Latin America

Argentina’s province to issue US dollar-pegged stablecoin

The province of San Luis in Argentina approved a legislation allowing the issuance of its own stablecoin pegged to the United States dollar. The token, dubbed the “Activo Digital San Luis de Ahorro”, will be available to all citizens of the province over the age of 18 and 100% collateralized in liquid financial assets of the province. The bill authorizes the province to issue the stablecoin up to 2% of its annual budget. It also stipulates that assets can be transferred between parties, but it does not specify which chain will be used for the transactions. The province of San Luis is home to over 430,000 people. The stablecoin issuance is only one of the initiatives described in the bill called “Financial Innovation for Investment and Social Economic Development”, which a...

Brazilian crypto industry gets regulatory clarity amid global uncertainty

As the global crypto community is still licking its wounds from the FTX collapse, a liquidity crisis continues to spread around centralized exchanges and decentralized finance (DeFi) alike. It is soon to be decided whether the coming regulation triggered by FTX’s bankruptcy will bring a silver lining to crypto. The Chamber of Deputies of Brazil, the lower house of the country’s federal legislative body, has passed a regulatory framework that legalizes the use of cryptocurrencies as a payment method within the country. It is estimated that 10 million Brazilians, or about 5% of the population, trade crypto assets. The largest centralized exchange in Brazil is a local business called Mercado Bitcoin, with roughly three million users. International players like Coinbase or Gemini do not ...

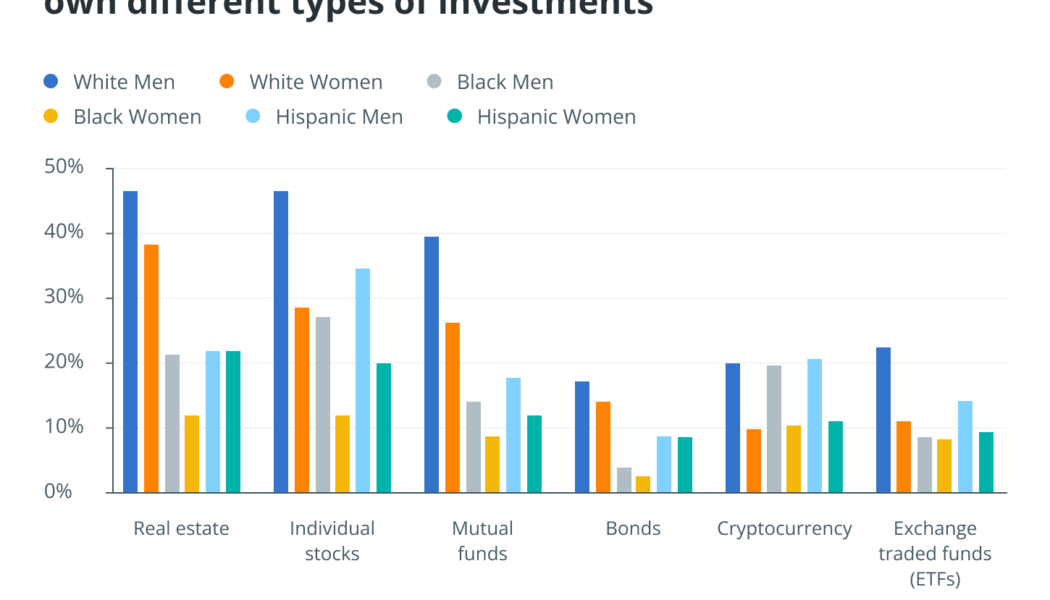

Web3 projects focus on education to bring Latin American women to the sector

Interest in Web3 continues to grow despite the crypto bear market. A recent article from McKinsey noted that venture capital investments in Web3 exceeded $18 billion during the first half of 2022. Findings from Cointelegraph Research also show that Web3 attracted the most interest from venture capitalists in comparison to other blockchain sectors during Q2 of this year. While notable, a lack of diversity has become apparent within the Web3 sector. For instance, it was found that only 16% of nonfungible token (NFT) creators are women. Although this number is low, women are taking an interest in owning digital assets. Given this, industry experts believe that a lack of education around Web3 is creating a barrier to entry for women, especially for those who are from underrepresented reg...

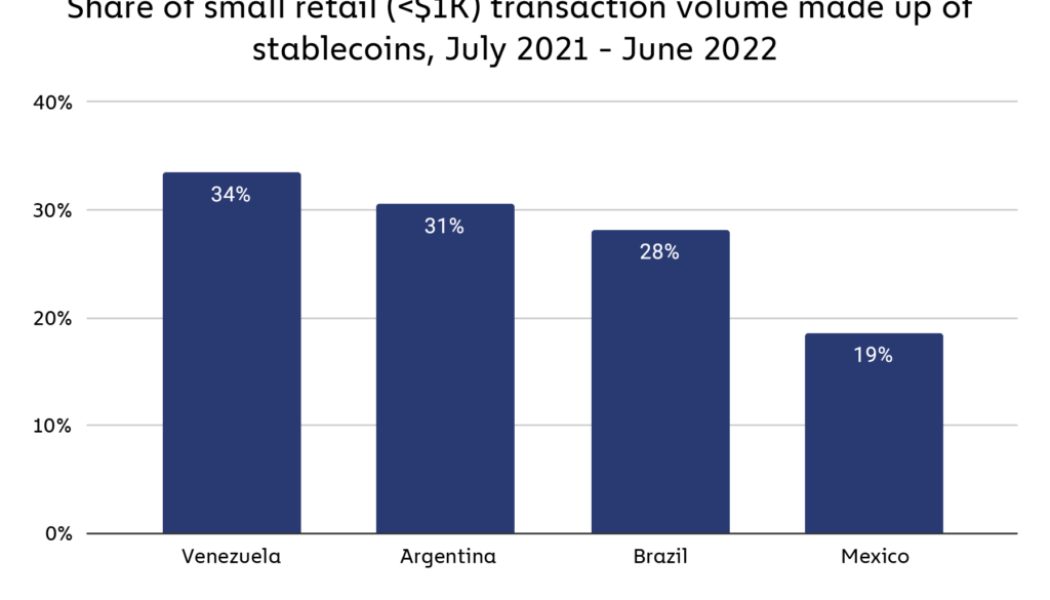

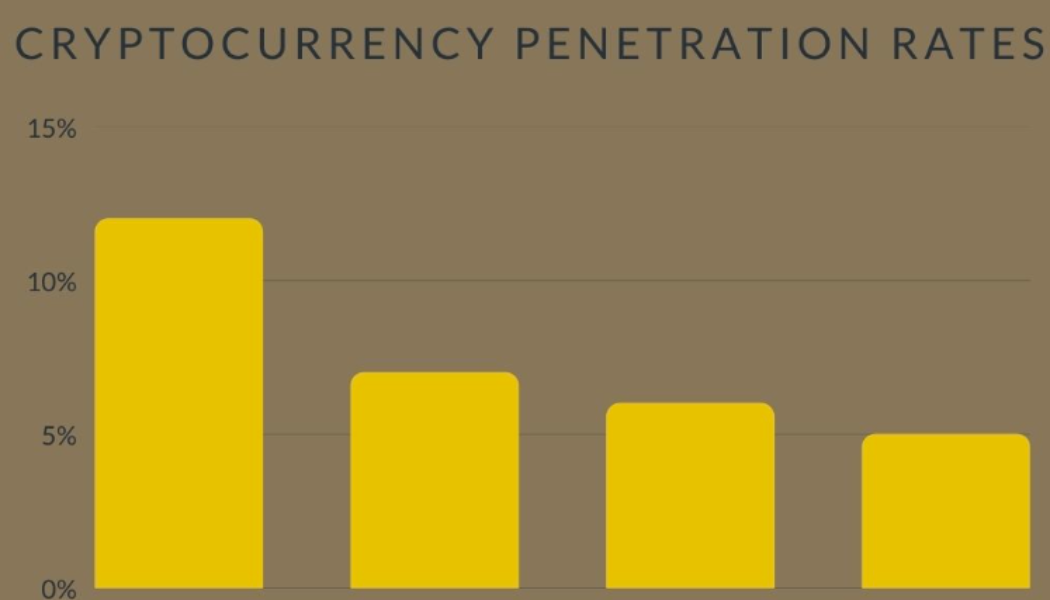

Remittances drive ‘uneven, but swift’ crypto adoption in Latin America

Remittance payments, fiat fears, and profit-chasing have been the three most significant drivers of crypto adoption in Latin America, according to a new report. The seventh-largest crypto market in the world saw the value of cryptocurrencies received by individuals rocket 40% between July 2021 to June 2022, reaching $562 billion, according to an Oct. 20 report from Chainalysis. Part of the surge was attributed to remittances, with the region’s overall remittance market estimated to have reached $150 billion in 2022. Chainalysis noted that crypto-based service adoption was “uneven, but swift.” The firm pointed to one Mexican exchange operating in the “world’s largest crypto remittance corridor” which processed over $1 billion in remittances between Mexico and the Unite...

Latin America is ready for crypto — just integrate it with their payment systems

Thriving on exploiting users’ data, Web2 monopolies like Facebook and Google have ushered in an era of massive internet centralization in recent years. This concentration of power has enabled huge shares of communication and commerce closed platforms, giving users little control over how their data is collected. An emerging concept, Web3, will provide a means to pivot from centralization to an open-source internet. A recent report from Andreessen Horowitz (a16z) found that this new digital economy could reach an astounding 1 billion users by 2031. If executed correctly, the decentralized internet will allow users to take control of their data and content. While Web3 promises to radically change the internet and its ability to provide value to users worldwide, key hurdles must be overcome b...

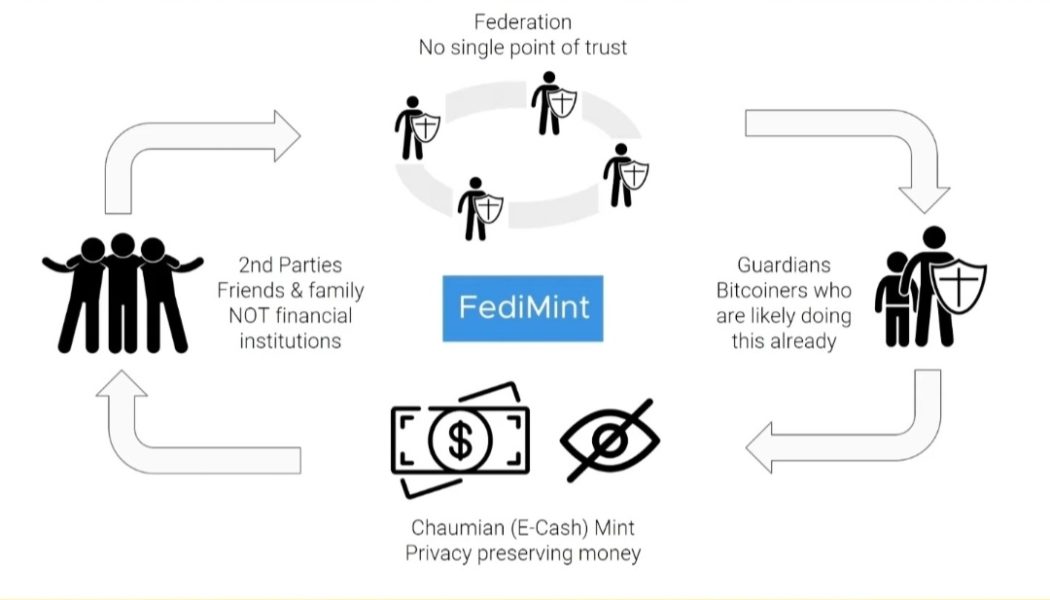

Bitcoin is for billions: Fedimint on scaling BTC in the global south

“Bitcoin is for billions, not billionaires,” a phrase first coined by investment researcher Lyn Alden, could soon become a reality, according to Fedimint. The protocol that aims to scale Bitcoin (BTC) while making it more private, has been buoyed by a $4.2 million seed round for the Fedi application. Cointelegraph spoke to Obi Nwosu, co-founder and CEO of Fedi, about the “incredible group of inspiring people who we are working with to support their activities to increase the freedoms of some of the most oppressed regions of the world,” and why the mobile app Fedi could solve issues related to scaling, custody and privacy. Lyudmyla Kozlovska, head of the Open Dialogue Foundation — which focuses on supporting people in post-soviet Europe — Farida Bemba Nabourema, a Togolese human right...

Reserve Rights (RSR) builds momentum ahead of its long-awaited mainnet launch

Bitcoin was created to give the average person a peer-to-peer economic system and a store of wealth asset that could provide financial autonomy and access to banking, especially for people living in places where financial services are sparse or non-existent. In the last five years, there have been a number of blockchain projects that aim to mirror Bitcoin’s original mission and the growing popularity of stablecoins further highlights the need for alternative financial models. One project that is beginning to see a bit of momentum is Reserve Rights (RSR), a dual-token stablecoin platform comprised of the asset-backed Reserve Stablecoin (RSV) and the RSR token which helps to keep the price of RSV stable through a system of arbitrage opportunities. Data from Cointelegraph Markets Pro an...

Argentines turn to Bitcoin amid inflation worries: Report

Since 2016, Argentina has been engaged in a war against inflation. Caused by multiple factors, like a lack of trust in the central bank or government overspending, the depreciation of the Argentinean peso has negatively impacted citizens’ purchasing power. This has brought 37.3% of the population under the poverty line, and many others have had their savings vanish into thin air. Against this backdrop, many Argentines have turned to Bitcoin (BTC) and crypto as a way to hedge against 60% inflation, despite the market being in the red for several months and the central bank forbidding financial institutions from operating with digital assets. Related: Argentina’s central bank steps in to block new crypto offerings from banks In an Americas Market Intelligence report cited by Reute...

Panama’s president says he won’t sign crypto bill into law ’at this moment’

Laurentino Cortizo, the president of Panama, has said he won’t sign off on a crypto bill recently approved by the country’s National Assembly without additional Anti-Money Laundering rules. Speaking at the Bloomberg New Economy Gateway Latin America conference on Wednesday, Cortizo said the bill recently passed by Panama’s legislature must go through legal checks before reaching his desk, but added he needed more information before potentially signing it into law. Describing the legislation as an “innovative law” and a “good law,” the president said he approved of certain aspects of the bill but hinted at possible illicit uses of cryptocurrencies that needed to be addressed. “I will not sign that law at this moment,” said Cortizo. “If the law has clauses related to money laundering activit...

Law Decoded: The difference between New York City and New York State, April 25-May 2

Last week, New York dominated crypto media headlines in very different ways. In New York State, the local Assembly voted in favor of the bill that would ban for two years any new mining operations that rely on proof-of-work (PoW) consensus mechanisms and use fossil fuel-generated energy. A temporary moratorium, which could be extended after the state’s Department of Environmental Conservation provides its assessments of the industry’s carbon footprint, marks the first major legislative attack on PoW mining on environmental grounds in the United States. The push mobilized the community — after digital asset advocacy groups rang the alarm on Twitter. Then, proponents of the ban had to endure three hours of a heated debate to narrowly pass the draft. There’s hope for an even tighter fig...

The world doesn’t need banks, policymakers or NGOs — It needs DeFi

Where I grew up, on the southern border in Texas, a tremendous number of people have come to the United States to work and send money back home. They don’t make much money, but they pay considerable fees on their transfers. Their focus is not on getting rich, but on supporting those back home in their native country. They support their families as they do hard labor day in and day out. It costs them too much to do so. Truth be told, my father was a migrant worker. He picked fruit in the fields. We sent money back to our family in Mexico. But the remittance providers chipped away at what little money he was able to make so that they had no hope of achieving the American Dream and prospering. The world needs DeFi due to corruption. Big governments and international corporations are controlle...

Top Latin America delivery app to accept crypto

Rappi, the most popular delivery service in Latin America, is working with Bitso and Bitpay to accept Bitcoin (BTC) and other cryptocurrency payments. As reported by Cointelegraph Brazil, Rappi is integrating with Bitso and Bitpay through a trial project in Mexico. However, it’s unclear whether the pilot plan will also enable access to the service in Brazil and other Latin American countries. In Mexico, Rappi, a Colombian delivery app with operations in nine Latin American countries, has launched a crypto payments pilot program. Customers will be able to convert crypto into credits that can subsequently be used to complete purchases on Rappi’s platform. — Crypto Goddy (@CryptoGoddy) April 12, 2022 Sebastián Mejia, the co-founder and president of Rappi, noted that cryptocurrenci...