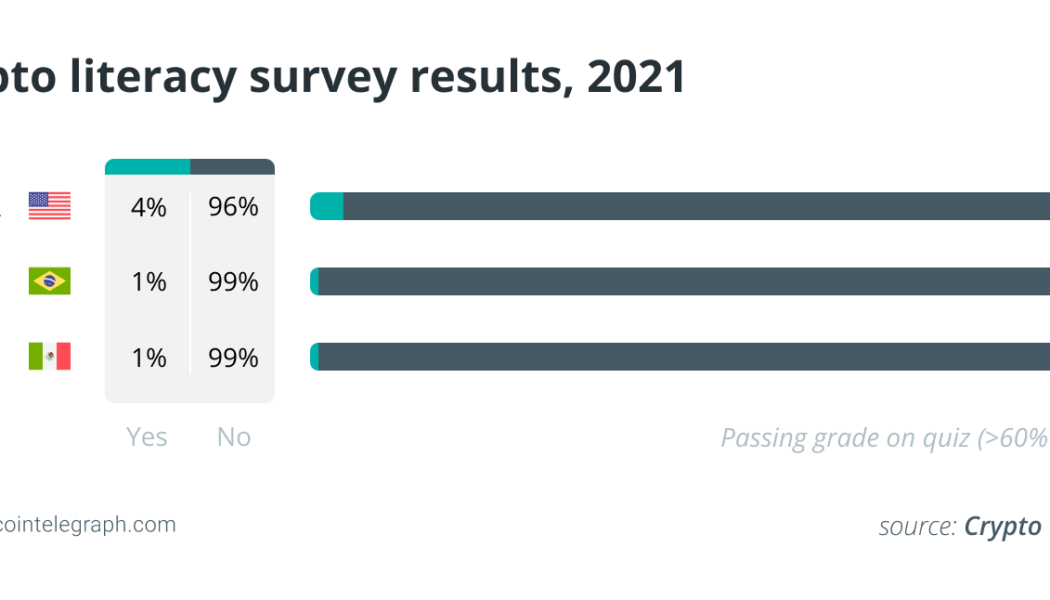

In October 2021, it was estimated that approximately 15% of the world’s supply of Bitcoin (BTC) was in circulation in Latin America. According to a recent report released by Crypto Literacy, however, 99% of Brazilian and Mexican respondents failed a basic assessment on crypto literacy. Crypto adoption is well underway across the region — on the rise even — but, people still lack a basic understanding of its underlying technology and use cases. When this lack of basic crypto literacy is considered in the context of developing markets across Latin America, where the use cases for blockchain technologies hold real significance, it becomes a serious concern. Latin American populations who lack crypto literacy risk missing out on stablecoins that can offer protection against Latin America...

NFTs, payments and conferences: Crypto in Latin America in 2021

In 2021, Latin America saw a soaring rise in crypto adoption among the 20 countries and 14 dependencies that make up the region. A slew of conferences, associations, new regulations and nonfungible token (NFT) projects as well as the global bull market made last year an intriguing one for the region. Let’s take a look at some of the most interesting developments in the blockchain and cryptocurrency ecosystem in Latin America in 2021. Colombian financial firms partner with crypto exchanges Early in 2021, the Financial Superintendence of Colombia authorized several partnerships between banking institutions licensed in the nation’s financial system and cryptocurrency exchanges. The nine partnerships included major names from the cryptocurrency industry such as Binance and Tyler and Cameron Wi...

P2P payments spurred crypto adoption across Venezuela in 2021

For Venezuela, 2021 has been a year of considerable changes at the microeconomic level, where even more than in 2020, the results of powerful catalysts for change such as COVID-19 were clearly visible. In a more dynamic economy with a higher volume of operations with foreign currencies, cryptocurrencies played a key role during this year for the South American country. In this review, we’ll take a look at the highlights of the Venezuelan crypto ecosystem in 2021 including related areas such as trading, play-to-earn (P2E) games, fintech, mining, regulation and nonfungible tokens (NFTs). More people accepting cryptocurrencies According to blockchain analysis firm Chainalysis, Venezuela ranks seventh in the Global Cryptocurrency Adoption Index 2021 thanks in large part to pe...

Does the IMF have a hidden script for El Salvador’s Bitcoin play?

On Jan. 25, the International Monetary Fund’s (IMF) directors asked El Salvador to “narrow the scope” of its Bitcoin Law by “removing Bitcoin’s legal tender status.” Adopting a cryptocurrency as the Central American country has done “entails large risks for financial and market integrity, financial stability and consumer protection,” the fund wrote. Why did the IMF ask El Salvador to effectively pull the plug on its cryptocurrency experiment? Surely this small country — ranked 104th globally in gross domestic product (GDP) — is no threat to the international bank’s balance sheet. Moreover, 70% of El Salvador’s populace is unbanked, and one-fifth of its GDP is from United States remittances. Arguably, it could profit from Bitcoin’s (BTC) use. Then again, it’s only been half a year since El ...

El Salvador buys its cheapest 410 Bitcoin as prices reach $36K

The Central American country of El Salvador has added 410 Bitcoin (BTC) to its central reserve as BTC prices trade below $37,000, a price last seen on July 26, 2021. The fresh addition to El Salvador’s BTC reserve was announced by President Nayib Bukele who confirmed that the purchase of 410 BTC was made against $15 million, placing the price at approximately $36,585 per BTC. Nope, I was wrong, didn’t miss it. El Salvador just bought 410 #bitcoin for only 15 million dollars Some guys are selling really cheap ♂️ https://t.co/vEUEzp5UdU — Nayib Bukele (@nayibbukele) January 21, 2022 El Salvador adopted BTC as a legal tender on September 7, 2021, as a means to overcome catastrophic inflation amid the weakening spending power of the nation. Fast forward to today, th...

2021: A year of mass adoption for cryptocurrencies in Brazil

Throughout 2021, the Brazilian cryptocurrency market managed to distance itself from the police pages and finally win acceptance with the general public, whether in the financial market or even in the greatest national passion: soccer. Last year, Bitcoin (BTC) acted as a strong alternative to the Brazilian real that ended 2021 by breaking negative records and reaching a devaluation of 6.5% by December, making it the 38th worst currency in the world. In a year of ups and downs for Bitcoin, the biggest cryptocurrency hit a bottom of 167,000 real in January and soared along with global markets to 355,000 real in May. Faced with Bitcoin’s dip, the BRL/BTC pair was stuck below 200,000 reals until August, when it began to rise to a new historic high of 367,000 real on Nov. 8. Faced with the need...