investments

Here is how studying tokens’ price history helps patient traders enjoy consistent average gains.

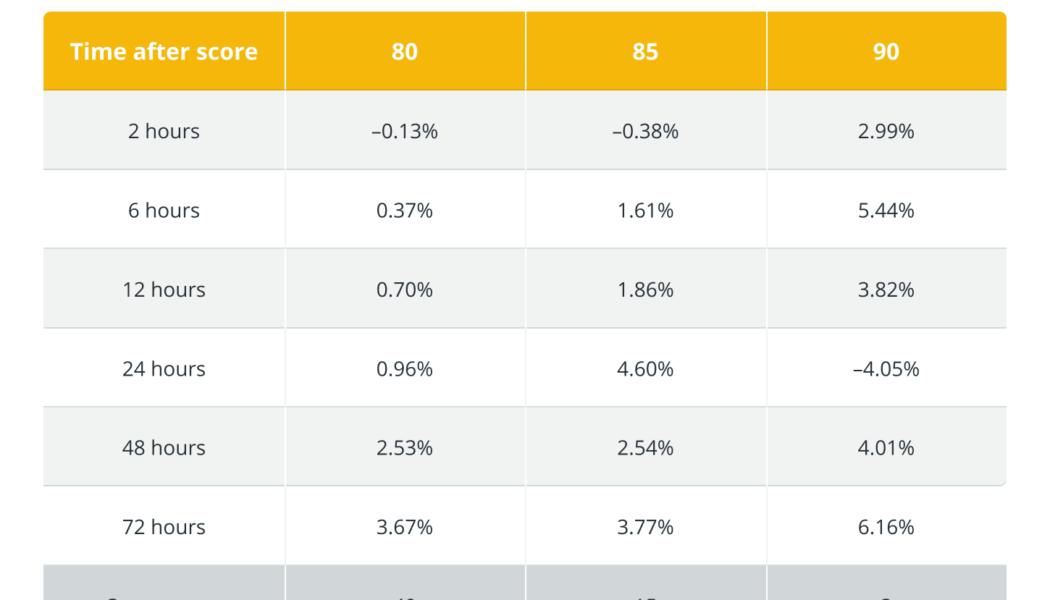

Whether you consider cryptocurrency trading as art, science or a game of skill, one thing is beyond dispute: Those who excel at it are not the traders who maintain the longest series of lucky one-offs but those who establish sustainable trading processes yielding consistent returns. Ask a sample of seasoned pros if they would prefer to catch one obscure token’s 300%-in-a-day brush with fame or learn a strategy that systematically generates a 3% return on investment. You will be surprised how many of them (likely close to 100% of the sample) prefer modest yet systematic profits. How does one make their trading processes more systematic? One way is to rely on automated data analytics tools with a proven track record of consistent performance. One such tool is the VORTECS™ Score, an ar...

Cryptocurrency vs. Stocks: Key differences explained

Both the crypto and the stock markets are volatile and subject to external influences. However, there are also differences between them. When we’re talking about cryptocurrency vs. stocks, there is a big difference in how they are traded. Cryptocurrency can be bought at a cryptocurrency exchange, whereas you can buy stocks at the stock exchange. Of course, there are differences in the exchanges and opening hours, as previously described. Normally, the crypto market is more volatile than the stock market. However, the stock market is also subject to volatility due to interest rate changes and uncertain situations like war, inflation rate and monetary policy changes. But, what about trading costs in cryptocurrency vs. stocks? Basically, transaction fees do not a...

Nexo and Amber Group executives claim ‘exponential’ growth in crypto institutional investment

During the 8th edition of the Blockchain Africa Conference 2022, Cointelegraph’s editor-in-chief Kristina Lucrezia Cornèr moderated a virtual panel titled “Cryptocurrency Institutional Investment: Increasing Returns and Improving Diversification.” Panelists Kalin Metodiev, co-founder and managing partner at Nexo, and Dimitrios Kavvathas, chief strategy officer at Amber Group, focused on the opportunities that institutional investors perceive in the blockchain and crypto space, both in Africa and globally. [embedded content] Nexo is a crypto borrowing and exchange platform that recently began offering crypto custodial services, products and lending services to institutional investors, in partnership with the crypto wing of Fidelity Investments, which is called Fidelit...

SEC could approve spot Bitcoin ETFs as early as 2023 — Bloomberg analysts

Eric Balchunas and James Seyffart, exchange-traded fund (EFT) analysts for Bloomberg, said that a proposed rule change with the United States Securities and Exchange Commission (SEC) could be the catalyst for the regulatory body approving a spot Bitcoin ETF in mid-2023. In a Thursday tweet, Balchunas said crypto platforms could fall under the SEC’s regulatory framework if the commission were to approve the amendment to change the definition of “exchange” proposed in January. The rule change would amend the Exchange Act to include platforms “that make available for trading any type of security” — seemingly including cryptocurrencies, making their investment vehicles more palatable for the regulator. “Once crypto exchanges are compliant, the SEC’s primary reason for denying spot Bitcoi...

Bottomed out? MINA rises 75% nine days after hitting its worst level to date

MINA, a utility token backed by a “lightweight” smart contracts platform of the same name, continued its upside move nine days after rebounding from $1.58, its lowest level to date. The coin rallied by about 75% to reach $2.75 as of March 24 as traders weighed a high-profile funding rounds involving the sale of $92 million worth of MINA tokens to Three Arrows Capital, FTX Ventures, and other venture capitalists. MINA/USD daily price chart featuring its correlation with Bitcoin. Source: TradingView An overall recovery sentiment across the crypto market also assisted in pushing MINA’s price higher, since altcoins typically move in tandem with Bitcoin (BTC). Additionally, Coinbase’s announcement on March 23 to add MINA support to its crypto exchange may have ...

NFT creator Yuga Labs raises $450M, bringing company valuation to $4B

Yuga Labs, the creators of Bored Ape Yacht Club (BAYC) and new owners of the CryptoPunks and Meebits brands, announced it is now valued at $4 billion after its latest $450 million seed funding round. VC firm Andreessen Horowitz, or a16z, led the company’s first institutional investment, marking one of the largest seed rounds for any nonfungible token (NFT) collection to date. Other investors included Animoca Brands, FTX and MoonPay, as well as LionTree, Sound Ventures and Thrive Capital. The company plans to use the funds to scale its team, attract more creative, engineering and operations talent, as well as for future joint ventures and partnerships. To celebrate the occasion, Chris Lyons, a general partner at Andreessen Horowitz, loaned his Bored Ape to a16z, which upload...

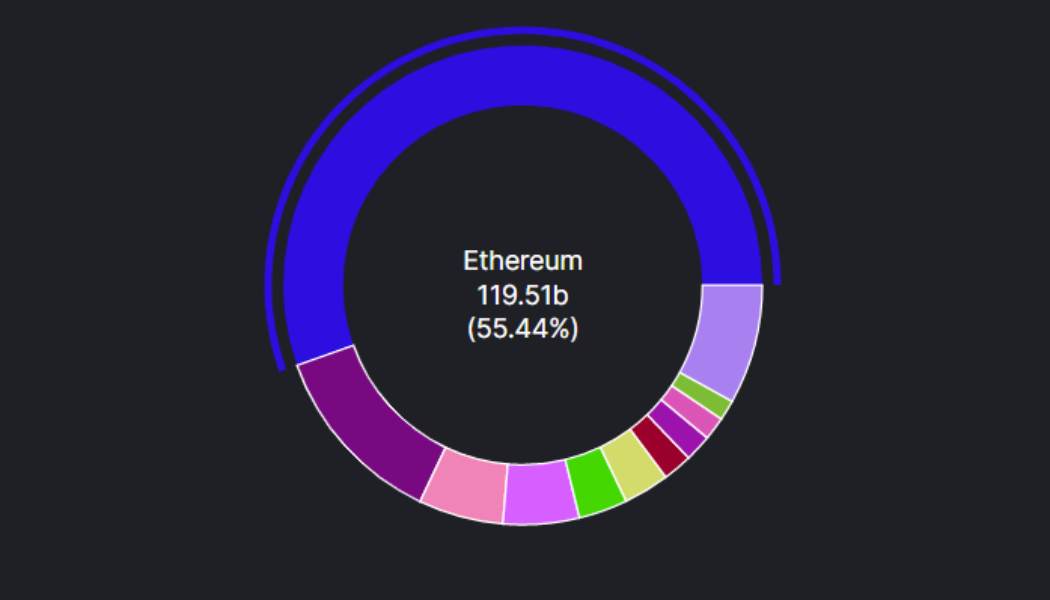

Grayscale launches smart contract fund for Ethereum competitors

Digital asset manager Grayscale Investments has unveiled a new cryptocurrency fund dedicated to smart contract platforms excluding Ethereum, underscoring growing investor appetite for alternative blockchain networks. The Grayscale Smart Contract Platform Ex-Ethereum Fund, also known by the ticker symbol GSCPxE, is the company’s 18th investment product. The fund will provide exposure to seven smart contract platforms at the following weightings: Cardano (ADA): 24.63% Solana (SOL): 24.27% Avalanche (AVAX): 16.96% Polkadot (DOT): 16.16% Polygon (MATIC): 9.65% Algorand (ALGO): 4.27% Stellar (XLM): 4.06% Grayscale said the new fund is now open for daily subscription by accredited investors. Ethereum’s dominance as the premier smart contract platform is being challenged by competitors that...

SEC pushes decisions on WisdomTree’s and One River’s applications for spot Bitcoin ETFs

The United States Securities and Exchange Commission has extended its window to approve or disapprove spot Bitcoin (BTC) exchange-traded fund (ETF) applications from asset managers WisdomTree and One River. According to separate Friday filings, the SEC will push the deadline for approving or disapproving a rule change allowing shares of the WisdomTree Bitcoin Trust and One River Carbon Neutral Bitcoin Trust to be listed on the Cboe BZX Exchange and New York Stock Exchange Arca, respectively. The regulator said it would extend its window for the decision on WisdomTree’s Bitcoin investment vehicle to May 15 and One River’s to June 2. The spot BTC ETF application from WisdomTree followed the SEC rejecting a similar offering from the asset manager in December 2021 after several delay...

Old but gold: Can digital assets become part of Americans’ retirement plans?

On March 11, the United States Department of Labor warned employers that sponsor 401(k) retirement plans to “exercise extreme care” when dealing with cryptocurrencies and other digital assets, even threatening to pay extra legal attention to retirement plans with significant crypto investments. Its rationale is familiar to any crypto investor: The risk of fraud aside, digital assets are prone to volatility and, thus, may pose risks to the retirement savings of America’s workers. On the other hand, we are seeing established players in the retirement market taking steps toward crypto. For one, retirement investment platform ForUsAll decided last year to implement crypto as an investment option for 401(k) fixed retirement accounts in partnership with Coinbase. Is this the beginning of a large...

Bitcoin could crush Russian ruble by rising another 140%, classic technical setup suggests

Bitcoin (BTC) has declined by around 30% after topping out at 5.8 million rubles a token on March 9. Nonetheless, the said drop could be an excuse for traders to dump another big stash of the Russian national currency if a classic bullish continuation pattern plays out. Bitcoin heads towards 11 million rubles Dubbed the “ascending triangle,” the pattern appears when the price consolidates between a rising lower trendline (support) and a flat upper trendline (resistance). It completes after the price breaks out of the consolidation range in the direction of its previous trend, eyeing levels at length equal to the maximum distance between the triangle’s upper and lower trendline. BTC’s price against the ruble has been trending inside a similar structure since January ...

Cryptocurrencies against the ‘silent thief.’ Can Bitcoin protect capital from inflation?

The world is becoming increasingly volatile and uncertain. The assertion that “inflation is the silent thief” is becoming less relevant. In 2021, inflation has turned into a rather loud and brazen robber. Now, inflation is at its highest in the last forty years, already exceeding 5% in Europe and reaching 7.5% in the United States. The conflict between Russia and Ukraine affects futures for gold, wheat, oil, palladium and other commodities. High inflation in the U.S. and Europe has already become a real threat to the capital of tens of thousands of private investors around the world. Last week at the Federal Open Market Committee (FOMC) meeting, Federal Reserve Chairman Jerome Powell said that he would recommend a cautious hike in interest rates. At the same time, Powell mentioned that he ...

US Labor Dept warns of crypto risks in retirement plans

The US Department of Labor (DOL) has told 401(k) investors to “exercise extreme care” when dealing with cryptocurrencies and other digital assets citing fraud, theft, and financial loss as “significant risks”. In a compliance report, released on Thursday, the DOL offered a stark warning to employers that seek to increase their 401(k) exposure to cryptocurrencies, stating that any significant crypto investments within company-sponsored retirement accounts may attract legal attention. A 401(k) is a retirement savings plan offered by most American employers that extend tax advantages and long-term financial security to those that opt-in. Regarding the legislation surrounding 401(k) investments, the Employee Retirement Income Security Act of 1974 (ERISA) does not specifically...