KuCoin Token

Top 5 cryptocurrencies to watch this week: BTC, FTT, XTZ, KCS, HNT

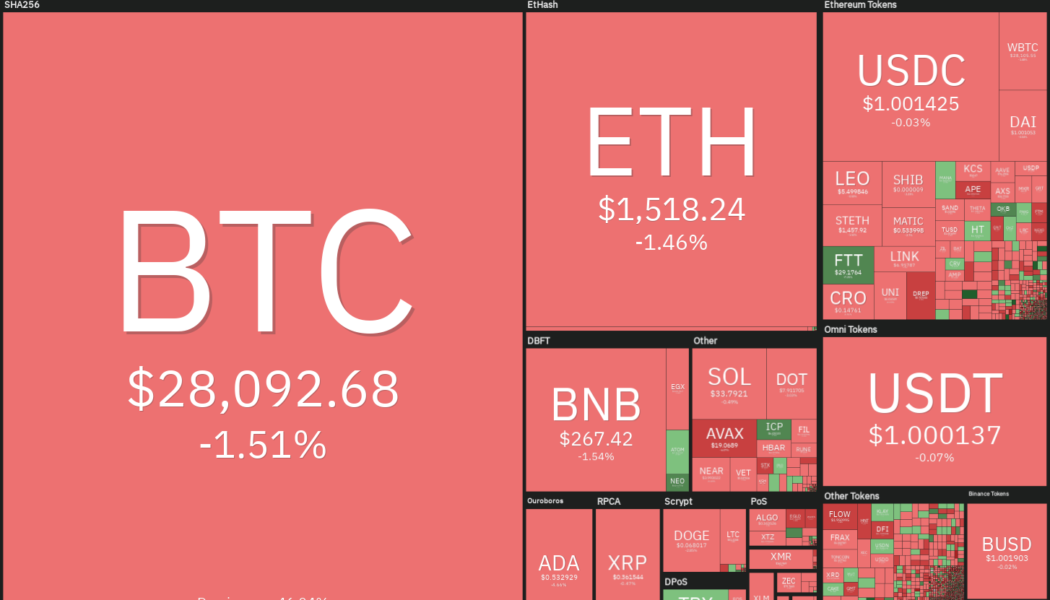

Bitcoin (BTC) is threatening to drop to its worst weekly close since December of 2020. The crypto markets are in are held firmly in a vice grip and the selling accelerated following a higher-than-expected inflation report from the United States on June 10. It is not only the crypto markets that are facing the brunt, even U.S. equities markets finished the week ending June 10 with sharp losses. Risky assets may remain volatile in the near term as traders await the outcome of the U.S. Federal Open Market Committee meeting on June 14 and June 15. Crypto market data daily view. Source: Coin360 Bloomberg Intelligence senior commodities strategist Mike McGlone warned that if the stock markets continue to drop, then it will signal that most assets may have seen their peak exuberance in the ...

Top 5 cryptocurrencies to watch this week: BTC, ETH, XTZ, KCS, AAVE

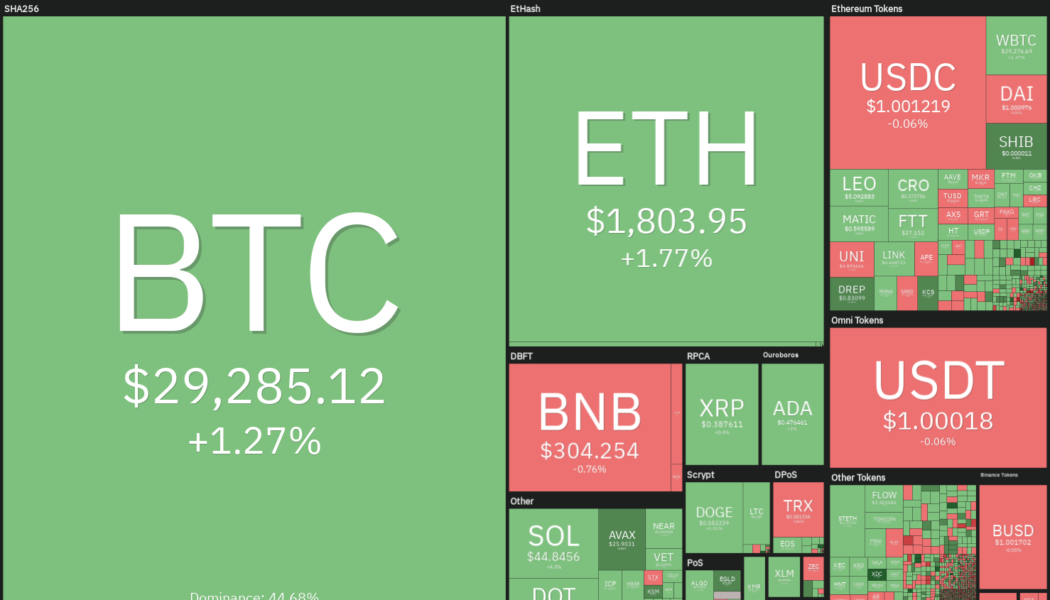

After declining for eight successive weeks, the Dow Jones Industrial Average rebounded sharply last week to finish higher by 6.2%. However, Bitcoin (BTC) has not been able to replicate the performance of the United States equities markets and is threatening to paint a red candle for the ninth week in a row. A positive sign is that Bitcoin whales have been buying the market correction. Glassnode data shows that the number of Bitcoin whale wallets with a balance of 10,000 Bitcoin or more has risen to its highest level since February 2021. The accumulation in the whale wallets suggests that their long-term view for Bitcoin remains bullish. Crypto market data daily view. Source: Coin360 Blockware Solutions highlighted that the Mayer Multiple metric which compares the 200-day simple moving aver...