investments

Crypto community members discuss bank run on Binance

Within the past 24 hours, cryptocurrency exchange Binance has seen outflows of over $1.14 billion due to rising FUD — or fear, uncertainty and doubt — within the crypto ecosystem. According to Binance CEO Changpeng “CZ” Zhao, the exchange has seen this before, and he believes “it is a good idea to ‘stress test withdrawals’ on each CEX [centralized exchange] on a rotating basis”. We saw some withdrawals today (net $1.14b ish). We have seen this before. Some days we have net withdrawals; some days we have net deposits. Business as usual for us. I actually think it is a good idea to “stress test withdrawals” on each CEX on a rotating basis. 1/2 https://t.co/uF9lLPDSyS — CZ Binance (@cz_binance) December 13, 2022 The bank run on Binance comes a month after CZ triggered a bank ...

Algorand to support bank and insurance guarantees platform in Italy

Layer-1 blockchain platform Algorand has been chosen as the public blockchain to support an “innovative digital guarantees platform” to be used in Italy’s banking and insurance markets. The Algorand-supported platform is expected to be launched in early 2023. According to Algorand’s Dec. 13 announcement, this is the first time an EU Member State will use blockchain technology for bank and insurance guarantees. A bank guarantee is when a lending institution promises to cover a loss if a borrower defaults on a loan. It’s an alternative to providing a security bond or a deposit to a supplier or vendor. An insurance guarantee is similar but is offered by an insurance company rather than a bank. Algorand said that blockchain technology was ideally suited for the “Di...

Web3 game DOGAMÍ secures $14M total funding

DOGAMÍ, an augmented reality mobile game involving nonfungible token (NFT) pet companions, has completed a $14 million seed funding round, according to a Dec. 12 press release provided to Cointelegraph. The Web3 mobile gaming company raised $7 million led by VC firm XAnge after initially securing $6 million from industry leaders in January 2022. DOGAMÍ, with community members in over 80+ countries, indicated that it has already sold 12,000 NFTs of dog avatars and 12,000 NFTs of canine accessories through a collaboration with omni-channel clothing retailer GAP. The company has also launched its first mobile application, “DOGA House”, which allows users to discover and interact with their “NFT puppies” in the “DOGAMÍ universe” while earning DOGA cryptocurrency. Relate...

$75M worth of FTX’s political donations at risk of being recalled due to bankruptcy: Report

Following the collapse of FTX and its Nov. 11 bankruptcy filing, $73 million worth of its political donations is currently at risk of being recalled to repay the failed exchange’s creditors, according to a report by Bloomberg. Speculators online allege that the former FTX CEO and his executives sought to influence industry regulations with their generous multimillion-dollar donations to politicians and super PACs. Sam Bankman-Fried and executives Ryan Salame and Nishad Singh are believed to have been high-paying donors to both the Republican and Democratic United States political parties. Many politicians who were at the receiving end of FTX’s generosity now face difficulty regarding what to do next, as they may be forced to return the money to the bankruptcy trustee. In order to...

FTT investors’ claims to be investigated for securities laws violations

To help out the recently duped investors of FTX Tokens (FTT), shareholder rights litigation firm — Schall Law Firm — has taken up the task of investigating the investors’ claims against FTX for violations of the securities laws. It is estimated that over one million people have lost their life savings owing to the financial fraud committed by FTX CEO Sam Bankman-Fried. To help the investors legally recoup losses, the law firm plans to investigate FTX for issuing misleading statements or failing to disclose crucial information. In an official statement, Schall Law Firm highlighted how various media publications uncovered the cracks within FTX-Alameda operations, eventually leading to the crash of FTX’s in-house FTT tokens. The law firm advised all FTT investors to participate in the drive b...

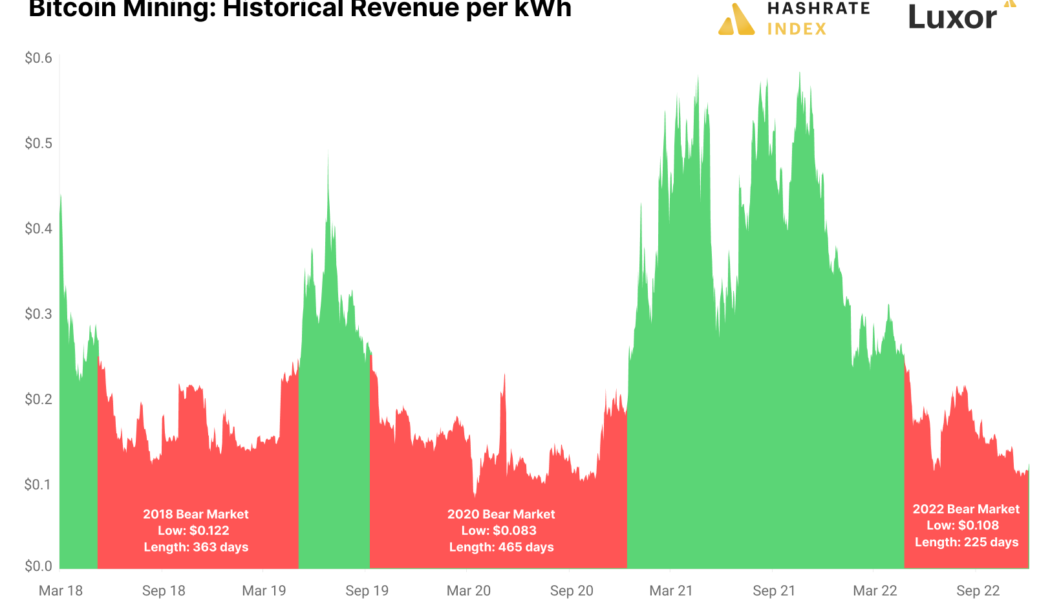

Data shows the Bitcoin mining bear market has a ways to go

Bitcoin (BTC) mining is the backbone of the BTC ecosystem and miners’ returns also provide insight into BTC’s price movements and the health of the wider crypto sector. It is well-documented that Bitcoin miners are struggling in the current bear market. Blockstream, a leading Bitcoin miner recently raised funds at a 70% discount. Current mining activity shares similarities to historic BTC bear markets with a few caveats. Let’s explore what this means for the current Bitcoin cycle. Analysis shows that based on previous cycles the bear market may continue Bitcoin mining profitability can be measured by taking the miner’s revenue per kilowatt hour (kWh). According to Jaran Mellerud, a Bitcoin analyst for Hashrate Index, a BTC mining bear market has a sustained period of revenue per kWh of les...

Amber Group ditches expansion plans after denying insolvency: Report

Cryptocurrency trading firm Amber Group is putting its expansion plans on hold despite the FTX contagion having “no disruption” to its daily operations, according to a senior executive. Amber has scrapped plans to expand in Europe and the United States as a consequence of exposure to the now-defunct exchange FTX and will focus on institutional clients in Asia, according to managing partner Annabelle Huang. Huang also said that Amber has been forced to deprioritize its new metaverse project due the FTX contagion, the Financial Times reported on Dec. 9. Apart from ditching its expansion plans, the firm has reportedly been cutting its headcount recently. After reportedly laying off up to 40% of staff in September, the firm continued to lay off employees again in December. According to Huang, ...

BlockFi employees were discouraged from describing risks in internal communications: Report

Following BlockFi’s Chapter 11 bankruptcy filing at the United States Bankruptcy Court for the District of New Jersey, reports have surfaced about the crypto lending company’s risk assessment and management culture. According to Forbes, as early as 2020, the company culture discouraged employees from “describing risks in written internal communications to avoid liability, “ as reported by a former employee at BlockFi. Although BlockFi claimed risk management was core to their DNA and central to their mission, reports surfacing paint a different picture of the company. BlockFi executives appear to have prioritized aggressive growth, while dismissing risk management professionals who attempted to do their job. According to a former employee, an internal team at BlockFi raise...

Malta prepares to revise regulatory treatment of NFTs

The Malta Financial Services Authority (MFSA) is currently reviewing requests to revise the “regulatory treatment” of Non-Fungible Tokens (NFTs) within its Virtual Financial Assets Framework. Under the current regulatory framework, NFTs are included within the scope of the Virtual Financial Assets Act, which also includes virtual tokens, virtual financial assets, electronic money, and all financial instruments built, or dependent on, Distributed Ledger Technology (DLT). However, the MFSA is proposing to have NFTs removed from the Virtual Financial Assets framework since they’re unique and nonfungible and therefore incapable of being used as payments for goods and services, or for investment purposes. According to the MFSA, “the inclusion of such assets within the scope of the V...

Margin trading vs. Futures: What are the differences?

Margin trading aims to amplify gains and allows experienced investors to potentially get them quickly. They may bring dramatic losses, too, if the trader doesn’t know how they work. When trading on margin, crypto investors borrow money from a brokerage firm to trade. They first deposit cash into a margin account that will be used as collateral for the loan, a kind of security deposit. Then they start paying interest on the borrowed money, which can be paid at the end of the loan or with monthly or weekly installments, based on current market conditions. When the asset is sold, proceeds are used to repay the margin loan first. The loan is necessary to raise investors’ purchasing power and buy larger amounts of crypto assets, and the assets purchased a...

FTX US ex-president reportedly seeks $6M funding to launch crypto startup

Just a month after the controversial fall of Sam Bankman-Fried’s FTX exchange and 130 affiliated companies, a former high-ranking executive is reportedly seeking out investors to launch a crypto startup. The ex-president of FTX US, Brett Harrison, is on the lookout for $6 million in funding to launch a start-up that would build crypto trading software for big investors, according to The Information. Harrison’s funding round would be against a $60 million valuation. On Sept. 27, Harrison announced his plans to step down as the president of FTX US as he moved into an advisory role — over a month before the infamous fall of FTX. As a result, the entrepreneur was not immediately accused of having direct involvement in misappropriating users’ funds. Like most here, I was surprised and saddened ...

Crypto Biz: Institutions short Bitcoin as SBF is ‘deeply sorry’ for FTX collapse

The monumental collapse of FTX will go down as one of the biggest corporate scandals of all time. But, at least Sam Bankman-Fried, or SBF, is sorry. On Nov. 22, the disgraced founder of FTX penned a letter to his former employees describing his role in the company’s bankruptcy. “I never intended this to happen,” he wrote. “I did not realize the full extent of the margin position, nor did I realize the magnitude of the risk posed by a hyper-correlated crash.” Get this: SBF still thinks the company can be saved because “there are billion of dollars of genuine interest from new investors.” Shouldn’t he be preoccupied with trying to avoid jail right now? Bitcoin (BTC) and the broader crypto market have been reeling in the wake of the scandal. While this has allowed many diamond handed hodlers ...