is ethereum a security

Why is Ethereum (ETH) price down today?

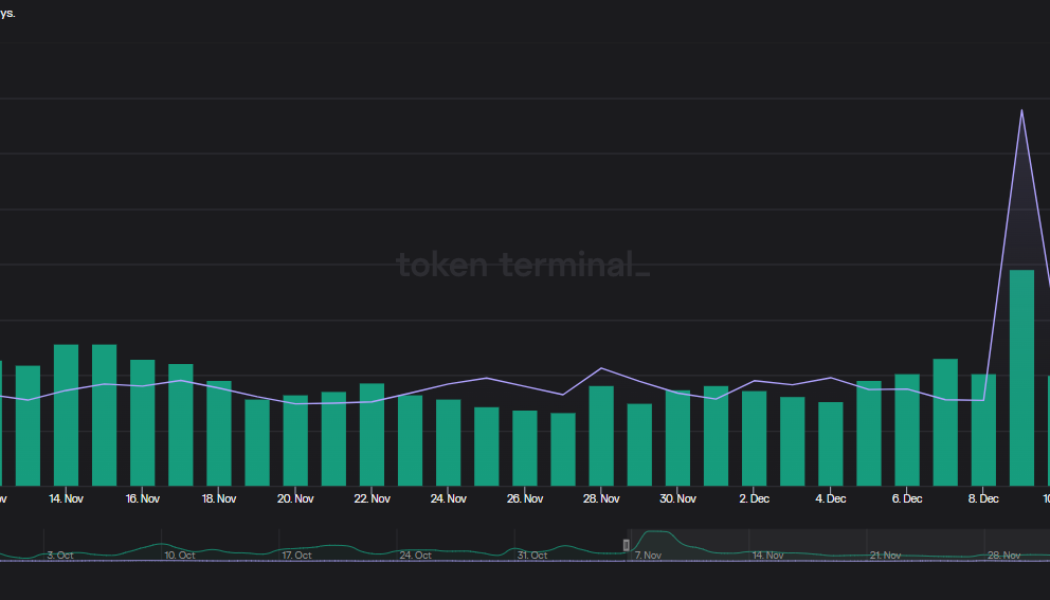

Ether (ETH) price is down on Dec. 16 and the pre-FOMC rally to $1,350 was obliterated after Federal Reserve chair Jerome Powell issued hawkish statements following a 0.50% hike in interest rates. The Ether sell-off follows a market-wide decline that has sent Ethereum network fees plummeting by 39.90% in the past 30-days. Daily Ethereum network fees and daily active users. Source: TokenTerminal The total value locked in Ethereum-based smart contracts also decreased by decentralized finance by 4.49% in 24-hours. Following the FTX exchange scandal, regulators are attempting to fast-track new regulations on the cryptocurrency sector. Total USD value locked on the Ethereum network. Source: DefiLlama While some analysts believe Ethereum still possesses multiple bullish catalysts that warrant inv...

Bitcoin and Ethereum gave back their gains, but has anything actually changed?

Crypto markets threw a nice head fake this week by rallying into resistance on a “positive” Consumer Price Index (CPI) report, before retracing the majority of those gains right after Federal Reserve Chair Jerome Powell took on a surprisingly hawkish tone during his post-rate-hike presser. The Fed hiked interest rates by 0.50%, which was well within the expectation of most market participants, but the eyebrow-raiser was the Federal Open Market Committee consensus that rates would need to reach the 5%–5.5%+ range in order to hopefully achieve the Fed’s 2% inflation target. This basically threw cold water on traders’ lusty dreams of a Fed policy pivot taking place in the first half of 2023, and the damper on sentiment was felt throughout crypto and equities markets. As the charts below...