investments

Global inflation mounts: How stablecoins are helping protect savings

Economies around the world are facing a motley of challenges caused by rising inflation. High inflation devalues national currencies, which, in turn, pushes up the cost of living, especially in scenarios where earnings remain unchanged. In the United States, the government has responded aggressivelyto inflation. The nation hit a 9.1% inflation rate in June, prompting the Federal Reserve to implement a series of fiscal countermeasures designed to prevent the economy from overheating. Hiking interest rates was one of them. Soaring Fed interest rates have consequently slowed down consumer spending and business growth in the country. The counter-inflation approach has also strengthened the value of the U.S. dollar against other currencies due to tight dollar liquidity checks. As 79.5% of all i...

SBF and the Mooch tie the knot as FTX Ventures takes 30% stake of SkyBridge Capital

FTX Ventures, an arm of Sam Bankman-Fried’s FTX crypto exchange, will acquire a 30% stake in alternative asset manager SkyBridge Capital, the firms announced Sept. 9. The terms of the deal were not disclosed, but SkyBridge will use $40 million of the proceeds to purchase cryptocurrencies to hold as a long-term investment, according to a statement. SkyBridge founder and managing partner Anthony Scaramucci said about the deal on Twitter, “There’s a small universe of outside investors SkyBridge would ever consider partnering with, and @SBF_FTX is one of them.” He added separately, “This won’t significantly impact our day-to-day business and doesn’t change our strategy. […] We will remain a diversified asset firm, while investing heavily in blockchain.” SkyBridge managed about $2.5...

Crypto investment product firm 21.co raises $25M to reach $2B valuation

21.co, the new parent firm of exchange-traded products (ETP) provider 21Shares, has become “Switzerland’s largest crypto unicorn,“ the firm announced on Tuesday. It raised $25 million in a funding round led by London-based hedge fund Marshall Wace. The new funding brings the firm’s valuation to $2 billion. 21.co is designed to unite 21Shares with third-party token provider Amun and other upcoming crypto projects aiming to build bridges into the crypto world, 21.co founder Hany Rashwan told Cointelegraph. All crypto ETP products launched by 21Shares will maintain the same nomenclature, Rashwan said. He also said that the new name won’t change much about the way 21Shares does business. According to Rashwan, the newly raised funds will help 21.co to continue expanding its business...

CME Group launches euro-denominated Bitcoin and Ether futures

Derivatives marketplace Chicago Mercantile Exchange Group has launched trading for Bitcoin euro and Ether euro futures contracts. In a Monday announcement, CME Group said that it launched contracts for euro-denominated Bitcoin (BTC) and Ether (ETH) futures sized at 5 BTC and 50 ETH per contract. Both contracts will be listed on CME, cash-settled and based on the CME CF Bitcoin-Euro Reference Rate and CME CF Ether-Euro Reference Rate, respectively. “Our new Bitcoin Euro and Ether Euro futures will provide institutional clients, both within and outside the U.S., with more precise and regulated tools to trade and hedge exposure to the two largest cryptocurrencies by market cap,” said CME Group global head of equity and FX products Tim McCourt. First announced on Aug. 4, the euro-denomin...

MAS doesn’t trust retail crypto investments, mulling more regulations

The managing director of the Monetary Authority of Singapore (MAS), Ravi Menon, addressed the agency’s mixed signals on crypto in the public sphere at a seminar on Aug. 29. The public claimed that local regulators were spreading crypto-positive sentiments while simultaneously threatening more regulations. According to the new statement from Menon, the observation is not entirely wrong. He says the agency needs to do “a better job explaining” the situation. Overall, MAS is pro-digital assets, as directly stated by Menon, “yes to digital asset innovation, no to cryptocurrency speculation.” Regulators want the island country to become a hub for fintech innovation and distributed ledger activity. Though according to recent statements, where the problem lies is within cryptocurrenci...

The number of crypto billionaires is growing fast, here’s why

Satoshi Nakamoto has more than 1 million BTC, making him the largest Bitcoin holder. He is followed by the founders of Grayscale and Binance, who together have about the same amount of BTC as Satoshi Nakamoto. When looking at the largest Bitcoin holders, there are a few parties that stand out. Of course, Satoshi Nakamoto, with a total of 1,100,000 BTC, has more significant holdings than number two and three holders of Bitcoin, namely Grayscale and Binance. These companies have over 600,000 BTC and 400,000 BTC, respectively, numbers that most Bitcoin investors can only dream of. Behind these top three Bitcoin holders are the cryptocurrency exchanges Bitfinex and OKX, both of which hold over 200,000 BTC. Then, with MicroStrategy and Block.one, there are two more parties that own more than 10...

How to tell if a cryptocurrency project is a Ponzi scheme

The crypto world has experienced an increase in Ponzi schemes since 2016 when the market gained mainstream prominence. Many shady investment programs are designed to take advantage of the hype behind cryptocurrency booms to beguile impressionable investors. Ponzi schemes have become rampant in the sector primarily due to the decentralized nature of blockchain technology which enables scammers to sidestep centralized monetary authorities who would otherwise flag or freeze suspicious transactions. The immutable nature of blockchain systems that makes fund transfers irreversible also works in the scammers’ favor by making it harder for Ponzi victims to get their money back. Speaking to Cointelegraph earlier this week, KuCoin exchange CEO Johnny Lyu said that the sector was fertile ground for ...

Alameda Research and FTX merge VC operations: Report

Sam Bankman-Fried’s cryptocurrency exchange FTX’s investment arm has reportedly absorbed the venture capital operations of Alameda Research in response to the ongoing crypto bear market. According to a Thursday Bloomberg report, Alameda’s Caroline Ellison said in an interview that the merger had happened prior to former co-CEO Sam Trabucco announcing his resignation on Wednesday, leaving Ellison as the firm’s sole CEO. The investment arm of the crypto exchange, FTX Ventures launched in January — when the absorption of Alameda reportedly began — with $2 billion in assets under management. BREAKING: Sam Bankman-Fried’s FTX and Alameda merged their VC operations as the billionaire copes with a prolonged crypto winter https://t.co/5bXiTHphzs pic.twitter.com/EYUSa2bItG — Bloomberg Crypto ...

Why $20.8K is a critical level for Bitcoin | Find out now on Market Talks with Charlie Burton

In this week’s episode of Market Talks, we welcome professional trader Charlie Burton. Charlie is a professional trader with 24 years of experience and has been trading full-time since 2001. He is the founder of EzeeTrader and Charlie Burton Trading. He is also undefeated in the annual London Forex show live trade-off for the five years it was running. He has also been featured in the hugely popular BBC documentary “Trader, Millions by the Minute.” Charlie is one of the very few trading educators who is also a professional money manager trading FCA-regulated capital. The main topic of discussion with Charlie will be the current support level for Bitcoin (BTC) and why it is so critical. If Bitcoin goes below its current support, what are other major price levels you should...

Summer doldrums? Crypto volumes are down 55%, according to CoinShares

Crypto investment products registered minor weekly outflows last week as volumes plunged to their second-lowest levels of the year, signaling weak demand among institutional investors during the tail end of summer. Outflows from digital asset investment products totaled $8.7 million in the week ending Sunday, CoinShares reported Monday. Bitcoin (BTC) investment products saw a third consecutive week of outflows totaling $15.3 million. Funds with direct exposure to Solana (SOL) also registered minor outflows totaling $1.4 million. Meanwhile, Ether (ETH) and multi-asset investment products registered small weekly inflows of $2.9 million and $2.7 million, respectively. Overall, crypto investment products registered $1 billion in weekly volumes, which is 55% below the yearly average. CoinShares...

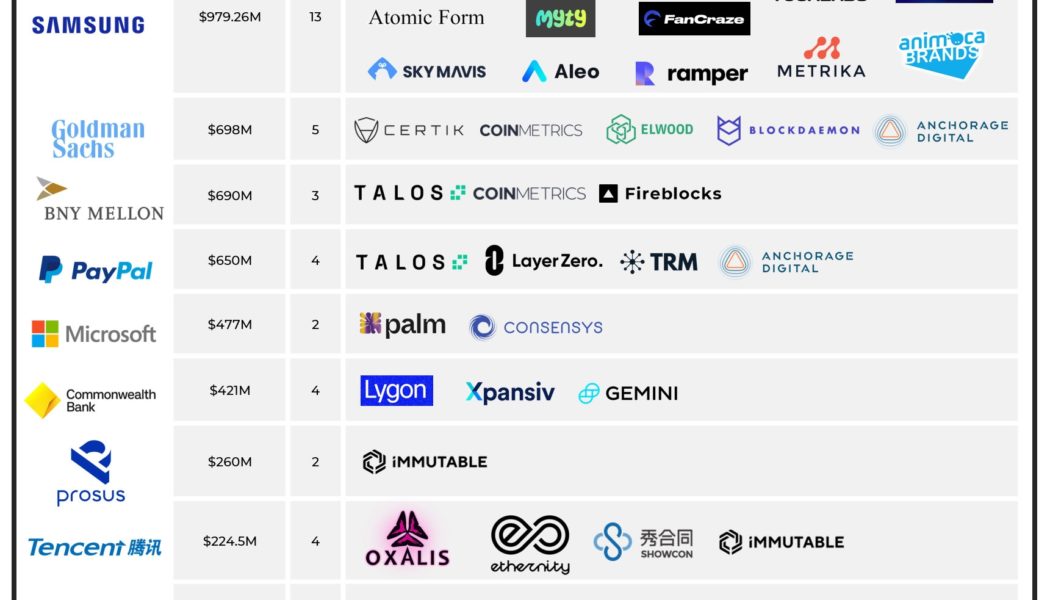

Google invested a whopping $1.5B into blockchain companies since September

Google parent company Alphabet poured the most amount of capital into the blockchain industry compared to any other public company, investing $1.5 billion between Sep. 2021 and Jun. 2022, a new report shows. In an updated blog published by Blockdata on Aug. 17, Alphabet (Google) was revealed as the investor with the deepest pockets compared to the top 40 public corporations investing in blockchain and crypto companies during the period. The company invested $1.5 billion into the space, concentrating on four blockchain companies including digital asset custody platform Fireblocks, Web3 gaming company Dapper Labs, Bitcoin infrastructure tool Voltage, and venture capital company Digital Currency Group. This is in stark contrast to last year, where Google diversified its much smaller $60...