investments

How to navigate cryptocurrency tax implications amidst the CPA shortage

Cryptocurrency is a hot topic worldwide, especially with prices of Bitcoin (BTC), Ethereum (ETH) and other cryptocurrencies hitting higher thresholds and resulting in another banner year for investors. While the earnings look good on paper, one factor is often left to consider –– that is, crypto taxes. It is not uncommon for traders to take advantage of the constant fluctuations, buy the dip, sell the uptrend, and repeat it frequently. Unfortunately, each transaction is considered a taxable event, making the conversation about cryptocurrency taxes a daunting one. The impending crackdown on cryptocurrency taxation only spurs on the need to start the conversation. This crackdown is far from recent, with 2021 headlines of an IRS chief stating the country was losing trillions of dollars in unp...

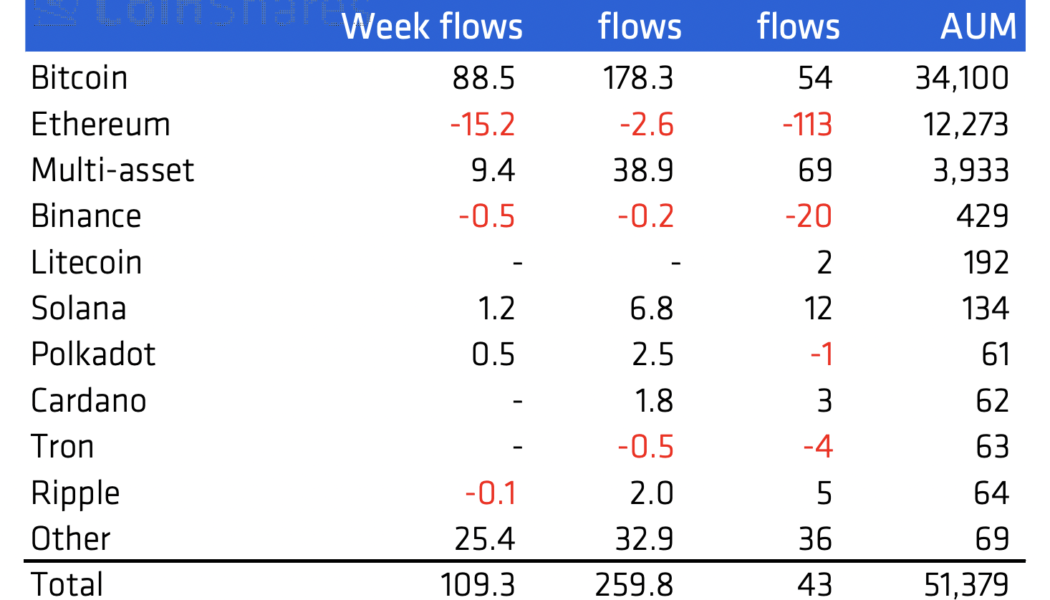

Crypto funds register largest weekly inflows since December

Inflows into cryptocurrency investment funds rose sharply last week, offering cautious optimism that investors are broadening their exposure to digital assets despite geopolitical uncertainty and monetary tightening from central banks. Digital asset investment products registered $127 million worth of cumulative inflows for the week ending March 6, according to CoinShares data. A CoinShares representative told Cointelegraph that this was the highest weekly inflows since Dec. 12, 2021. The increase was also significantly higher than the $36 million of inflows registered the previous week. Like in previous weeks, Bitcoin (BTC) products recorded the largest weekly inflows at $95 million. Bitcoin fund flows have increased for seven consecutive weeks. Ether (ETH) funds saw inflows totaling $25 ...

Terra’s Mirror Protocol MIR rebounds 40% two days after crashing to record low

Mirror Protocol, a decentralized finance (DeFi) protocol built on the Terra blockchain, was hit by one of the biggest collapses in financial history this week after Vladimir Putin ordered military strikes against Ukraine. Terra tokens rally Mirror Protocol’s native token, MIR, dropped to $0.993 on Feb. 24, its worst level to date amid a selloff across the broader crypto market. But a sharp rebound ensued, taking the price to as high as $1.41 two days later, up more than 40% when measured from MIR’s record low. MIR/USD four-hour price chart. Source: TradingView Just like the drop, MIR’s upside retracement came in the wake of similar recoveries elsewhere in the crypto market. But interestingly, MIR/USD returns appeared larger than some of the highly valued digital assets, i...

Avalanche price rallies 20% after report reveals $25M inflows into AVAX investment vehicles

Avalanche (AVAX) rallied by around 20% in the last two days as a new report revealed millions of dollars flowing into AVAX-based investment products. Penned by CoinShares, an institutional crypto fund manager, the report highlighted that Avalanche-based investment vehicles attracted about $25 million in the week ending Feb. 21, the second-biggest inflow recorded in the said period after Bitcoin’s (BTC) $89 million. Flow of assets. Source: Bloomberg, CoinShares In contrast, Ether (ETH), Avalanche’s top rival in the smart contracts sector, witnessed an outflow totaling $15 million. On the whole, Avalanche and similar cryptocurrency investment products attracted around $109 million, recording their fifth week of positive inflows in a row. AVAX rebounds against macro headwinds...

Fidelity International launches Bitcoin ETP on Deutsche Boerse

Major financial services firm Fidelity International will be listing a Bitcoin exchange-traded product on the SIX Swiss Exchange and Germany’s Xetra digital stock exchange. According to a Tuesday announcement from Deutsche Boerse, a physical Bitcoin exchange-traded product, or ETP, from Fidelity International is now available for trading on the Deutsche Boerse Xetra and Frankfurt Stock Exchange under the ticker FBTC. In addition, the company reportedly said it planned to have the crypto investment vehicle listed on the SIX Swiss Exchange in the coming weeks. Fidelity Digital Assets will act as the custodian for the physically-backed Bitcoin (BTC) ETP, which will be centrally cleared with global exchange Eurex Clearing. The ETP has a total expense ratio of 0.75%. At the time of publication,...

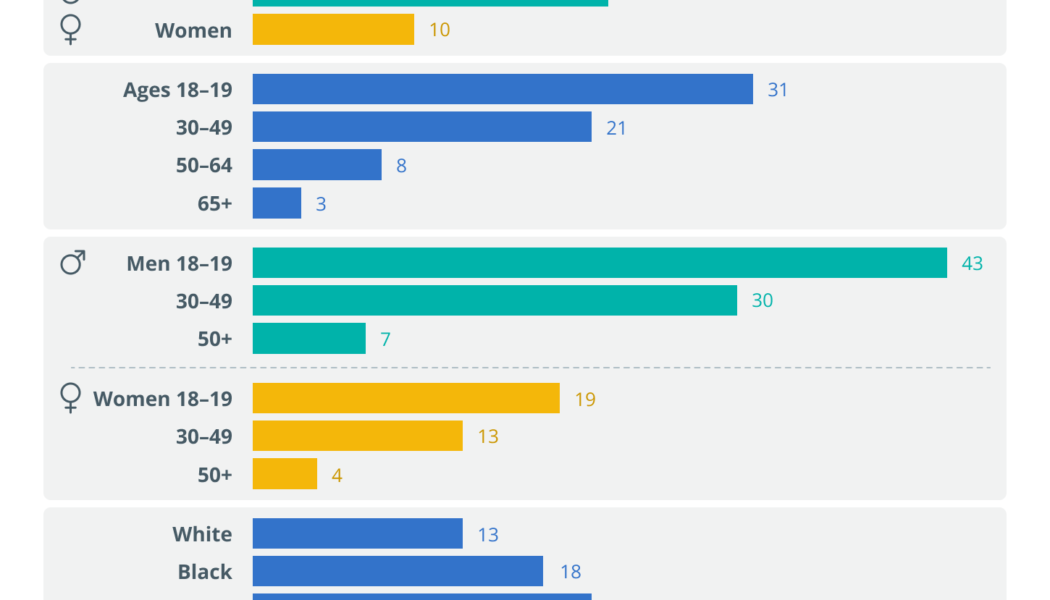

Bitcoin’s last security challenge: Simplicity

It’s been just 13 years since Bitcoin’s (BTC) “Mayflower moment,” when a tiny handful of intrepid travelers chose to turn their back on the Fiat Empire and strike out to a new land of financial self-sovereignty. But, whereas it took 150 years for the American colonists to grow sufficient in number to throw off the yoke of unrepresentative government, the Republic of Bitcoin has gone from Pilgrims to Revolutionary Army in little over a decade. What sort of people are these new Bitcoiners? How do their character, demographics and technical knowledge differ from earlier adopters? Is “Generation Bitcoin” sufficiently prepared to protect their investment against current and future security threats? And, most importantly, what are the challenges that the rapidly growing community must urgently a...

Bitcoin dated futures with physical settlement go live on Eqonex

The Nasdaq-listed digital assets financial services company Eqonex has launched a new type of Bitcoin (BTC) investment product, a BTC dated futures contract with a physical settlement. Announcing the news on Wednesday, Eqonex explained that its BTC dated futures are denominated in the USD Coin (USDC) stablecoin and increase in parallel with the BTC price increase against USDC. In contrast to perpetual futures, which have no maturity limit, dated futures expire at a pre-set date and time frame like each month or each quarter, Eqonex noted. “Any position in a perpetual future stays open until the trader decides to close the trade by executing an offsetting trade, or until the trade gets liquidated by Eqonex,” the firm added. According to the announcement, the Eqonex BTC dated futures contrac...

3 things the crypto sector must offer to truly mainstream with TradFi

In the past year, we’ve seen the crypto economy undergo exponential expansion as heaps of money poured into various cryptocurrencies, decentralized finance (DeFi), nonfungible tokens (NFT), crypto indices, insurance products and decentralized options markets. The total value locked (TVL) in the DeFi sector across all chains has grown from $18 billion at the beginning of 2021 to $240 billion in January 2022. With so much liquidity in the ecosystem, the crypto lending space has also grown a significant amount, from $60 million at the beginning of 2021 to over $400 million by January 2022. Despite the exponential growth and the innovation in DeFi products, the crypto lending market is still only limited to token-collateralized loans, i.e. pledge one cryptocurrency as collateral to borro...

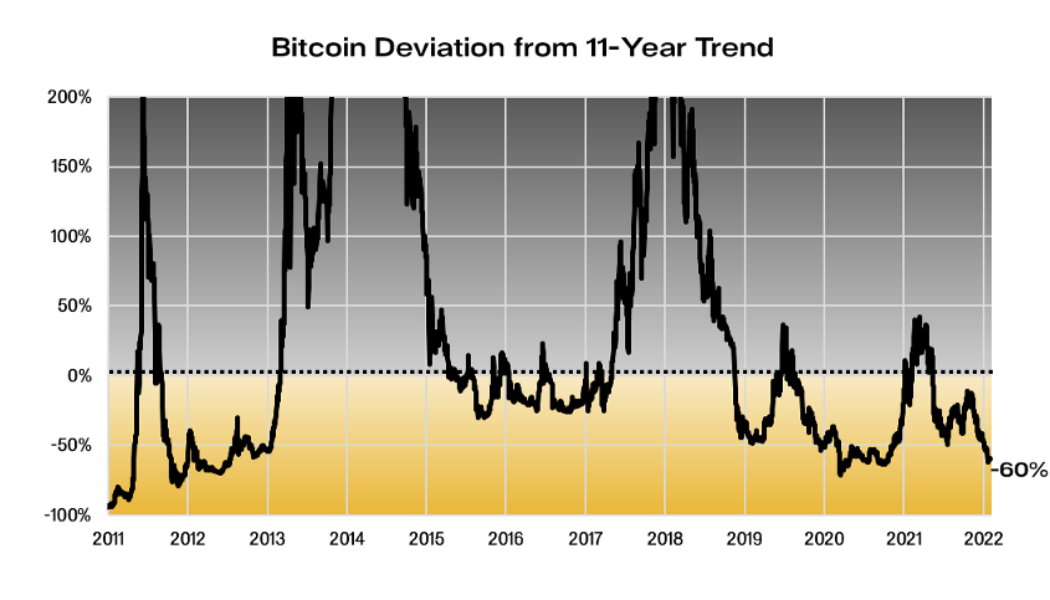

Winter is coming! Here are 5 ways to survive a crypto bear market

The cryptocurrency market has an interesting way of catching even the most seasoned veterans off guard as each bull and bear market initially shows similarities to previous cycles only to veer off in an unexpected direction and wipe out the fortunes of newly minted crypto millionaires. This was the case with the weak close of 2021 which completely went against the bullish $100,000 BTC price estimates that crypto analysts and influencers were peddling nonstop. Currently, Bitcoin price is more than 50% away from its $69,000 all-time high and altcoins have fared worse, with many down more than 60% in the last 2 months. In times like these, traders need to regroup and re-evaluate their investment strategy, rather than just buying every price dip. Here are five strategies traders can use ...

South Park destroys Matt Damon’s Crypto.com ad in season premiere

More than three months after its release, the ad from crypto exchange Crypto.com featuring Hollywood star Matt Damon was the subject of ridicule in the latest episode of the animated series South Park. In the first episode of its 25th season titled “Pajama Day”, the creators of South Park took on people in the United States refusing to wear a mask and once again associated crypto investments with scams. Characters in the show attacked Damon’s appearance in an TV spot titled “fortune favors the brave”, showing the actor speaking about Crypto.com amid a digital landscape of historic figures. “My dad said he listened to Matt Damon and lost all his money…” “Yes, everyone did! But they were brave in doing so!” The criticism is likely related to cryptocurrencies losing more than $500 billion in ...

Staying cool: Is crypto snowballing to 1 billion users this year?

Crypto.com raised a few eyebrows this past week when it announced cryptocurrency users worldwide could reach 1 billion by the end of 2022. The timing was curious, given that Bitcoin (BTC) and many other cryptos are entwined in one of the largest drawdowns in their (albeit short) history and with the prospect of United States Federal Reserve interest-rate tightening edging ever nearer. But the cryptocurrency exchange, which in November gave its name to the arena where the Los Angeles Lakers basketball team plays in a 20-year deal, was obviously taking the long view. Also, its prediction was contingent on two things happening: one in the “developed” world, the other in less-mature national economies. It also involved some statistical extrapolation. To wit, the main arguments for ...