JPMorgan Chase

Crypto is a nonexistent asset for big institutional investors – JPMorgan exec

Big institutional investors are still largely staying away from the crypto market, as the asset class’ volatility poses a challenge to money managers, Jared Gross, head of institutional portfolio strategy at JPMorgan Asset Management, told Bloomberg. “As an asset class, crypto is effectively nonexistent for most large institutional investors,” Gross noted, explaining that “the volatility is too high, the lack of an intrinsic return that you can point to makes it very challenging.” Gross believes that most institutional investors are currently “breathing a sigh of relief that they didn’t jump into that market”, which is unlikely to happen anytime soon. The bear market also brought to an end the idea that Bitcoin (BTC) could be a form of digital gold or serv...

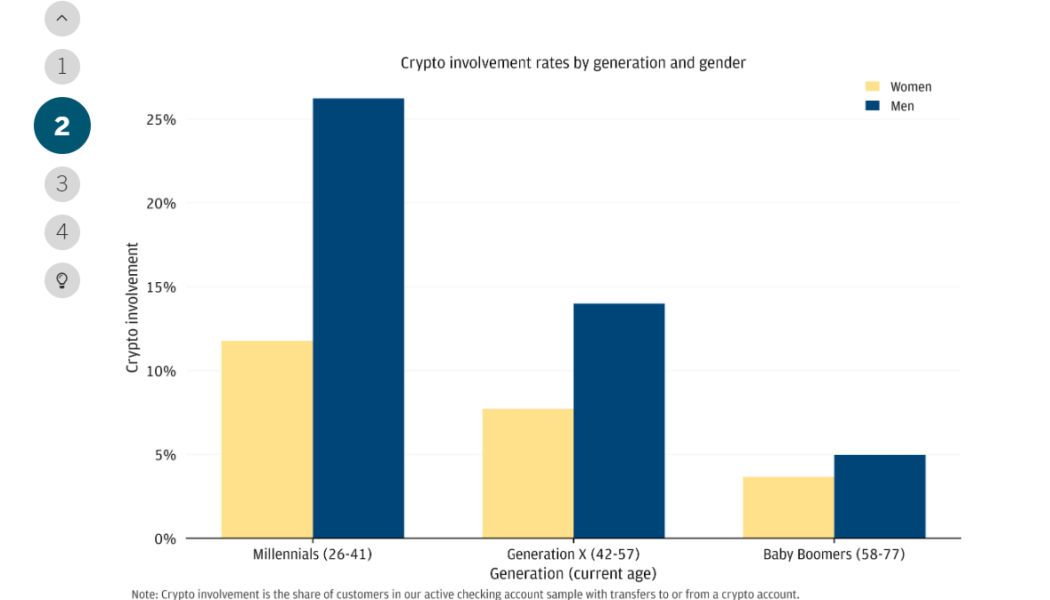

13% of Americans have now held crypto: JPMorgan research

Around 13% of the American population — or 43 million people — have held cryptocurrency at some point in their lives, new research from JPMorgan Chase has revealed. According to a Dec. 13 report titled “The Dynamics and Demographics of U.S. Household Crypto-Asset Use,” this number has risen dramatically since before 2020, when the figure was only around 3%. The latest data from JPMorgan comes from analyzing checking account transfers from a sample of over 5 million customers. It found that 600,000 customers in this sample group transferred cash to crypto accounts at some point during period from 2020 to 2022. The study also noted that cryptocurrency holders typically made their first crypto purchases during spikes in crypto prices. During this time, the amount of cash being sent into...

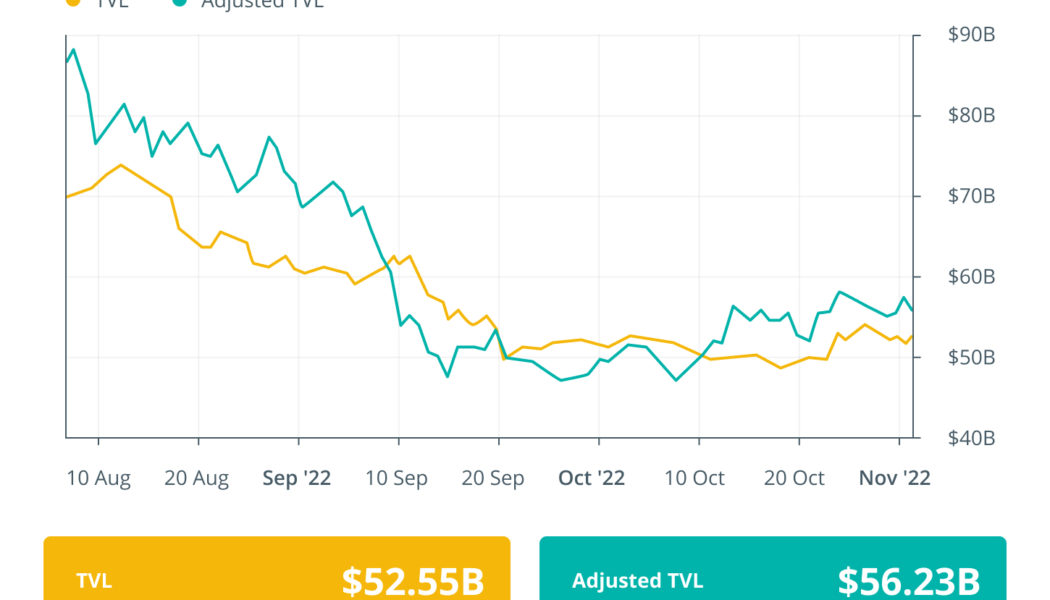

Traders expect 200% upside from MATIC, but does Polygon network data support that?

In the past year, Polygon (MATIC) has focused on growing their list of high-profile partners which includes luminaries like Disney, Starbucks and Robinhood. The recent announcements of partnerships with both Instagram and JPMorgan have speculators pushing the token price up nearly 200%. In addition to partnerships, blockchain adoption through network usage is important to analyze. Blockchain adoption can be analyzed by looking into daily active users of the blockchain, protocols using the technology, number of transactions and total locked value. Total value locked on Polygon rises above $1B Total value locked (TVL) is one cryptocurrency indicator used to assess the market’s sentiment towards a particular blockchain. TVL on Polygon requires utilizing the MATIC blockchain and locking ...

JPMorgan executes first DeFi trade on a public blockchain: Finance Redefined

Welcome to Finance Redefined, your weekly dose of essential decentralized finance (DeFi) insights — a newsletter crafted to bring you significant developments over the last week. The first week of November saw the institutionalization of DeFi markets as major international banks and financial institutions executed and completed their first DeFi transactions. The global financial giant JP Morgan completed its first-ever cross-border transaction using DeFi on a public blockchain with the help of the Monetary Authority of Singapore’s (MAS) Project Guardian. DBS Bank started a trading test of foreign exchange (FX) and government securities using permissioned DeFi liquidity pools. Apart from JPMorgan and DBS Bank, the Bank for International Settlements also said that automated market-making tec...

Crypto Biz: $43T bank enters crypto — Probably nothing, right?

As crypto traders debate whether Bitcoin (BTC) is going to $25,000 or $15,000 first, the world’s largest financial institutions are laying the groundwork for mass adoption. The proverbial floodgates are unlikely to open before the United States provides a clear regulatory framework for crypto, but regulators and industry insiders are confident that guidance could come in 2023 at the earliest. In the meantime, megabanks like BNY Mellon, whose roots date back to 1784, are entering the space. This week’s Crypto Biz chronicles BNY Mellon’s foray into digital assets, JPMorgan’s ongoing experimentation with blockchain technology and Crypto.com’s new European headquarters. BNY Mellon, America’s oldest bank, launches crypto services Arguably the biggest story of the week was news of another ...

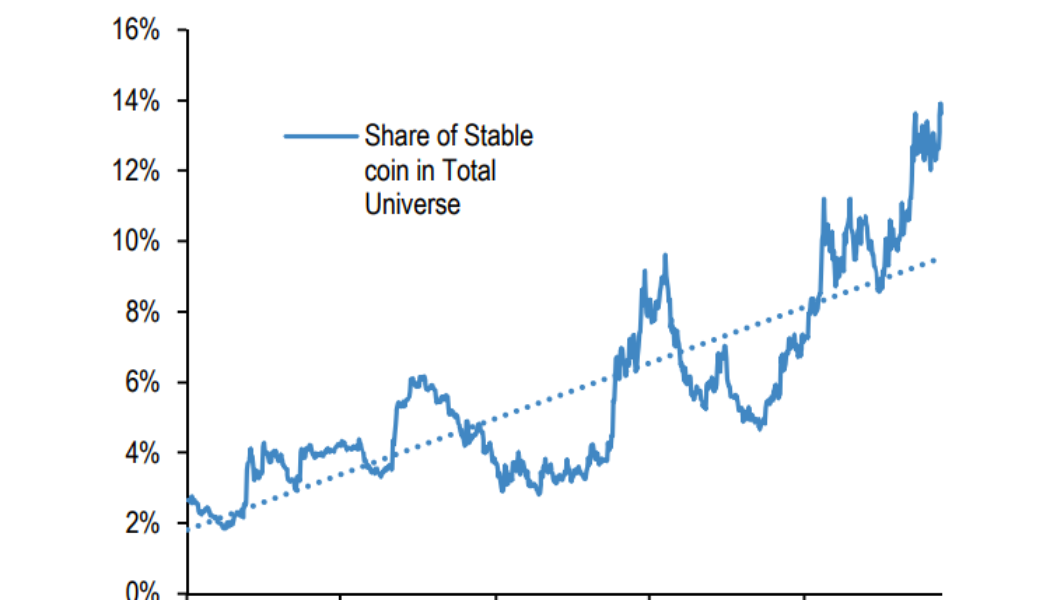

Record stablecoin market share points to crypto upside: JPMorgan

The rapid surge in share of stablecoins like Tether (USDT) in the cryptocurrency market may point to an upcoming crypto upside, according to analysts at the American investment bank JPMorgan Chase. The percentage of stablecoins in the total crypto market value has been on the rise, reaching new historical highs in mid-June, JPMorgan strategists believe. Led by JPMorgan crypto market analyst Nikolaos Panigirtzoglou, the analysts provided their industry insights in the bank’s new investor note shared with Cointelegraph. Released on June 15, the investor note reads that the share of all stablecoins rose to above 14%, or a “new historical high, which brings it to well above its trend since 2020.” “The share of stablecoins in total crypto market cap looks excessively high, pointing to ove...

Finance Redefined: Maker founder proposes endgame, Singapore explores DeFi and more

The past week in the decentralized finance (DeFi) ecosystem saw many new developments, including the rebirth of the Terra 2.0 blockchain. Meanwhile, Binance’s incubation platform Binance Labs launched a $500 million fund to support and promote Web3 adoption. Singapore’s central bank partnered with JP Morgan to explore DeFi applications in wholesale funding markets by establishing tokenized bonds. KuCoin launched its very decentralized wallet with DeFi and nonfungible token support. The top-100 DeFi tokens showed signs of a breakout from a month-long bearish trend, with most of the tokens showing overall gains in the past seven days. Maker founder proposes MetaDAOs and synthetic ETH in ‘Endgame Plan’ MakerDAO co-founder Rune Christensen has issued a new monumental proposal to push the proje...

JPMorgan unveils research on quantum resistant blockchain network

U.S. banking giant JPMorgan Chase has unveiled research on a Quantum Key Distribution (QKD) blockchain network that is resistant to quantum computing attacks. QKD utilizes quantum mechanics and cryptography to enable two parties to exchange secure data and detect and defend against third parties that are attempting to eavesdrop on the exchange. The technology is seen as a viable defense against potential blockchain hacks that could be conducted by quantum computers in the future. According to a Feb.17 announcement, JPMorgan collaborated with Toshiba and Ciena to deploy and test the QKD blockchain. “At this time, QKD is the only solution that has been mathematically proven to defend against a potential quantum computing-based attack, with security guarantees based on the laws of quantum phy...

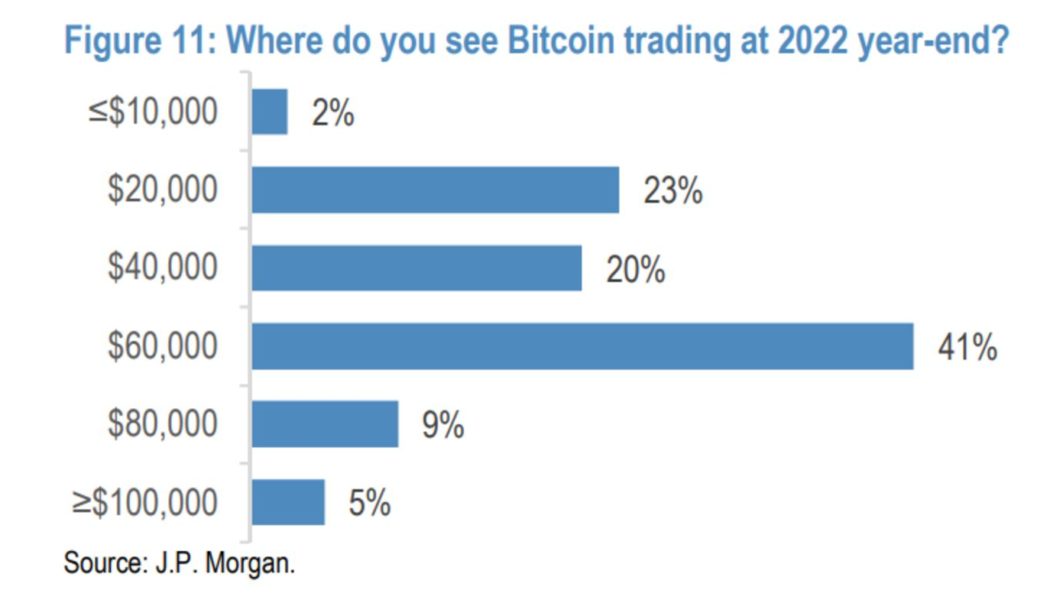

Wall Street still not convinced on Bitcoin $100K this year: JPMorgan survey

One of the world’s largest investment banks has its Bitcoin (BTC) price predictions ready for 2022. In a recent poll, JPMorgan Chase asked its clients, “Where do you see Bitcoin trading at 2022 year-end?” Just 5% said they saw the digital coin reaching $100,000, and 9% saw it breaking previous all-time highs, reaching over $80,000. The bank is known for its wealthy client portfolio. While some BTC bulls may welcome the news that 14% of JPMorgan’s clients expect at least a twofold increase, it’s not the fireworks the crypto market is accustomed to. On balance, however, the survey is generally positive. Most clients (55%) see BTC trading at $60,000 or above at the end of the year, with only one quarter expecting prices to slide from the recent lows of $40,000. “I’m not surprised by Bit...