JPMorgan

JPMorgan secures DeFi partnership in Singapore as crypto giants leave for Dubai

The Monetary Authority of Singapore is partnering with JPMorgan Chase to lead a pilot program exploring the DeFi niche The move is an initiative to explore the economic potential and value-adding use cases of crypto by the central bank of Singapore The project involves creation of tokenised bonds and deposits in a liquidity pool for DeFi applications The Monetary Authority of Singapore recently announced Project Guardian, a pilot digital asset program to examine the potential of tokenisation of bonds on public blockchains. The project intends to establish a liquidity pool of tokenised bonds and deposits. Involved would be trusted financial players who will serve as trust anchors, including JP Morgan Chase & Co, DBS Bank Ltd, and digital asset venture Marketnode. Project Guardian ...

JPMorgan picks out crypto as the preferred alternative asset

JPMorgan analysts chose Bitcoin over real estate, adding that the former’s fair value is 30% above current prices They also observed that VC funding should turn the current bear market and prevent a crypto winter akin to 2018/2019 JPMorgan analysts led by Nikolaos Panigirtzoglou have opined on the current crypto market, finding that the fair price of the world’s leading digital asset, Bitcoin, is 30% higher than current prices. The bank’s analysts said that there’s significant potential that Bitcoin could rise to $38,000 and carry other crypto tokens along with it, despite recent market capitulation. “The past month’s crypto market correction looks more like capitulation relative to last January/February, and going forward, we see upside for Bitcoin and crypto markets more generally,...

JPMorgan trials blockchain for collateral settlement in after-hours trading

Multinational investment bank JPMorgan Chase & Co is reportedly trialing the use of its own private blockchain for collateral settlements. According to Bloomberg JPMorgan conducted a pilot transaction last Friday which saw two of its entities transfer a tokenized representation of Black Rock Inc. money market fund shares A money market fund is a type of mutual fund that is considered as a low risk investment as it offers exposure to liquid and short term assets such as cash, cash equivalents and debt-securities with high credit ratings. In terms of JPMorgan’s broader vision for its private blockchain, the bank said that it intends to enable investors to put forward a wide range of assets as collateral that can also be used outside of regular market hours. It pointed to equities and fix...

JP Morgan’s Christine Moy resigns, latest exec to flee Wall Street for crypto?

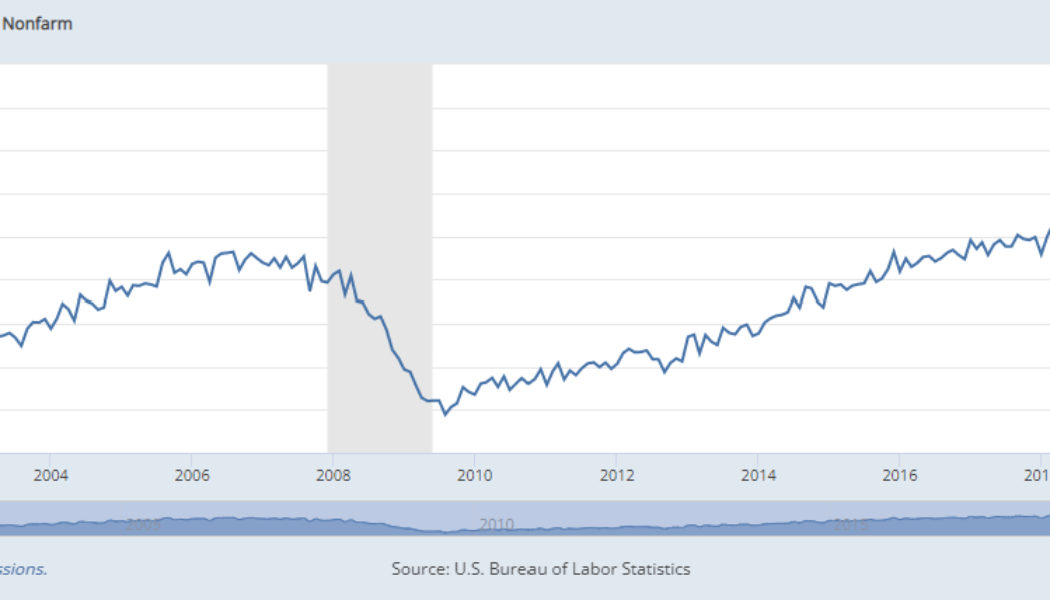

The inexorable flow of workers handing in their notices has become known as the Great Resignation. Over 33 million Americans quit their jobs between spring 2021 and end of year, with the graph below showing visually quite how stark the trend has been in historical terms. Via FRED St. Louis Pandemic Effects The pandemic has ushered in a completely new way of working. Employees have realised quite how un-fun sitting in traffic is for two hours each day, or how much they dislike packing into a rush-hour subway, their face brushing up against the sweaty armpit of a 6”4 guy (why is there always somebody without deodorant?). People enjoy flexible hours (especially with children in the picture) and an employer that cares about their desires. Personally, I thank a higher power every mo...

Ethereum developers disagree with JP Morgan’s prediction of loss of dominance

The analyst team had predicted that Ethereum’s market share would continue shrinking Last Wednesday, JPMorgan Chase & Co. research analysts in a team led by Nikolaos Panigirtzoglou said Ethereum’s dominance is at risk of getting chopped off by competing blockchain ecosystems. JP Morgan’s projection According to Bloomberg, analysts from the American investment bank said in a note that Ethereum’s market share could remain on the path of decline until the final phase, sharding, arrives. Labelled the most critical stage for scaling, it is not expected to arrive until 2023. Evidently, Ethereum has seen a decline in dominance in the decentralised finance niche. At the start of 2021, it locked almost 100% of the total DeFi value, a figure which declined to about 7...