KYC

Edge announces confidential no-KYC digital currency Mastercard

On Wednesday, self-custody crypto exchange Edge announced a no-Know Your Customer (KYC) debit Mastercard that can be funded with Bitcoin and other digital currencies. Without KYC verification, users would be able to spend their crypto at more than 10 million merchant terminals in the United States. Currently, one can fund the Edge Mastercard using Bitcoin (BTC), Bitcoin Cash (BCH), Dogecoin (DOGE), Litecoin (LTC) and Dash (DASH) directly from the Edge app. In a statement to Cointelegraph, representatives at Edge say that the card is compliant with Anti-Money Laundering and Counter-Terrorism Financing regulations because of a $1,000 daily spending limit on the card (approx. $30,000 monthly). In addition, the card is only available for use at U.S. merchant terminals. Paul Puey, a co-founder ...

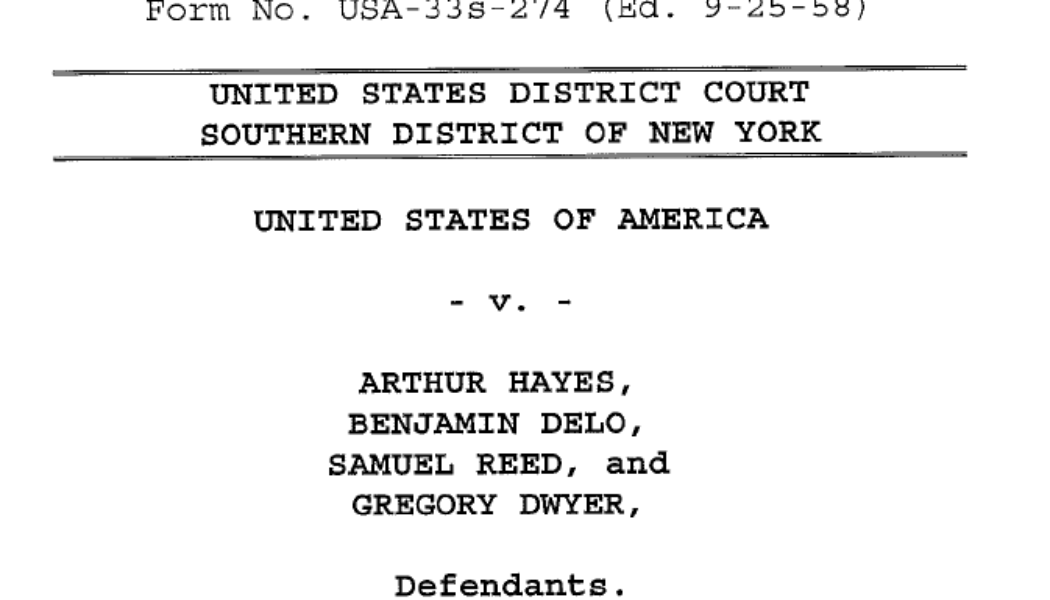

Arthur Hayes to serve 2-year probation owning up to BitMEX’s AML mishap

Bringing closure to the long-awaited judgment related to the money laundering activities over the BitMEX crypto exchange, one of the four federal district courthouses in New York reportedly sentenced two-year probation and six months of home detention to founder and ex-CEO Arthur Hayes. Arthur Hayes, along with the other BitMEX co-founders — Benjamin Delo and Samuel Reed — and the company’s first non-employee Gregory Dwyer, pleaded guilty to the Bank Secrecy Act (BSA) violations on Feb 24, admitting to “willfully failing to establish, implement and maintain an Anti-Money Laundering (AML) program at BitMEX.” Indictment against BitMEX co-founders and employees for violating BSA. Source: Justice.gov Pleading guilty to supporting money laundering is a punishable offense, often carrying a ...

Crypto mixers’ relevance wanes as regulators take aim

Cryptocurrency mixers have been an interesting topic of discussion ever since the advent of cryptocurrencies and their adoption by retail investors around the world. Cryptocurrency mixers are services that essentially focus on one feature of a blockchain network: privacy. Cryptocurrency mixers, also known as tumblers, provide anonymity so no one can trace the sender or receiver of a transaction. This can help protect the identity of individuals who want to be completely anonymous and non-traceable. How cryptocurrency mixers work is that they break down the funds sent using the mixer and scramble them with other transactions. They break the link which associates the holder’s identity to the crypto they own. A process used to anonymize cryptocurrency transactions is known as Coin...

Privacy coins are surging. Will regulatory pressure stall their stellar run?

Recent weeks saw a massive surge of the so-called privacy coins’ prices — namely Monero (XMR), Dash (DASH), Zcash (ZEC) and Haven Protocol (XHV). As many other cryptocurrencies and the industry at large faced immense regulatory pressure amid the war in Ukraine, one narrative that began taking hold in the crypto space was the potential of such privacy-enhancing assets to provide investors a greater level of financial anonymity. But, can privacy coins deliver on Bitcoin’s (BTC) original promise? A good month for privacy-focused assets Over the past month, Monero has almost doubled its tally. With some minor oscillations, it rose from $134 on Feb. 24 to over $200 on March 26. ZEC showed even more impressive dynamics that hiked from $88 to $202 over the same period. DASH also pulled off ...

Yuga Labs faces user backlash for under wraps KYC-restricted project

Yuga Labs, the creator of the Bored Ape Yacht Club, or BAYC, teased a new collaboration with blockchain game publisher Animoca Brands on Twitter on Thursday. The catch is that no details about the project have been revealed yet, and users who signed up for it via a Know Your Customer, or KYC, verification process have expressed their concerns on social media. BAYC simply tweeted out a link to a website where interested fans can apply in the hope of being approved to participate in whatever “is brewing.” To apply, users must connect to an Ethereum wallet, provide a photo of their license, passport or other ID as well as proof of their home address, and take a headshot on the camera of the device on which they sign up. fuck it, again.https://t.co/1KlPpVjWkb — Bored Ape Yacht Club...

Are crypto and blockchain safe for kids, or should greater measures be put in place?

Crypto is going mainstream, and the world’s younger generation, in particular, is taking note. Cryptocurrency exchange Crypto.com recently predicted that crypto users worldwide could reach 1 billion by the end of 2022. Further findings show that Millennials — those between the ages of 26 and 41 — are turning to digital asset investment to build wealth. For example, a study conducted in 2021 by personal loan company Stilt found that, according to its user data, more than 94% of people who own crypto were between 18 and 40. Keeping children safe While the increased interest in cryptocurrency is notable, some are raising concerns regarding the ways those under the age of 18 are interacting with digital assets. These challenges were highlighted in UNICEF’s recent “Prospects for children in 202...

What is the importance of blockchain in the RegTech ecosystem?

Financial regulators and service providers are looking for the best and most cost-effective solutions to help the banks and other financial institutions comply with the rules and do business in a compliant regulatory environment. As blockchain is already disrupting the conventional ways of doing businesses, thanks to its benefits in terms of enhanced transparency, faster procedures, decentralized and most importantly, cost-effective nature. In essence, blockchain provides the solutions for the existing problems faced by financial institutions in terms of Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. As the transactions in the blockchain system are immutable, they cannot be changed and altered, providing transparency regarding AML and KYC compliance. Customer onboard...

Singaporean megabank DBS works on expanding Bitcoin trading to retail

DBS Bank, Singapore’s largest bank, is working on expanding its cryptocurrency exchange beyond its current investor base of institutional clients, according to the CEO. DBS Bank CEO Piyush Gupta spoke of the bank’s cryptocurrency business during the Q4 2021 earnings call on Monday, stating that the company will focus on measures to further scale its crypto exchange operations in 2022. During the call, Gupta was asked whether DBS Bank has a roadmap for rolling out digital asset trading to retail investors. While the CEO did not provide a straightforward answer, he still said that DBS Bank did initiate some work in order to expand its current investor base, stating: “We’ve started doing the work on seeing how we get in a sensible way, take it out and expand it beyond the current investo...

Laundering via digital pictures? A new twist in the regulatory discussion around NFTs

On Feb. 6, the United States Department of the Treasury released a report under the headline “Study of the facilitation of money laundering and terror finance through the trade in works of art.” In fact, only a tiny fraction of the 40-page document is dedicated to the “Emerging Digital Art Market,” by which the department understands the market for nonfungible tokens, or NFTs. Still, even a brief mention of the emerging NFT space in this context can have major implications for the tone of the nascent regulatory debate with regard to the asset class. What the report said The overall tone of the report is hardly alarming for the NFT space: The document casually mentions the growing interest in the digital art market both from private investors and legacy institutional players such as a...

Are NFTs an animal to be regulated? A European approach to decentralization, Part 1

Nonfungible tokens (NFTs) are constantly in the news. NFT platforms are springing up like mushrooms and champions are emerging, such as OpenSea. It is a real platform economy that is emerging, like those in which YouTube or Booking.com gained a foothold. But it is a very young economy — one that is struggling to understand the legal issues that apply to it. Regulators are starting to take an interest in the subject, and there is risk of a backlash if the industry does not regulate itself quickly. And, as always, the first blows are expected east of the Atlantic. In this first article devoted to the legal framework of NFTs, we will focus on the application of the digital asset regime and financial law to NFTs in France. In a second article, we will come back to the issues of liability and c...

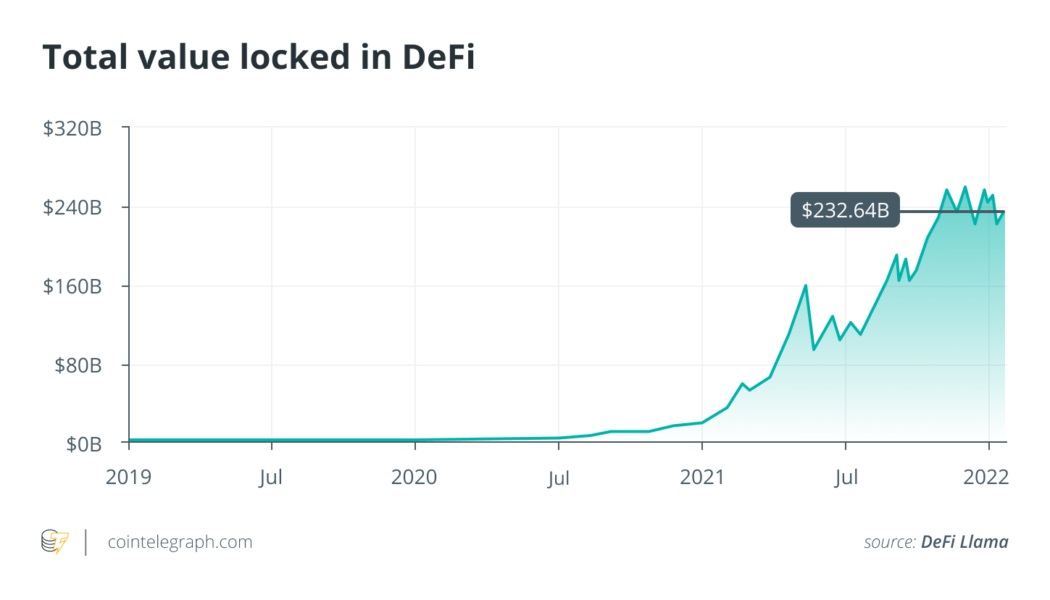

How should DeFi be regulated? A European approach to decentralization

Decentralized finance, known as DeFi, is a new use of blockchain technology that is growing rapidly, with over $237 billion in value locked up in DeFi projects as of January 2022. Regulators are aware of this phenomenon and are beginning to act to regulate it. In this article, we briefly review the fundamentals and risks of DeFi before presenting the regulatory context. The fundamentals of DeFi DeFi is a set of alternative financial systems based on the blockchain that allows for more advanced financial operations than the simple transfer of value, such as currency exchange, lending or borrowing, in a decentralized manner, i.e., directly between peers, without going through a financial intermediary (a centralized exchange, for example). Schematically, a protocol called a DApp (for decentra...

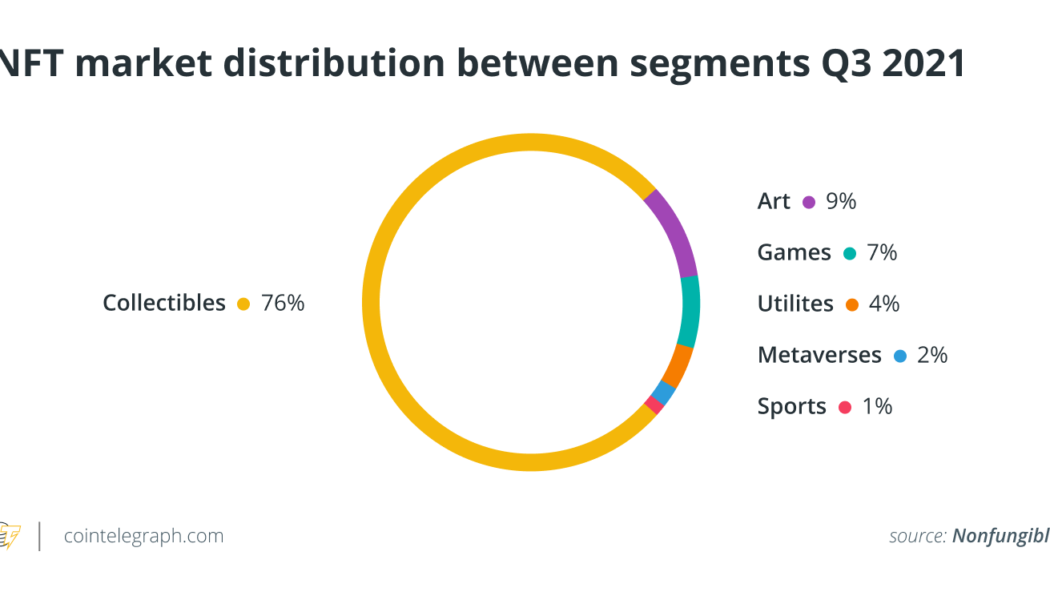

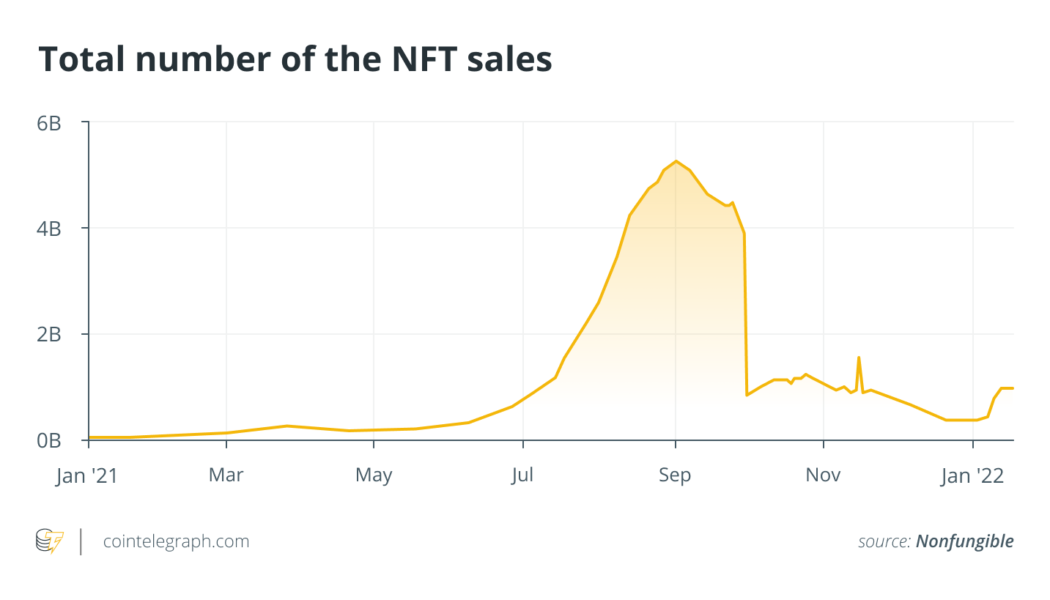

NFTs and compliance: Why we need to be having this conversation

“Good people do not need laws to tell them to act responsibly, while bad people will find a way around the laws.” — Plato The above quote has withstood the test of time. Across industries, markets, communities and ideas, people ultimately will find a way to either do good or at worse, wrong. Nonfungible tokens (NFTs) and crypto are certainly no exception to the rule. The industry is exploding — overflowing even — with endless drops, jaw-dropping floor prices and adoption across ever-expanding corners of culture. NFTs are moving forward at breakneck speed, and the money is there. According to data from market tracker DappRadar, NFT sales skyrocketed to $10.7 billion in the third quarter of 2021, up more than 8x from the previous quarter. That’s a lot of Apes and Penguins. Creators, br...