investments

21Shares launches S&P risk controlled Bitcoin and Ether ETPs

With cryptocurrency markets shrinking over 50% this year, 21Shares are working to replicate S&P Dow Jones Indices’ benchmarks with its new risk-adjusted crypto investment products. The Swiss crypto investment firm 21Shares has launched two new exchange traded products (ETP) offering investors exposure to the largest cryptocurrencies — Bitcoin (BTC) and Ether (ETH) — while aiming to soften volatility via rebalancing assets to the U.S. dollar (USD). The new products, the 21Shares S&P Risk Controlled Bitcoin Index ETP and 21Shares S&P Risk Controlled Ethereum Index ETP, will start trading on the Swiss SIX Exchange on July 20. The ETPs will trade under tickers SPBTC and SPETH, the firm announced on Wednesday. Both ETPs target a volatility level of 40%, which is achieved through dyn...

Skybridge announces suspension of withdrawals from of its one crypto-exposed funds

Skybridge Capital has suspended withdrawals from its Legion Strategies fund – one of the firm’s funds with crypto exposure. Founder Anthony Scaramucci confirmed the move July 19 in an interview on CNBC, after Bloomberg reported it a day earlier citing anonymous sources. “Our board made the decision to temporarily suspend until we can raise capital inside the fund,” Scaramucci told CNBC. “The fund is unlevered, so there’s definitely no fear of any liquidation whatsoever and about 18% of the fund is in what we would call crypto exposure.” An independent board also took art in the decision, Scaramucci said. “Our board made a decision to temporarily suspend until we can raise capital inside the fund and then make sure when people get out they get out orderly,” says @scaramucci. “About 18...

Christie’s launches venture fund aimed at Web3 and blockchain investments

Christie’s, the auction house known for its sales of art and luxury items, has launched an investment fund to support emerging companies with technology enabling “seamless consumption of art.” In a Monday announcement, the auction company said the fund, Christie’s Ventures, will financially support firms in Web3, “art-related financial products and solutions,” and technology related to art and luxury goods. According to Christie’s, its first investment will be in LayerZero Labs, a company developing solutions for enabling omnichain decentralized applications, allowing a more seamless transfer of assets between blockchains. “We will focus on products and services, which can solve real business challenges, improve client experiences and expand growth opportunities, both across the art ...

Why is there so much uncertainty in the crypto market right now? | Market Talks with Crypto Jebb and Crypto Wendy O

In the fourth episode of Market Talks, we welcome YouTube media creator and crypto educator Crypto Wendy O. Crypto Wendy O is a YouTube media creator and crypto educator. Wendy became interested in cryptocurrency and blockchain technology in November of 2017. She has been into crypto full-time since the summer of 2018 and focuses on providing transparent marketing & media solutions for blockchain companies globally. Wendy also provides free education via YouTube and Twitter to her growing audience of over 170 thousand, giving her the largest following of any female crypto influencer in the world. Some of the topics up for discussion with Wendy are the new consumer price index (CPI) numbers and how they might impact the crypto market going forward, and why there is so much uncertai...

SEC extends window to decide on ARK 21Shares spot Bitcoin ETF to August

The United States Securities and Exchange Commission has pushed the deadline to approve or disapprove ARK 21Shares’ Bitcoin exchange-traded fund to August 30. According to a Tuesday filing from the SEC, the regulatory body extended the deadline for approving or disapproving the ARK 21Shares spot Bitcoin (BTC) ETF from July 16 for an additional 45 days, to August 30. The application, originally filed with the SEC in May and published for comment in the Federal Register on June 1, included a proposed rule change from the Chicago Board Options Exchange BZX Exchange. Ark Invest partnered with Europe-based ETF issuer 21Shares to file for a spot Bitcoin ETF listed on CBOE BZX Exchange in 2021, but the SEC rejected its application in April. Under current rules, the regulatory body is able to dela...

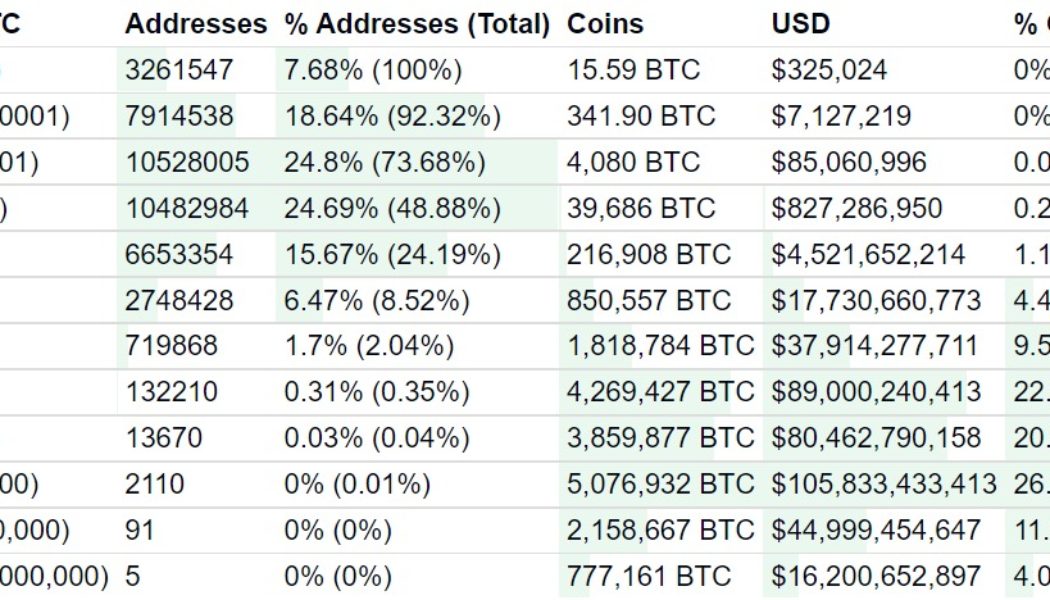

Hodlers and whales: Who owns the most Bitcoin in 2022?

One of the main features of the Bitcoin blockchain is its transparency. Bitcoin lets anyone see every transaction that has ever been made on its network and check the balance of every address out there. Because of this transparency, we’re able to know who owns the most Bitcoin (BTC) in 2022. It’s important to look at who owns the most BTC, as the cryptocurrency’s supply is limited to 21 million coins. In February, Kim Grauer, director of research at blockchain forensics firm Chainalysis, told Cointelegraph that an estimated 3.7 million BTC have been lost, effectively deflating the cryptocurrency’s circulating supply. Experts estimate that as Bitcoin’s adoption rises, demand for it will skyrocket. As 3.7 million coins are estimated to be lost and a significant amount is being held on-chain ...

Hodlers and whales: Who owns the most Bitcoin in 2022?

One of the main features of the Bitcoin blockchain is its transparency. Bitcoin lets anyone see every transaction that has ever been made on its network and check the balance of every address out there. Because of this transparency, we’re able to know who owns the most Bitcoin (BTC) in 2022. It’s important to look at who owns the most BTC, as the cryptocurrency’s supply is limited to 21 million coins. In February, Kim Grauer, director of research at blockchain forensics firm Chainalysis, told Cointelegraph that an estimated 3.7 million BTC have been lost, effectively deflating the cryptocurrency’s circulating supply. Experts estimate that as Bitcoin’s adoption rises, demand for it will skyrocket. As 3.7 million coins are estimated to be lost and a significant amount is being held on-chain ...

NYDIG study calculates the value of regulation worldwide in terms of BTC price gains

The need for regulation is a common theme in discussions about cryptocurrency, and the claim is often taken to be self-evident. Now, financial services company New York Digital Investment Group (NYDIG) has done some number crunching to prove the point. In a new study, NYDIG quantifies the effect of regulation on the price of Bitcoin (BTC) worldwide. NYDIG studied Bitcoin prices at regular intervals following regulatory events affecting digital asset taxation, accounting and payments, as well as decisions on the legality of service providers and the digital assets themselves. The research looked at the Americas, Europe, China and Asia except for China, and confined itself to the period between September 30, 2011, and March 31, 2022. The number of regulatory events considered in the study va...

MicroStrategy scoops up 480 Bitcoin amid market slump

Business intelligence firm MicroStrategy has added to its Bitcoin (BTC) holdings, reaffirming CEO Michael Saylor’s bullish outlook on the digital asset despite its recent struggles. In a Form 8-K filing with the United States Securities and Exchange Commission (SEC), Microstrategy disclosed that it had acquired an additional 480 BTC at an average price of roughly $20,817. The total purchase amount was $10 million in cash. With the purchase, MicroStrategy now holds 129,699 BTC, making it the largest corporate holder of Bitcoin. The total value of its holdings is roughly $3.98 billion. MicroStrategy has purchased an additional 480 bitcoins for ~$10.0 million at an average price of ~$20,817 per #bitcoin. As of 6/28/22 @MicroStrategy holds ~129,699 bitcoins acquired for ~$3.98 billion at...

How crypto is attracting some institutional investors — Huobi Global sales head

James Hume, head of sales at Huobi Global, said that while some institutional investors have gotten “cold feet” over crypto, many with billions of dollars are exploring the space. Speaking to Cointelegraph at the European Blockchain Convention on Tuesday, Hume said that the crypto exchange had observed increasing interest from institutional investors within the last one to two years in entering the digital asset space. According to Hume, it took a long time for certain firms and hedge funds to “build teams, raise capital and understand the infrastructure” to participate in crypto, estimating that 20–30 firms with more than $1 billion could start trading within the year. “I think it’s a pretty exciting time,” said Hume. “A lot of the more speculative bets in crypto… Some have got a bit of c...

Grayscale reports 99% of SEC comment letters support spot Bitcoin ETF

Digital asset manager Grayscale reported overwhelming support in public comments for its application to launch a spot Bitcoin exchange-traded fund. In a Monday letter to investors, Grayscale said that of the more than 11,400 letters the United States Securities and Exchange Commission, or SEC, had received in regards to its proposed Bitcoin (BTC) investment vehicle, “99.96 percent of those comment letters were supportive of Grayscale’s case” as of June 9. According to Grayscale, roughly 33% of the letters questioned the lack of a spot BTC ETF in the U.S., given the SEC had already approved investment vehicles linked to Bitcoin futures, as was the case for ProShares and Valkyrie. “The SEC’s actions over the past eight months […] have signaled an increased recognition of and comfort wi...