IT News Africa

Tech-Driven Agriculture to Boost 50,000 Women and Youth Farmers in Nigeria

/* custom css */ .tdi_4_809.td-a-rec-img{ text-align: left; }.tdi_4_809.td-a-rec-img img{ margin: 0 auto 0 0; } Building on its work to boost food security in Nigeria through technology-drivenagricultural services, Thrive Agric has launched a 1-year project to support 50,000 smallholder farmers growing rice, maize, and soybean. This comes as part of Thrive Agric’s commitment to strengthen agricultural value chains in the country, including for these three staple crops. The USAID-funded West Africa Trade & Investment Hub (Trade Hub) is backing this effort with a $1.75-million co-investment grant. Thrive Agric /* custom css */ .tdi_3_be9.td-a-rec-img{ text-align: left; }.tdi_3_be9.td-a-rec-img img{ margin: 0 auto 0 0; } A natural partner for the Trade Hub, Thrive Agric has already helped...

How Blockchain and Crypto Can Lessen Financial Exclusion in Developing Countries

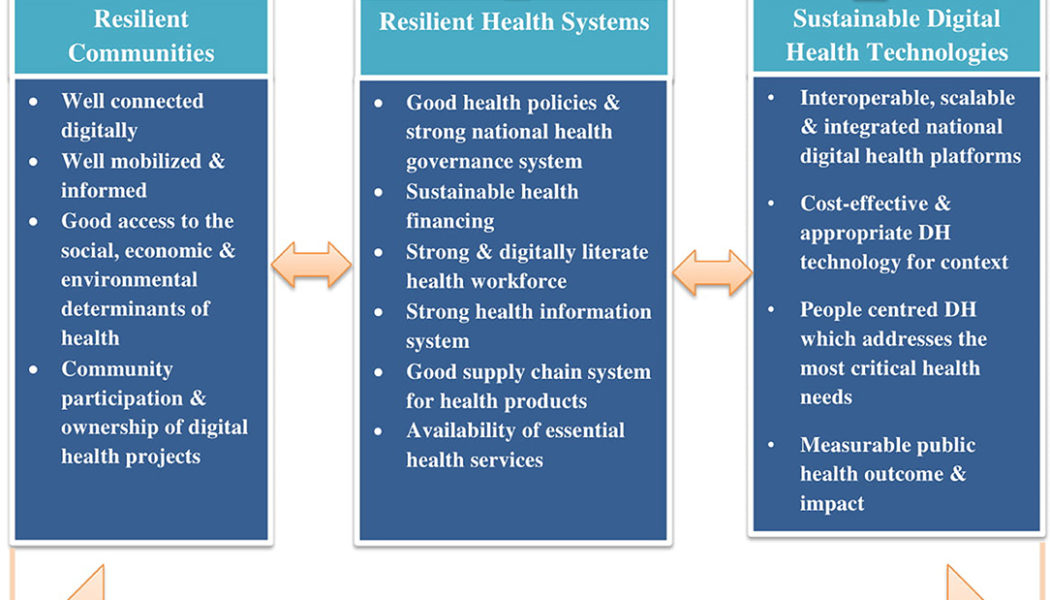

/* custom css */ .tdi_4_8ce.td-a-rec-img{ text-align: left; }.tdi_4_8ce.td-a-rec-img img{ margin: 0 auto 0 0; } While the COVID-19 crisis has reversed the recent global poverty reduction, according to the UN and other experts, it has also sped up financial inclusion via mobile financial services apps provided by crypto, blockchain and FinTech startups. Many people worldwide take for granted the services billions of others struggle to access. In their book “Financial Exclusion and the Poverty Trap,” authors Pamela Lenton and Paul Mosley assert that one of the main causes of poverty is financial exclusion, which they define as the inability to access finance from mainstream banks. /* custom css */ .tdi_3_d8d.td-a-rec-img{ text-align: left; }.tdi_3_d8d.td-a-rec-img img{ margin: 0 auto 0 0; } ...