Jerome Powell

The Federal Reserve’s pursuit of a ‘reverse wealth effect’ is undermining crypto

The Federal Reserve’s strategy to hike interest rates may continue, making it difficult for the crypto industry to bounce back. For crypto assets to become the hedge against inflation, the industry needs to explore ways to decouple crypto from traditional markets. Decentralized finance (DeFi) can perhaps offer a way out by breaking away from legacy financial models. How Federal Reserve policies are affecting crypto In the 1980s, Paul Volcker, the chairman of the Federal Reserve Board, introduced the interest hiking policy to control inflation. Volcker raised interest rates to over 20%, forcing the economy into a recession by reducing people’s purchasing capacity. The strategy worked, and the Consumer Price Index (CPI) went down from 14.85% to 2.5%. Even now, the Federal Reserve continues t...

Jerome Powell is prolonging our economic agony

Can we all agree that the Federal Reserve has a plan to combat runaway inflation? They do. Chair Jerome Powell has all but admitted it. After tempering his comments before previous rate hikes, allowing wiggle room which gave way to market rebounds, Powell has left no bones about this one. It is necessary to wreak some havoc on the economy and put downward pressure on the labor markets and wage increases to stop the creep of inflation. Whether you buy into that logic or if you believe — like Elon Musk — that such movements could result in deflation — doesn’t matter. All that matters is what those voting on the rate hikes believe, and there’s plenty of evidence that they won’t stop until the rate is over 4%. Wednesday’s rate increase of 75 basis points only moves us in that direction. This i...

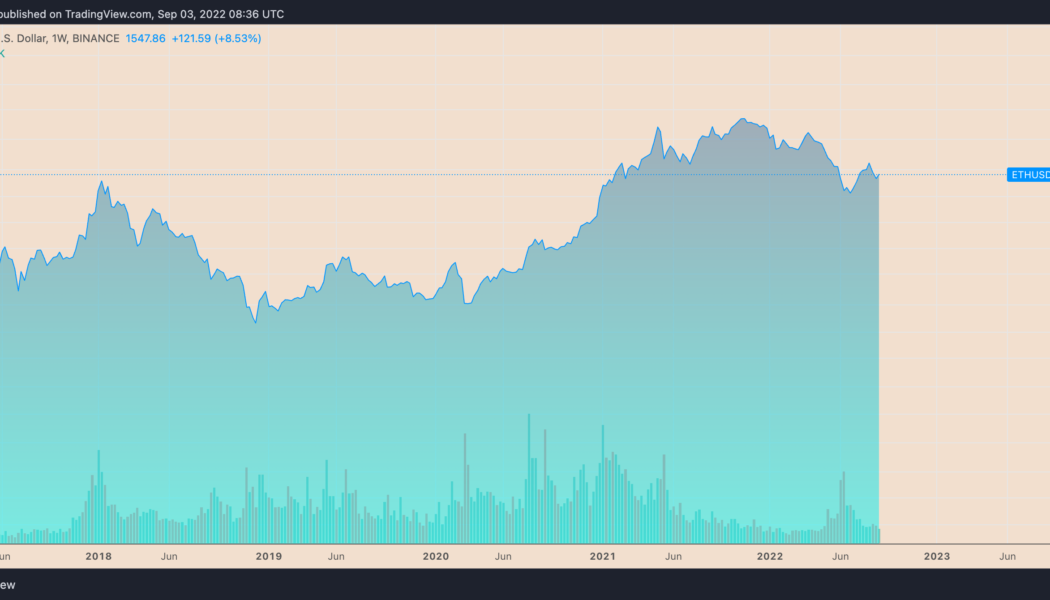

Surge or purge? Why the Merge may not save Ethereum price from ‘Septembear’

Ethereum’s native token, Ether (ETH), is not immune to downside risk in September after rallying approximately 90% from its bottom of around $880 in June. Much of the token’s upside move is attributed to the Merge, a technical upgrade that would make Ethereum a proof-of-stake (PoS) protocol, slated for Sep. 15. But despite logging impressive gains between June and September, Ether still trades almost 70% below its record high of around $4,950 from November 2021. Therefore, its possibility of heading lower remains on the cards. ETH/USD weekly price chart. Source: TradingView Here are three Ethereum bearish market indicators that show why more downside is likely. Sell the Ethereum Merge news Ethereum options traders anticipate Ether’s price to reach $2,200 f...

US stocks lose $1.25T in a day — more than entire crypto market cap

Bitcoin (BTC) and altcoins lost big on Aug. 26 after the United States Federal Reserve delivered hawkish remarks on economic policy. Across the board, risk assets took a major hit — U.S. equities shed around $1.25 trillion in a single session. Analyst: Powell retiring “soft landing” rhetoric As comments by Fed Chair, Jerome Powell, suggested that larger rate hikes were still firmly on the table despite recent data hinting that inflation was already slowing, investors rushed to cut risk. “Restoring price stability will likely require maintaining a restrictive policy stance for some time. The historical record cautions strongly against prematurely loosening policy,” Powell said at the annual Jackson Hole economic symposium. The S&P 500 closed down 3.4% on the...

Bitcoin price briefly loses $20K on ‘bunch of nothing’ Powell speech

Bitcoin (BTC) analysts were keen to draw fresh price targets on Aug. 27 after the largest cryptocurrency briefly fell below $20,000. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Sub-$20,000 BTC price targets stay in place Data from Cointelegraph Markets Pro and TradingView showed BTC/USD hitting $19,945 on Bitstamp the night after hawkish comments from the United States Federal Reserve. Intraday losses for the pair neared 9% and United States equities cratered over the outlook for inflation policy, which looks to increasingly abandon the “soft landing” narrative. “Restoring price stability will take some time and requires using our tools forcefully to bring demand and supply into better balance. Reducing inflation is likely to require a sustained...

3 reasons why the Bitcoin price bottom is not in

Bitcoin (BTC) recovered modestly on Aug. 20 but remained on course to log its worst weekly performance in the last two months. Bitcoin hash ribbons flash bottom signal On the daily chart, BTC’s price climbed 2.58% to $21,372 per token but was still down by nearly 14.5% week-to-date, its worst weekly returns since mid August. Nonetheless, some on-chain indicators suggest that Bitcoin’s correction phase could be coming to an end. That includes Hash Ribbons, a metric that tracks Bitcoin’s hash rate to determine whether miners are in accumulation or capitulation mode. As of Aug. 20, the metric is showing that the miners’ capitulation is over for the first time since August 2021, which could result in the price momentum switching from negative to positive. Bitcoin Hash R...

US Senate confirms Jerome Powell for another four years as Fed chair

The United States Senate has confirmed the nomination of Jerome Powell as the chair of the board of governors of the Federal Reserve System until 2026. In an 80–19 landslide vote on the Senate floor on Thursday, U.S. lawmakers confirmed Powell as chair of the Federal Reserve, a position he held from February 2018 until February 2022, when he was named chair pro tempore until a confirmation vote could be secured. Powell was one of four Fed nominees awaiting a full Senate vote following weeks of delays due, in part, to partisan obstructionism — Republican lawmakers in the Senate Banking Committee boycotted a meeting in February that would have likely sent Powell’s nomination to the Senate for a vote earlier. However, some of United States President Joe Biden’s nominations for the Fed have re...

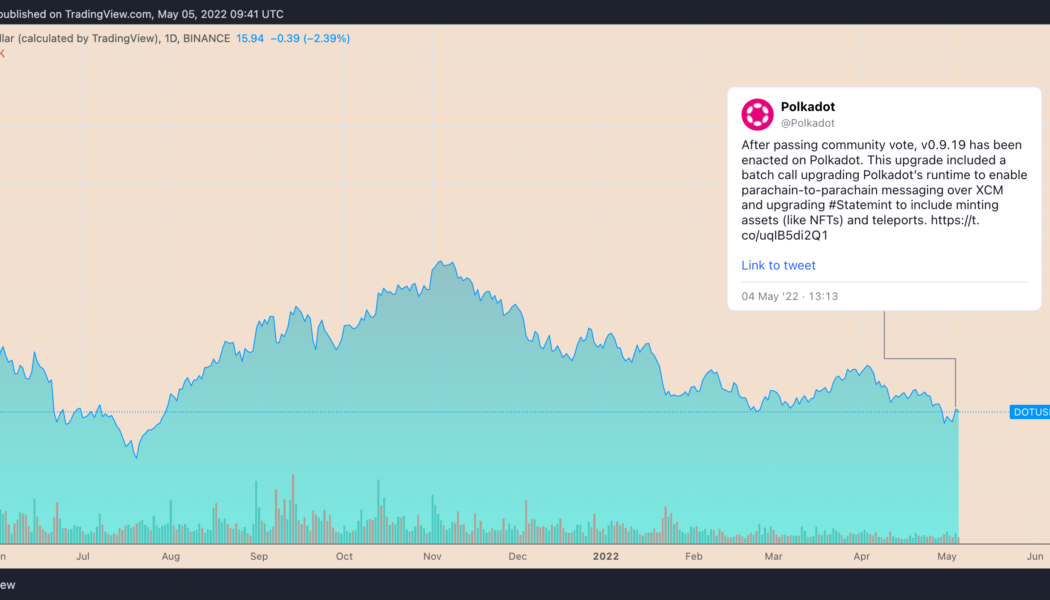

DOT rallies 12% in a day as Polkadot gears up to solve a major blockchain hacking problem

Polkadot (DOT) price ticked higher in the past 24 hours on anticipations that its new cross-chain communications protocol would solve a long-standing problem in the blockchain sector. DOT price gains 12% on XCM launch Bulls pushed DOT’s price to $16.44 on May 5 from $14.72 a day before, gaining a little over 12% as they assessed the launch of XCM, a messaging system that allows parachains — individual blockchains that operate in parallel inside the Polkadot ecosystem — to communicate with each other. DOT/USD daily price chart. Source: TradingView As Cointelegraph reported, future updates in the XCM protocol would see parachains exchanging messages without relying on Polkadot’s central blockchain, the Relay Chain. That expects to eliminate bridge hacks that have cost the in...

Ethereum eyes $3.5K as ETH price reclaims pandemic-era support with 40% rebound

Ethereum’s native token Ether (ETH) looks poised to hit $3,500 in the coming sessions as it reclaimed a historically strong support level on Feb. 5. Ethereum price back above key trendline ETH price rising above its 50-week exponential moving average (50-week EMA; the red wave in the chart below) means the price also inched above $3,000, a psychological support level that may serve as the ground for Ether’s next leg up. ETH/USD weekly price chart. Source: TradingView The 50-week EMA was instrumental in maintaining Ether’s bullish bias across 2020 and 2021. For instance, it served as a strong accumulation zone during the market correction in the second and third quarters last year, pushing ETH price from around $1,700 to as high as $4,951 (data from Binance). As a result, ...

The US Federal Reserve is making some analysts bullish on Bitcoin again

Signs of a steady Bitcoin (BTC) price recovery emerged earlier this week as investors shifted away from the U.S. dollar on weaker-than-expected economic data. In detail, Bitcoin’s drop last week to below $33,000 met with a healthy buying sentiment that pushed its per token rate to as high as $39,300 on Feb. 1. As of Thursday, BTC’s price dipped below $37,000 but was still up 13% from its local bottom. Meanwhile, the U.S. dollar index (DXY), which measures the greenback’s strength against a basket of top foreign currencies, rose to 97.441 last Friday, logging its best level since July 2020. However, the index corrected by nearly 1.50% to over 96.00 by Feb. 3. DXY vs. BTC/USD daily price chart. Source: TradingView Some market analysts saw the dollar’s renewed weakness...