KYC

Crypto scammers are using black market identities to avoid detection: CertiK

Crypto scammers have been accessing a “cheap and easy” black market of individuals willing to put their name and face on fraudulent projects — all for the low price of $8, blockchain security firm CertiK has uncovered. These individuals, described by CertiK as “Professional KYC actors” would, in some cases, voluntarily become the verified face of a crypto project, gaining trust in the crypto community prior to an “insider hack or exit scam.” Other uses of these KYC actors include using their identities to open up bank or exchange accounts on behalf of the bad actors. According to a Nov. 17 blog post, CertiK analysts were able to find over 20 underground marketplaces hosted on Telegram, Discord, mobile apps, and gig websites to recruit KYC actors for as low as $8 for simple “gigs” lik...

Crypto adoption via regulation: Setting rules for centralized exchanges

Centralized cryptocurrency exchanges have become the backbone of the nascent crypto ecosystem, making way for retail and institutional traders to trade cryptocurrencies despite a constant fear of government crackdowns and lack of support from policymakers. These crypto exchanges over the years have managed to put self-regulatory checks and implemented policies in line with the local financial regulations to grow despite the looming uncertainty. Cryptocurrency regulation continues to occupy mainstream debates and experts’ opinions, but despite public demand and requests from stakeholders of the nascent ecosystem, policymakers continue to overlook the rapidly growing sector that reached a market capitalization of $3 trillion at the peak of the bull run in 2021. Over the past five years...

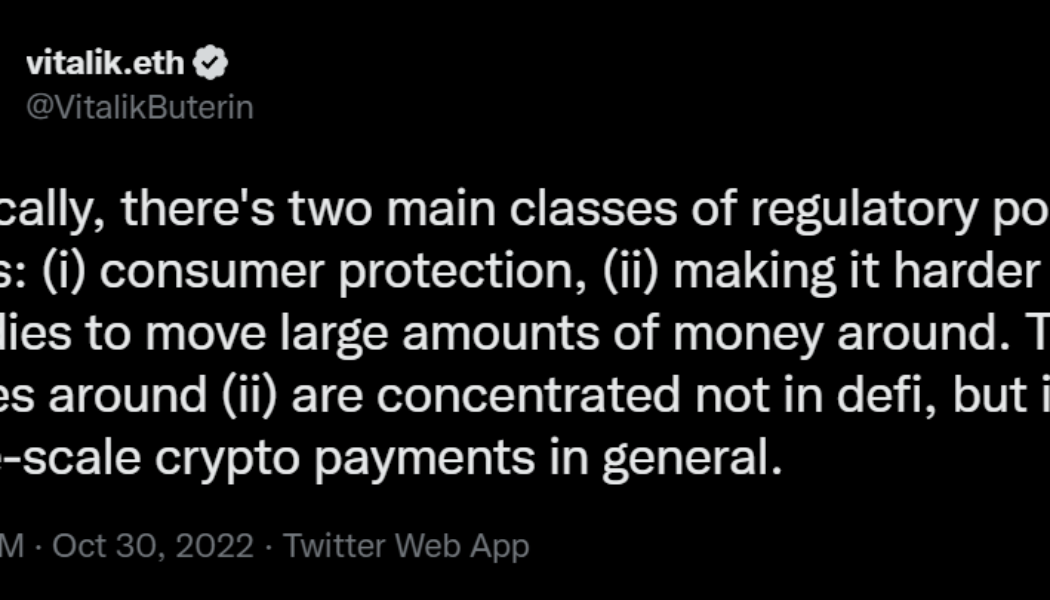

Vitalik Buterin ‘kinda happy’ with ETF delays, backs maturity over attention

The co-founder of Ethereum (ETH), Vitalik Buterin, believes that the crypto ecosystem needs to mature and be in tune with the regulatory policies that allow crypto projects to operate internally freely. Sharing his opinion around crypto regulations, Buterin spoke against the regulations that have an impact on the inner workings of a crypto ecosystem. Considering the current circumstances, he believed it was better to have regulations that allow inner independence to crypto projects, even if it hampers mainstream adoption. Buterin opined: “I’m actually kinda happy a lot of the exchange-traded funds (ETFs) are getting delayed. The ecosystem needs time to mature before we get even more attention.” The use of know-your-customer (KYC) on decentralized finance (DeFi) frontends was another ...

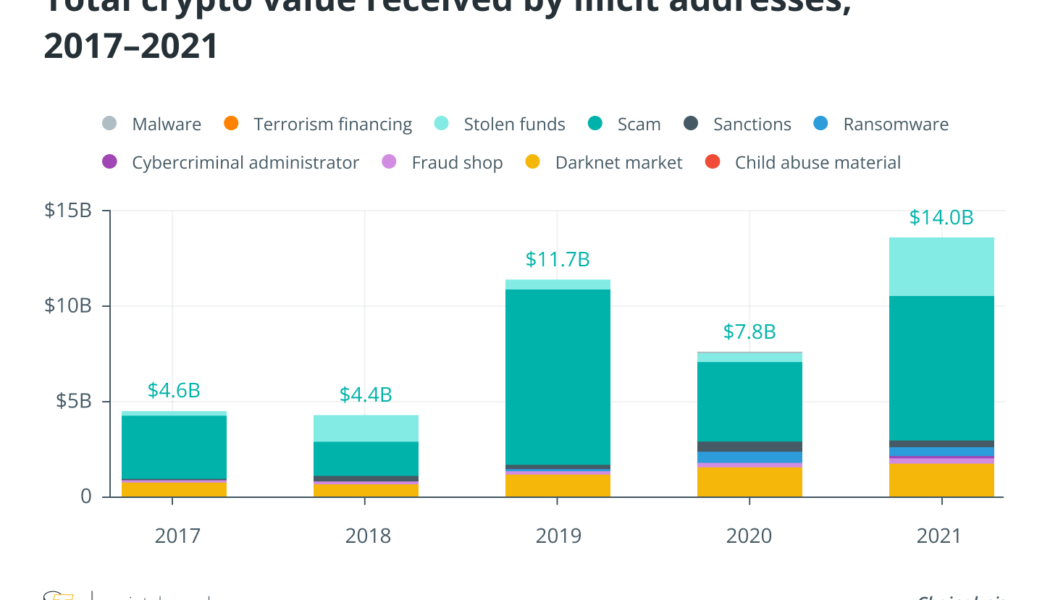

Institutional crypto adoption requires robust analytics for money laundering

Institutions have begun to take crypto seriously and have entered the space in numerous ways. As noted in a previous analysis, this has resulted in banks and fintechs looking at custody products and services for their clients. However, as custodians of clients’ assets, banks must also ensure they are clean assets and stay compliant. This is where on-chain analytics solutions have a huge role to play in understanding patterns in transactions to identify money laundering and other spurious activities within the cryptocurrency and digital assets space. According to a report by Chainalysis, over $14 billion of illicit transactions took place in 2021. Therefore, it is critical to build the foundational infrastructure around Anti-Money Laundering (AML) to support the growing institutional ...

Are decentralized digital identities the future or just a niche use case?

As users take advantage of online services and explore the internet, they eventually create a digital identity. This type of identity is then tied to central entities like Google and Facebook, which make it easier to share data with new services through simple sign-in buttons. While these digital identity management systems are convenient, they are relying on centralized intermediaries that hold and control user data. Personal identifiers and attestations are in their hands, and they can decide — or be forced — to share this information with other parties. Blockchains offer a solution: decentralized digital identities. These allow individuals to manage information related to their identities, create identifiers, control who they’re shared with and hold attestations without relying on a cen...

Can the government track Bitcoin?

Apart from data analysis done alone or in cooperation with private companies, authorities may request information from centralized exchanges. Due to regulation, centralized exchanges may also be obligated to share such information. However, not all cryptocurrency exchanges collaborate with authorities. A centralized exchange is a cryptocurrency exchange that is run by a single entity, such as Coinbase. To become a licensed operator in a certain country or territory, centralized exchanges need to comply with regulations. For instance, to decrease cryptocurrency anonymity and the illicit use of cryptocurrencies, most centralized exchanges have incorporated Know Your Customer (KYC) checks. KYC is meant to verify customers’ identities alongside helping authorities to analyze activity...

Are Bitcoin transactions anonymous and traceable?

It can be difficult to track Bitcoin transactions when people use various wallets and Bitcoin mixers. These factors disrupt the search process and take up a lot of time. Despite the fact that it is challenging for users of a Bitcoin wallet to conduct transactions completely anonymously, there are several ways to get close to anonymity. For example, it is possible to use a cryptocurrency mixer. In this case, it is a Bitcoin mixer, which ensures that it is more difficult to make Bitcoin traceable. This is done by mixing BTC transactions from different people together in a pool, then sending the transactions to the intended addresses. In addition, wallets can also be very difficult to monitor. If someone does not want their activities on the Bitcoin network to be traceable, it is possible to ...

Georgia aims to adopt European crypto standards for Anti-Money Laundering

Georgia, one of the world’s most cryptocurrency-friendly countries, is moving to introduce new crypto regulations to pursue its ambitions to become a global crypto hub. Georgian lawmakers have prepared a new regulatory framework targeting digital business and cryptocurrency trading in the country, Georgian Minister of Economy and Vice Prime Minister Levan Davitashvili announced. Davitashvili said that a draft bill has been sent to the parliament and the amendments are expected to be passed in the autumn session, local news agency Business Media Georgia reported on Monday. According to the minister, the draft bill aims to coordinate local cryptocurrency laws with three major European Union directives, including the Payment Services Directive (PSD2), the Capital Requirements Directive (CRD) ...

Are non-KYC crypto exchanges as safe as their KYC-compliant peers?

Many see implementing Know Your Customer (KYC) tools in crypto as a deterrent to the Bitcoin (BTC) Standard, which has predominantly promoted anonymized peer-to-peer transactions. However, regulators stay put on promoting KYC and anti-money laundering (AML) implementations as a means to ensure investors’ safety and protection against financial fraud. While most crypto exchanges have begun implementing regulatory recommendations to remain at the forefront of crypto’s mainstream adoption, investors still have the choice to opt for crypto exchanges that promote greater anonymity by not imposing KYC processes. But does opting for the latter as an investor mean compromising on safety? A matter of trust Anonymity goes both ways in most cases. Owners of crypto exchanges running non-KYC (or ...

AML and KYC: A catalyst for mainstream crypto adoption

For Satoshi Nakamoto, the creator of Bitcoin (BTC), the motivation to create a new payment ecosystem from scratch in 2009 stemmed from the economic chaos caused by the banking sector’s over-exuberant and risky lending practices mixed accompanied by the bursting of the housing bubbles in many countries at the time. “And who do you think picked up the pieces after the fallout? The taxpayer, of course,” said Durgham Mushtaha, business development manager of blockchain analytics firm Coinfirm, in an exclusive interview with Cointelegraph. Satoshi recognized the need for a new monetary system based on equity and fairness — a system that gives back power into the hands of the people. A trustless system with anonymous participants, transacting peer-to-peer and without the need of a central ...

Indian law enforcement accuses WazirX exchange of aiding in laundering of $130M

India’s Enforcement Directorate (ED), the agency responsible for financial crimes, is looking at cryptocurrency exchanges suspected of processing transactions that sent more than 10 billion rupees, or about $130 million, from firms under investigation to international wallets. At least ten crypto exchanges are allegedly involved, according to an official who spoke to The Economic Times, and bank accounts of exchange WazirX have been frozen, the newspaper reported. Transactions of up to 1 billion rupees, or $1.3 million, were allegedly made in the names of people with no connections to the money by companies under investigation in a case involving instant loans. Thes companies often had ties to China. Even though Know Your Customer/Anti-Money Laundering (KYC/AML) procedures showed the trans...

BitMEX former executive pleads guilty to violating the Bank Secrecy Act

Another top executive joins three co-founders of the crypto exchange BitMEX, pleading guilty in the United States District Court for the Southern District of New York. The court case under the headline “U.S. v. Hayes et al.” goes on for two years, with BitMEX management being indicted for violating the U.S. Bank Secrecy Act. According to the Wall Street Journal, on Aug. 8, a one-time head of business development at BitMEX, Gregory Dwyer, admitted his guilt of violating the Bank Secrecy Act in court. As part of a plea deal, Dwyer would pay a $150,000 fine. As Manhattan Attorney Damian Williams commented on this development: “Today’s plea reflects that employees with management authority at cryptocurrency exchanges, no less than the founders of such exchanges, cannot willfu...