investments

DEX dev Uniswap Labs looks for new funding at unicorn valuation: Report

Major decentralized exchange (DEX) Uniswap is in the early stages of raising significant funds to further expand its decentralized finance (DeFi) offerings, according to a new report. Uniswap Labs, a DeFi startup contributing to the Uniswap Protocol, is engaging with a number of investors to raise an equity round of $100 million to $200 million, TechCrunch reported on Sept. 30. The startup is working with investors like Polychain and one of Singapore’s sovereign funds as part of the upcoming funding round, the report notes, citing two anonymous people familiar with the matter. According to the report, Uniswap would be valued at $1 billion, but the terms of the deal are subject to changes as the discussions around the round have not been finalized. The new funding reportedly aims to bring m...

FTX, Binance and CrossTower are competing to buy Voyager Digital assets: Source

Cryptocurrency exchanges FTX, Binance and CrossTower are competing to acquire beleaguered crypto lender Voyager Digital’s assets out of bankruptcy, according to insider sources. According to details published by former investment banker and angel investor Simon Dixon, the three exchanges are competing in an auction to acquire Voyager Digital, and have each proposed their own terms and conditions for the acquisition. The details, which were also posted to Reddit, suggested that FTX and Binance have each proposed roughly $50 million in cash for Voyager’s assets, though Binance’s dollar amount is higher. The cash amount would go toward “deficiency and other claims,” the source said. IF THEY WANT YOU TO TAKE THE HIT PUSH FOR EQUITY TO FILL THE HOLE: https://t.co/ThslVDktYY – LATEST...

Coinsquare acquires publicly traded crypto exchange CoinSmart

Canada’s crypto exchange landscape appears to be consolidating after Coinsquare, one of the largest digital asset trading platforms in the country, acquired CoinSmart for an undisclosed amount. On Thursday, Coinsquare announced that it had entered into a definitive agreement to purchase all issued and outstanding shares of CoinSmart’s wholly-owned subsidiary Simply Digital. Once the deal becomes final, CoinSmart will hold a roughly 12% ownership stake in Coinsquare on a pro-forma basis. Shares of the CoinSmart crypto exchange, which trade on the NEO Exchange, were up 67% on Friday, largely in response to the news. The acquisition makes Coinsquare one of Canada’s largest crypto exchanges and expands its operational and business capabilities. Founded in 2014, Coinsquare has expanded it...

Lawyers for Celsius investors file motion to have interests represented in court

An international law firm representing groups of Celsius investors has filed a motion to appoint a committee to represent their interests in the crypto lending firm’s bankruptcy case. In a Thursday filing with the U.S. Bankruptcy Court in the Southern District of New York, lawyers with the law firm Milbank requested the appointment of an “Official Preferred Equity Committee” to represent certain Celsius shareholders. According to the filing, the equity holders “urgently require their own fiduciary” for representation in court alongside Celsius debtors and an Unsecured Creditors Committee, or UCC. “The need for a fiduciary to pursue the Equity Holders’ interests is particularly critical when one considers the practical realities of these cases: There are only two groups of real ...

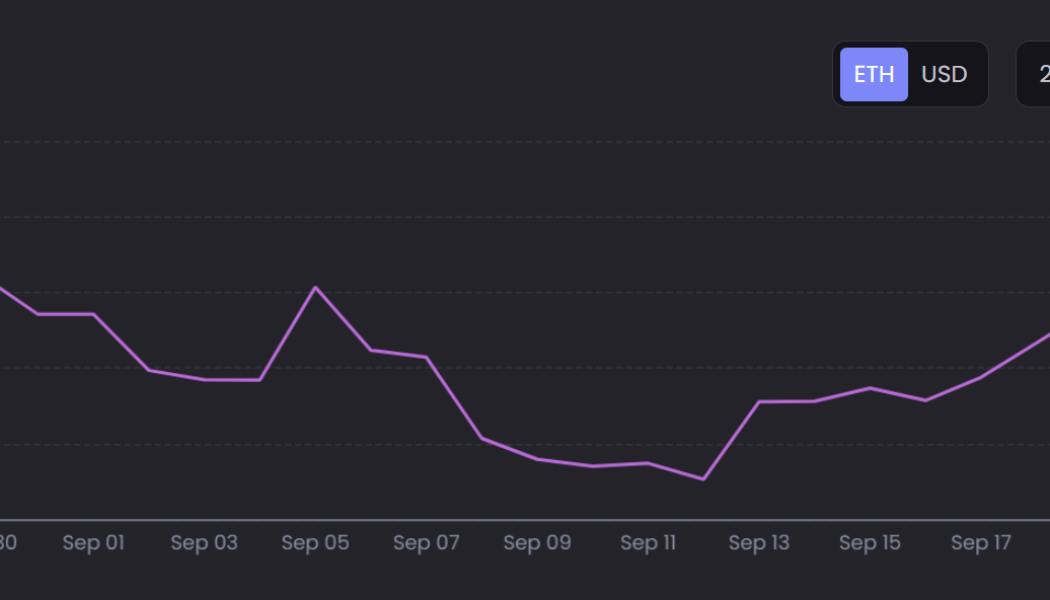

NFT ecosystem attempts a bounce back amid bearish market sentiment

Over the past two years, nonfungible tokens (NFTs) gave the crypto ecosystem the boost it needed to grab mainstream attention — owing to the involvement of prominent artists and celebrities. However, despite the enormous losses suffered by NFT investors following the ongoing, 10-month-long bear market, the ecosystem showed sustainable signs of a comeback in the last two weeks. Since Sept. 12, the performance of blue-chip NFT collections witnessed a steady growth, inching back toward the 10,000 Ether (ETH) that was lost in mid-August 2022, according to data by NFTGo. The performance of blue-chip NFT collections. Source: NFTGo On Sept. 20, the market capitalization, which is derived from the floor price and the trading price of NFTs, spiked nearly 16.5% at roughly 11.25 million ETH. Mar...

How crypto is playing a role in increasing healthy human lifespans

It’s a question that’s infatuated scientists for decades: how can we prolong life expectancy — giving humans everywhere more years of good health? This field is known as longevity science, and within this industry, experts argue care which regards ageing as a normal but treatable ailment are rare — and of the approaches available, they can only be accessed by those who are highly educated and privileged. Just some of the key tenets that govern this approach to medicine involve therapeutics, personalized medicine, predictive diagnostics and artificial intelligence. The goal is to eliminate a “one size fits all” attitude toward treatment, and ensure that therapies are customized to an individual’s unique medical profile. This can matter in many different ways — ...

Pantera Capital’s CEO suggests blockchain growth will continue despite economic turmoil

The economic landscape may seem dire at the moment, but it’s unlikely to affect blockchain development, according to Pantera Capital CEO Dan Morehead. In an interview for Real Vision on Thursday, the venture capitalist said that he believes blockchain technology will perform based on its own fundamentals, regardless of the conditions indicated by traditional risk metrics: “Like any disruptive thing, like Apple or Amazon stock, there are short periods of time where it’s correlated with the S&P 500 or whatever risk metric you want to use. But over the last 20 years, it’s done its own thing. And that’s what I think will happen with blockchain over the next ten years or whatever, it’s going to do its own thing based on its own fundamentals.” ...

Blurring the line between crypto and TradFi could redefine global finance

Despite the current struggle in the global economy, the gap between traditional finance (TradFi) and crypto seems to be closing with each passing day. For example, earlier this month, Vienna-based fintech unicorn Bitpanda announced that it was adding commodities to its list of investment options, thus allowing investors to rake in profits from short-term price fluctuations related to traditional instruments such as oil, natural gas and wheat. In a recent interview with Cointelegraph, the company’s CEO, Eric Demuth, noted that the bear market had had no major impact on investor demand. He claims that more people are now looking for solutions that can bring the world of TradFi and decentralized finance (DeFi) together. Not only that, there are lessons to be learned about what works out...

Influential celebrities that joined the crypto club over the past year

The inclusive crypto ecosystem has become home to numerous A-list celebrities over the years — primarily driven by the nonfungible tokens (NFT) hype of 2021. However, despite the prolonged bear market and an evident dip in cryptocurrency prices, celebrities continue to pour in support for the crypto market. Over the past year, celebrities have started exploring sub-ecosystems beyond NFTs, trying to diversify their presence across trading, gaming and other investment avenues. In this light, here’s an overview of some of the most influential celebrities that got into crypto over the past year and how well-prepared they are for the next bull run. Connor McGregor partners with Tiger.Trade UFC superstar Connor McGregor, one of the highest-paid athletes, recently partnered with Tiger.Trade...

Golden cross vs. death cross explained

Compared to the golden cross, a death cross involves a downside MA crossover. This marks a definitive market downturn and typically occurs when the short-term MA trends down, crossing the long-term MA. Simply put, it’s the exact opposite of the golden cross. A death cross is usually read as a bearish signal. The 50-day MA typically crosses below the 200-day MA, signaling a downtrend. Three phases mark a death cross. The first occurs during an uptrend when the short-term MA is still above the long-term MA. The second phase is characterized by a reversal, during which the short-term MA crosses below the long-term MA. This is followed by the start of a downtrend as the short-term MA continues to move downward, staying below the long-term MA. Like golden crosses, ...

Beyond the NFT hype: The need for reimagining digital art’s value proposition

With cryptocurrency prices wavering this year, nonfungible tokens (NFTs) and other sub-ecosystem investors have also found themselves in the grips of a bear market. However, looking beyond the trading value of Ether (ETH), NFTs were primarily created to represent assets and ownership in the real and virtual world. The bear market, as a result, has reignited discussions around how NFTs can backtrack and focus on attending to use cases while the market recovers. In a conversation with Cointelegraph, Tony Ling, the co-founder of analytics platform NFTGo, shared insights into the NFT ecosystem, revealing the expected trajectory of the ecosystem. Cointelegraph: NFTs’ rise to mainstream popularity is often attributed to the various real-world use cases it can and has solved. What is your take on...