Kraken

Crypto layoffs mount as exchanges continue to be ravaged by the prevailing bear market

There’s no denying that the crypto market has been gripped by immense bearish pressure over the past year, as made evident by the fact that the total capitalization of this sector has continued to hover below the $900 billion mark for most of the year after having scaled up to an all-time high of $3 trillion in 2021. These conditions have been characterized by many companies facing insolvency, as well as many of the world’s top exchanges laying off their staff in recent months. Moreover, the recent FTX debacle has set in motion a contagion effect that has continued to have a major effect on several crypto platforms, dissuading newer investors from entering the space in the process. Since Q2 2022, a host of prominent crypto entities (including many digital asset trading and lending platform...

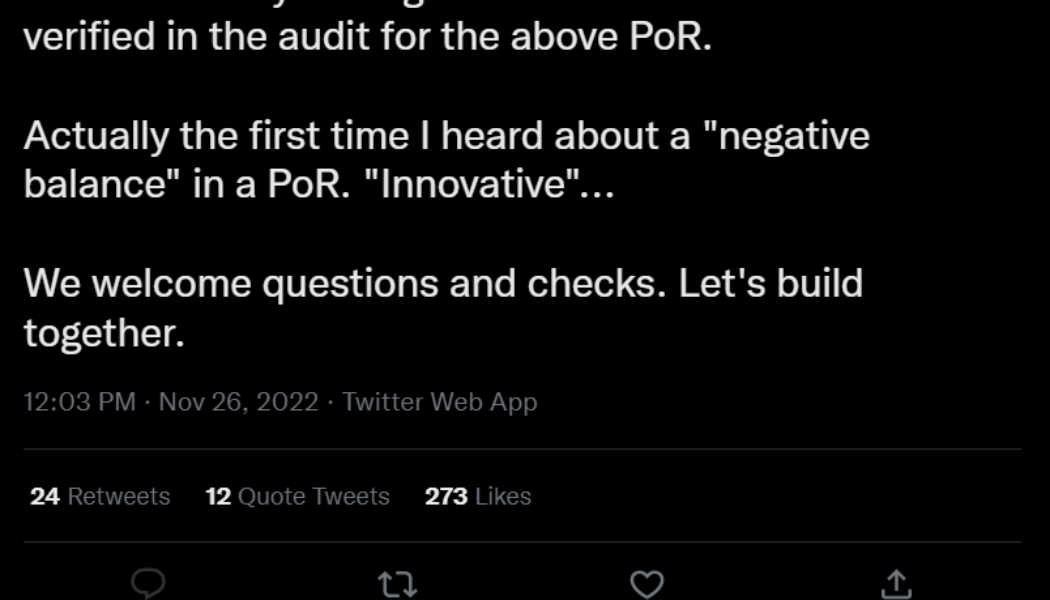

Binance proof-of-reserves is ‘pointless without liabilities’: Kraken CEO

Disclaimer: The article has been updated to reflect Binance CEO CZ’s response to the concerns raised by Kraken CEO Jesse Powell. The collapse of the crypto exchange FTX revealed the importance of proof-of-reserves in avoiding situations involving the misappropriation of users’ funds. While exchanges have proactively started sharing wallet addresses to prove the existence of users’ funds, several entrepreneurs, including Kraken CEO and co-founder Jesse Powell, called the practice “pointless” as exchanges fail to include liabilities. According to Powell, a complete proof-of-reserve audit must include the sum of client liabilities, user-verifiable cryptographic proof that each account was included in the sum and signatures proving the custodian’s control over the wallets. Whil...

US crypto exchanges lead Bitcoin exodus: Over $1.5B in BTC withdrawn in one week

Bitcoin (BTC) has flooded out of exchanges in the past week as users become wary of security and regulatory scrutiny. Data from on-chain monitoring resource Coinglass shows United States exchanges in particular seeing heavy BTC balance reductions. U.S. exchanges lead BTC exodus In the wake of the FTX scandal, efforts to draw attention to the risk involved in custodial BTC storage stepped up on social media. Users appeared to heed the warning, withdrawing over $3 billion in cryptocurrency in the week immediately following the solvency debacle and ordering record numbers of hardware wallets. The aftermath of FTX is only just beginning, meanwhile, and as regulators plan investigative action and more attention to crypto as a whole, investors angst continues to grow. The data shows the trend is...

Contagion only hit firms with ‘poor balance sheet management’ — Kraken Aus boss

The crypto contagion sparked by Terra’s infamous implosion this year only spread to companies and protocols with “poor balance sheet management” and not the underlying blockchain technology, says Kraken Australia’s managing director Jonathon Miller. Speaking with Cointelegraph, the Australian crypto exchange head argued that sectors such as Ethereum-based decentralized finance (DeFi) revealed its fundamental strength this year by weathering severe market conditions: “Some of the contagion that we saw across some of the lending models in the space, [was in] this traditional finance kind of lending model sitting on top of crypto. But what we didn’t see is a kind of catastrophic failure of the underlying protocols. And I think that’s been recognized by a lot of people.” “Platforms...

Coinbase, Binance and Kraken under scrutiny: Law Decoded, July 25-August 1

Despite some good signs of the crypto prices recovery, last week could hardly be called bright for the market, as the major news came from the enforcers and not the regulators. According to a report from the New York Times, the United States Treasury Department’s Office of Foreign Assets Control (OFAC) has been investigating crypto exchange Kraken for allegedly allowing users based in Iran and other countries to buy and sell crypto in a potential violation of U.S. sanctions. In the other hemisphere, the Philippines’ think tank Infrawatch PH filed a twelve-page complaint calling on the local Securities and Exchange Commission (SEC) to crack down on Binance’s activities in the country. The news comes shortly after the Philippines’ Department of Trade and Industry (DTI) waved off a Bina...

OpenSea lays off 20% of its staff, citing ‘crypto winter’

Nonfungible token (NFT) marketplace OpenSea announced mass layoffs on Thursday, joining other crypto companies in reducing headcount during one of the most volatile periods in the industry’s history. Co-founder and CEO Devin Finzer took to Twitter Thursday afternoon to disclose that his company was laying off up to 20% of its staff. In a long message conveyed to employees, Finzer blamed “an unprecedented combination of crypto winter and broad macroeconomic instability” for the layoffs. Today is a hard day for OpenSea, as we’re letting go of ~20% of our team. Here’s the note I shared with our team earlier this morning: pic.twitter.com/E5k6gIegH7 — Devin Finzer (dfinzer.eth) (@dfinzer) July 14, 2022 “[W]e need to prepare the company for the possibility of a prolonged downtu...

Crypto community condemns Canada for freezing dissidents’ Bitcoin wallets

Global cryptocurrency enthusiasts have expressed concerns over Canadian authorities freezing bank accounts and crypto wallets involved in funding local COVID-19 protests. On Thursday, Ontario Superior Court Justice Calum MacLeod issued an order freezing all the digital assets and bank accounts associated with “Freedom Convoy,” a series of ongoing protests against COVID-19 vaccine mandates and restrictions. According to a report by the Toronto Star, the amount of funds frozen so far in bank accounts and digital wallets with Bitcoin (BTC) and other assets is estimated at more than $1 million. “The names of both individuals and entities as well as crypto wallets have been shared by the RCMP with financial institutions and accounts have been frozen and more accounts will be frozen,” Deputy Pri...

Arsenal football club in dispute with ASA over ‘irresponsible’ crypto ad

The Advertising Standards Authority (ASA), a body that oversees advertising in the United Kingdom, is cracking down on non-compliant crypto advertisements. Earlier this year, Arsenal became one of the many football clubs to collaborate with blockchain firm Chiliz and launch a fan token. On Aug. 12 this year, the club promoted its fan token AFC on its official Facebook page, which the ASA has banned for allegedly violating its advertising rules. The agency stated that the post did not highlight the risks involved in the investment. In a different event, as per a BBC report, the monitor claims that the topic of content on Arsenal’s official website — particularly, a page published on Aug. 6, 2021, with the title “$AFC Fan Token: Everything you need to know” — was violating advertising ...

Crypto exchange Kraken acquires non-custodial staking platform Staked

Major cryptocurrency exchange Kraken has announced that it purchased blockchain infrastructure company and investment manager Staked for an undisclosed amount. In a Tuesday announcement, Kraken — the crypto exchange aiming for a $10 billion valuation — said it had added Staked to its portfolio of yield products following the acquisition. The company described the Staked deal as “one of the largest crypto industry acquisitions to date” but did not disclose the amount. According to Kraken CEO Jesse Powell, Staked users will have access to Kraken’s portfolio of yield products. Staked CEO Tim Ogilvie cited the exchange’s “commitment to supporting proof-of-stake networks” as well its track record on customer experience and security in its decision to move forward with the deal. As we gear up fo...

UK advertising watchdog bans crypto ads for Coinbase and Kraken

The Advertising Standards Authority, or ASA, the United Kingdom’s independent advertising regulator, has taken down another batch of cryptocurrency-related ad campaigns promoting several major industry firms. On Dec. 15, the advertising watchdog issued several rulings on ad violations involving six crypto-related firms including Coinbase, Kraken, eToro, Exmo, crypto broker Coinburp and Luno crypto exchange. The ASA also issued a similar ruling for pizza chain Papa John’s. All seven ads or promotions were banned for “irresponsibly taking advantage of consumers inexperience and for failing to illustrate the risk of the investment,” the rulings said. The ASA argued that Coinbase’s European branch specifically put out a “misleading” promotion on its paid Facebook ad in July 2021, including a t...