investments

Why are institutions accumulating crypto in 2022? Fidelity researcher explains

Institutions’ investment in crypto has increased in 2022 despite the bear market, according to a recent survey by Fidelity Digital Assets. In particular, the amount of large investors betting on Ethereum have doubled in the last two years, as revelead by Chris Kuiper, the Head of Research at Fidelity Digital Assets in a recent interview with Cointelegraph. “The percentage of respondents saying they were invested in Ethereum doubled from two years ago”, pointed out Kuiper. Kuiper pointed out that Ethereum’s appeal in the eyes of institutions is likely to increase even more now that after the Merge, Ether has become a more environmentally friendly, yield-bearing asset. In general, according to the same survey, institutional players are accumulating crypto despite the cr...

Ex-WMG Innovation Chief Scott Cohen Named CEO of Music Investing Platform

Former Warner Music Group executive and the Orchard co-founder Scott Cohen said on Tuesday (Nov. 1) he is taking a new job as chief executive officer of a fintech platform aimed at selling fractional shares in song catalogs. Cohen, who stepped down from his role as chief innovation officer at WMG in September, said the aim of the new venture is to “fractionalize ownership of music royalties.” Fractional shares are a familiar concept in finance, and brokerages like Robinhood and Fidelity Investments sell them as a way to buy a slice of a share for less than the price of the whole stock. The market for buying and investing in music publishing rights has traditionally been open to only the world’s largest music companies and, more recently, money managers. Introducing fractional shares could ...

Japanese port city wants to become the Web3 hub for the country

In Japan, the city of Fukuoka is looking towards the future of Web3 in its latest partnership with Astar Japan Labs – the company behind Japan’s leading blockchain, the Astar network. Fukuoka is the country’s second-largest port city and has officially been designated as a National Special Strategic Zone. Now it also plans to become the country’s hub for all things Web3 and crypto. The Astar Japan Labs partnership will allow both entities to work together on new use cases for Web3 technologies. Fukuoka joins more than 45 companies working with Astar, including Microsoft Japan and Amazon Japan. According to the announcement, the city wants to attract global, competitive businesses to the area. Representatives from Astar will regularly visit the city to provide education and new use ca...

Women remain bullish on crypto investment despite market lull: Survey

The crypto market downturn is proving a difficult storm to weather for both investors and businesses alike in the industry. However, according to new data, this hasn’t stopped women from being bullish on crypto. A new survey conducted by BlockFi, a crypto trading and investment platform, asked women across the United States about their views of and participation in the crypto industry between Sept. 2021 and Mar. 2022. According to the findings one in ten women chose crypto as their first investment, with 17% of that being Millennial women investors and 11% Gen Z. Findings even revealed that of the women surveyed 7% of Gen X, which includes individuals born between 1965-1980, reported crypto as their first investment. However, as past data has revealed, more education and clarity surroundin...

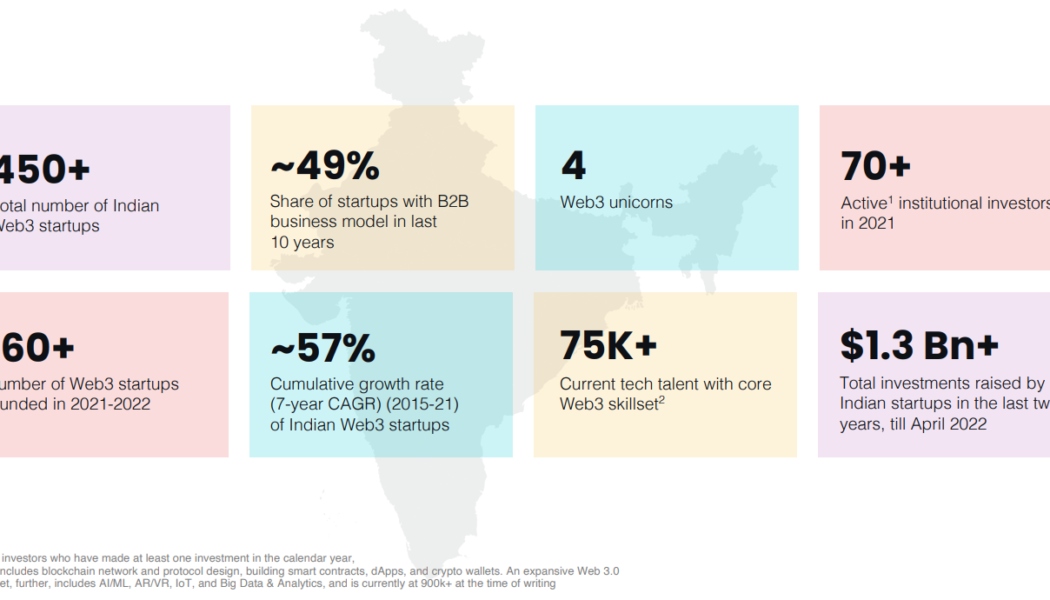

Web3 to inject $1.1T in India’s GDP by 2032, following 37x growth since 2020

The global Web3 boom is expected to add $1.1 trillion to the Indian economy over the next decade, supporting the investment-based momentum driven by over 450 in-house startups, including CoinDCX, Polygon and CoinSwitch. A recent study from the National Association of Software and Service Companies (NASSCOM), an Indian non-governmental trade association and advocacy group, highlighted India’s position as a leading global player in the Web3 market owing to several factors spanning a large talent pool, high adoption rate and product development for international markets. Snapshot of India’s Web3 startup ecosystem in 2022. Source: NASSCOM The US-India Strategic Partnership Forum (USISPF) estimated that “Web3 can add $1.1 trillion of new economic value to the Indian GDP in the next 10 yea...

Not like China: Hong Kong reportedly wants to legalize crypto trading

Hong Kong is taking action to regain its status as a global cryptocurrency hub by launching several legal initiatives related to the crypto industry. A city and special administrative region of China, Hong Kong is willing to distinguish its crypto regulation approach from the blanket crypto ban in mainland China. The government of Hong Kong is considering introducing its own bill to regulate crypto in its own China-free way, according to Elizabeth Wong, head of the fintech unit at the Securities and Futures Commission (SFC). One of the SFC’s initiatives is allowing retail investors to “directly invest into virtual assets,” Wong said during a panel held by InvestHK, the South China Morning Post reported on Oct. 17. Such an initiative would mark a significant shift from the SFC’s stance over...

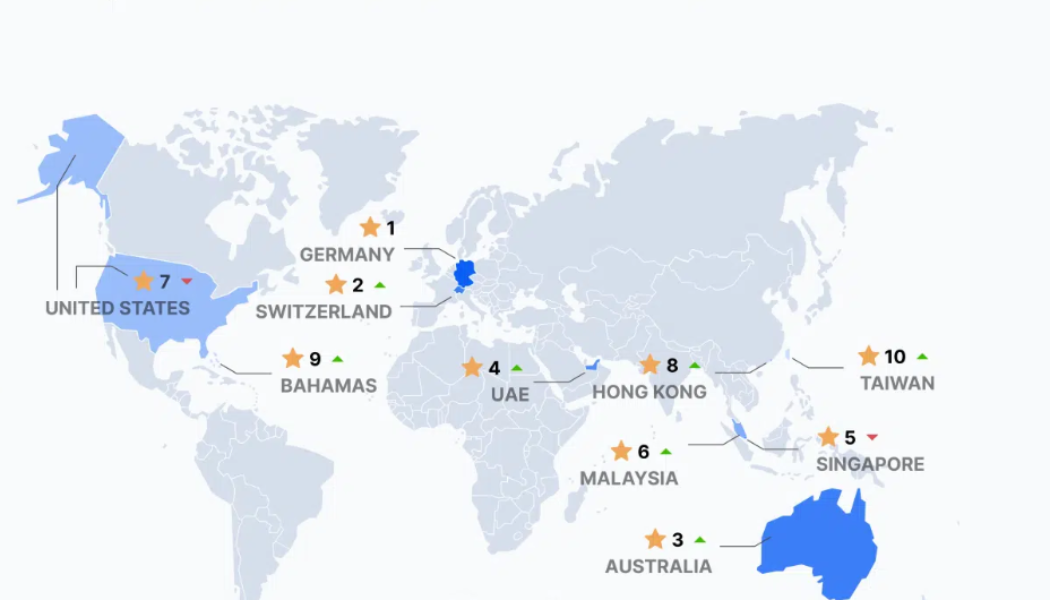

Germany leaves the US behind in top crypto economies in Q3: Report

Germany has become the most favorable crypto economy in the world in the third quarter of 2022, according to a new report. The United States, the joint top-rank holder from last quarter, fell six places to rank seventh on the top crypto economy. The crypto economy rankings compiled by Coincub looked into various factors such as favorable crypto outlook, clear crypto tax rules, more transparent regulatory communications and more to rank countries. Germany although not a tax haven, is considered one of the strongest all-around ‘traditional-tax’ crypto economies that reward long-term crypto holders. German law charges zero tax on crypto holdings of over a year. Switzerland ranked second with its positive crypto regulatory stance and is home to some of the top crypto organizations in the ...

What is the economic impact of cryptocurrencies?

Although the cryptocurrency market appears to grow in a positive feedback loop, that does not mean that (un)expected events may not impact the trajectory of the ecosystem as a whole. Although blockchain and cryptocurrencies are fundamentally meant as ‘trustless’ technologies, trust remains key there where humans interact with one another. The cryptocurrency market is not only impacted by the broader economy, but it may also generate profound effects by itself. Indeed, the Terra case shows that any entity — were it a single company, a venture capital firm or a project issuing an algorithmic stablecoin — can potentially set into motion or contribute to a “boom” or “bust” of the cryptocurrency ma...

NFT space bridges passions for tennis legend Maria Sharapova

Tennis legend Maria Sharapova appeared at the Binance Blockchain Week Paris 2022 to share her interest in nonfungible tokens (NFTs). During an exclusive interview with Cointelegraph, Sharapova mentioned that “she is exposing herself to this new world of crypto and Web3,” noting that the sector will help her better engage with her fans. Sharapova was also one of the strategic investors behind MoonPay’s Series A financing round, yet she mentioned that she aims to bridge her personal experiences to the digital world moving forward. Maria Sharapova (right) with Cointelegraph senior reporter Rachel Wolfson (left) at Binance Blockchain Week Paris 2022. Source: Rachel Wolfson Cointelegraph: What are you doing here today at Binance Blockchain Week Paris? Maria Sharapova: I’m crypto curious and wou...

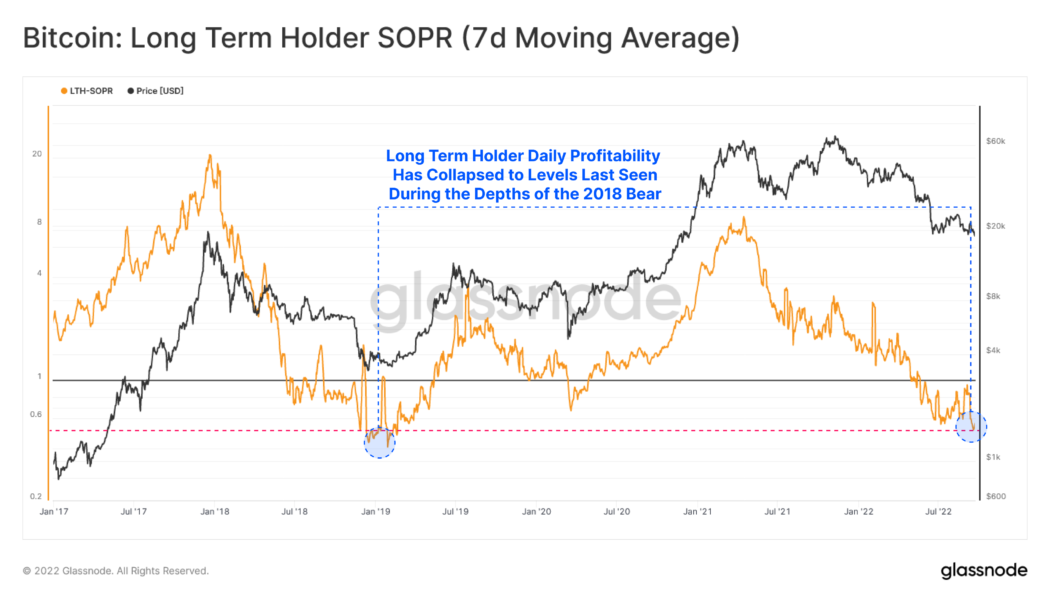

Bitcoin profitability for long-term holders decline to 4-year low: Data

Bitcoin’s (BTC) long-term profitability has declined to levels last seen during the previous bear market in December 2018. According to data shared by crypto analytic firm Glassnode, BTC holders are selling their tokens at an average loss of 42%. Bitcoin long term holders. Source: Glassnode The Glassnode data indicate that long-term holders of the top cryptocurrency selling their tokens have a cost basis of $32,000, meaning the average buying price for these holders selling their stack is above $30,000. The current market downturn added to the declining profitability can be attributed to several macroeconomic factors. The BTC market still has a heavy correlation with the stock market, especially tech stocks, which are currently seeing an even bigger downtrend than crypto. The rising inflat...