investments

Bitcoin cycle is far from over and miners are in it for the long haul: Fidelity report

Fidelity Digital Assets — the crypto wing of Fidelity Investments which has $4.2 trillion assets under management–shared their “two sats” on the future of the digital assets space. The key takeaways touched upon miners’ behavior and Bitcoin (BTC) network adoption. In the annual report released last week, the group shared some insights into the world of BTC mining: “As Bitcoin miners have the most financial incentive tho make the best guess as to the adoption and value of BTC (…) the current bitcoin cycle is far from over and these miners are making investments for the long haul.” The report stated that the recovery in the hash rate in 2021 “was truly astounding”, particularly when faced the world’s second-largest economy China banning Bitcoin in 2021. The rebound in hash rate s...

Institutional investment will boost Bitcoin to $75,000, says SEBA CEO

The CEO of Switzerland-based financial institution SEBA Bank shared his predictions for Bitcoin (BTC) in 2022. A boon for BTC bulls, Guido Buehler was optimistic about institutional adoption and a price increase to $75,000 per coin. He explained in an interview that at SEBA, asset pools are looking for the right time to invest; however, they need the right counterparties and the necessary regulation in order to deploy capital. When pressed on whether Bitcoin would hit new highs this year, Buehler thinks it’s possible, “The question is always time.” He noted that with BTC dominance bottoming out at 40%, it’s a pivotal moment for investors looking for a directional play. The interview took place at the Crypto Finance Conference in St. Moritz, Switzerland, where “sophistic...

Billionaire investor Bill Miller puts 50% of net worth in Bitcoin

Investor Bill Miller is bullish on Bitcoin (BTC) despite the cryptocurrency touching multi-month lows below $40,000 in early January 2022. Miller no longer considers himself just a “Bitcoin observer” but rather a real Bitcoin bull, as he said in a WealthTrack interview last Friday. The billionaire investor now holds 50% of his net worth in Bitcoin and related investments in major industry firms like Michael Saylor’s MicroStrategy and BTC mining firm Stronghold Digital Mining. An early Amazon investor, Miller owns almost 100% of the rest of his portfolio in Amazon, he noted. Miller bought his first Bitcoin back in 2014 when BTC was trading around $200 and then purchased a “little bit more overtime” when it became $500. The investor did not buy it for years until BTC plummeted to $30,000 aft...

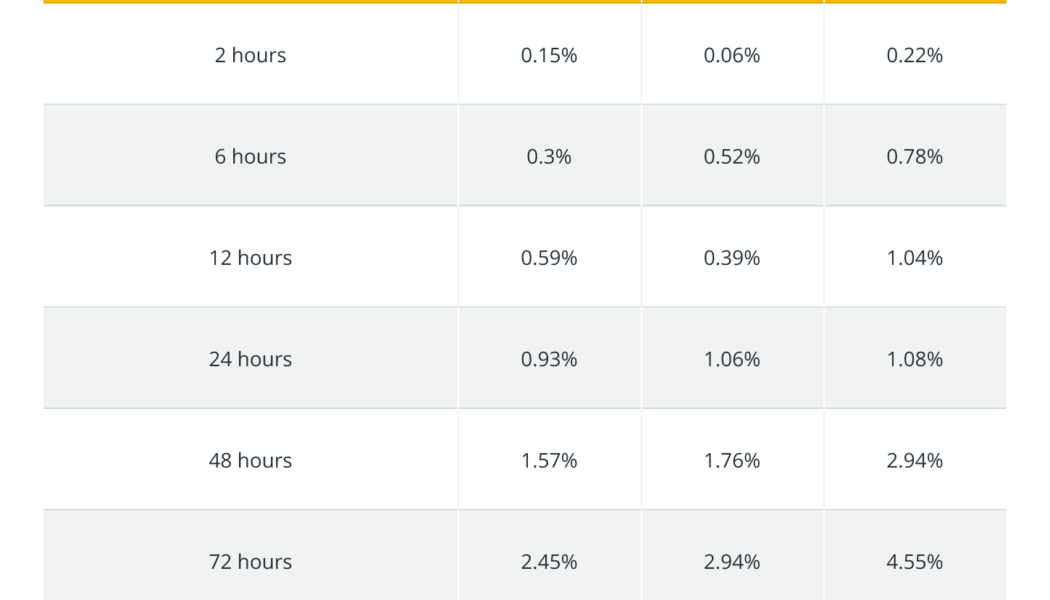

Even after the pullback, this crypto trading algo’s $100 bag is now worth $20,673

Exactly one year ago, on Jan. 9, 2021, Cointelegraph launched its subscription-based data intelligence service, Markets Pro. On that day, Bitcoin (BTC) was trading at around $40,200, and today’s price of $41,800 marks a year-to-year increase of 4%. An automated testing strategy based on Markets Pro’s key indicator, the VORTECS™ Score, yielded a 20,573% return on investment over the same period. Here is what it means for retail traders like you and me. How can I get my 20,000% a year? The short answer is – you can’t. Nor can any other human. But it doesn’t mean that crypto investors cannot massively enhance their altcoin trading game by using the same principles that underlie this eye-popping ROI. The figure in the headline comes from live testing of various VORTECS™-based tra...

Crypto funds attracted $9.3B in inflows in 2021 as institutional adoption grew

Institutional cryptocurrency funds attracted record inflows in 2021, as demand for digital assets such as Bitcoin (BTC) and Ether (ETH) continued to grow during a volatile and often unpredictable bull market. Crypto investment products registered $9.3 billion in inflows during the year, up from $6.8 billion in 2020, according to the latest CoinShares data, which was released on Tuesday. Bitcoin funds attracted $6.3 billion worth of capital last year, while Ether products saw inflows totaling nearly $1.4 billion. Multi-asset funds were also popular, attracting $775 million in investor capital. A total of 37 investment products launched in 2021, compared with 24 that hit the market the year before. Notably, crypto assets that were included in investment products expanded to 15 from nin...

Bitcoin is new gold for millennials, Wharton finance professor says

Bitcoin (BTC), the world’s most-valued cryptocurrency, has replaced gold as an inflation hedge for young investors, according to Wharton’s finance professor. Gold’s performance was “disappointing” in 2021, Wharton School finance professor Jeremy Siegel said in a CNBC Squawk Box interview on Friday. On the other hand, BTC has been increasingly emerging as an inflation hedge among younger investors, Siegel argued: “Let’s face the fact, I think Bitcoin as an inflation hedge in the minds of many of the younger investors has replaced gold. Digital coins are the new gold for the Millennials. I think that the story of gold is a fact that the young generation is regarding Bitcoin as the substitute.” Siegel also reminded that older generations witnessed how gold had soared during the inflation...

Kevin O’Leary says his crypto holdings could reach 20% of portfolio

Shark Tank celebrity Kevin O’Leary, also known as “Mr. Wonderful,” has said he would be ready to increase his crypto allocations up to 20% as soon as there are clearer regulations around stablecoins. O’Leary, a former Bitcoin (BTC) skeptic, is now a vocal advocate of cryptocurrency, which currently makes up over 10% of his investment portfolio. Mr. Wonderful is particularly focused on U.S. dollar-pegged stablecoins, which he sees as an effective hedge against rising levels of inflation. By staking stablecoins, he pointed out, he can make up to 6% returns. He explained to Cointelegraph: ”When inflation is 6%, your buying power 12 months from now is 6% less. And that’s a lot. […] I’m a huge advocate for solving this problem with stablecoin.” A clear regulatory framework would al...

Bitcoin ‘died’ 45 times in 2021 as media still eager to post BTC obituaries

As Bitcoin (BTC) was hitting new historical highs above $68,000 this year, global cryptocurrency naysayers were increasingly blasting BTC for its extreme volatility and potential risks. According to Bitcoin Obituaries data by Bitcoin education portal 99Bitcoins, the original cryptocurrency was declared “dead” as many as 45 times in 2021, which is at least three times more than in 2020. Despite the growing number of Bitcoin critics in 2021, the number of obituaries is still significantly less this year than was recorded in 2017, the year when BTC first reached close to $20,000. That year, Bitcoin “died” 124 times. Incepted in 2010, 99Bitcoins’ Bitcoin Obituaries list has English-language statements, including content about the fact that Bitcoin “is or will be worthless.” To qualify an obitu...

Genesis issues $6M NFT-backed loan to Meta4 Capital

Genesis Global Capital has completed one of its first purely NFT-backed loans for $6 million to Meta4 Capital, a Miami-based Web3 focused investment management firm. This loan is notable not just for its amount but for solely using nonfungible tokens (NFTs) as collateral instead of including broader liquid collateral. Meta4 operates as an NFT VC backed by Andreessen Horowitz, specializing in acquiring presumed rare and historically significant NFTs. The proceeds of Genesis’ loan were used to finalize Meta4’s purchase of three NFTs part of Sotheby’s Metaverse “Natively Digital” October NFT auction: the $3.4 million record-setting gold Bored Ape Yacht Club #8817, the Rare Pepe PEPENOPOULOS for $3.6 million and an NFT from FingerprintDAO’s Mitchell F. Chan for $1.5 million. These acquisitions...

Sequoia China leads $25M equity round for DeFi wallet DeBank

DeBank, a cryptocurrency wallet focused on decentralized finance (DeFi) solutions, has closed new funding led by major venture capital firm Sequoia China. The firm announced Tuesday on Twitter that it raised $25 million, bringing DeBank’s total valuation to $200 million. Apart from Sequoia China, the funding round featured major crypto investment firms like Dragonfly, Hash Global and Youbi. The raise also included strategic funding from Coinbase Ventures, Crypto.com exchange, stablecoin provider Circle and hardware wallet maker Ledger. DeBank is a cryptocurrency wallet designed to track DeFi data, including decentralized applications or exchanges (DEX) and DeFi interest rates. It also lets users navigate and manage various DeFi assets and projects. The platform includes analytics for decen...

Indian police commissioner issues a public warning against crypto frauds

The Additional Commissioner of Police Shikha Goel warned Indian citizens about the rise in cybercrime in an event hosted by the city police of Hyderabad, India, suggesting not to transfer cryptocurrencies to unauthorized private wallets. Goel highlighted the various methods that are actively being used by fraudsters to dupe investors such as lucrative investment opportunities, illegitimate bank transfers and cryptocurrencies. Acknowledging the growth of Indian crypto users, Goel added: “They [fraudsters] ask you to share your cryptocurrency details. And once you put it in your wallet, then the money is taken away.” After simplifying the elaborate fraud in a sentence, Goel also highlighted that sixteen such cases have been registered involving cryptocurrencies. Do not transfer your cryptocu...

Binance VC arm leads $60M round in cross-chain protocol Multichain

Binance Labs, the venture capital and incubation arm of Binance cryptocurrency exchange, has led a financing round for the cross-chain protocol Multichain, previously known as Anyswap. Shortly after rebranding from Anyswap last week, Multichain has raised $60 million in a seed funding round led by Binance Labs, the firm officially announced on Dec. 21. Other participants in the raise included major VC firms and industry investors like Sequoia China, IDG Capital, Three Arrows Capital, Primitive Ventures, DeFiance Capital, Circle Ventures, Hypersphere Ventures, HashKey and Magic Ventures. Apart from providing capital investment for Multichain, Binance is also building a stronger relationship with the cross-chain protocol. On Dec. 20, Multichain announced that it is now officially recommended...